Bitcoin (BTC) Weekly Update ETF Inflows Return as Price Swings Between $90K and $97K (Jan 16, 2026)

Bitcoin spent this week grinding higher but keeping traders on edge, swinging between the high-$80Ks and just under $97K before settling back near the mid-$95Ks. In this Bitcoin (BTC) weekly update, ETF flows, macro headlines, and US regulatory noise all played a visible role in every larger move.

If you just want the bottom line: BTC is still holding the $90K+ zone, spot Bitcoin ETF inflows have roared back, and the market is behaving much more like a macro-driven asset than a pure retail mania trade.

Bitcoin (BTC) Weekly Update at a Glance

This Bitcoin (BTC) weekly update finds BTC trading around $95K, up roughly 5–6% over the last 7 days, with a weekly range between about $89,876 and $97,538 according to CoinGecko. The move has been supported by renewed spot Bitcoin ETF inflows over $1.7B in three days but tempered by fresh US regulatory worries and broader macro uncertainty.

Short-term support is clustered around $90K–$89K, while immediate resistance sits in the $97K–$100K region after BTC briefly hit an eight-week high near $97K this week.

Key Data Snapshot (as of Jan 16, 2026, 11:04 UTC)

Current BTC price: ≈ $95,362

(Bitcoin price on CoinGlass: $95,361.90)

24h change: -1.46%

7d change: +5.4%

7d high / low: $97,538.10 / $89,875.94 (7-day range, CoinGecko)

Market cap: ≈ $1.90T (BTC #1 by market cap)

24h total volume (spot + derivatives): ≈ $46.9B

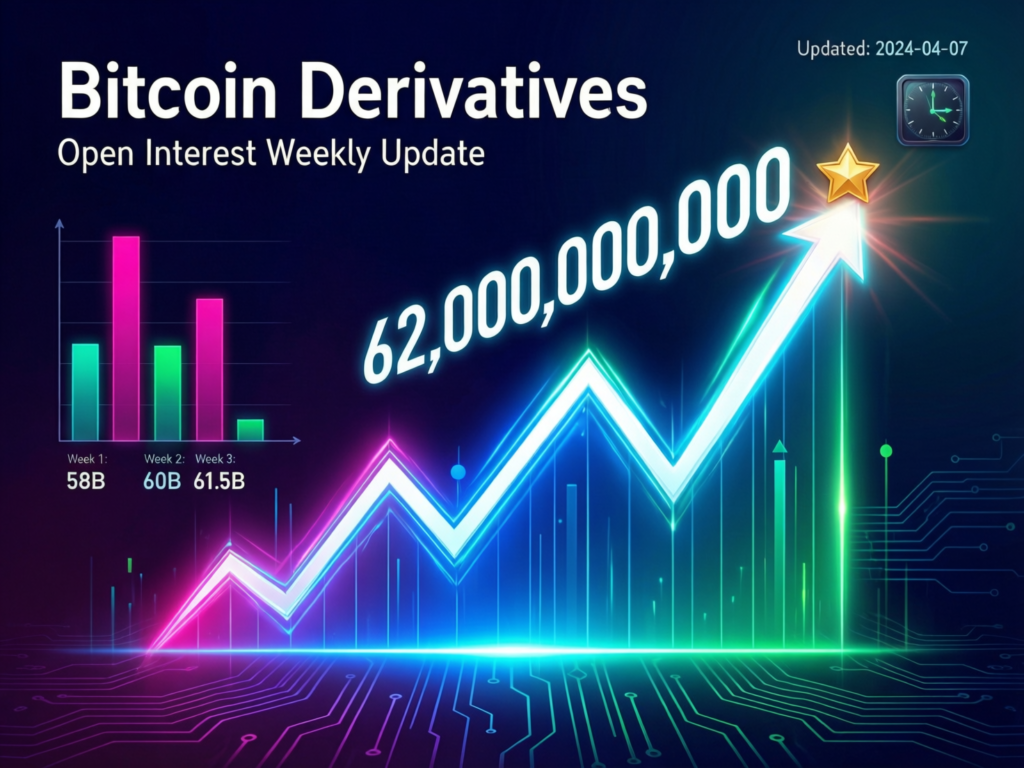

Derivatives snapshot (CoinGlass)

Futures volume (24h)

$68.8B

Spot volume (24h)

$7.6B

Futures open interest

$62.0B

Bitcoin dominance

≈ 57.6% of total crypto market cap.

