Strategy $1.2 billion Bitcoin purchase lifts BTC stash after MSCI reprieve

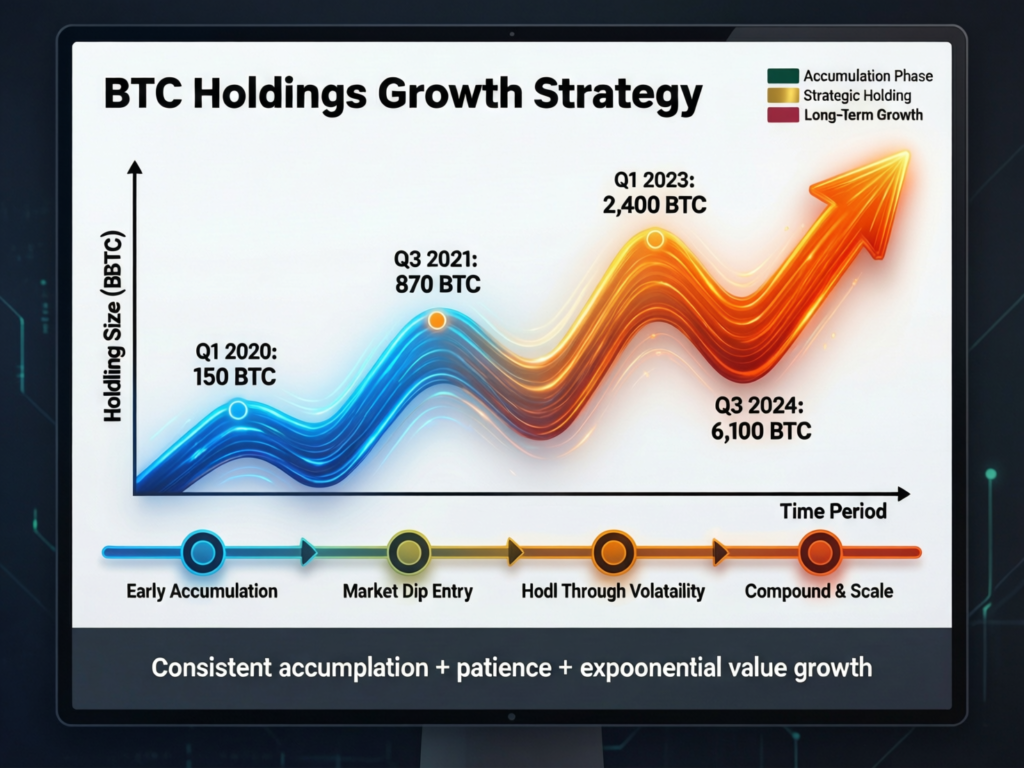

Strategy announced its largest weekly Bitcoin acquisition in over five months, confirming the purchase of approximately 13,600 BTC worth around $1.2 billion during the past week. The disclosure, reported through coverage of the company’s press release, highlights Strategy’s continued confidence in Bitcoin as a long-term asset. This aggressive buying marks a notable acceleration compared with recent months, signaling renewed momentum in the firm’s crypto accumulation strategy amid shifting market conditions.

The purchase comes shortly after MSCI decided to postpone potential index changes that could have removed companies with heavy cryptocurrency exposure from its benchmarks. By delaying these adjustments, MSCI reduced near-term uncertainty for crypto-focused firms, providing some relief to investors. Strategy’s move appears to capitalize on this window of stability, reinforcing its commitment to Bitcoin while broader discussions around index inclusion and crypto exposure continue to evolve.

Market-moving update.

Reports indicate Strategy bought about 13,600 BTC valued near $1.2 billion at recent prices marking its biggest weekly haul since late July. Coverage attributes the funding primarily to common stock issuance, alongside a tranche of preferred shares. The company signaled that steady access to capital markets remains central to its BTC accumulation strategy.

