Smart Contracts in Islamic Finance: A Shariah-Safe Guide

Smart contracts in Islamic finance are self-executing blockchain programs that automate Shariah-based contracts such as murabaha, mudarabah, ijara and sukuk, with transparent logic and on-chain audit trails. Whether they are halal or haram depends entirely on the underlying structure: if the code implements riba-free, low-gharar, non-speculative transactions approved by qualified Shariah scholars, smart contracts are generally treated as a neutral tool that can be used in a compliant way.

Introduction

Smart contracts in Islamic finance are moving from conference slides to real pilots in New York, London, Frankfurt and Dubai. For Islamic banks and fintechs in the US, UK, Germany and wider EU, they promise “programmable Shariah compliance”: contracts that calculate profit-sharing, trigger sukuk payouts, or ringfence waqf funds automatically.

Global Islamic finance assets are estimated in the low-to-mid trillions of US dollars and projected to keep growing strongly through 2028. At the same time, the global smart contracts market is now worth a few billion dollars annually and is forecast to expand rapidly as banks and fintechs adopt blockchain-based automation. The question for Islamic finance leaders is no longer if they should adopt smart contracts, but how to do it in a way that is riba-free, low in gharar and robust enough for SEC, FCA, BaFin and MiCA-era scrutiny.

This guide walks through what smart contracts in Islamic finance actually are, the current halal/haram debates, practical use cases, risks, governance models and a phased roadmap for banks and fintechs in the US, UK and EU.

What Are Smart Contracts in Islamic Finance?

Smart contracts in Islamic finance are pieces of code on a blockchain that automatically execute Shariah-based contractual terms when defined conditions are met. Unlike static PDFs in a document management system, the code itself enforces payment, ownership transfer or profit distribution once inputs (like delivery confirmation or maturity dates) are satisfied.

Basic Smart Contract Mechanics in Plain Language

A smart contract is like a vending machine for agreements: once the right inputs are provided, the outcome happens automatically. On a blockchain, a smart contract might release payment only when a carrier’s API confirms that goods reached a warehouse in Chicago, or distribute profit to investors in London and Frankfurt based on a pre-agreed mudarabah ratio. The rules are written in code, deployed to the network, and executed by the blockchain without manual intervention.

How Smart Contracts Differ from Conventional Digital Contracts

A conventional “digital contract” is usually just a scanned or e-signed legal document stored in a system; humans (or back-office software) still decide when and how to act on it. A smart contract, by contrast, lives on a blockchain ledger: it is tamper-resistant, time-stamped, transparent to authorized participants and self-executing. Once deployed, its logic is extremely hard to alter without consensus, and every state change is recorded, creating a natural audit trail that’s attractive for Islamic banking oversight.

Shariah Principles Touched by Smart Contracts (Riba, Gharar, Maysir)

Smart contracts themselves are tools, but they directly affect how riba, gharar and maysir show up in digital products.

Riba concerns arise if the code implements interest-bearing debt, late-payment penalties that look like interest, or derivative-style cash-settled products.

Gharar appears in unclear triggers, ambiguous asset ownership, or oracle feeds that don’t clearly map to real-world events.

Maysir can creep in where tokens represent highly speculative, zero-utility assets or gamified leverage.

When encoding Islamic contracts into code, Shariah boards look for clear ownership and risk-sharing (e.g., in murabaha and sukuk), transparent rights and obligations, and an architecture that doesn’t hide conventional interest behind new terminology.

Shariah Foundations & Fatwa Debates on Smart Contracts

Shariah scholars increasingly view smart contracts as neutral infrastructure: halal or haram depending on what they execute. Most contemporary opinions accept blockchain and smart contracts in principle, provided the underlying contract structure, assets and risk-sharing meet Islamic finance standards and are supervised by qualified Shariah boards. ([Islamic Finance Review.

Are Smart Contracts Halal or Haram? Current Scholarly Views

Most scholars and fatwa bodies treat smart contracts as “digital agents” that can implement either compliant or non-compliant structures. When a smart contract automates a valid ijara or murabaha contract with real assets and clearly defined margins, it is generally considered halal. If the same technology is used for interest-based lending, excessive leverage, or speculative DeFi tokens, the outcome is haram even if the process is automated.

AAOIFI and IFSB have not yet issued a single, dedicated “smart contract standard,” but their sukuk, banking and governance standards provide principles for ownership, risk-sharing and transparency that can be translated into code. Cautious fatwas often flag immutability, oracle risk and jurisdictional enforceability as reasons to proceed via pilots and sandboxes rather than full-scale deployment.