Main data sources

CoinMarketCap, CoinGecko, CoinGlass, CoinDesk, Economic Times, CryptoQuant.

This Week in Bitcoin (BTC) Quick Summary

Bitcoin’s weekly move was constructive but choppy. BTC climbed from the high-$80Ks / low-$90Ks to test ~$97K, then slipped back toward the mid-$95Ks. Renewed spot Bitcoin ETF inflows over $800M in a single day and around $1.7B across three days played a big part in driving that push higher.

Those gains were partially faded as headlines about potential US regulatory action hit the tape, briefly knocking BTC back toward $95K and keeping intraday volatility elevated.

Overall, this Bitcoin (BTC) weekly update still places BTC in a broad post-correction recovery phase. Macro data and ETF flows are increasingly steering price action, with classic retail speculation playing a smaller (but still important) role.

Bitcoin Price Action & Key Levels

Weekly performance

7-day performance

BTC is up roughly 5–6% over the last week.

Weekly range

CoinGecko shows a 7-day low around $89,876 and a 7-day high near $97,538, a swing of about 8–9%.

Context

BTC briefly touched its highest level in eight weeks near $97K before sliding back toward $95K, as easing inflation worries helped risk assets, while regulatory noise later capped the move.

From a “Bitcoin price analysis this week” perspective, bulls clearly defended the $90K area and pushed price to the top of its recent range, but they have not yet forced a clean breakout toward six-figure territory.

Short-term technical view (reference levels, not signals)

Some reference levels traders are watching this week include:

Immediate resistance

$97K–$98K: the recent weekly high zone and where upside momentum has stalled.

$100K: a major psychological barrier, likely to attract heavy options activity and ETF-related flows.

Key support

$90K–$89K: aligns with this week’s low; a decisive break below would signal a weaker near-term structure.

Mid-$80Ks: cited in several institutional notes as the next deeper support band if volatility expands.

Volatility has been elevated but not extreme. A roughly $7.6K intrawweek range is meaningful, yet modest compared with some of 2025’s blow-off phases.

News & Narratives That Moved Bitcoin This Week

Spot ETF inflows roar back

US spot Bitcoin ETFs logged about $843.6M of net inflows in one day, the largest since October, and roughly $1.7B across a three-day streak. That points to renewed institutional interest after a quieter Q4.

Macro relief, then regulatory jitters

BTC’s push toward $97K was supported by easing inflation concerns and a US Supreme Court decision that helped risk sentiment at the margin. The rally cooled as fresh headlines about potential US regulatory tightening on crypto pushed BTC back toward $95K and encouraged profit-taking.

Conflicting longer-term forecasts

Some research desks have cut medium-term BTC targets, citing slower ETF growth and macro uncertainty. Others still outline a potential path toward $150K into 2026, leaning on halving dynamics plus structural institutional demand.

Systemic-risk debates

Traditional-finance strategists increasingly group AI, Bitcoin, and private credit into a “risky trinity” of correlated exposures, warning they could amplify any future risk-off episode if they unwind together.

On-Chain, Derivatives & Sentiment

On the derivatives side, CoinGlass shows.

Open interest around $62B, up from prior weeks but still below euphoric extremes.

Futures volume (24h) around $68.8B versus $7.6B spot, underscoring that price discovery remains heavily derivatives-driven.

Roughly $63M in futures liquidations over the last day moderate compared with the multi-billion liquidations seen during 2025’s sharp crashes.

On-chain, CryptoQuant data suggests that once exchange addresses are filtered out, larger “whale” wallets are not aggressively buying this dip, pushing back against the narrative that big players are hoovering up all supply at current prices.

Sentiment looks neutral to slightly greedy. Binance’s crypto Fear & Greed index is hovering around 50 (neutral), while some BTC-specific gauges flag a return to “Greed” after this week’s bounce.

Bitcoin vs. the Rest of Crypto Dominance & Market Context

Bitcoin’s dominance near 57–58% underlines how BTC continues to outpace most altcoins in early 2026. ([CoinGecko][6]) Majors such as ETH and SOL have seen relief rallies, but flows remain skewed toward BTC especially via ETFs and institutional products.

