Blockchain in Government: How Gulf States Lead

Blockchain in government means using shared, tamper-evident ledgers and smart contracts to run services like identity, land records, licensing and benefits with fewer intermediaries and clearer audit trails. Gulf states such as the UAE, Saudi Arabia, Bahrain and Qatar already use blockchain to streamline visas, property transfers and fintech licensing, offering a practical playbook for US, UK and EU public-sector teams.

Introduction

Across Washington DC, London, Berlin and Brussels, public-sector teams are under pressure to modernise legacy systems, cut fraud and deliver digital-by-default services that citizens actually trust. At the same time, Gulf governments from Dubai and Abu Dhabi to Riyadh, Manama and Doha are quietly turning blockchain in government from a buzzword into live public services.

This article is written for US, UK, German and wider EU policymakers, digital leaders and gov-tech vendors who want something more concrete than “DLT will change everything”. We’ll unpack how Gulf states use blockchain for core services like identity, land, licensing and trade, what’s really working, and how to collaborate without falling foul of GDPR, UK-GDPR, DSGVO, PDPL or HIPAA-style rules.

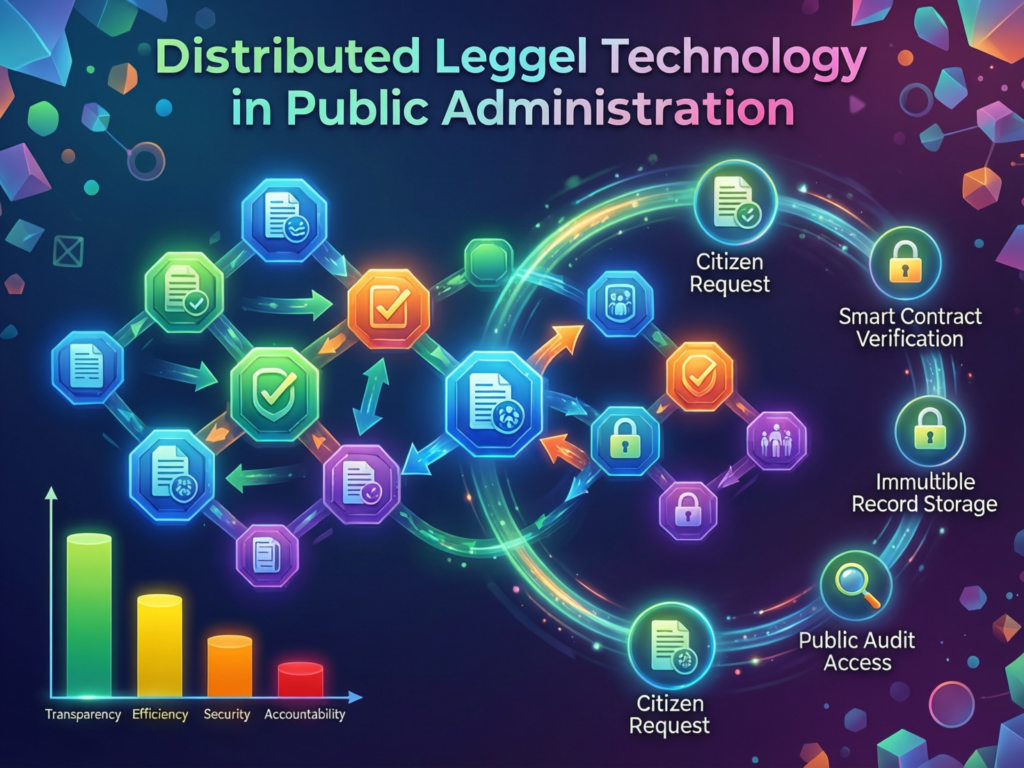

By blockchain in government we mean distributed ledger technology in public administration: permissioned ledgers, smart contracts and e-government digital identity on blockchain not speculative crypto trading. Think tamper-evident records, shared data layers and automated workflows for services that today run on disconnected, paperwork-heavy systems.

Global estimates already put the “blockchain government” market in the low single-digit billions of dollars in 2023–2024, with some forecasts suggesting it could grow five-to-six-fold by the early 2030s.

