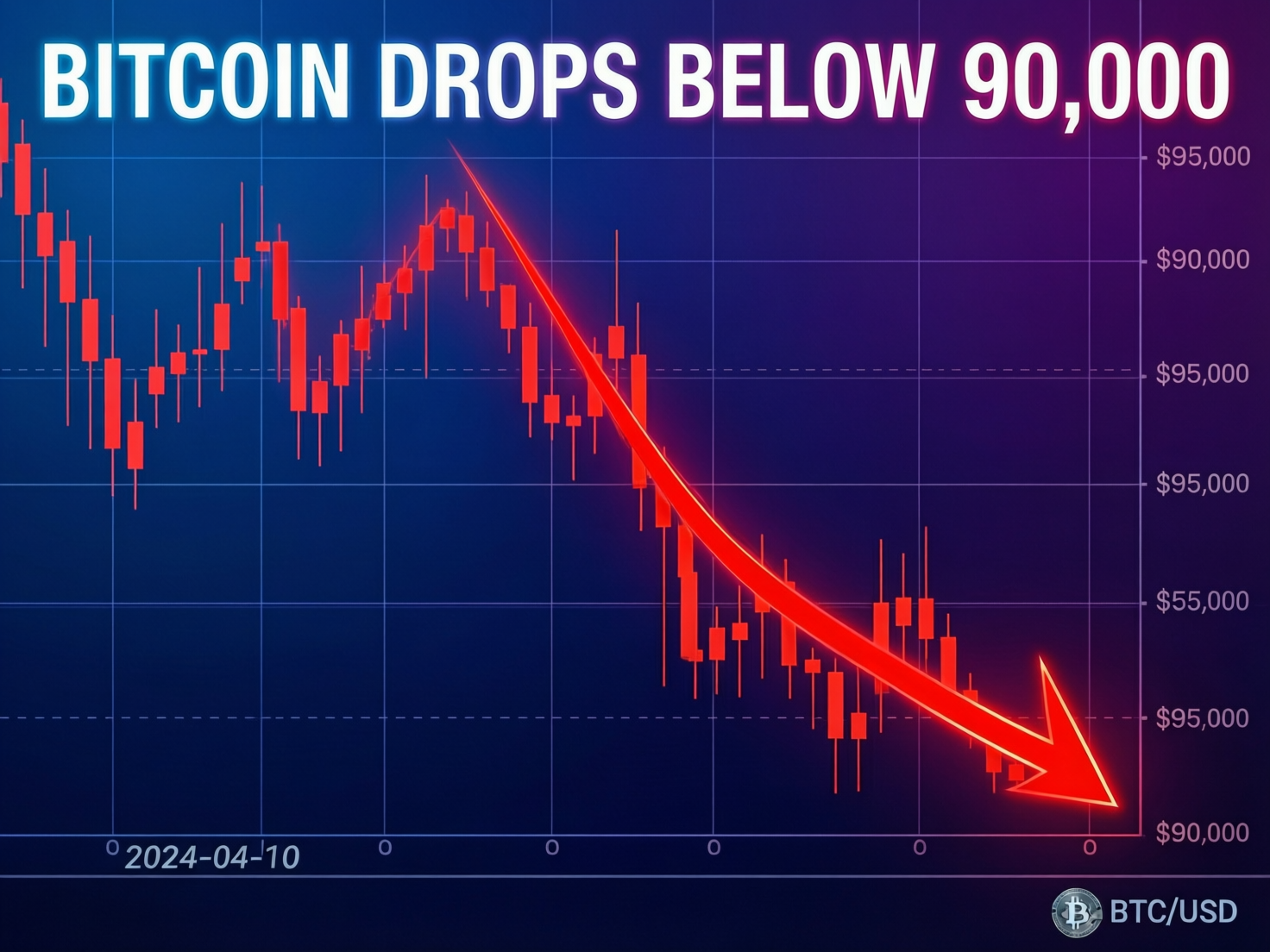

BTC slips under $90K; U.S. spot ETFs log $486M in redemptions

Bitcoin drops below $90,000 after early January pop as BTC ETFs see $480 million outflows reflects ETF redemptions and macro currents that left crypto mixed on the day. The pullback followed a brief New Year rally, as investors reacted to shifting expectations around interest rates, bond yields, and overall risk appetite. Selling pressure intensified as U.S.-listed spot Bitcoin ETFs recorded heavy net outflows, signalling reduced institutional demand and profit-taking after recent gains.

Broader financial conditions also weighed on sentiment. Rising yields and a firmer dollar pushed traders toward caution, dampening enthusiasm for risk assets including cryptocurrencies. While Bitcoin underperformed, some altcoins showed relative resilience, highlighting uneven market positioning. Analysts note that near-term price action remains closely tied to macro data, ETF flows, and central-bank signals, suggesting continued volatility as markets reassess growth, inflation, and liquidity trends.

