Best Altcoins to Invest in 2025: Gulf Investor Guide

In 2025, the best altcoins to invest in are less about single “moonshot” coins and more about diversified themes: large-cap smart contract platforms (L1s), Ethereum layer-2 (L2) networks, DeFi protocols, gaming/metaverse projects, and real-world asset (RWA) tokens connected to real adoption.

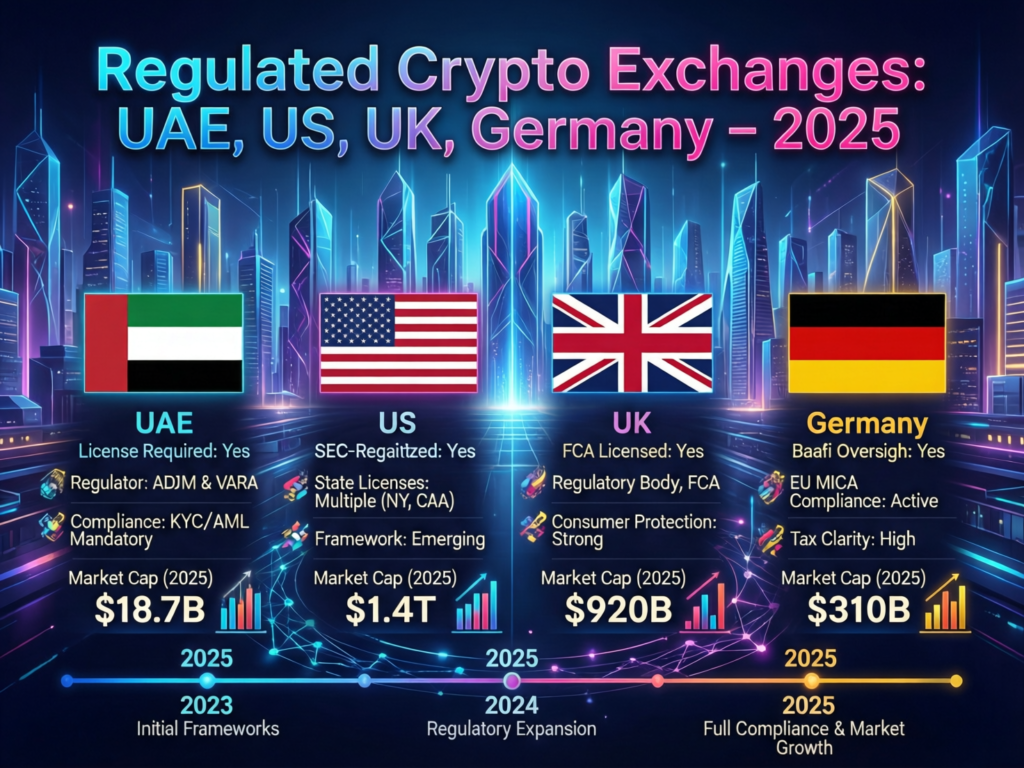

For Middle East–based investors, a common starting point is high-liquidity L1/L2 assets listed on regulated exchanges (VARA, ADGM, CBUAE, Central Bank of Bahrain, FCA, BaFin or MiCA-ready EU venues). Even then, altcoins remain high-volatility, high-risk instruments that can fall 70–90% in a single cycle. This guide is education only, not personal financial, legal, tax or Sharia advice.

Introduction

If you live in Dubai, Riyadh or Doha, it’s hard to ignore how loud the “crypto bull run 2025 altcoins” conversation has become. Global crypto market cap climbed to roughly 3% of world GDP in 2024, nearly doubling from the year before. At the same time, MENA monthly crypto flows peaked above $60 billion in late 2024, underlining the region’s growing role in digital assets.

This guide looks at the best altcoins to invest in 2025 as themes, not “secret picks”. We’ll walk through large-cap L1/L2, DeFi, gaming, infrastructure and RWA trends, then add something global lists often skip: how UAE, Saudi Arabia, Qatar and Bahrain rules interact with SEC, FCA, BaFin and EU MiCA frameworks. It is general education only not investment, legal or tax advice.

Put simply, many serious investors in the Middle East, US, UK, Germany and wider EU are using diversified altcoin themes (L1/L2, DeFi, gaming, RWA, infra) as a small, satellite slice of a broader portfolio while treating altcoins as speculative, high-risk assets that can drop 70–90% in a single cycle.