What Does “Blockchain in Government” Really Mean in 2025?

Blockchain in government means using distributed ledgers and smart contracts to run core public services such as identity, land registries and licensing on a shared, tamper-evident record. Instead of each agency keeping its own opaque database, multiple ministries share a synchronised ledger where every update is logged, signed and auditable.

Core concepts for public administration

For public administrators, you can think of distributed ledger technology in public administration as a shared spreadsheet that many agencies can append to, but no one can quietly rewrite. Each “row” (a transaction) is cryptographically linked to the last, so attempts to alter history are obvious.

Key building blocks

Permissioned vs public chains

Public (e.g., Bitcoin, Ethereum-style): anyone can run a node and view transactions; good for transparency, but tricky for sensitive citizen data.

Permissioned: only approved government or partner nodes participate; transactions can still be tamper-evident without exposing personal data broadly. This is the model used in most government blockchain projects today.

Smart contracts

These are small programs that sit on the ledger and automatically execute rules: “if all documents are valid, issue licence”; “if payment received, transfer title”. In public services, this becomes smart contracts for public service delivery: benefits approvals, permit renewals, subsidy disbursement, procurement milestones and more.

Compared with traditional databases

Traditional government databases are centralised: one department owns the system, others request extracts, emails or batch feeds. That creates reconciliation work, data silos and room for manipulation. A properly governed blockchain creates a single, jointly controlled history of events, with role-based access to the details.

The key point: blockchain isn’t magic, but it’s a useful way to make high-value records tamper-evident and shareable across ministries, regulators and even borders.

Global government blockchain use cases in the US, UK, Germany & EU

Globally, more than 200 public-sector blockchain use cases have been catalogued, from land registries to procurement systems. In practice, most activity clusters around a few themes:

Land and property registries US states such as Vermont and Texas have explored land-title pilots on blockchain, aiming to reduce fraud and speed up conveyancing.

Company registers & licensing corporate registries, beneficial-ownership logs and regulated-entity lists are obvious candidates where multiple agencies and regulators need a shared source of truth.

Digital identity and eID Estonia’s KSI blockchain underpins secure logging and integrity for national registries and e-Residency, while the EU’s new Digital Identity Wallet is being piloted across 26 member states plus Norway, Iceland and Ukraine.

Healthcare and patient data from NHS-adjacent pilots for blockchain-backed health records to US and EU experiments in sharing consent and claims data, many projects focus on auditability and consent management rather than raw data storage.

Cross-border data sharing in the public sector customs data, diplomas, professional licences and eIDAS-style qualified credentials are being tested as verifiable, tamper-evident credentials that can move between jurisdictions.

For US CIOs and European CDOs, the signal is clear: blockchain is already a live tool in peer governments, especially for registries, identity and compliance-heavy workflows.

Benefits and limits.

Used well, blockchain in government offers.

Transparency & auditability every change is logged with a timestamp and signer, simplifying audits and FOI responses.

Government transparency and anti-corruption technology tamper-evident land and licence records make it harder to “lose” files or backdate decisions. (rwa.io)

Cross-agency data sharing different ministries can read and write to the same ledger while keeping sensitive fields encrypted or off-chain.

Reduced fraud & paperwork smart contracts can cut manual approvals, double-data entry and opportunities for falsification.

But there are real limits

Not every workflow needs a blockchain; simple, well-governed databases often suffice.

Governance, legal frameworks and interoperability matter more than tech choices.

On-chain personal data is risky in GDPR/UK-GDPR/DSGVO and HIPAA contexts; most serious architectures use “off-chain data, on-chain integrity proofs” to stay compliant. (EUR-Lex)

Why Are Gulf States Betting on Blockchain for Public Services?

Gulf governments are investing heavily in blockchain to leapfrog legacy IT, attract foreign investors and deliver digital-by-default citizen journeys in areas like visas, identity, land and licensing. Their bet is simple: if public services are fast, predictable and auditable, they gain competitiveness and trust at the same time.

For US, UK and EU readers asking why Gulf states use blockchain for public services, the answer is less about hype and more about national digital strategies.

