JPMorgan bucks crypto bulls, sees Fed hike in 2027

JPMorgan has outlined a policy outlook that differs sharply from both market expectations and views held by parts of the crypto community. The bank believes the Federal Reserve will keep interest rates on hold throughout the current year, with the policy rate remaining in a 3.5%–3.75% range. This stance suggests policymakers are comfortable maintaining restrictive conditions as inflation and economic growth continue to rebalance.

Looking further ahead, JPMorgan forecasts a single 25 basis point rate hike in the third quarter of 2027. This projection stands in contrast to futures markets, which continue to price in rate cuts well before that timeframe. The divergence highlights growing uncertainty over the long-term path of monetary policy and underscores the gap between institutional forecasts and market sentiment, particularly among investors who expect easier financial conditions sooner rather than later.

Market Outlook and JPMorgan’s Base Case

Why JPMorgan thinks the next move is higher

JPMorgan’s latest economics call envisions a long hold through 2026, with the next policy change being a quarter-point hike in Q3 2027. The view diverges from traders’ expectations for easing this year and follows labor data showing only tepid deterioration.

How this squares with futures pricing

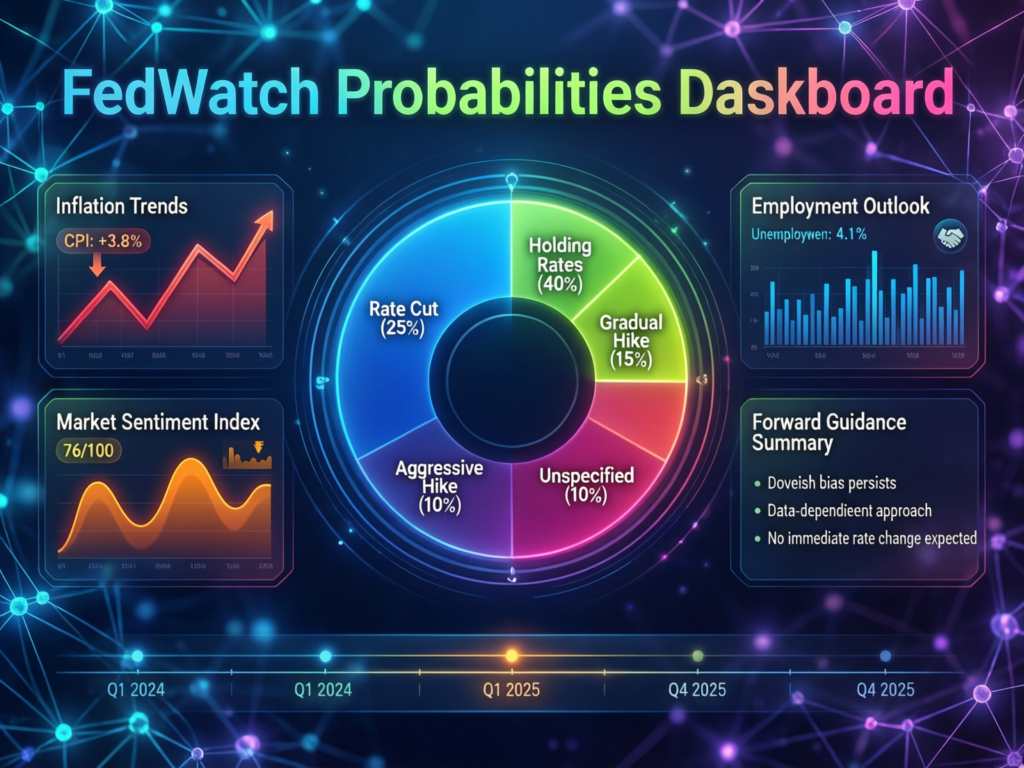

The CME FedWatch tool derived from 30-Day Fed Funds futures continues to show probabilities skewed toward one or more cuts in upcoming meetings this year, underscoring the gap between JPMorgan’s call and market odds.

