How to Store Crypto Safely: Beginner Hardware Guide

The safest way to store crypto is to use a reputable hardware wallet, keep your private keys and seed phrase completely offline, and avoid leaving more than a small trading balance on exchanges. For users in the Middle East, US, UK and Germany, this mix of cold storage, secure backups and minimal exchange exposure dramatically cuts the risk of hacks, scams and regulatory disruptions.

Introduction

Crypto is no longer a niche hobby. Millions of people in the USA, UK, Germany and across the Middle East now hold Bitcoin, Ethereum and stablecoins. As adoption rises, so do attacks analysts estimate hackers stole around $2.2 billion worth of crypto in 2024, up roughly 20% from 2023.

By mid-2025, some reports suggest losses had already exceeded $2.1 billion, with wallet compromises making up a big chunk of the damage. At the same time, regulators from Dubai’s Virtual Assets Regulatory Authority (VARA) to Germany’s BaFin and the UK’s FCA are tightening rules on exchanges and marketing.

If you’re trying to understand how to store crypto safely with a hardware wallet especially if you live in the Gulf (UAE, Saudi, Qatar, Bahrain) or send money there from London, New York or Berlin this guide is for you. We’ll walk through why hardware wallets are the safest default, how to move coins off exchanges step by step, how to back up your seed phrase in a GDPR-friendly way, and what Middle East users should know about regulations and everyday OPSEC.

In practice, the safest setup is a reputable hardware wallet, an offline seed phrase backup stored in more than one secure location, and keeping only a small balance on exchanges for active trading.

Important.

Nothing in this guide is financial, legal or tax advice. Treat it as educational information and always consult a qualified professional in your country before making big decisions.

What Is the Safest Way to Store Cryptocurrency?

For most individuals in the Middle East, US, UK and Germany, the safest way to store cryptocurrency is to use a non-custodial hardware wallet, keep your private keys and seed phrase offline, and leave only a small amount of crypto on exchanges for short-term trades. Compared to leaving everything on a centralized platform, this greatly reduces your exposure to exchange hacks, insolvency and account freezes.

Hardware Wallet + Offline Backup + Minimal Exchange Use

Here’s the safest setup for most people in Dubai, Riyadh, Doha, London, New York or Berlin:

Use a reputable hardware wallet such as Ledger, Trezor, BitBox, SafePal or Tangem.

Keep private keys and seed phrases offline never in email, cloud storage or notes apps.

Only keep small trading balances on exchanges like Binance, Coinbase, Crypto.com or OKX (including OKX UAE).

Protect all exchange logins and wallet apps with strong passwords and 2FA (ideally an authenticator app, not SMS).

This combination cold storage for long-term holdings, hot wallets/exchanges for “pocket money” is the core of safe crypto storage for Middle East users.

Hot Wallet vs Cold Wallet: What’s the Difference?

A hot wallet is any wallet that’s usually online: mobile apps, desktop clients and browser extensions like MetaMask or Phantom. They’re convenient for trading, DeFi and NFTs but more exposed to malware, phishing and SIM-swap attacks.

A cold wallet or cold storage means your private keys are kept offline typically in a hardware wallet or an air-gapped device, with paper or metal backups of your seed phrase. This is ideal for long-term savings and larger balances.

| Feature | Hot Wallet (Mobile/Web) | Cold Wallet (Hardware / Air-gapped) |

|---|---|---|

| Internet connection | Always or frequently online | Offline by default |

| Best for | Daily payments, DeFi, NFTs, active trading | Long-term holdings, large balances |

| Main security risks | Malware, phishing, SIM-swaps, device theft | Physical theft, seed loss if backups are weak |

| Typical user examples | US day trader on Coinbase + MetaMask, UK DeFi user | German saver with Trezor, UAE expat with Ledger |

For users in the US, UK, Germany and the Middle East, the usual pattern is: small everyday balances in hot wallets, serious money in cold storage.

Why Keeping Crypto on an Exchange Is So Risky

Keeping large balances on a centralized exchange is riskier than using a hardware wallet because you do not control the private keys and you’re exposed to counterparty risk. If the exchange is hacked, becomes insolvent, has accounts frozen by regulators or geo-blocks your country, your coins can be locked or lost.