What Are the Best Altcoins to Invest in 2025?

How We Selected 2025 Altcoin Opportunities

When people ask “what are the best altcoins to invest in 2025?”, they usually want a short list of tickers. A better question is: what kind of altcoin pattern tends to survive multiple cycles?

For this guide, we focus on examples that broadly fit criteria like.

Market cap & liquidity

Meaningful trading volumes and deep order books on top exchanges, so Middle East and European investors can enter/exit without huge slippage.

Real usage & developer activity

Active users, TVL (for DeFi), daily transactions, and teams that ship not just market their tokens.

Tokenomics

Reasonable emission schedules, no obvious “VC unlock cliff” and no permanent sell pressure baked in.

Regulatory posture

Listed on exchanges that can realistically be supervised by VARA, ADGM, DFSA, the FCA, BaFin or MiCA-ready EU regulators.

Security & audits

Track record against hacks, plus security reviews aligned with frameworks like SOC 2 for infrastructure and PCI DSS where cards/fiat gateways are involved.

We rely on on-chain analytics, reputable research platforms, MiCA/VARA/FCA/BaFin guidance and major exchanges’ listings but nothing here is a personal buy signal. Treat these as educational patterns to stress-test with your own research and professional advice.

Top 5 Altcoin Themes for 2025

Rather than chasing single tickers, it’s usually more realistic to think in five buckets.

Large-cap smart contract platforms (L1)

What to look for.

High TVL and a strong ecosystem (wallets, DeFi, NFTs, RWAs).

Clear roadmap for scalability and fees; active developer community.

Deep liquidity on regulated exchanges (e.g., MiCA-ready, VARA/FCA-aligned venues).

Layer-2 scaling and infrastructure (L2 + rollups)

What to look for.

Proven L2s that already handle significant mainnet traffic.

Sustainable fee economics, not just temporary “points” or airdrop hype.

Transparent security model (optimistic vs ZK rollups) and clear documentation.

DeFi protocols (lending, DEXs, yield)

What to look for.

“Blue-chip” money markets and DEXs with multi-year uptime and battle-tested smart contracts.

Conservative collateral rules; on-chain oracles that survived volatility.

External audits, ongoing bug bounties, and clear disclosure of smart-contract risks.

Gaming and metaverse altcoins

What to look for.

Real players (DAU/MAU), not just NFT speculation.

Revenue streams beyond token emissions (skins, in-game items, sponsorships).

Presence on mainstream platforms (PC, mobile, consoles), with App Store/Google Play-compliant monetization.

Real-world asset (RWA) and institutional-grade tokens

What to look for:

Ties to regulated real-estate or private-credit platforms, including RWA pilots out of Dubai and Abu Dhabi free zones.

Clear legal structure of the underlying asset and claim.

Institutional custodians and MiCA/VARA-aware legal opinions.

Within each bucket, many Gulf investors narrow down to altcoins that appear on both regional (UAE/Bahrain/Saudi) and global (US/UK/EU) regulated venues to reduce delisting and counterparty risk.

Best Altcoins to Invest in 2025 for Middle East–Based Investors

For Middle East–based investors, “best altcoins 2025” usually depends on profile type.

Conservative

Primarily large-cap L1/L2 with the deepest liquidity and listings on VARA, ADGM or Central Bank of Bahrain-regulated exchanges, plus major US/UK/EU platforms.

Caveat: Prices can still drop 60–80% in a severe drawdown; regulations and exchange lists can change quickly.

Income-seeking

Established staking and DeFi protocols that have survived past hacks and bear markets, focusing on major chains and audited contracts.

Caveat: Yield often comes with smart-contract risk and may raise Sharia questions many investors seek specialised Islamic finance guidance first.

Growth-oriented

Infrastructure, L2 and RWA altcoins connected to real adoption stories in Dubai, Abu Dhabi or Riyadh (for example, tokenised real estate or trade-finance pilots).

Caveat: Project and regulatory risk is higher; expect longer lock-ups, changing rules, and complex tax/reporting under UAE guidance, EU CARF and similar frameworks.

We’ll come back to portfolio construction and tax later see “How to Build a Diversified Altcoin Portfolio for the 2025 Cycle” and “Tax and Reporting Rules for Altcoin Profits in 2025.”