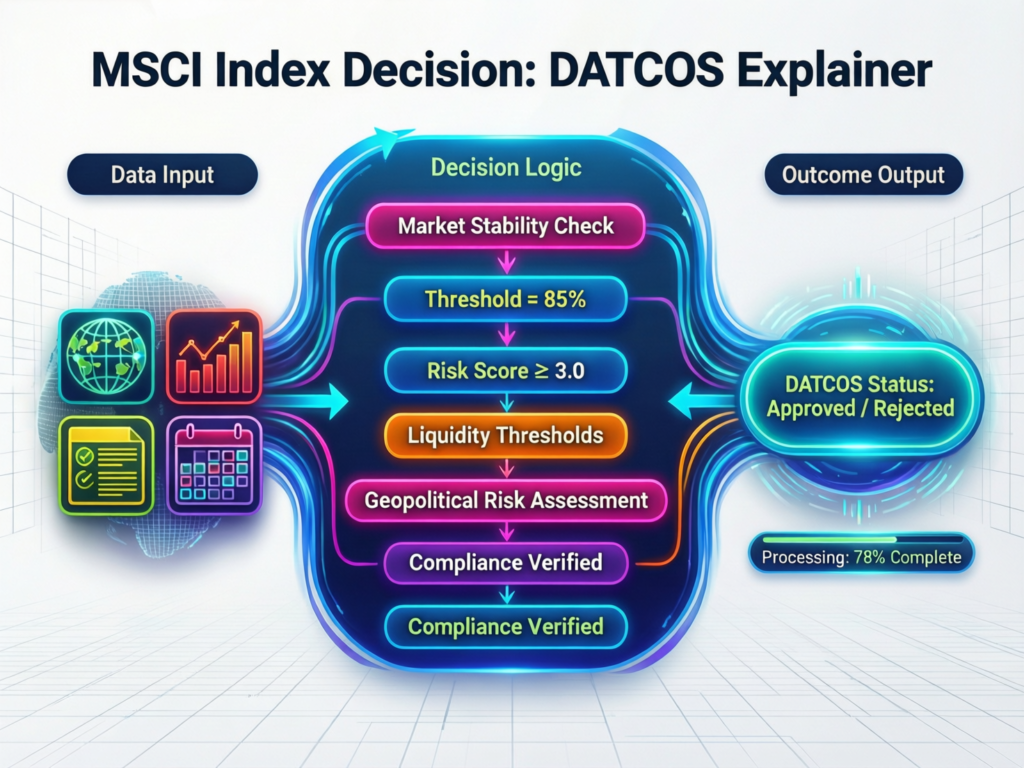

MSCI’s deferral stabilizes index eligibility

Global index provider MSCI said last week it would not immediately exclude “digital asset treasury companies” (DATCOs) from its benchmarks, opting for a broader consultation on classifying non-operating companies. The decision preserves Strategy’s index inclusion for now and removes a near-term overhang for passive flows tied to MSCI products.

Where Strategy’s BTC stack stands now

Based on contemporaneous reporting, Strategy’s total Bitcoin holdings and implied average cost have increased with the latest buy. Coverage places the firm’s BTC stash and blended cost near updated highs, though exact tallies can shift with subsequent purchases and price moves. (See “Facts Box.”)

Why the Strategy $1.2 billion Bitcoin purchase matters

Signals continued confidence in Bitcoin as a treasury reserve amid index-policy uncertainty.

Reinforces the firm’s capital-markets-funded accumulation model.

Offers beta-plus exposure for equity investors sensitive to BTC price and issuance dynamics.

Investor flows and index mechanics after the Strategy $1.2 billion Bitcoin purchase

MSCI’s deferral averts immediate exclusion risk yet leaves open a broader review of how to treat non-operating or asset-heavy companies at the next index update cycle. Analysts note this reduces near-term forced-selling risk for DATCOs while keeping future reclassification on the table.

Context & Analysis

Strategy’s stepped-up buying coincides with MSCI’s pause, which eliminated an immediate passive-index headwind. Still, MSCI’s broader consultation into non-operating classifications suggests policy risk isn’t fully resolved. Historically, Strategy has paired opportunistic market timing with equity issuance; that model’s sensitivity to index rules and share-count methodologies bears watching into the next review window.

To Sum Up

Strategy’s latest action further strengthens its position as the world’s most high-profile corporate holder of Bitcoin. The company continues to stand out for its aggressive accumulation strategy, reinforcing its long-term conviction in BTC as a core treasury asset. This approach keeps Strategy at the center of market attention, especially as institutional interest in digital assets continues to evolve.

With MSCI’s index decision deferred, market focus now turns to upcoming policy developments and Bitcoin’s price volatility. These factors will play a key role in shaping Strategy’s ability to issue capital and attract investor interest during Q1 and Q2 of 2026, potentially influencing both its growth strategy and broader market sentiment.

FAQs

Q : What did Strategy announce?

A : It purchased approximately 13,600 Bitcoin, worth around $1.2 billion, marking its largest weekly BTC acquisition since late July.

Q : Why now?

A : The purchase followed MSCI’s decision to defer removing crypto-heavy companies from its indexes, easing a near-term market overhang.

Q : How was the purchase funded?

A : Reports cite common stock issuance along with a preferred tranche as the main funding sources.

Q : Does this change Strategy’s risk profile?

A : Yes. The move increases Bitcoin exposure, leaving equity investors sensitive to BTC price swings and share-issuance dynamics.

Q : What is MSCI reviewing next?

A : A broader consultation on classifying non-operating or asset-heavy firms, including DATCOs.

Q : How much Bitcoin does Strategy hold now?

A : Holdings are near updated highs, though exact totals change with new purchases and price movements.

Q : Does the MSCI move affect passive flows?

A : The deferral avoids immediate exclusion risk but does not rule out future index methodology changes.

Q : Is the phrase “Strategy $1.2 billion Bitcoin purchase” important for SEO?

A : Yes. It aligns with user search intent and improves clarity and discoverability in the article.

Facts

Event

Strategy executes largest weekly BTC buy since July (~13,600 BTC; ~$1.2B).Date/Time

2026-01-12T12:00:00+05:00Entities

Strategy (MSTR), Michael Saylor; MSCI (Digital Asset Treasury Companies policy).Figures

~13,600 BTC; ~$1.2B notional; index-policy deferral for DATCOs.Quotes

“MSCI… will not move forward with its initial proposal to exclude DATCOs… [and] will conduct a broader consultation.” MSCI statement summary (reported)Sources

Decrypt Strategy spends $1.2B on BTC (https://decrypt.co); Reuters MSCI drops plan to exclude DATCOs (https://reuters.com)