Gharar and Smart Contracts

Smart contracts can significantly reduce gharar by turning vague clauses into clear, machine-executable conditions. If “profit distribution quarterly based on audited profit” is encoded as a formula pulling from verified financial data, parties gain more certainty than from manual spreadsheets. Immutable logs also help resolve disputes.

However, new forms of gharar emerge: bugs in code, unclear integration with off-chain systems (like core banking) and opaque oracle providers can create uncertainty about how and when obligations are actually fulfilled. Scholars therefore push for robust testing, code review and clear documentation linking the fiqh reasoning, the legal contract and the deployed code.

Global Shariah Standards and Local Opinions (AAOIFI, IFSB, GCC vs Europe)

AAOIFI and IFSB set global benchmarks for Islamic finance, emphasizing genuine asset ownership, risk-sharing and governance. Recent work such as AAOIFI’s Standard 62 on sukuk tightens expectations around true asset transfer and risk allocation core issues for tokenised sukuk on blockchain.

Local Shariah boards, from Malaysia’s SAC to GCC banks and European Shariah advisory firms, may interpret how these principles apply to smart-contract platforms differently. A German Islamic crowdfunding platform working under BaFin and local Shariah supervision might take a more conservative approach than a Dubai-based DeFi experiment, especially around token design and leverage.

Islamic Contracts on Smart Contract Platforms

Smart contracts in Islamic finance are most compelling where you have repeatable, rule-based contracts that benefit from transparency and automation. These include retail murabaha financing, corporate ijara leases, mudarabah investment pools, sukuk issuances and waqf or zakat distribution.

Murabaha, Mudarabah and Ijara in Code (Retail & Corporate)

For murabaha, smart contracts can encode the cost price, disclosed profit margin, asset details and payment schedule. A halal investment app in New York or Houston could use on-chain logic to ensure the bank (or platform) genuinely acquires the asset before selling it on, and that no extra interest-like penalties appear beyond agreed late fees.

In mudarabah, the contract can hold investor funds, record profit-sharing ratios and distribute profits to users in London, Birmingham, Berlin or Dublin automatically when audited profit figures are approved by both parties. For ijara (leasing), smart contracts can manage rental schedules, purchase options and title transfer conditions for Islamic mortgages or equipment leases, while integrating with local land and collateral registries where possible.

Sukuk on Blockchain: Tokenised Cashflows and Covenants

Smart contracts can represent sukuk as tokens, with each token holder entitled to a share of periodic profit and principal redemption. For sukuk listed in London, Luxembourg or Frankfurt, smart contracts could:

Automate periodic profit distributions based on underlying asset performance

Enforce covenant checks (e.g., leverage or asset coverage thresholds)

Trigger early-redemption or dissolution events when pre-agreed conditions are breached

AAOIFI’s renewed focus on genuine asset ownership and risk-sharing in sukuk structures dovetails with tokenisation efforts, as programmable contracts can better align economic reality with documented structures.

Waqf, Zakat and Social Finance Automation

In Islamic social finance, smart contracts can ringfence waqf capital so that only returns, not principal, are disbursed to beneficiaries. A healthcare-linked waqf supporting NHS services in London or social programs in the EU could use smart contracts to schedule distributions, publish transparent reports and integrate with audited healthcare payment systems.

Zakat platforms can encode nisab thresholds, calculation rules and disbursement policies, reducing administrative overhead and building trust among donors in the US, UK, Germany and beyond.

Risks of Smart Contracts in Islamic Finance

Poorly designed smart contracts can quietly reintroduce riba, gharar and legal uncertainty into otherwise Shariah-compliant products. Islamic banks and fintechs must therefore treat them as critical infrastructure subject to Shariah review, legal scrutiny and cybersecurity controls.

Shariah Non-Compliance Risks Hidden in Code

A structure that looks Shariah-compliant on a term sheet can become non-compliant in practice if the coded logic deviates from what scholars approved. Examples include.

Late-payment logic that compounds charges in a way that mimics interest

Automatic rollovers that effectively turn a sale contract into a revolving credit line

Embedded speculative features (e.g., price-triggered payouts detached from real assets)

Because many Shariah board members are not developers, there is a real risk of “Shariah-washing” via code. Bridging this gap requires code walkthroughs, technical Shariah advisors and testing that validates the code against the fatwa, not just the legal documents.

Operational, Technical and Cyber Risks for Banks & Fintechs

Smart contracts introduce classic IT and cyber risks.