Dubai Blockchain Strategy, Saudi Vision 2030 & GCC digital agendas

Dubai’s early Blockchain Strategy and the UAE’s Emirates Blockchain Strategy set a bold target: move a large share of applicable government transactions to blockchain to improve efficiency and paperless operations. These sit alongside Digital Dubai, Digital UAE and Dubai Future Foundation programmes focused on smart city services, AI and data sharing.

Saudi Arabia’s Vision 2030 explicitly calls for digital government, financial innovation and smart cities like NEOM, where blockchain is one of several enabling technologies for licences, urban services and digital finance.

Bahrain and Qatar weave blockchain into broader digital-economy agendas: Bahrain via a pioneering virtual-assets regime and fintech sandbox; Qatar via its Digital Agenda 2030 and a National Blockchain Blueprint that highlights identity, education and supply-chain use cases.

In other words, blockchain is one strand in a larger fabric alongside AI, data centres and cloud. (If you’re tracking those themes too, Mak It Solutions’ guides to Middle East data centers and Middle East cloud providers for KSA, UAE & Qatar CIOs offer complementary detail on the infrastructure side.)

Why blockchain fits the Gulf public-sector context

Several structural factors make blockchain a natural fit in the Gulf.

Young, mobile-first populations in cities like Dubai, Riyadh and Doha expect digital-only interactions.

High digital adoption and strong ID systems pair well with e-government digital identity on blockchain and app-based service delivery.

Centralised decision-making lets governments run ambitious cross-agency programmes (one-stop shops for visas, residency, business setup) without years of inter-department negotiation.

GCC data-protection regimes (UAE PDPL, Saudi PDPL, Bahrain PDPL) are converging toward GDPR-inspired principles, making permissioned ledgers a structured way to prove integrity while respecting privacy.

For US state governments or European ministries, the context is obviously more fragmented but the underlying patterns in fraud-prone, document-heavy services look very similar.

Trust, transparency and competitiveness

Gulf states care deeply about investor confidence and perception. When real-estate deals, trade documents and fintech licences sit on auditable, timestamped ledgers, it becomes easier for foreign investors in New York, London or Frankfurt to assess risk.

Bahrain’s vehicle-registration blockchain and virtual asset regulations, for example, are framed explicitly around transparency, real-time verification and regulatory oversight. Dubai Land Department’s blockchain registry for property lets banks and developers verify titles instantly, reducing disputes and processing time.

For Western audiences tuned into government transparency and anti-corruption technology, the Gulf story is less “crypto casino” and more “make it impossible to quietly alter ownership, licences or customs declarations”.

What Blockchain Initiatives Are Gulf Governments Using to Modernise Public Services?

Gulf governments are already using blockchain for digital identity, visas, land registries, healthcare records, trade, licensing and smart city services. The most active hubs today are Dubai and Abu Dhabi in the UAE, Riyadh and NEOM in Saudi Arabia, and Manama and Doha in Bahrain and Qatar.

If you’re asking what are the most important blockchain initiatives Gulf governments are using to modernise public services, it’s these high-friction, high-value citizen journeys.

UAE and Dubai.

The UAE has gone furthest in connecting blockchain strategies to live services:

Visas, residency & identity as part of the Emirates Blockchain Strategy and Digital UAE agenda, authorities have piloted blockchain-backed visa and residency workflows, tying into initiatives like Golden Visa programmes and unified digital identity.

Land registry & property Dubai Land Department’s blockchain land registry connects property data to utilities and telecoms, enabling faster title transfers and reducing fraud.

Smart city services under Digital Dubai and Dubai Future Foundation, projects extend blockchain to permits, utility connections and business services as part of a fully digital city vision.

Abu Dhabi’s Department of Government Enablement and federal Digital UAE programmes are pushing similar patterns: shared data layers, consentable identity and verifiable credentials for business and citizen journeys.

If you work on digital government in London or Berlin, this is the practical face of the “UAE blockchain strategy implications for EU governments”: fewer stamps, more verifiable digital events.