Is Altcoin Investing a Good Idea in 2025?

Macro Drivers for the 2025 Altcoin Cycle

Altcoin interest in 2025 doesn’t exist in a vacuum.

The latest Bitcoin halving, plus record inflows into global crypto ETFs (almost $6 billion in one week in October 2025), has pulled new capital into the asset class.

Global crypto activity in early 2024 exceeded peak 2021 bull-market levels.

MiCA entered full force across the EU in December 2024, giving clearer rules for exchanges and many tokens.

Dubai’s VARA and free-zone initiatives in ADGM have been deliberately positioning the UAE as a regulated Web3 and virtual-asset hub.

All of this supports altcoin narratives but it does not make altcoin investing “safe”. Late 2025 also showed how quickly sentiment can flip: more than $1.2 trillion was wiped from global crypto markets in just six weeks during a risk-off episode.

Key Risks Middle East Investors Should Consider Before Buying Altcoins in 2025

Middle East investors asking “what risks should I consider before buying altcoins in 2025?” should weigh at least:

Extreme volatility – 50–90% drawdowns are common, even in projects that later recover.

Liquidity & slippage

Many altcoins trade thinly; large orders on offshore exchanges can move the market significantly.

Smart-contract risk & hacks

Even audited DeFi platforms, cross-chain bridges and gaming projects have lost hundreds of millions of dollars to exploits.

Exchange & counterparty risk

Unregulated or lightly regulated exchanges can freeze withdrawals, mismanage reserves or be targeted by regulators.

Regulatory risk

Gulf regulators can tighten or loosen rules; Qatar and Kuwait, for example, have historically restricted some crypto activities, while the UAE pushes a licensing model.

Tax & reporting risk

CARF-aligned regimes mean that Gulf residents using offshore exchanges may have their data shared with foreign tax authorities from 2027 onwards.

Cultural/ethical layer

Some products (high-leverage perpetuals, yield farming) may be difficult to reconcile with Sharia interpretations. Many investors choose Sharia-screened strategies or seek advice from qualified scholars.

If you can’t tolerate the idea of a 70% drawdown, a multi-year recovery period, or evolving rules under bodies like VARA, the SEC, FCA or BaFin, then aggressive altcoin exposure may not fit your profile.

When Altcoins May Not Be Right for You

Altcoins likely aren’t a good fit if you:

Have high-interest debt or no 3–6-month emergency fund.

Need the capital within the next 1–3 years (for example, a house purchase in London or Frankfurt).

Find yourself checking prices every hour and losing sleep over volatility.

In those situations, it’s usually better to focus first on financial basics and education, and treat altcoins if at all as a very small, speculative slice.

Gulf and Global Regulations

Why UAE and Bahrain Are Becoming Crypto and Altcoin Hubs

Gulf countries like the UAE and Bahrain are becoming altcoin hubs because they’ve deliberately created crypto-specific regulators and licensing paths.

Dubai’s VARA is the dedicated virtual-assets regulator for most of the emirate, tasked with promoting Dubai as a regional and international hub for virtual assets.

Abu Dhabi Global Market (ADGM) and the Financial Services Regulatory Authority (FSRA) offer frameworks for exchanges, custodians and asset managers.

The Central Bank of Bahrain has been early in licensing crypto-asset firms under its own regulatory sandbox and rules.

In one line: Gulf policymakers want to attract Web3 builders, exchanges and asset managers onshore with licensing, capital requirements and AML controls rather than pushing everything offshore.

Middle East vs SEC/CFTC, FCA, BaFin and MiCA

Middle East (UAE, Saudi, Qatar, Bahrain)

The UAE mixes VARA (Dubai), ADGM/FSRA, DFSA and SCA/CBUAE rules, creating several supervised zones; Saudi Arabia and Qatar have been more cautious.

Licensing usually covers exchanges (VASPs), custodians, brokers and in some cases certain DeFi-like activities.

United States (SEC/CFTC)

The SEC often treats many altcoins as securities; the CFTC focuses on crypto derivatives and some spot markets.

Enforcement actions drive delistings and can dramatically change which altcoins US platforms can offer.

United Kingdom (FCA)

The FCA supervises crypto firms under AML rules and enforces strict financial-promotion rules for all firms marketing to UK consumers, regardless of where the firm is based.

