Bitcoin (BTC) Weekly Update Price Analysis This Week as Bulls Defend $90K (Jan 9, 2026)

Bitcoin (BTC) is trading around $90,400, holding above key support in the $88,000–$89,000 zone after failing to sustain moves above $94,000–$95,000 earlier in the week. Over the last 7 days, BTC has traded roughly between $88,400 and $94,700, for a modest weekly gain of about +1–2%.

According to CoinDesk and The Block, mixed spot ETF flows and rebuilding futures open interest have kept price in a choppy range around $90K, with resistance still concentrated near $94K–$95K.

Key Data Snapshot

Data as of: Jan 9, 2026, 10:50 UTC

Current price: ≈ $90,400 (BTC/USD)

24h change: ≈ +0.3% (sources show ~+0.2–0.5%)

7d change: ≈ +1.1% (CoinGecko 7-day performance)

7d high / low: roughly $94,745 / $88,392 based on daily high/low data from Jan 2–8, 2026

Market cap: ≈ $1.80–1.81T

24h volume: ≈ $38–39B

Bitcoin dominance: around 57–59% of total crypto market cap

Global crypto market cap: ≈ $3.1T

Main data sources: CoinMarketCap, CoinGecko, Binance, Investing.com, YCharts, CoinDesk

Market Snapshot for Bitcoin (BTC)

Bitcoin is a crypto asset trading in the CRYPTO market.

Current price: 90408.0 USD, with a change of 210.00 USD (0.00%) from the previous close.

Intraday high: 91384.0 USD

Intraday low: 89312.0 USD

This Week in Bitcoin (BTC) Quick Summary

In this Bitcoin price analysis this week, BTC is consolidating around the $90K mark after an early-year push above $94K faded. Price action has been shaped by a three-way tug-of-war between ETF-driven flows, cautious derivatives positioning and broader macro uncertainty ahead of U.S. jobs data and tariff-related headlines.

U.S. spot Bitcoin ETFs saw a strong $697M single-day inflow on Jan 5, led by BlackRock’s IBIT, but several subsequent sessions of net outflows erased most of those gains, leaving sentiment more “balanced” than outright bullish.

BTC Price Action & Key Levels

Weekly Performance

Over the last 7 days, Bitcoin has traded in a relatively wide but controlled range, with an approximate 7-day high near $94,700 and a low close to $88,400, based on aggregated daily high/low data.

On a percentage basis, BTC is up around 1–2% for the week. CoinGecko shows a 7-day change of about +1.1%, while some market commentaries cite a slightly higher +2–3% move depending on the starting point they use.

At the post this time.

Earlier in the week, price briefly pushed into the $94K–$95K band but failed to hold above it. Multiple reports now note that BTC has slipped back to just around $90K as the early-2026 rally cools off and traders digest the latest macro and ETF news.

Short-Term Technical View

From a short-term technical perspective, this is how the current Bitcoin price analysis this week stacks up.

Immediate support

Key zone: $88,000–$89,000, marking a recent weekly low cluster and prior breakout area.

Deeper support

Around $85,000, where many traders see the next significant liquidity pocket if the first support band fails.

Near-term resistance

$94,000–$95,000 remains the primary resistance zone after this week’s failed breakout.

Psychological resistance

$100,000, still untested but central to many analyst narratives and retail expectations.

Volatility has been noticeable but not extreme. BTC has seen intraday swings of a few thousand dollars, yet there has been no broad liquidation cascade so far this week.

News & Narratives That Moved Bitcoin This Week

Key stories shaping this Bitcoin (BTC) weekly update.