Saudi Arabia: Vision 2030, NEOM and public-sector blockchain pilots

Saudi Arabia’s Vision 2030 uses blockchain as one of several tools to digitise public services, finance and smart cities.

Licensing & registries trade, investment and professional licences are natural candidates for permissioned ledgers shared between ministries and regulators such as the Saudi Central Bank and Saudi Communications, Space & Technology Commission (CST).

NEOM & smart cities NEOM’s urban operating system explores distributed ledgers alongside AI and IoT to track assets, permissions and service entitlements across The Line, Oxagon and other zones.

Trade, customs & public finance pilots link customs data, trade finance and public procurement to shared ledgers to cut paperwork, reduce fraud and give the Ministry of Finance real-time visibility.

For US readers, think of this as combining a state-wide blockchain land registry, DMV, tax authority and port authority pilot into a single Vision 2030 portfolio.

Bahrain, Qatar, Kuwait & Oman.

Smaller Gulf states punch above their weight in targeted niches.

Bahrain a regional pioneer for virtual-asset and fintech regulation, Bahrain’s Central Bank runs a well-known regulatory sandbox and has authorised multiple blockchain-based fintechs. Government services around vehicle registration and personal data protection increasingly assume verifiable, digital records rather than paper.

Qatar Qatar’s National Blockchain Blueprint and Digital Agenda 2030 emphasise digital identity, logistics and sector-specific pilots in healthcare and education, aligned with its goal of becoming a leading digital economy.

Kuwait & Oman while less publicised, both have tested blockchain for identity, municipal services and land in the context of wider data-protection and smart-city agendas.

For more on the regional tech backdrop, Mak It Solutions’ pieces on scaling startups in the Middle East and GCC tech startup hubs beyond Dubai are a good complement.

Government blockchain use cases that matter most to citizens

From a citizen or investor perspective, only a few use cases truly matter.

E-government digital identity on blockchain single sign-on to services, verifiable IDs and credentials that work across agencies and, in time, across borders.

Smart contracts for public service delivery rules-based payment of benefits, permit issuance, social-support disbursement and vendor milestones.

Land & asset registries property, vehicles, licences and secured loans tied to auditable records reduce disputes and corruption.

Customs, trade & logistics tamper-evident bills of lading, certificates of origin and supply-chain events decrease friction for exporters.

Healthcare record-sharing not storing raw patient data on-chain, but logging consent, integrity and access in ways regulators can audit.

Across Dubai, Riyadh, Manama and Doha, several of these are live or in production-grade pilots; others remain proofs of concept. For private-sector readers, Mak It Solutions’ guide to proven enterprise blockchain use cases for global business maps nicely onto what public administrations are trying too.

How Is Blockchain Actually Implemented Inside Government Workflows?