In practice this can mean.

High-profile hacks and exploits draining exchange wallets.

Insolvency events where withdrawals are paused for months or indefinitely.

Regional blocks or banking restrictions in some GCC countries that limit access to specific platforms.

With a hardware wallet, the private keys reside on your device, not with Binance, Coinbase or a local GCC exchange, so exchange-level failures can’t directly take your coins.

How to Store Crypto Safely with a Hardware Wallet

A crypto hardware wallet is a small device that stores your private keys offline and signs transactions securely, so your keys never touch your phone or laptop. For a Middle East expat in Dubai, a German saver in Munich or a UK investor in London, this is the default way to dramatically reduce hack risk.

What Is a Crypto Hardware Wallet and How Does It Work?

A crypto hardware wallet is a non-custodial wallet: it generates and stores your private keys inside a secure chip and lets you approve transactions on a physical screen and buttons. Devices from vendors like Ledger, Trezor and BitBox use secure elements and firmware that sign transactions internally; your seed phrase never needs to be typed into your PC.

When you send Bitcoin or USDT, your hardware wallet:

Receives transaction details from the companion app (on your phone or desktop).

Shows them on its screen so you can confirm.

Signs the transaction inside the device and returns only the signed data to broadcast.

Exchanges such as Binance, Coinbase, Crypto.com or OKX UAE are not hardware wallets they’re custodial platforms where they hold the keys on your behalf. A hardware wallet protects you from exchange hacks because even if an exchange is breached, your self-custodied coins remain under your control.

Hardware Wallet vs Hot Wallet Security (Desktop, Mobile, Browser Extensions)

Hot wallets on desktop, mobile or as browser extensions are prime targets for:

Phishing sites that trick you into signing malicious transactions.

Malware and keyloggers that steal private keys or seed phrases.

SIM-swap attacks where attackers hijack SMS 2FA codes.

Hardware wallets dramatically reduce this risk because the private key never leaves the device, and you must physically confirm each transaction. Well-designed devices use secure elements, audited firmware and a security culture similar to PCI DSS and SOC 2 environments in traditional finance.

You still need to watch for fake apps and phishing, but a hardware wallet makes it much harder for an attacker in New York, London or Dubai to drain your funds with one bad click.

Non-Custodial Wallets Explained for Beginners

You’ll often hear “not your keys, not your coins.” A non-custodial wallet means you control the private keys (via your seed phrase), so no exchange, broker or bank can unilaterally freeze or move your funds.

The trade-off.

There are no password resets if you lose your seed phrase.

There’s no “call centre” like your local bank in Riyadh or the NHS helpdesk; you are the recovery process.

The good news: with a simple seed backup routine even beginners in the US, UK, Germany, UAE and Saudi can manage this safely. You’ll see how in the backup section below.

How to Move Bitcoin from an Exchange to a Hardware Wallet

To move Bitcoin (or another coin) from an exchange to a hardware wallet, you prepare your wallet and seed phrase, find your receive address, then withdraw a small test transaction before sending larger amounts. For US/UK/EU users sending funds to the Middle East, the process is the same; only the exchanges and banks around it differ.

Prepare Your Hardware Wallet and Seed Phrase

First, get your hardware wallet out of the box and set it up in a safe, private place:

Initialize the device: choose a PIN and, optionally, a passphrase.

Update firmware using the official app or site only.

Generate your seed phrase on the device and write it down on paper or a metal backup plate never take a photo or store it in the cloud.

Store the written seed somewhere safe (we’ll cover backups in detail later).

Micro AEO checklist how to move Bitcoin to a hardware wallet:

Set up and back up your hardware wallet (PIN + seed phrase).

Get your Bitcoin receive address from the official wallet app.

On the exchange, choose Withdraw, paste the address, send a small test, then send the full amount once confirmed.

Withdraw from US/UK/EU Exchanges to Your Hardware Wallet

The withdrawal flow is similar on most large exchanges (Coinbase, Binance, Kraken, OKX, etc.)