Germany & EU (BaFin + MiCA/MiCAR)

MiCA/MiCAR is now fully in force, harmonising crypto-asset rules across EU states and empowering regulators like BaFin in Germany.

CASPs (crypto-asset service providers) face requirements for investor protection, disclosure and market-abuse prevention, and ESMA actively warns against misleading “MiCA-regulated” marketing.

Practical impact for you: these regimes determine which altcoins can be listed, the leverage allowed, KYC/AML checks and what happens in disputes.

What These Rules Mean for Your 2025 Altcoin Strategy

For 2025, regulations affect altcoin investors in at least three ways.

Exchange access

A Dubai-based investor may legally access a different set of exchanges and derivatives than a London or New York investor.

Token availability & stability

Tokens that fail MiCA or VARA standards may be delisted quickly, even in a bull market.

Data sharing & tax compliance

CARF and EU DAC8 push exchanges to report user data to tax authorities in 48+ countries from 2027 onwards.

So when you design a 2025 altcoin strategy, you’re not just choosing what to buy; you’re choosing which regulated venues, which jurisdictions your data will flow through, and how much compliance friction you’re willing to accept.

How to Buy Altcoins Safely in 2025 (UAE, US, UK, Germany)

Choosing a Regulated Altcoin Exchange in Your Region

Step 1 is always platform choice. A quick checklist by region:

US investors (New York, Austin, San Francisco)

Look for exchanges registered with FinCEN and aligned with SEC/CFTC expectations.

Prefer platforms that publish SOC 2 reports and independent security audits.

UK investors (London, Manchester)

Confirm the exchange appears on the FCA cryptoasset register or has appropriate authorisation.

Check for GBP deposits/withdrawals and clear risk warnings.

Germany/EU investors (Frankfurt, Berlin)

Use exchanges licensed as CASPs under MiCA/MiCAR or supervised by BaFin and other EU regulators.

Check whether the platform is fully MiCA-ready (not only partially regulated products).

Middle East investors (Dubai, Abu Dhabi, Manama, Riyadh)

Prioritise exchanges licensed by VARA, ADGM/FSRA, DFSA or the Central Bank of Bahrain and ensure local banking rails (AED/SAR) are supported where possible.

User experience, fees, staking options and supported coins matter but regulatory status and security should come first.

Deposits and On-Ramps.

Once you’ve selected a platform.

Fund your account using bank transfer, open-banking connections (UK/EU), or approved card payments, depending on your jurisdiction.

Expect KYC/AML checks, proof of address and sometimes source-of-funds documentation, especially for larger deposits. Many exchanges also implement travel-rule data sharing above certain thresholds.

Some banks in the Middle East, UK and EU still restrict crypto-related transfers. Always check your bank’s policy before moving large AED/SAR/EUR/GBP amounts.

From First Purchase to Secure Storage

After your first altcoin purchase.

Use limit orders for thinner pairs to avoid unexpected slippage.

Decide what stays on the exchange vs what moves to a non-custodial wallet. Many investors keep frequent-trading balances on regulated exchanges and move long-term holdings to hardware wallets.

Upgrade security.

Enable 2FA (authentication app, not SMS)

Use unique passwords and a password manager.

Learn to spot phishing sites and fake mobile apps.

Serious investors often check whether exchanges run on reputable cloud providers (for example, AWS) and follow standards like SOC 2 for infrastructure and PCI DSS for card data.

If you’re not comfortable managing private keys and seed phrases, it may be safer to stay with regulated custodial solutions while understanding that custody risk never fully disappears.

How to Build a Diversified Altcoin Portfolio for the 2025 Cycle

How Much of Your Portfolio in Altcoins in 2025?

There is no magic percentage for “how much altcoin in 2025”, but there are common patterns.

Many diversified investors keep altcoins as a small satellite allocation around a more stable core of cash, bonds, stocks and possibly Bitcoin/ETH.

For typical retail investors, that often means single-digit or low double-digit percentages of total investable assets, adjusted for income stability and risk tolerance but this is not a prescription.

If a 50% drawdown in your altcoin slice would threaten rent, school fees or business operations, the allocation is probably too high.

For most people, altcoins belong in the “speculative growth” bucket, not the “retirement essentials” bucket.