Coding bugs and vulnerabilities in Solidity/Rust

Oracle failures breaking the link between on-chain logic and off-chain events

Key mismanagement exposing wallets or admin functions

Protocol-level hacks on underlying chains

Vendor lock-in to specific platforms or integrators

For US, UK and EU Islamic fintechs that already rely heavily on cloud infrastructure, these risks intersect with SOC 2, PCI DSS and sometimes HIPAA requirements, especially when handling card data or health-linked waqf flows.

Legal and Contractual Enforceability in US, UK, Germany/EU

In the US, some states (e.g., Wyoming, Texas) explicitly recognize smart contracts in their statutes, while federal regulators like the SEC and CFTC focus on whether tokens and platforms fall under securities or derivatives rules.

In the UK, the UK Jurisdiction Taskforce’s legal statement affirmed that smart contracts can be enforceable under English law, and the FCA continues to explore DLT in its regulatory sandboxes. In the EU and Germany, BaFin and ESMA are embedding smart contracts and DeFi into the MiCA framework, clarifying when tokens become regulated financial instruments.

For Islamic institutions, the key is to ensure three-way alignment: the Shariah contract, the legal documentation and the on-chain code all describe the same rights and obligations.

Governance, Audit and Regulation of Smart Contracts in Islamic Finance

Robust governance is what turns crypto experiments into bank-grade Islamic finance infrastructure in New York, London, Frankfurt, Riyadh or Kuala Lumpur. That governance needs Shariah boards, risk teams, legal counsel and engineers working together.

Shariah Governance for Smart Contracts (Boards, AAOIFI, IFSB)

A target model for Shariah governance around smart contracts typically includes:

Shariah boards defining acceptable structures under AAOIFI/IFSB principles

Pre-deployment reviews of business logic, legal contracts and smart contract code

Ongoing monitoring of upgrades, parameter changes and new integrations

Islamic banks in New York, London, Frankfurt and Dubai can look to AAOIFI’s Shariah standards and IFSB guidance on governance as the “source of truth,” adapting them to their regulatory environment.

Auditability and Code Review

Traditional Shariah review focuses on documentation, processes and financial flows. In a smart-contract world, that must be extended with.

Secure code review and penetration testing

Formal verification for high-value contracts

Independent smart contract audits, ideally aligned with SOC 2 and PCI DSS controls for fintechs handling payments

Recent academic work on the auditability of smart contracts in Islamic finance stresses the need to bridge IT controls with Shariah governance rather than treating them as separate streams.

Regulatory Landscape in US, UK and EU (SEC, FCA, BaFin, MiCA, GDPR/DSGVO)

In the US, Islamic fintechs using smart contracts must navigate SEC/CFTC classifications, OCC guidance and state money-transmission laws, especially when customers hold tokens or stablecoins.

In the UK, the FCA’s work on DLT and the Bank of England’s digital initiatives give Islamic institutions space to experiment in sandboxes and innovation pathways, including Islamic DeFi-style pilots.

In the EU and Germany, BaFin, ESMA and EBA are rolling out MiCA and related guidance, while GDPR/DSGVO’s “right to be forgotten” clashes with immutable ledgers. This pushes Islamic projects towards permissioned chains, off-chain personal-data storage and careful key management so data can be logically erased even if transaction hashes remain.

Islamic DeFi and the Future of Programmable Shariah Compliance

Islamic DeFi tries to combine on-chain programmability with Shariah rules against interest, excessive uncertainty and gambling. It targets not only traditional Muslim-majority markets but also ethical investors across the US, UK and EU.

What Makes an Islamic DeFi Protocol Different?

An Islamic DeFi protocol removes or restructures leverage, interest-bearing lending and speculative yield farming. Instead of borrowing at interest, users might enter profit-and-loss sharing pools, asset-backed liquidity arrangements or tokenised ijara structures. Collateral is ideally real-world and halal-screened, and profit distribution is linked to real economic activity rather than pure token emissions.

Shariah-Compliant Tokens, NFTs and On-Chain Governance

Shariah-compliant tokens are typically backed by real assets or ownership interests such as sukuk, real estate ijara or commodity murabaha portfolios rather than pure algorithmic claims. NFTs can serve as on-chain proofs of ownership for units in an ijara fund or waqf-backed property in Berlin or Istanbul.

On-chain governance can implement Shariah boards as voting committees, with multi-signature approvals required for major parameter changes, delistings or new asset listings. This “programmable Shariah governance” makes rulings more transparent and easier to audit.