In your hardware wallet’s app (e.g., Ledger Live or Trezor Suite), go to Receive > Bitcoin and copy your address.

On the exchange (say Coinbase in New York or Kraken in Berlin), go to Withdraw > Bitcoin, paste the address and choose the correct network (e.g., Bitcoin mainnet, not a random sidechain).

Send a small test amount first, wait for network confirmations (often 1–6 blocks), then verify it appears in your hardware wallet.

After the test lands, repeat with the larger amount.

For US residents sending coins to family in the Middle East, you can withdraw to your own hardware wallet in Austin or New York and then send on-chain from there to a relative’s self-custody wallet in Dubai or Riyadh.

For UK and EU/German users, local exchanges regulated by the FCA or BaFin may offer SEPA and Faster Payments for fiat, while still allowing crypto withdrawals to hardware wallets for self-custody.

Special Steps for Middle Eastern Users Facing Restrictions

In some GCC countries, access to global exchanges or banking rails can be limited or change quickly. If you’re in Qatar, Kuwait or Oman, for example, you might see extra friction around on-ramps/off-ramps.

Safety tips

Prefer licensed local exchanges in hubs like Dubai, Abu Dhabi, Bahrain and Qatar where available, and check they’re supervised by bodies such as VARA or ADGM.

Be very cautious with P2P and OTC deals; scams and frozen bank transfers are common.

Regardless of how you buy, withdraw to your hardware wallet as soon as practical to reduce reliance on any single platform.

Always check your current local regulations before using offshore platforms or cash-heavy P2P trades.

Backing Up Your Seed Phrase Safely in US, UK, Germany and the Middle East

Your seed phrase is the master key to your wallet. If you lose it, you lose access; if someone else gets it, they own your coins. Backing it up securely is just as important as buying a hardware wallet in the first place.

Seed Phrase Backup Best Practices

For users in New York, London, Berlin, Dubai or Riyadh, the fundamentals are the same:

Write your seed phrase on paper or metal, clearly but privately.

Don’t store it in photos, screenshots, email, Google Drive, iCloud or WhatsApp.

Keep at least two copies in different secure locations, such as a home safe plus a safe-deposit box where legal and practical.

Consider a trusted relative in another country (e.g., parents in Germany while you live in the UAE) as an extra layer of geographic redundancy.

Once comfortable, test recovery with a small wallet to prove you can restore funds from the seed.

GDPR/DSGVO-Friendly Backup Options in EU and UK

For EU and UK residents, GDPR/DSGVO and UK-GDPR focus on protecting personal data, not directly on your seed phrase, but the mindset is helpful: sensitive data belongs under your control.

Best practices.

Avoid storing seed phrases in any cloud service or email, even if encrypted these locations are frequent breach targets.

Expect that hardware wallet vendors processing your shipping and account details should comply with GDPR/DSGVO and security frameworks like PCI DSS or SOC 2, but treat the seed phrase itself as offline-only.

If you use password managers for other secrets, store only hints or partial information, never the full seed.

Discreet Seed Storage for Middle East Households and Expats

In many Middle East households, social and physical security matter just as much as cyber-security.

Don’t brag about large holdings in cafés or on social media in Dubai, Jeddah or Doha.

Avoid safes labelled “Bitcoin” or flashy crypto merch that advertises your stack.

For expats from the US, UK or Germany living in GCC countries, consider multi-country redundancy: one backup in your host country, one in your home country with a trusted family member, plus clear instructions for your heirs.

When crossing borders, keep hardware wallets low-key and avoid carrying written seed phrases if possible; memorize a passphrase instead, where legally safe and appropriate.