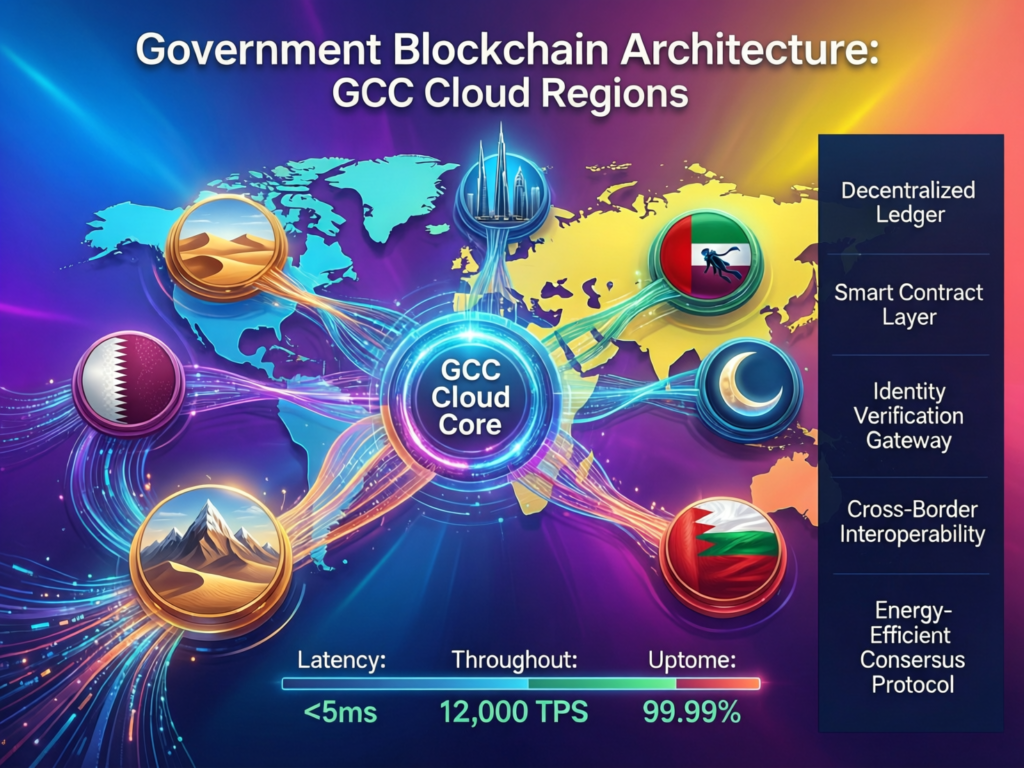

In practice, Gulf governments deploy permissioned blockchains hosted on cloud platforms, integrate them with legacy systems via APIs, and govern them through cross-agency consortia under national data-protection and financial regulations. For Western vendors, understanding this implementation reality of blockchain in government is essential for compliant collaboration.

Reference architectures.

A typical government blockchain architecture in the GCC looks like this:

Permissioned ledger layer nodes operated by ministries, regulators and sometimes strategic partners (e.g., banks or customs authorities)

Cloud and data centre infrastructure hosted in GCC cloud regions or sovereign data centres (AWS, Azure, Google Cloud, STC Cloud, G42/Core42, e& enterprise, Ooredoo), aligned with national residency rules.

Identity & PKI integration linkage to national ID systems, PKI and mobile ID apps; citizens sign transactions or consents using familiar e-ID flows.

API and event layer REST/GraphQL APIs and message buses connect the ledger to existing registries, case-management systems and portals.

From a compliance standpoint, international vendors joining these projects are expected to align with PCI DSS, SOC 2 and FedRAMP-style controls for their components, especially when handling payments or sensitive data.

Integrating blockchain with existing government IT and data flows

Most government workflows are not greenfield. Integration patterns include.

Side-by-side registries the blockchain acts as a notarisation layer for key events, while the existing database remains the operational system of record until confidence grows.

Gradual migration new records are written to both systems; over time, legacy reads become a fallback only.

Interoperable data models & open APIscareful data modelling allows cross-agency and even cross-border data sharing, including interoperability with EU eIDAS 2.0 and the EU Digital Identity Wallet for European partners.

For US and European vendors, this is where practical work happens: mapping legacy schemas, aligning event models, and ensuring your components can speak both the chain’s protocol and government API standards.

Compliance, GDPR/DSGVO & PDPL.

Gulf data-protection laws increasingly mirror core principles of GDPR and UK-GDPR.

UAE’s Federal Decree-Law No. 45 of 2021 on Personal Data Protection introduced EU-style rights and data-processing obligations.

Saudi Arabia’s PDPL governs processing of personal data about individuals in the Kingdom, including by entities abroad.

Bahrain’s Law No. 30 of 2018 established a national Personal Data Protection Law and supervisory authority.

When these regimes meet GDPR/DSGVO in Berlin or Brussels and UK-GDPR/ICO guidance in London, the safest government blockchain pattern is to:

keep personal data off-chain, in encrypted databases or document stores;

store hashes, signatures and minimal metadata on-chain to prove integrity and sequence;

enforce data-residency by pinning nodes to approved data centres or regions;

use strong encryption and key-management practices to align with HIPAA and PCI DSS where health or payments intersect.

Governance, risk and change management in public administration

Technology is the easy bit. Gulf programmes that move beyond pilots share a few governance patterns:

Multi-agency steering councils ministries and regulators share a formal governance body for the consortium ledger.