Permissioned Chains, Oracles and Off-Chain Shariah Boards

For regulated banks in London, Frankfurt or Luxembourg, fully permissionless public chains may be too risky. Hybrid architectures therefore combine:

Permissioned blockchains with known validators

Strong oracle frameworks pulling in FX rates, asset prices or delivery confirmations

Off-chain Shariah boards and legal teams whose approvals are reflected on-chain via signed transactions

Data protection concerns (GDPR/DSGVO, UK-GDPR) drive a pattern where personal data stays in encrypted databases or HSM-backed key stores, while the blockchain holds pseudonymous references and financial logic.

Implementation Roadmap for Islamic Banks and Fintechs

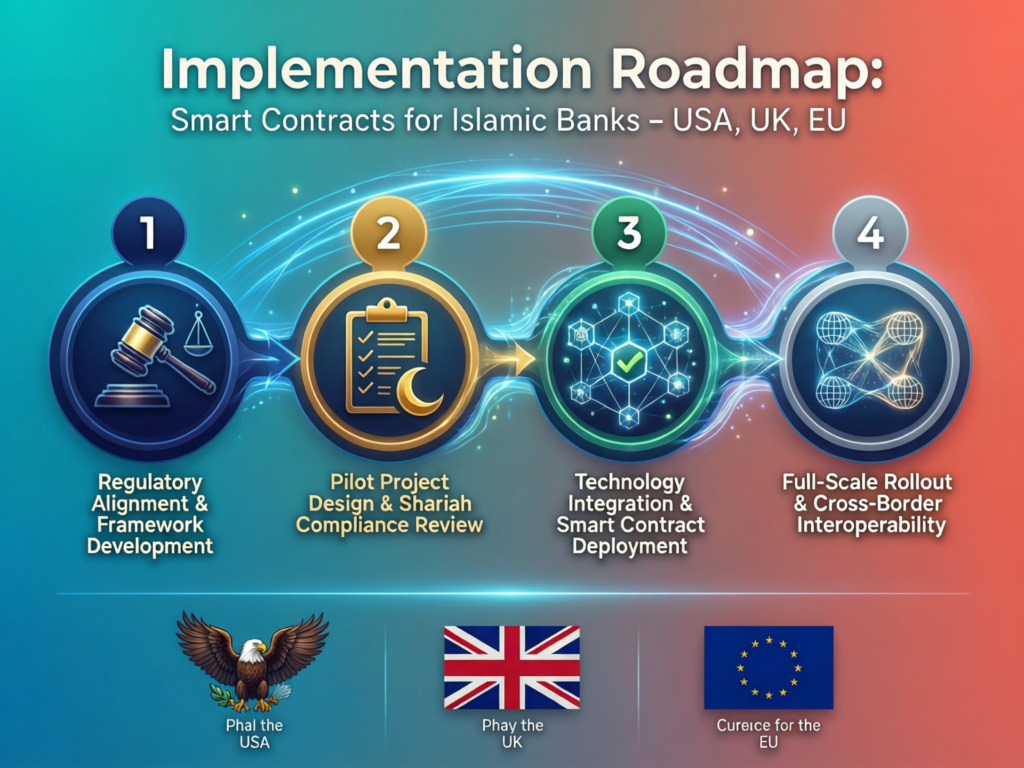

You don’t need to build a full Islamic DeFi protocol on day one. A staged roadmap helps align Shariah, legal and technical stakeholders and gives regulators comfort in the US, UK, Germany and EU.

Assess Use Cases and Shariah Position (US/UK/Germany/EU)

Start by mapping current and planned products murabaha, ijara, mudarabah, sukuk, waqf, zakat and asking where automation could add real value. Clarify your institution’s Shariah stance on blockchain, tokens and DeFi with your board and external advisors, referencing AAOIFI/IFSB guidance. In parallel, your legal and compliance teams should map applicable rules (SEC/CFTC, FCA, BaFin, MiCA, GDPR/DSGVO, state money-transmission laws).

Design, Sandbox and Pilot with Regulators

Next, design one or two focused pilots, such as a tokenised sukuk coupon engine or automated waqf distribution module. Where possible, use FCA or EU digital sandboxes, or informal engagement with BaFin or the SEC to de-risk interpretations before scale-up. Run pilots with capped volumes, robust rollback plans and parallel offline processes so customers are never stranded by bugs.

Vendor Selection, Cloud & Ongoing Governance

Finally, choose platforms and partners: permissioned Ethereum, Hyperledger or similar; cloud providers with SOC 2 and regional data-residency guarantees; and specialist auditors for both security and Shariah. Smart contract audit and Shariah review should become part of your ongoing change-management process, not a one-off launch activity.

Here, working with experienced engineering partners such as for cloud, web and mobile architectures can help you integrate blockchain modules into your existing SaaS and analytics stack across the US, UK and EU.

