Russia’s A7A5 stablecoin tops 2025 supply gains amid capital controls

A7A5, a ruble-denominated stablecoin that was largely unknown just a year ago, emerged as the fastest-growing stablecoin by the end of 2025. Its rapid rise surprised the crypto market, as it outperformed long-established leaders in terms of supply expansion. The token’s growth highlights increasing interest in non-dollar stablecoins and the evolving demand for alternative fiat-pegged digital assets.

According to on-chain data compiled by Artemis and reported by CoinDesk, A7A5’s circulating supply increased by approximately $89.5 billion over the past year. This figure significantly surpassed the growth of major stablecoins, with USDT adding around $49 billion and USDC expanding by about $31 billion. The data underscores a notable shift in stablecoin dynamics during 2025.

What is A7A5 and who’s behind it?

Launched in January 2025, A7A5 is a ruble-pegged stablecoin issued under Kyrgyz regulation and available on the Tron and Ethereum blockchains. Public materials and independent analyses describe ties between the A7 group and Russia’s state-owned Promsvyazbank (PSB), as well as Moldovan businessman Ilan Șor. Compliance researchers have further connected A7A5’s ecosystem to sanctioned Russian crypto venues.

Where does A7A5 trade?

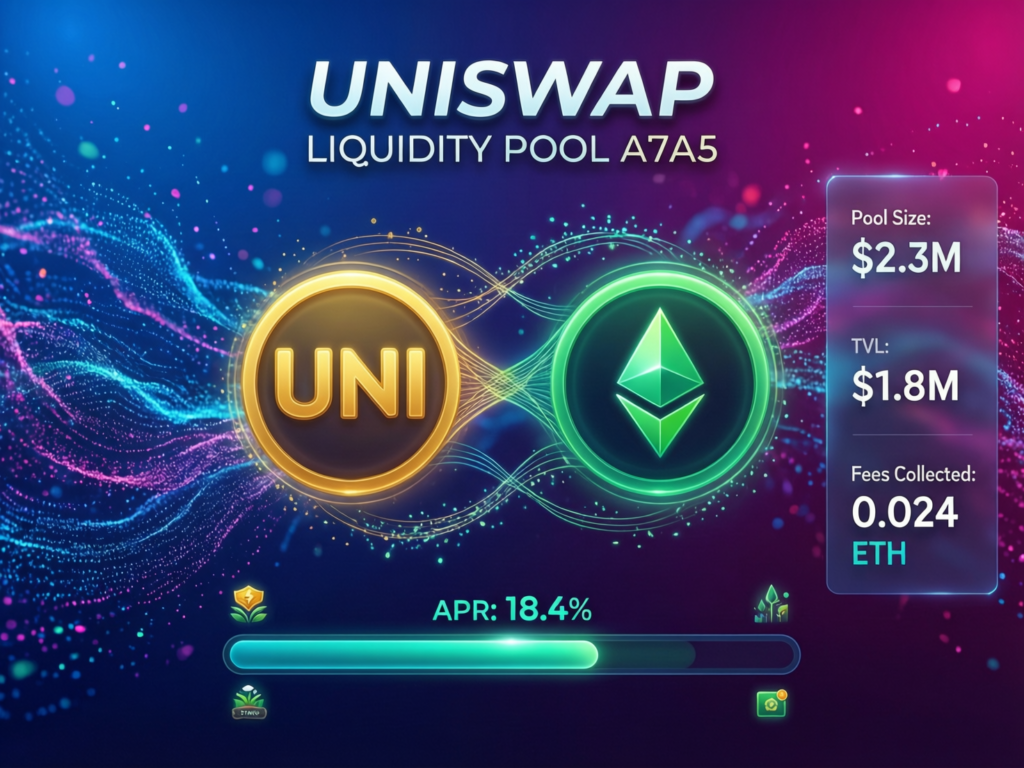

Despite its size, A7A5 does not list on major centralized exchanges. CoinGecko shows liquidity concentrated on Uniswap, reinforcing its role as a DeFi-routed payment bridge into broader stablecoin markets.

Why did A7A5 grow so fast?

A combination of capital controls, policy intervention, and a sharply stronger ruble in 2025 created tailwinds for ruble-based rails. Reuters and other outlets documented the ruble’s ~40–45% rally versus the U.S. dollar last year one of the world’s best performances—amid tight monetary policy and FX operations. These conditions likely encouraged ruble-denominated flows that A7A5 was positioned to capture.