Why Policy Path Matters for Bitcoin

JPMorgan predicts Fed rate hike in 2027 vs. crypto bulls’ cut narrative

CoinDesk highlights that many crypto analysts still frame potential 2026 cuts as supportive for bitcoin, given the asset’s sensitivity to global liquidity conditions. FXTM’s Lukman Otunuga, for example, told CoinDesk that lower rates alongside thinning active supply could aid prices in 2026 even as JPMorgan’s house view points to no near-term easing.

What recent macro data suggest

December’s U.S. jobs report showed payrolls up by 50,000 and the unemployment rate dipping to 4.4%. Several banks shifted their timelines for rate reductions to later in the year on signs of a still-resilient labor market.

Strategy Implications

Positioning if the Fed stays on hold longer

Duration

A delayed easing cycle could keep upward pressure on the front end; curve steepening risk persists.

Risk assets

Liquidity-sensitive segments, including parts of crypto, may see higher volatility around data and FOMC dates.

Dollar

A prolonged pause can complicate USD downside bets tied to rapid U.S. easing.

Context & Analysis

The dispersion between JPMorgan’s “higher-for-longer, then hike” baseline and futures-implied easing reflects uncertainty around how quickly inflation converges to target versus how much slack emerges in the labor market. If unemployment drifts higher or disinflation accelerates, the Fed has left the door open to renewed easing yet recent data have not forced that shift.

Concluding Remarks

Upcoming inflation data, revisions to labor-market figures, and guidance from Federal Reserve officials will be critical in determining the direction of market expectations. These signals will influence whether investors gradually align with JPMorgan’s forecast of a rate hike in 2027 or instead push the bank’s outlook toward earlier monetary easing.

For the crypto market, the timing and speed of any shift in Fed policy remain central themes. Changes in interest-rate expectations often shape risk appetite, capital flows, and broader market narratives, making macro signals especially important for digital-asset investors watching for clues on future liquidity conditions.

FAQs

Q : What exactly does JPMorgan expect the Fed to do?

A : JPMorgan expects the Federal Reserve to keep interest rates unchanged at 3.5%–3.75% this year, followed by a single 25 basis point hike in the third quarter of 2027.

Q : How does this differ from futures pricing?

A : Fed funds futures continue to price in the possibility of rate cuts as early as this year, creating a clear disconnect with JPMorgan’s higher-for-longer outlook.

Q : Why would crypto care about the Fed path?

A : Bitcoin and other crypto assets are sensitive to liquidity conditions and risk appetite, both of which are heavily influenced by interest rates and expectations for policy easing.

Q : Did recent jobs data change timelines for cuts?

A : Yes. Softer but stable labor data around 50,000 jobs added and a 4.4% unemployment rate has led some banks to delay expectations for rate cuts.

Q: Is inflation still a concern?

A : Yes. Markets are closely watching upcoming CPI releases and services inflation to assess how quickly core inflation moves toward the Fed’s target.

Q : Does JPMorgan predict multiple hikes?

A : No. JPMorgan flags only one hike in Q3 2027, with any further moves dependent on inflation and labor-market trends.

Q : Will the Fed cut if the economy weakens sharply?

A : Yes. If the labor market deteriorates materially or inflation falls faster than expected, rate cuts could return to consideration.

Facts

Event

JPMorgan updates Fed outlook; sees first move as a 25 bps hike in Q3 2027Date/Time

2026-01-13T12:00:00+05:00Entities

JPMorgan Chase & Co.; U.S. Federal Reserve (FOMC); CME Group (FedWatch); CoinDeskFigures

Policy rate 3.5%–3.75% (hold in 2026); unemployment 4.4% (Dec.); payrolls +50k (Dec.)Quotes

“Lower interest rates and a thinning active supply could support prices.” Lukman Otunuga, FXTM (to CoinDesk)Sources

Reuters (J.P. Morgan forecasts 2027 Fed hike) CoinDesk coverage.