Legal frameworks for smart contracts clear decisions on when a smart contract is legally binding, how disputes are resolved and how upgrades are handled.

Auditability by design log structures, role-based access and reporting shaped so auditors and anti-corruption bodies can actually use them.

Skills & change management training for civil servants, regulators and auditors so they understand distributed ledgers, not just “the blockchain project”.

Western teams can transplant many of these ideas into NHS data platforms, BaFin-supervised registries or US federal programmes with minor localisation.

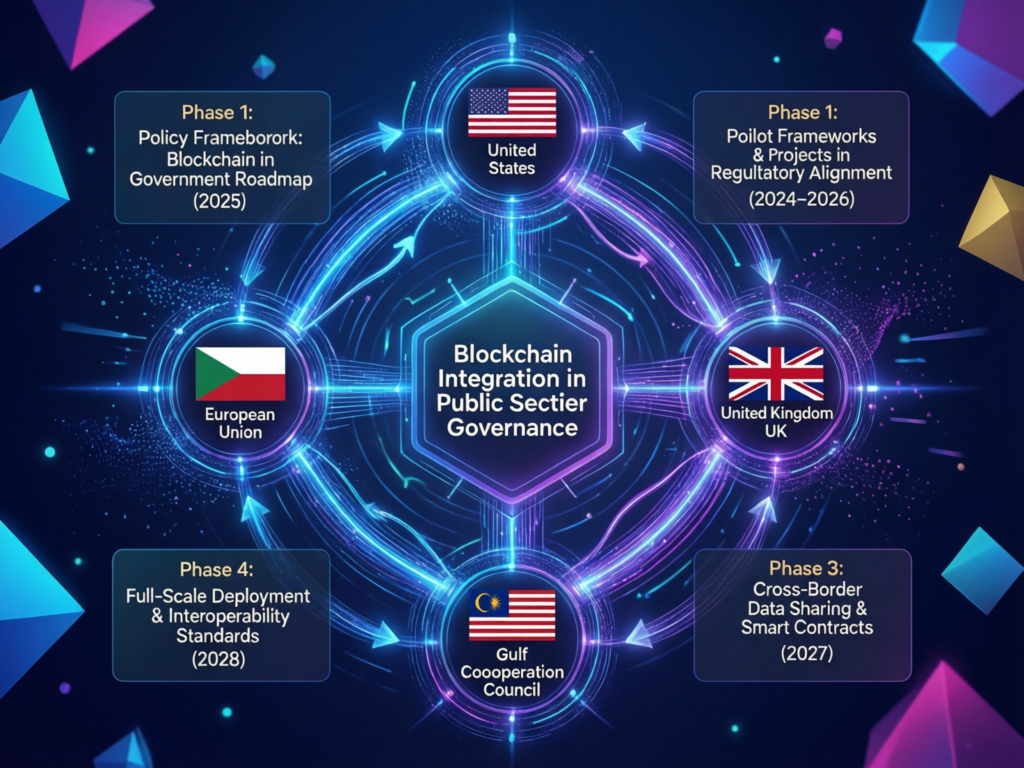

What Can US, UK and European Governments Learn from Gulf Blockchain Projects?

US, UK and European governments can learn to start with high-friction services, design cross-agency data sharing from day one and use targeted pilots not big-bang replacements to unlock blockchain’s value in public services. That’s the heart of the lessons for US government from Gulf blockchain projects.

Selecting high-impact government blockchain use cases

A simple prioritisation framework.

Fraud & leakage where is money or value leaking today (benefits, tax, subsidies, land, procurement)?

Cross-agency friction which services require citizens to bounce between agencies (business setup, residency, trade)?

Regulatory readiness where are regulators (e.g., BaFin, NHS regulators, EU Commission, US state regulators) open to sandboxes or innovation tracks?

Gulf examples suggest starting with.

Land & property as Dubai and Bahrain demonstrate, blockchain land registries can cut fraud and speed up transactions.

Identity & licensing where shared registries reduce duplication between central agencies and sector regulators.

Healthcare & social services where tamper-evident logs of consent and access can support NHS-style or EU data-space initiatives without exposing raw health data.