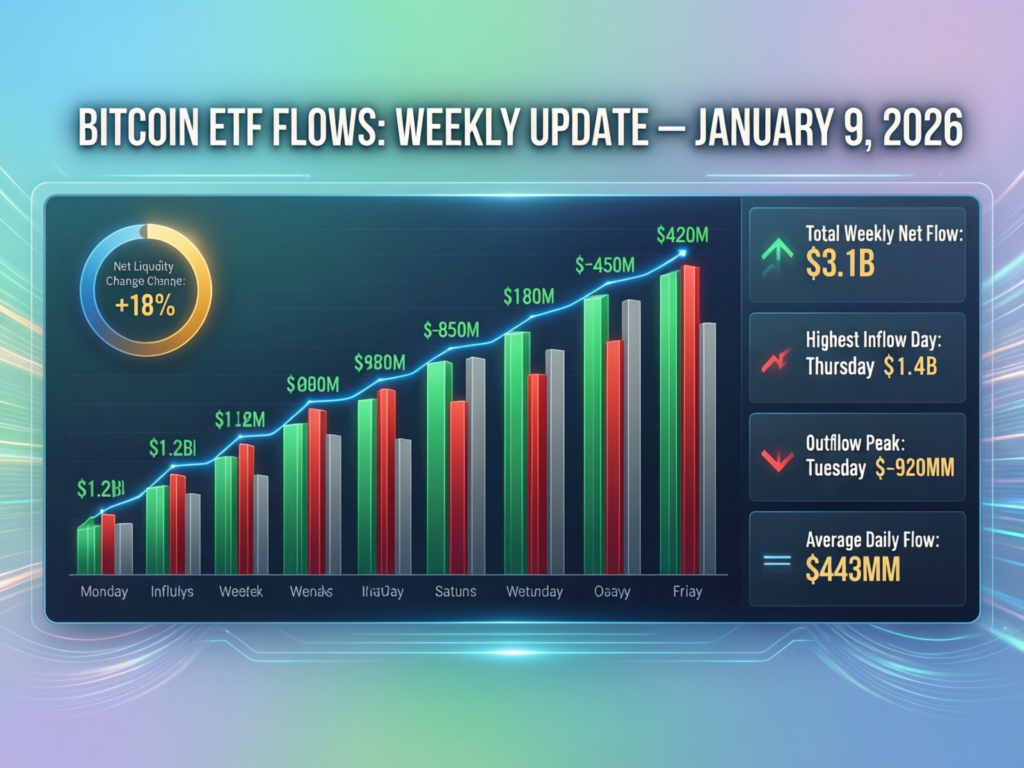

ETF flows: from big inflows to net outflows

U.S. spot Bitcoin ETFs recorded their largest one-day net inflow in three months (~$697M on Jan 5), driven mainly by BlackRock’s IBIT. That was followed by a three-day outflow streak that effectively neutralized the early-month inflows, cooling some of the ETF-driven optimism.

Price rejection near $95K and return to the $90K zone

CoinDesk and The Block both highlight how BTC failed to sustain levels above $94K–$95K, then slipped back below $90K at one point as overhead resistance, cautious funding and rebuilding open interest weighed on upside momentum.

Macro: U.S. jobs data and tariff headlines

Markets are watching U.S. jobs data and a Supreme Court ruling on global tariffs, adding a macro “wait-and-see” tone to BTC price action as investors reassess risk appetite across risk assets.

Policy attention: talk of a state-level Bitcoin reserve

A bill in Florida proposing a state-run Bitcoin reserve underscores how BTC is increasingly being treated as a strategic asset by some policymakers, even while the price consolidates rather than trends.

On-Chain, Derivatives & Sentiment

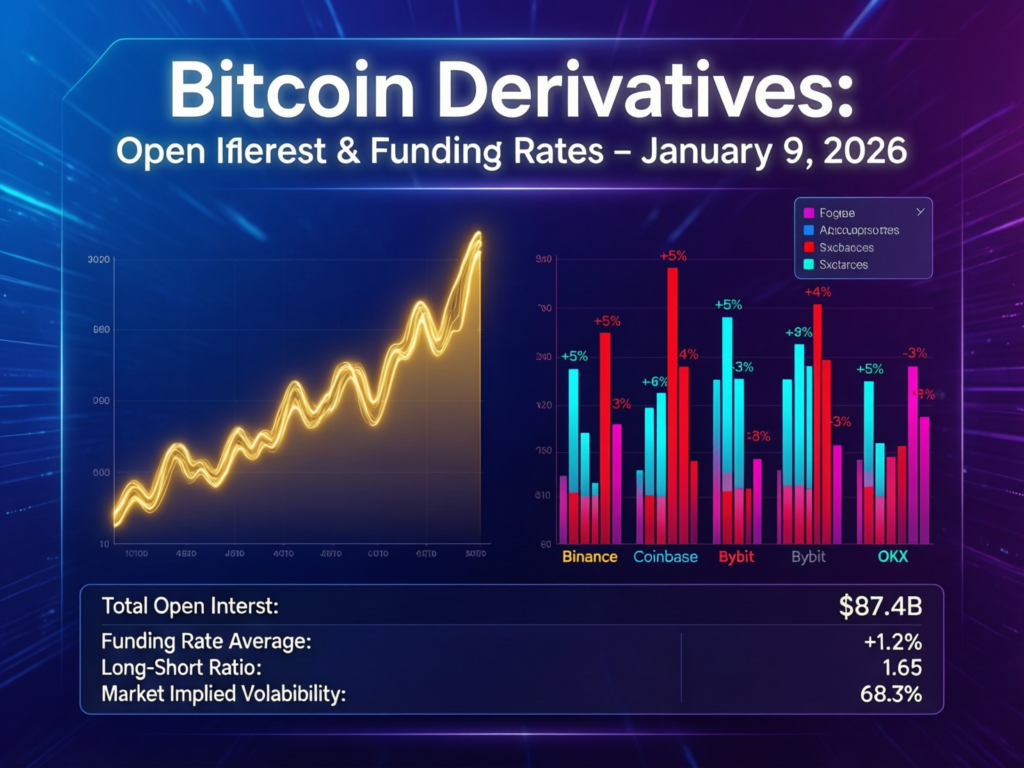

Derivatives and on-chain-adjacent metrics this week suggest a market that is engaged, but not in full risk-on mode.

Open interest rebuilding, but below peak

Futures open interest has started to rebuild after year-end deleveraging, but remains below prior peaks. Analysts describe this as “cautious leverage” rather than an aggressive chase higher.