Final Thoughts

Smart contracts in Islamic finance are tools not fatwas. Their value appears when Shariah principles, modern regulation and serious engineering come together to build products that are transparent, riba-free, auditable and globally scalable. For Islamic banks and fintechs in the US, UK, Germany and broader EU, the opportunity is to move early, experiment safely and bake Shariah governance into the code itself.

Whether you’re exploring a tokenised sukuk pilot in Frankfurt or an Islamic investment app in London or New York, a structured roadmap and the right partners will make the difference between a one-off experiment and a durable, compliant platform.

This article is for general information only and does not constitute legal, regulatory, Shariah or investment advice. Always consult qualified Shariah scholars and professional advisors before launching new products.

Key Takeaways

Smart contracts in Islamic finance are neutral tools that can implement either halal or haram structures, depending on how riba, gharar and maysir are handled in the code.

Shariah boards increasingly accept blockchain and smart contracts when underlying contracts follow AAOIFI/IFSB standards and are backed by strong governance and audits.

High-value use cases include murabaha, mudarabah, ijara, sukuk and Islamic social finance (waqf and zakat), especially in regulated hubs like New York, London and Frankfurt.

Key risks span hidden Shariah non-compliance in code, cyber vulnerabilities, operational complexity and cross-border regulatory uncertainty under regimes like MiCA and GDPR.

A phased roadmap assessing use cases, running sandboxes/pilots, and institutionalising Shariah-plus-technical governance offers a practical path for US/UK/EU Islamic banks and fintechs.

If you’re planning a smart contract or Islamic DeFi initiative, you don’t need to tackle Shariah, regulation and engineering alone. can help you map use cases, design compliant architectures, and integrate blockchain modules into your existing cloud, web and mobile stack across the US, UK and EU.

Share your current roadmap or a draft term sheet, and explore a scoped discovery or pilot engagement that fits your risk appetite and budget. You can learn more about our teams and certifications across US/UK/EU markets.( Click Here’s )

FAQs

Q : Can Islamic banks use public blockchains like Ethereum, or do they need private permissioned networks?

A : Islamic banks can, in principle, use either public or permissioned blockchains, as Shariah focuses on the nature of the transaction rather than the infrastructure. However, regulatory, privacy and governance requirements in the US, UK and EU often push institutions toward permissioned or hybrid models where validators are known and data protection rules (GDPR/DSGVO, UK-GDPR) are easier to satisfy. Many banks therefore experiment on permissioned chains first, then selectively bridge to public networks where liquidity or interoperability demands it.

Q : How do smart contracts handle disputes and contract amendments in Islamic finance?

A : By default, smart contracts execute exactly as coded, which means they don’t “negotiate” amendments or disputes on their own. Islamic institutions typically keep an off-chain master contract and Shariah-approved governance process that allows parties, courts or arbitrators to override or replace a contract if errors or new circumstances arise. In practice, this is implemented with upgradeable proxy contracts, pausable modules or multi-signature admin keys all tightly controlled and documented to align with the Shariah and legal position.

Q : Do Shariah boards need in-house developers to review smart contracts, or can they rely on external auditors?

A : Shariah boards don’t need to become full-time developers, but they do need access to technical expertise they trust. Some institutions hire in-house “Shariah technologists” who can translate between fiqh and code, while others rely on specialist external auditors who provide both security reviews and Shariah mapping. A hybrid model internal understanding plus external review often works best for banks in London, Frankfurt or New York that run multiple smart contract products across different platforms.

Q : What skills and roles should an Islamic bank hire for a smart-contract and DeFi initiative?

A : A serious initiative typically needs blockchain engineers, smart contract developers (e.g., Solidity), DevOps/cloud engineers, cybersecurity specialists, and data/privacy experts familiar with GDPR/DSGVO and US/UK regulations. On the business side, you’ll want product managers who understand Islamic finance structures, plus Shariah advisors who are comfortable with digital platforms. Upskilling existing teams through certifications and training in cloud, security and blockchain can be more efficient than hiring entirely new teams.

Q : How can small Islamic fintech startups in Europe afford secure, Shariah-compliant smart contract audits?

A : Smaller fintechs can manage costs by starting with limited-scope pilots, using open-source audited contracts where appropriate, and bundling security and Shariah review into a single engagement. EU or national innovation grants, sandboxes and accelerator programs sometimes subsidise audit or compliance costs, especially under MiCA-focused initiatives. Partnering with experienced dev shops and cloud providers can also reduce the need to build all security and governance capabilities in-house from day one.