Blending Large-Cap, Thematic and Speculative Altcoins

A simple bucket model for altcoin portfolio diversification in 2025:

Core (lower risk within crypto)

Large-cap L1 and major L2 altcoins with deep liquidity and multi-region listings (US, UK, EU, Middle East).

Held for long-term network adoption rather than short-term trading.

Satellite (thematic)

DeFi and gaming altcoins 2025 with real users, plus infrastructure plays (oracles, rollups, bridges).

Sized smaller than core; rebalanced regularly.

High-risk / speculative

Experimental, micro-cap or early-stage thematic plays.

Strict position sizing, assuming many may go to zero.

This structure helps separate long-term vs speculative altcoins, and makes it easier to rebalance during the crypto bull run 2025 altcoins phase instead of chasing every narrative.

Special Considerations for Middle East Investors

For GCC investors.

Access & licensing

Check which regulated exchanges currently serve UAE, Bahrain, Saudi Arabia, Qatar or Kuwait; offerings can change as local rules evolve.

Sharia considerations

Staking, leveraged trading and some DeFi structures may conflict with certain interpretations; many investors either avoid unclear products or obtain Sharia-compliant portfolio guidance.

Cross-border flows & CARF

Using offshore exchanges from Dubai or Riyadh may still trigger reporting to foreign tax authorities once CARF exchanges begin. Record-keeping (dates, values, counterparties) is increasingly essential.

Tax and Reporting Rules for Altcoin Profits in 2025

UAE and Wider Middle East.

Headlines often call the UAE “tax-free”, but the reality is shifting:

Many UAE residents still face low or zero personal income tax, but the country is aligning with CARF-style global transparency, which means more structured reporting from exchanges and banks.

Gulf states differ widely: one may treat frequent trading as a business activity, another may restrict retail crypto use outright.

For investors in Dubai, Abu Dhabi or Manama, the practical takeaway is simple: keep good records (trades, swaps, DeFi rewards) even if you currently expect zero local tax that assumption may not hold forever.

US, UK, Germany and EU.

High-level only (always confirm with a tax professional)

United States

The IRS treats digital assets as property; selling, swapping or spending them is generally a taxable event, and staking/airdrop rewards can be income.

United Kingdom

HMRC’s Cryptoassets Manual confirms that tax depends on the nature and use of the token.

Most individuals face capital gains tax on disposals; specific guidance covers DeFi and staking.

New CARF-aligned rules from 2026 require exchanges to share detailed user data with HMRC.

Germany/EU (including under MiCA/MiCAR)

Germany typically taxes crypto gains as private sales, with rules around holding periods and thresholds; BaFin is the designated crypto regulator under MiCA.

The EU’s DAC8 directive adds crypto to existing information-exchange systems, closely tied to the OECD’s CARF.

In short, US, UK and EU investors increasingly face detailed reporting obligations, and CARF means Gulf-based investors using foreign platforms may be pulled into this net as well.

Why Changing Tax Rules Matter for Your 2025 Altcoin Strategy

Tax rules change your net returns and behaviour.

A 50% nominal gain can shrink dramatically once capital-gains and income tax are applied in the US, UK, Germany or EU.

CARF and DAC8 mean it’s much harder to “forget” to report offshore trading; more than 70+ jurisdictions have committed to implement CARF.

Good portfolio tools, clear cost-basis tracking and early planning for cross-border moves (for example, relocating from London to Dubai) can have a bigger impact on your real outcomes than picking one extra altcoin.

Key Takeaways

In 2025, the best altcoins to invest in usually means diversified themes large-cap L1/L2, DeFi, gaming, infra and RWAs not single magic coins.

Macro tailwinds (ETF inflows, MiCA, VARA, rising MENA adoption) are real but coexist with brutal volatility and regulatory shocks.

Regulation in the Middle East, US, UK and Germany shapes which exchanges you can use, which tokens stay listed, and how your data is shared.

Sensible investors treat altcoins as a satellite, high-risk allocation, diversify across buckets and rebalance according to pre-set rules.

For Middle East readers, local licensing, Sharia considerations and CARF reporting are key constraints; for US/UK/German/EU readers, tax, MiCA and FCA/SEC enforcement matter just as much as tokenomics.