Policy and regulatory takeaways for Western administrations

Gulf sandboxes offer a useful blueprint.

Regulatory sandboxes & digital authorities bodies akin to Dubai’s VARA or Bahrain’s CBB sandbox give innovators a supervised space to test blockchain-based services.

Data spaces & open banking EU data spaces and UK/EU Open Banking/Finance can borrow from Gulf experiments in tokenised credentials and shared ledgers for consent and access control.

US federal & state innovation federal agencies and states can align blockchain pilots with broader digital-identity, payments and cybersecurity strategies instead of treating them as isolated experiments.

Cultural and procurement lessons

Some soft-factor lessons Western teams can take from Dubai, Riyadh or Doha.

Agile policy-making shorter consultation cycles and time-boxed sandboxes rather than multi-year strategy exercises.

Public–private partnerships co-design with regulators, cloud providers and system integrators, clearly defining risk and responsibilities.

Innovation funds & challenge programmes contest-style procurement that scopes small, verifiable pilots instead of vast waterfall projects.

Mak It Solutions often helps bridge these cultural gaps for clients rolling out cross-border platforms, bringing together architecture, compliance and vendor selection in one roadmap.

How Can US/UK/EU Vendors and Policymakers Collaborate with Gulf Governments on Blockchain in Government?

International vendors should align with Gulf digital strategies, design GDPR/UK-GDPR- and PDPL-compliant architectures, partner with local entities and focus on concrete pilots in identity, land, trade and smart-city services. For policymakers, this means clarifying what “good” looks like in joint projects before the RFP hits the street.

If you’re wondering how US/UK/EU governments and vendors can collaborate with Gulf states on compliant blockchain-in-government projects, the answer lies in partnership structure, roadmaps and trust signals.

Partnership and delivery models for government blockchain services

Typical models include

Joint ventures with local partners especially in Saudi Arabia and the UAE, where local presence and alignment with national strategies are essential.

System-integrator partnerships pairing Western blockchain/gov-tech vendors with GCC integrators who understand ministries, regulators and data-residency nuances.

Cloud-provider alliances tri-party setups between a Gulf ministry, a hyperscaler (AWS, Azure, GCP) and specialist vendors, often hosted in GCC cloud regions.

Gov-tech consortia cross-border teams delivering shared reference architectures for identity, land or trade services.

For US or European firms, a practical starting point is to map which offerings can plug into GCC-hosted, sovereign-friendly cloud architectures Mak It Solutions’ Middle East cloud providers guide is a useful companion here.

Designing a government blockchain implementation roadmap

A workable government blockchain implementation roadmap usually follows six steps:

Discovery & policy alignment map pain points, regulatory constraints (GDPR/UK-GDPR, PDPLs, HIPAA, PCI DSS), and national digital strategies.

Concept & architecture design a permissioned-ledger reference architecture, choose regions/data centres, and define off-chain vs on-chain boundaries.

Technical pilots & sandboxes run narrow pilots (e.g., land-title transfers in one city, one trade lane, one professional licence type) under regulatory sandbox supervision.

Evaluation & risk management stress-test security, performance, legal enforceability and change-management impacts.

Scaling & integration roll out to new agencies, regions or user groups; deepen integration with legacy systems and cross-border partners.

Operations & continuous improvement long-term governance, monitoring and iterative upgrades.

This stepwise approach reduces public-sector blockchain risks and regulation headaches while still delivering visible wins in 12–24 months.

Building trust: EEAT, transparency and long-term governance

To win and keep trust with Gulf and Western public-sector stakeholders, vendors should:

publish clear documentation on architectures, data flows and compliance mappings;

undergo independent audits (SOC 2-style reports, penetration tests, privacy assessments)

secure local certifications where available (e.g., alignment with national cloud or data-residency schemes);

showcase public-sector case studies from GCC and European contexts, not just generic enterprise examples.

This is where Mak It Solutions typically steps in: translating complex technical stacks and cross-border regulatory constraints into a roadmap senior officials in Dubai, London or Washington DC can actually sign.

Key takeaways

Blockchain in government is about shared, tamper-evident registries, not speculative crypto especially for identity, land, licensing and trade.