Comparative growth: USDT and USDC

Artemis-sourced figures reported by CoinDesk indicate USDT added ~$49B in supply in 2025 and USDC about ~$31B both substantial, yet still trailing A7A5’s ~$89.5B increase. The delta underscores how regional use-cases can overwhelm headline dominance by global dollar-pegged tokens.

Sanctions exposure and conference presence

Monitoring firms have tied A7/A7A5 to sanctioned entities and alleged sanctions-evasion activity, while Reuters reported A7A5’s high-profile (and later scrubbed) sponsorship presence around TOKEN2049 Singapore. These contradictions visibility at global events alongside enforcement risk highlight the policy complexity surrounding A7A5.

Risks and oversight for A7A5 ruble stablecoin growth

Sanctions risk

Links to PSB and accused networks could subject related wallets or facilitators to designation and freezing actions.

Liquidity concentration

Dependence on Uniswap pairs may limit fiat off-ramps and increase smart-contract/execution risk.

Data transparency

Issuer claims vs. attestation standards remain an area to watch relative to major dollar stablecoins. (General observation, supported by cited profiles.)

Market structure notes on A7A5 ruble stablecoin growth

Chains

Tron and Ethereum enable lower-fee transfers and DeFi composability.

Use-case

Cross-border settlement for Russian users constrained by banking restrictions; routing into USDT pools via DeFi.

Context & Analysis

The outsized rise of A7A5 illustrates how regional frictions can reshape stablecoin league tables independent of global brand share. It also underscores an enforcement gap: DeFi liquidity can enable access to dollar liquidity without custodying dollar-pegged assets directly raising hard questions for regulators about jurisdiction, venue responsibility, and cross-chain monitoring.

Concluding Reamrks

A7A5’s swift rise was fueled by strong localized demand, regulatory and policy limitations, and its integration with DeFi infrastructure. These factors combined to reshape stablecoin growth rankings in 2025, allowing the ruble-pegged token to outperform more established competitors. Its expansion reflects how regional needs and alternative financial rails can significantly influence stablecoin adoption.

Looking ahead to 2026, A7A5’s ability to maintain this momentum remains uncertain. Future growth will largely depend on regulatory enforcement, continued exchange support, movements in the ruble, and how transparently the project operates compared with well-established dollar-pegged stablecoins.

FAQs

Q : What is A7A5?

A : A7A5 is a ruble-pegged stablecoin launched in January 2025. It is issued under Kyrgyz regulation and operates on both the Tron and Ethereum blockchains.

Q : Why did A7A5 grow so quickly in 2025?

A : Its rapid growth was driven by ruble strength, capital controls, and increased use of DeFi routing for cross-border payments.

Q : Is A7A5 available on centralized exchanges?

A : No major centralized exchange listings are shown. CoinGecko lists Uniswap as its primary trading venue.

Q : Who is linked to A7A5?

A : Analyses have connected A7/A7A5 to Promsvyazbank and Ilan Șor’s network.

Q : Did A7A5 really outpace USDT and USDC?

A : Yes. Artemis data reported by CoinDesk shows A7A5 added about $89.5B in 2025, compared with $49B for USDT and $31B for USDC.

Q : How risky is using A7A5?

A : Sanctions exposure and concentrated DeFi liquidity increase legal and counterparty risks. Legal or compliance advice is recommended.

Q : Where can I track A7A5 on-chain?

A : You can use block explorers and analytics dashboards, starting with issuer addresses and reputable on-chain trackers.

Facts

Event

A7A5 ruble-pegged stablecoin records the largest 2025 supply increase among stablecoinsDate/Time

2026-01-09T00:00:00+05:00Entities

A7A5; A7 LLC/A7 Group; Promsvyazbank (PSB); Ilan Șor; Tron; Ethereum; Tether (USDT); Circle (USDC)Figures

A7A5 +~$89.5B supply (2025); USDT +$49B; USDC +$31B; Ruble +~40–45% vs USD in 2025Quotes:

Sources

CoinDesk article on A7A5 outpacing leaders (https://www.coindesk.com/markets/2026/01/09/a-ruble-stablecoin-outpaced-market-leaders-last-year-despite-international-sanctions); Reuters on ruble performance (https://www.reuters.com/business/finance/why-russian-rouble-is-outperforming-what-it-means-2025-07-24/)