Positive funding rates and long squeeze risk

CoinDesk notes that funding rates are positive while open interest approaches ~700,000 BTC, which can indicate crowded long positioning. This backdrop increases the odds of a sharp downside flush if sentiment turns or a negative catalyst hits.

Sentiment: constructive but cautious

Market commentary often frames the backdrop as “constructive but cautious.” BTC above $90K and a market cap around $1.8T signal resilience, but traders know that ETF flows and macro headlines can flip risk appetite quickly.

Bitcoin vs the Wider Crypto Market

The global crypto market cap sits around $3.1T, with Bitcoin dominance roughly 58%, keeping the market clearly in “Bitcoin season” rather than a broad altcoin-led environment.

At the same time, several reports note that major altcoins like ETH and XRP have, at times, outperformed BTC since the start of 2026. This points to selective risk-on behavior: traders are willing to rotate into specific large-cap alts even while BTC trades sideways around $90K.

For this week, BTC’s modest gain and consolidation near local highs leaves it broadly in line with or slightly behind the strongest large-cap altcoins, while still anchoring overall crypto market direction.

What This Means for Traders & Long-Term Holders

For Active Traders (Informational, Not Financial Advice)

The $88K–$89K band is a key near-term support cluster to watch for potential reactions if price dips into it again.

On the upside, $94K–$95K remains the first serious resistance; repeated failures here would reinforce the current range-bound structure.

Positive funding with rebuilding open interest suggests leverage is creeping back in, raising the odds of sharper moves in either direction.

ETF flows are still a major driver; sequences of strong inflows or outflows can quickly tilt intraday bias.

Short-term traders in markets like the U.S., EU, and Asia may want to pay particular attention to how price behaves around U.S. economic data releases, as these have been key volatility catalysts in recent weeks.

For Long-Term Holders

BTC is consolidating above $90K with a market cap around $1.8T, reinforcing its role as the dominant crypto asset and primary liquidity anchor.

Institutional access especially through U.S. spot ETFs continues to deepen, even if weekly flows are choppy.

Macro factors (interest rates, growth, regulatory clarity) and structural narratives (store of value, “digital reserve asset”, potential state-level reserves) remain central to BTC’s long-term thesis.

Volatility at these price levels is significant; long-term positioning typically assumes multi-year horizons and the possibility of large drawdowns along the way.

Risks, Scenarios.

Bullish Scenario

ETF inflows resume strongly, macro data stays supportive of risk assets, and derivatives leverage builds in a relatively orderly fashion. In this case, BTC could retest and potentially break above $95K, re-opening discussions around the $100K psychological level.

Neutral / Range-Bound Scenario

ETF flows remain mixed, macro headlines offset each other, and BTC continues to oscillate between roughly $88K and $95K. That would continue to “chop up” both bulls and bears, while Bitcoin dominance remains elevated and altcoin rotations stay selective.

Bearish Scenario

A negative macro shock, regulatory surprise, or sharp ETF outflows trigger a long squeeze in over-leveraged derivatives positioning. In that scenario, BTC could revisit or dip below the mid-$80Ks, denting near-term sentiment even if longer-term narratives remain intact.

Final Thoughts

Stepping back, this Bitcoin price analysis this week shows a market that remains structurally strong even as it chops sideways around the $90K area. Bulls are defending key support near $88K–$89K, ETF flows are mixed rather than broken, and derivatives positioning is elevated but not yet at blow-off levels.

For traders and long-term holders alike, the focus now is on whether upcoming macro data and ETF headlines can finally nudge BTC out of this range. Staying disciplined on risk, time horizon, and position sizing remains essential as the decisive move could develop quickly in either direction over the coming weeks.

FAQs

Q : Why did Bitcoin hover around $90K this week instead of extending the rally?

A : BTC stalled near $94K–$95K as strong resistance, mixed ETF flows and cautious derivatives positioning capped upside momentum. After failing to hold above that zone, price drifted back toward $90K, where buyers have so far defended support.

Q : What are the most important Bitcoin price levels to watch right now?

A : In the very short term, many market participants are watching $88K–$89K as a key support zone and $94K–$95K as overhead resistance. A sustained move below support could open room toward the mid-$80Ks, while a clean break and hold above $95K would refocus attention on the $100K psychological level.

Q : How are Bitcoin ETFs affecting BTC price this week?

A : U.S. spot Bitcoin ETFs saw a big $697M inflow on Jan 5, followed by several days of net outflows that essentially neutralized those gains. This push-and-pull in flows has contributed to choppy price action, with neither bulls nor bears firmly in control.

Q : Is leverage in the Bitcoin futures market becoming risky again?

A : Open interest has started to rebuild and funding rates are positive, signaling that leverage is returning on the long side. While still below earlier peaks, this setup can increase the risk of a long squeeze if sentiment turns or a negative catalyst hits the market.

Q : Is Bitcoin safer than altcoins in the current market environment?

A : Bitcoin accounts for about 58% of total crypto market cap and remains the primary liquidity anchor, which generally makes it less volatile than most altcoins. However, BTC can still see large swings, and some major altcoins have recently outperformed it, so “safer” is relative and depends on each investor’s risk tolerance and time horizon.