Gulf states are running some of the world’s most ambitious public-sector blockchain projects, tied to strategies like Dubai’s Blockchain Strategy, UAE’s digital agenda and Saudi Vision 2030.

The most citizen-relevant use cases are land, identity, licensing and healthcare, where fraud and paperwork are high and multi-agency coordination is hard.

Implementation success depends on permissioned architectures, cloud/data-centre choices, and strong data-protection alignment across GDPR, UK-GDPR, DSGVO and GCC PDPLs.

US, UK and EU teams can learn from Gulf pilots by starting small, picking high-friction journeys and using sandboxes, not trying to “blockchain everything”.

Cross-regional collaboration works best when vendors bring clear EEAT signals audits, references and transparent architectures plus local partners and sovereign-ready hosting.

From pilots to production.

If you work in a ministry, regulator or gov-tech vendor in New York, London, Berlin or Brussels, start by picking one high-friction service and mapping how a shared, tamper-evident registry could remove pain for citizens, businesses and auditors. Then look outward: where could a Gulf partner Dubai, Riyadh, Manama, Doha provide a live reference or even a joint pilot?

Mak It Solutions can help you design that cross-regional blockchain-in-government roadmap: from discovery and architecture through to vendor selection and GCC/EU/US compliance alignment.

If you’d like a concrete view of how Gulf government blockchain patterns apply to your agency or product.

Share your current architecture and priority citizen journeys.

We’ll map where blockchain genuinely adds value and where simpler tech is enough.

Together, we can sketch a GCC-aware, GDPR-aligned roadmap you can defend to ministers, regulators and audit committees.

You can start the conversation today via our Contact page or explore our broader services portfolio for cloud, data and mobile-app expertise.

FAQs

Q : Which Gulf country is currently most advanced in blockchain-based public services?

A : The UAE especially Dubai and Abu Dhabi is generally seen as the most advanced, thanks to early strategies like the Emirates Blockchain Strategy and Dubai Blockchain Strategy, and live projects in land registries, licensing and smart-city services. Saudi Arabia is catching up fast under Vision 2030, particularly through NEOM and fintech initiatives, while Bahrain and Qatar lead in focused niches like virtual assets, trade and digital identity.

Q : Can governments safely store citizen data on public blockchains, or should they always use permissioned ledgers?

A : Most serious government projects avoid putting raw personal data on public blockchains, because that clashes with GDPR/UK-GDPR, DSGVO, HIPAA and national PDPL regimes. Instead, they use permissioned ledgers with strict access controls and keep identifiable data off-chain in encrypted databases, recording only hashes and minimal metadata on-chain. Public chains may still play a role for transparency in non-personal datasets, but permissioned architectures are the default for citizen data.

Q : How does blockchain in government compare to traditional databases for audits and anti-corruption efforts?

A : Traditional databases can certainly be audited, but they rely heavily on internal controls and logs that admins can, in theory, alter or misconfigure. A well-governed blockchain ledger gives auditors and anti-corruption bodies a tamper-evident timeline of events that multiple agencies jointly control, making it harder to “rewrite history”. That doesn’t remove the need for proper process and whistle-blowing protections, but it strengthens the technical foundation for transparent government.

Q : What funding and procurement models do Gulf states use for blockchain pilots in the public sector?

A : Gulf governments typically combine central funding (often as part of national digital or Vision 2030-style programmes) with agile procurement: innovation challenges, regulatory sandboxes and co-funded pilots with cloud providers and system integrators. Once pilots show value, they are often folded into broader smart-city, e-government or data-platform budgets, giving vendors a path from prototype to production.

Q : How can a mid-sized European city or US state start learning from Gulf blockchain projects without overhauling all legacy systems?

A : A practical approach is to treat blockchain as a side-by-side integrity layer, not a rip-and-replace database. Start with one use case perhaps land titles, business licensing or a cross-agency benefit and run a pilot that notarises key events on a permissioned ledger while legacy systems continue operating. Learn from Gulf playbooks around sandboxes, cloud-region selection and public-private partnerships, and only migrate core records once auditors, users and regulators are comfortable.