General Education vs Personal Financial Advice

This article is general education only. It is not investment, legal, tax or Sharia advice, and it doesn’t tell you which specific coins to buy, hold or sell. Your situation income, obligations, residency, risk tolerance, beliefs is unique, and decisions about altcoins should be made with licensed advisors in your own jurisdiction.

What to Do Before You Buy Any Altcoin

Before buying any altcoin in 2025, at minimum:

Read the whitepaper, docs and tokenomics; understand what problem the project is actually solving.

Check audits, security reports and exchange listing status (especially under VARA, FCA, BaFin, SEC/CFTC or MiCA supervision).

Understand your tax position, reporting obligations and withdrawal rules for your region.

Start small, assume high volatility, and be willing to walk away from anything you don’t fully understand.

If you’re a founder, family office or high-growth business in the Middle East, US, UK, Germany or wider EU and you’re exploring crypto, DeFi or RWA products, you don’t just need “devs” you need a partner who understands regulation, security and UX.

Mak It Solutions helps teams design and build compliant, scalable digital platforms from Web3 dashboards and trading interfaces to data analytics and reporting tools that support CARF, MiCA and GDPR obligations. If you’d like a practical, non-salesy conversation about your next crypto or fintech product, reach out via the Mak It Solutions contact page and request a scoped consultation.

For more on our capabilities, see.

Services overview https://makitsol.com/services/

Web development services https://makitsol.com/web-development-Services/

Mobile app development services https://makitsol.com/service/mobile-app-development-services/

Search Engine Optimization services –https://makitsol.com/service/search-engine-optimization/

Business Intelligence and data analytics (for CARF/MiCA dashboards) via the Business Intelligence Services hub on Mak It Solutions author page

About Mak It Solutions https://makitsol.com/about-us/

FAQs

Q : Can I use more than one crypto exchange for my 2025 altcoin portfolio?

A : Yes many investors deliberately use more than one exchange to diversify counterparty and jurisdiction risk. For example, a Dubai-based investor might use a VARA-licensed local exchange for AED on-ramps and a MiCA-regulated EU platform for EUR pairs. The trade-off is extra KYC, more wallets to secure and more complex tax reporting. A simple rule: minimise the number of platforms you actively trade on, but avoid putting everything on a single unregulated venue.

Q : What red flags suggest an altcoin project might be a scam or rug pull?

A : Red flags include anonymous or unverifiable founders, no clear product beyond marketing, copied or vague whitepapers, unrealistic APYs, heavy reliance on referral schemes, and smart contracts that haven’t been audited by reputable firms. Watch for aggressive “guaranteed returns” messaging, social-media shills with no risk disclosure, and tokens that are only tradable on obscure offshore exchanges. If the project can’t explain, in plain language, how it makes money and why the token needs to exist, treat that as a major warning sign.

Q : Do staking and yield rewards on altcoins count as taxable income in 2025?

A : In many jurisdictions, yes. The IRS in the US and HMRC in the UK generally treat staking, yield farming and some airdrops as forms of income at the time you receive them, with additional capital-gains tax when you later sell the tokens. In Germany and other EU states, treatment can depend on holding periods and whether the activity looks more like investing or business. Because rules differ between the UAE, Saudi Arabia, the UK, US and EU, it’s important to keep detailed records and consult a tax professional.

Q : Are hardware wallets necessary if I only invest a small amount in altcoins?

A : If your total altcoin exposure is modest and held on a well-regulated exchange, a hardware wallet is optional the bigger priority is strong passwords, 2FA and avoiding phishing. But once your holdings are large enough that losing them would genuinely hurt your finances, moving a portion to a reputable hardware wallet becomes more compelling. Non-custodial storage reduces exchange risk but adds personal responsibility: if you lose your seed phrase, there is usually no recovery. Start with small test transactions and only scale up when you’re comfortable.

Q : How often should I rebalance an altcoin portfolio during a crypto bull run?

A : There’s no one-size answer, but many investors choose time-based (for example, quarterly) or threshold-based (for example, when a position drifts 5–10% from its target weight) rebalancing. In a fast bull run, it can make sense to skim profits from speculative altcoins back into more stable holdings or even out of crypto entirely. Rebalancing too frequently can increase fees and tax events; too rarely can leave you over-exposed to a single narrative. Whatever you choose, write down your rules in advance so you’re not making emotional decisions mid-volatility.