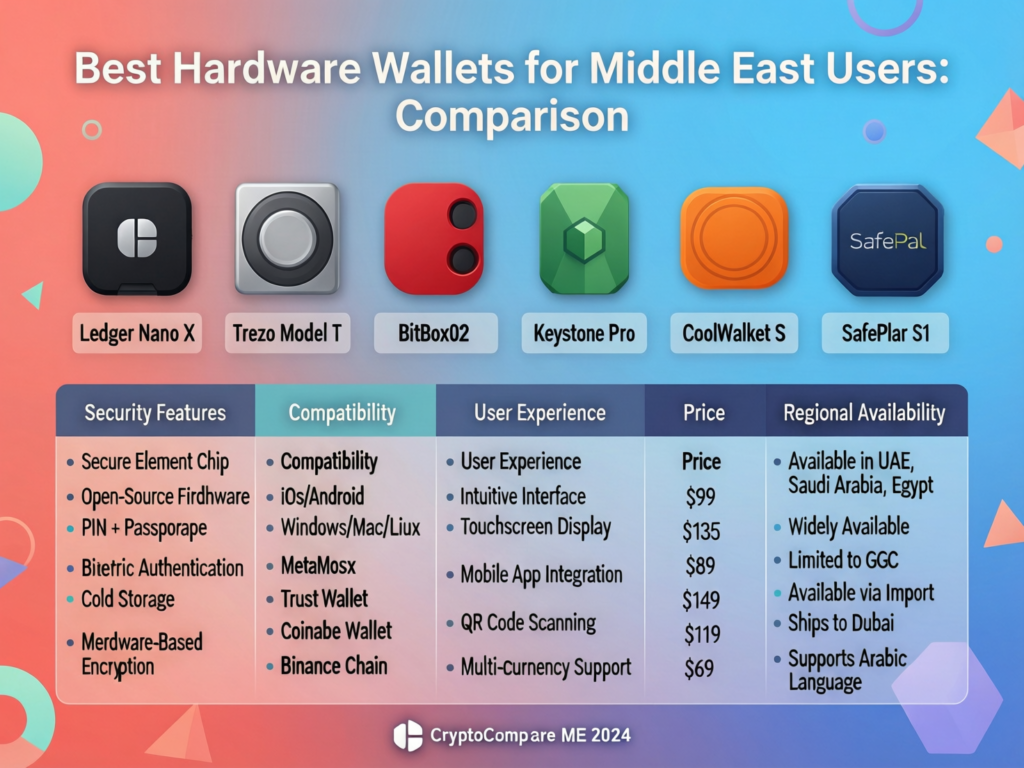

Choosing the Best Hardware Wallet for Middle East Users

Choosing the “best” hardware wallet is about matching security, usability and supported coins to your actual needs in the Middle East, US, UK or Germany. In practice, most people are choosing between a handful of established brands, plus a few card-style devices that are popular in the GCC.

Key Features to Compare (Security, UX, Supported Coins)

When comparing devices, look at.

Security architecture: secure element vs general microcontroller, open-source vs closed firmware, independent audits.

User experience: screen size, touch vs buttons, how easy it is to confirm addresses and amounts.

Supported assets: Bitcoin, Ethereum, stablecoins (USDT/USDC), and local favourites on Gulf exchanges (often on Ethereum, Tron or BNB Chain).

Mobile support: Bluetooth or NFC can be essential if you rely on your phone in Dubai or Riyadh more than a laptop.

Language and support: documentation and apps in English, Arabic and German, plus responsive support channels.

Ledger vs Trezor vs BitBox vs SafePal vs Tangem

A quick positioning snapshot (not financial advice):

Ledger

Secure-element devices (Nano series, Ledger Stax) with strong mobile and DeFi integrations; closed-source firmware. Popular with users who want broad altcoin support.

Trezor

Open-source firmware, strong Bitcoin and multi-coin support, and a straightforward UX. Favoured by many European users.

BitBox

Swiss-made, security-focused hardware wallet with strong support among privacy-conscious German and EU users.

SafePal

Hardware and app ecosystem with QR workflows; card-style and affordable options that are popular in some GCC communities.

Tangem and card-style wallets

Bank card-like form factor, NFC-based usage, often convenient for Middle East users who want something that looks and feels like a familiar payment card.

For Middle Eastern users, mobile-friendly devices with robust card or QR workflows can fit daily life in Dubai, Abu Dhabi, Riyadh and Doha, while EU users may prioritise open-source firmware and integration with desktop clients.