In practice, Bitcoin is still the reference asset, and much of the broader crypto market is taking its cues from BTC’s swings between $90K and $100K.

What This Means for Traders & Long-Term Holders

For active traders (not financial advice)

Expect two-sided volatility between roughly $90K and $97K, with liquidity and options interest clustering around round numbers like $90K and $100K.

Keep an eye on open interest and ETF flows. Rising OI plus strong ETF inflows can amplify both upside breakouts and downside squeezes.

Regulatory headlines are moving price intraday; new comments or actions from US regulators or courts can quickly shift risk appetite.

With funding rates and positioning not at extremes, both bullish breakouts and deeper pullbacks remain plausible from here.

For long-term holders

The post-halving supply backdrop remains supportive, but recent research underlines that macro conditions, ETF flows, and institutional positioning now matter as much as the halving itself.

Strong ETF inflows suggest regulated channels are still accumulating BTC, even as some analysts trim their long-range price targets.

Elevated dominance implies Bitcoin continues to be viewed as the “safer” crypto asset relative to high-beta altcoins.

Key structural risks remain: macro shocks, regulatory clampdowns, or a sustained drop in ETF demand could all quickly change the narrative.

Risks, Scenarios

Looking ahead from this Bitcoin (BTC) weekly update, a few broad scenarios stand out:

Bullish scenario

ETF inflows stay strong or accelerate, macro data remains benign, and BTC convincingly breaks above $97K–$100K, potentially reopening the path toward prior highs and, in some analyst views, the $150K discussion into 2026.

Neutral / range-bound scenario

ETF flows cool but stay positive, regulatory news is mixed, and BTC oscillates between the mid-$80Ks and high-$90Ks, digesting 2025’s huge swings while maintaining elevated dominance.

Bearish scenario

A negative regulatory surprise or macro shock triggers ETF outflows and leverage unwind, sending BTC back to retest or break below the $85K region, weighing heavily on broader crypto sentiment.

Final Thoughts

This Bitcoin (BTC) weekly update shows a market that’s holding up well above $90K, but still very sensitive to ETF flows and US regulatory headlines. Bulls defended key support, ETFs returned to strong net inflows, and Bitcoin dominance stayed elevated, keeping BTC firmly in charge of the broader crypto narrative.

Looking ahead, the path between $90K and $100K remains a battle zone where macro data, policy developments, and institutional positioning will likely decide the next big move. Cautious optimism is justified, but so is respect for volatility, headline risk, and the very real possibility of deeper pullbacks along the way.

FAQs

Q : Why did Bitcoin move between roughly $90K and $97K this week?

A : BTC climbed toward $97K on easing inflation worries and a more risk-on macro tone, helped by strong spot Bitcoin ETF inflows. It then pulled back toward the mid-$95Ks as new US regulatory concerns hit sentiment and some traders locked in profits near the top of the recent range.

Q : What are the key Bitcoin support and resistance levels right now?

A : Short-term resistance sits around $97K–$98K, where price stalled this week, with the next major psychological barrier near $100K. On the downside, the $90K–$89K band marks the recent weekly low, while several analyses still highlight the mid-$80Ks as a deeper support zone if volatility picks up.

Q : How are Bitcoin ETFs affecting BTC price in this weekly update?

A : Spot Bitcoin ETFs absorbed about $843M in a single day and roughly $1.7B over three days, marking their strongest intake since October. These flows add sustained buy-side demand and have helped BTC hold above $90K even though on-chain data suggests large, non-exchange whales are not yet aggressively accumulating.

Q : Is Bitcoin in a bullish or bearish phase in early 2026?

A : Structurally, BTC remains well above prior cycle highs and benefits from post-halving supply cuts plus institutional access via ETFs, which many analysts view as broadly bullish into 2026. At the same time, lingering macro and regulatory risks and some downgraded long-term targets mean the market is treating this as a more mature, macro-driven cycle, not a simple runaway super cycle.

Q : How risky is trading Bitcoin this week compared with usual?

A : Trading risk is elevated but not extreme. BTC has traded in roughly a $89.9K–$97.5K weekly range with about $63M in liquidations over 24 hours. Derivatives open interest near $62B and a neutral to slightly greedy sentiment backdrop suggest leverage is present but not overheated so both upside breakouts and downside flushes remain on the table.