Shipping, Taxes and Warranty for UAE, Saudi, Qatar and Beyond

When buying hardware wallets into the GCC.

Prefer official brand sites shipping from the US, UK, Germany or EU, or authorised resellers in Dubai, Abu Dhabi, Riyadh, Doha or Manama.

Factor in customs and import duties, which can vary by country and shipment value.

Avoid grey-market or used devices on random marketplaces; tampering is a real risk, especially if a seed phrase is pre-printed.

Check warranty and return policies for your region before you buy, particularly if you’re shipping devices to multiple locations (for example, one device to Berlin, one to Dubai).

Legal, Regulatory and Tax Considerations for Middle Eastern Crypto Holders

Regulation in the Middle East is evolving quickly, but for individuals the big questions are usually: “Is it legal to hold crypto?”, “Which regulators matter?” and “When do I need professional advice?”

Nothing in this section is legal or tax advice; it’s a starting point for conversations with a qualified advisor in your jurisdiction.

Is Crypto Legal for Individuals in UAE, Saudi Arabia, Qatar and Other GCC States?

In many GCC countries, holding crypto as an individual is not outright banned, but rules differ significantly by state and can change at short notice. The UAE and Bahrain have positioned themselves as relatively supportive hubs, while others, such as Qatar, have historically taken a more restrictive stance on trading and financial institutions’ involvement.

Key points

Self-custody in a hardware wallet simply holding and managing your own coins – is conceptually different from running an unlicensed exchange or brokerage.

You should still check whether your activities (frequent trading, OTC desks, business use) fall under local virtual asset or securities rules.

Key Regulators and Frameworks Middle East Users Should Know

Some names you’ll see referenced.

VARA (Dubai)

Regulates virtual assets across most of Dubai.

ADGM (Abu Dhabi Global Market)

A financial centre with its own crypto framework.

DFSA (DIFC)

Regulator for the Dubai International Financial Centre.

SAMA

(Saudi Central Bank) and related capital-markets regulators increasingly active in shaping virtual asset policy.

For context, in Europe BaFin supervises crypto service providers in Germany, while the FCA sets rules for crypto marketing and, increasingly, regulated activities in the UK.

Think of it a bit like the NHS or HIPAA rules for health data in the US: they don’t tell you how to store your Ledger, but they do define how companies around you must treat customer funds and data.

When to Talk to a Professional About Tax, Inheritance and Compliance

It’s time to speak to a local tax or legal professional if.

You have large holdings or run your own trading or mining business.

You’re an expat from the US, UK or Germany living in the GCC, where home-country tax rules (like US worldwide taxation) can overlap with local laws.

You want to plan for inheritance, so heirs can access hardware wallets and seed phrases without exposing them prematurely.

A professional can help you document your seed backups, hardware wallets and account lists in a way that’s clear, secure and consistent with local law.

Common Hardware Wallet Mistakes and How to Avoid Scams

Even with a hardware wallet, user mistakes can still be costly. The goal is to avoid giving attackers an easy angle whether in Frankfurt, London, Dubai or online.

Seed Phrase Scams, Fake Wallets and Phishing Emails

Watch out for.

Fake support agents asking for your seed phrase or PIN. No legitimate team will ever ask for this whether they claim to be Ledger, Trezor, Binance or your bank.

Fake apps and browser extensions that imitate real wallets; always download from official sites and verified app stores.

Pre-configured or second-hand devices that arrive with a seed phrase already printed. This is a huge red flag always generate the seed yourself during setup.

A hardware wallet is only as safe as your operational security. If you type your seed into a random website, even the best device can’t save you.

Travel, Border Crossings and Everyday OPSEC for Middle East Users

If you travel frequently between London, New York, Frankfurt, Dubai, Riyadh or Doha

Keep hardware wallets discreet they look like USB sticks, so don’t advertise them.

Use passphrases and hidden accounts (where legal) so a stolen device isn’t automatically enough to access your full holdings.

Be mindful of using public Wi-Fi in hotels or airports when managing wallets; stick to viewing balances, and avoid major moves on untrusted networks.

Simple Crypto Safety Checklist You Can Start Today

Here’s a quick checklist you can review this week:

Buy a reputable hardware wallet from an official source.

Move the majority of your crypto off exchanges into cold storage.

Set a strong PIN and enable passphrase features if supported.

Create at least two offline seed backups in different secure locations.

Review local regulations in your country at least once a year.

Turn on 2FA with an authenticator app on every exchange and wallet.

Educate close family members about recovery and inheritance basics.

If you’d like a simple PDF version of this checklist or want help designing secure wallet processes for your business or startup, the team at Mak It Solutions can help you think through architecture, risk and compliance across your broader tech stack.

Key Takeaways

The safest way to store crypto is a hardware wallet + offline seed backups + minimal exchange balances, whether you’re in the US, UK, Germany or the Middle East.

Non-custodial, cold storage significantly reduces exposure to exchange hacks, insolvency and regional platform restrictions.

A clear seed phrase backup strategy with multiple secure, discreet locations is critical photos and cloud storage are off-limits.

Middle East users should keep an eye on regulators like VARA, ADGM, DFSA and SAMA, and align self-custody practices with evolving rules.

Choosing between Ledger, Trezor, BitBox, SafePal and Tangem is about balancing security, UX, mobile workflows and shipping/warranty realities into the GCC.

Good OPSEC avoiding seed scams, buying only from trusted vendors, and travelling discreetly is just as important as the device you buy.

If you’re serious about how to store crypto safely especially across borders between the US, UK, Germany and the Middle East now is the time to put a proper hardware-wallet and backup plan in place. Mak It Solutions can help you design secure, compliant workflows around your wallets, exchanges, apps and analytics stack so security becomes a habit, not a headache.

Reach out to our Editorial Analytics Team to request a scoped security review, or book a consultation to discuss how we can support your broader fintech, Web3 or data platform roadmap.( Click Here’s )

FAQs

Q : Is a hardware wallet really necessary if I only hold a small amount of crypto?

A : If your holdings are truly tiny say less than the cost of a hardware wallet—you might be fine using a reputable hot wallet with strong security and 2FA. But balances often grow over time, and the cost of a hardware wallet is small compared to losing everything in a hack or exchange failure. Many users in the US, UK, Germany and the Middle East buy a hardware wallet early, then “grow into it” as they accumulate more crypto.

Q : Can hardware wallets be hacked, and what security features should I look for?

A : No device is 100% hack-proof, but reputable hardware wallets are designed so that remote attacks are extremely difficult. Look for features like secure elements, audited or open source firmware, strong PIN and passphrase options, and a good track record of responding to security research. Your own behaviour still matters: if you give away your seed phrase or use fake apps, even the best wallet can’t protect you.

Q : What happens to my crypto in a hardware wallet if I move from the US/UK to the Middle East?

A : Your coins don’t care where you live; they stay on the blockchain, controlled by your seed phrase. If you move from New York or London to Dubai or Riyadh, you simply take your hardware wallet and seed backups with you (subject to any legal limits) and continue using them. The main changes are local regulations, tax rules and banking options, so it’s wise to get region-specific advice and update any backup locations when you relocate.

Q : How many hardware wallets or seed backups should I have for large holdings?

A : For significant holdings, many people use at least two hardware wallets: one primary, one backup device initialized with the same seed, both stored separately. You should also keep two or more seed backups in distinct, secure places often a mix of home safe, safe-deposit box and trusted family abroad. More copies can increase resilience but also raise exposure risk, so focus on quality and secrecy of each location rather than sheer quantity.

Q : Is it safer to buy a hardware wallet from Amazon or directly from the manufacturer?

A : The safest option is usually to buy directly from the manufacturer or from a clearly authorised reseller with tamper-evident packaging and strong reviews. Marketplaces like Amazon can be fine when the seller is the official brand store, but third-party sellers introduce extra risk of tampering or pre-configured devices. Always inspect packaging, make sure you generate the seed phrase yourself on first use, and never trust any wallet that arrives with a seed already printed.