Market snapshot

Bitcoin hovered around the high-$80,000s to ~$90,000 after slipping intraday, down roughly 2–3% over 24 hours but still positive week-to-date. Ether eased ~3% on the day and remained higher over seven days. Dogecoin led with a ~22% weekly gain, while XRP fell ~4–5% on the session but stayed up on the week.

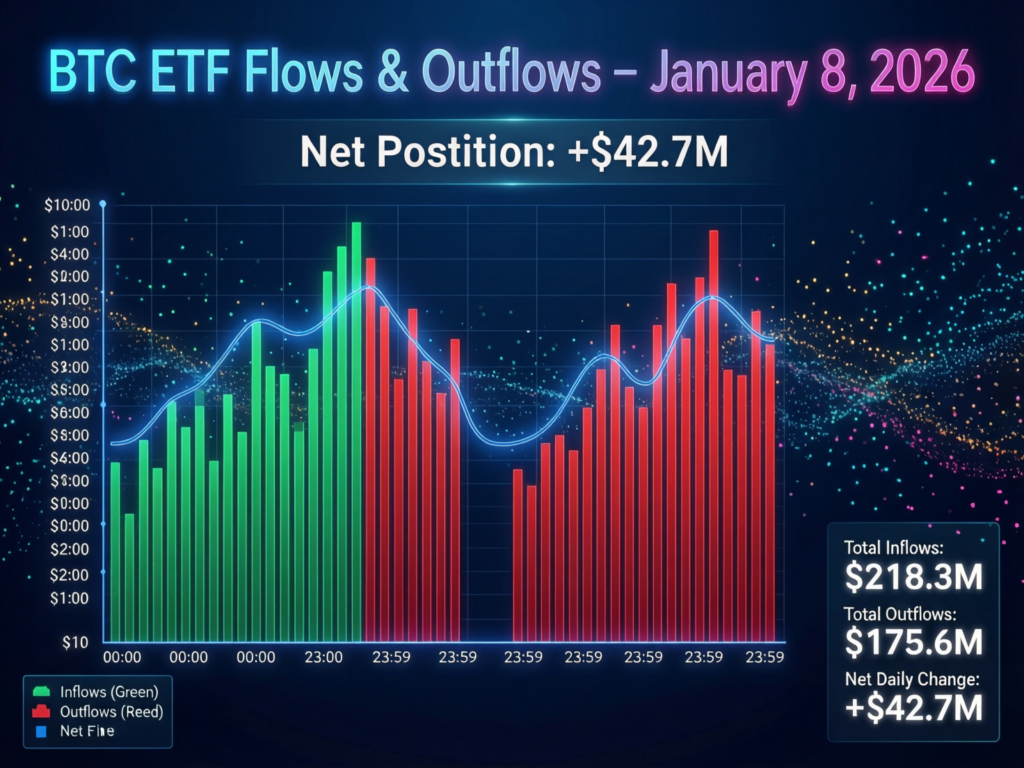

Flows: U.S. spot ETFs turn negative again

Spot bitcoin ETFs in the U.S. recorded approximately $486.1 million in net outflows on Wednesday, marking a second consecutive negative day of 2026 after Tuesday’s ~$243 million. The turn follows strong inflows earlier in the week.

Macro backdrop: yields slip on softer data

Treasuries extended gains as weaker private-payrolls data (ADP +41,000 for December) helped nudge expectations toward additional Fed cuts later in 2026. The 10-year yield traded near ~4.12–4.14% during Wednesday/Thursday sessions. Risk assets were mixed despite the friendlier rates backdrop.

Sentiment & positioning

Analysts described crypto as a high-beta risk asset led by bitcoin dominance, with flows and macro acting as primary drivers. December’s thin liquidity and year-end de-risking gave way to a January reset, but the latest pullback shows traders are not treating the rebound as linear. Yahoo Finance

What it means when Bitcoin drops below $90,000

Short-term breaks of big round numbers (like $90K) can amplify volatility as stops trigger and funding normalizes. Still, weekly performance remained positive, and rate-cut hopes persisted alongside a global bond rally. Watch ETF flow direction, yield trends, and cross-asset risk appetite for confirmation of trend. Farside+1

Near-term levels if Bitcoin drops below $90,000

Market participants are watching whether BTC can reclaim ~$90K–$93K or retest the upper-$80Ks as ETFs digest flows and macro data land.

Context & Analysis

ETF flow direction often sets the day’s tone for BTC in the current cycle. Two straight outflow days after a strong start suggest profit-taking and shorter-term positioning at work. Softer yields may cushion risk assets, but sustained inflows would likely be needed to extend crypto’s January bounce.

Concluding Remarks

Bitcoin’s move below $90,000 highlights a fragile equilibrium between easing rate expectations and unpredictable ETF flows. While supportive monetary conditions can help sustain risk appetite, persistent ETF redemptions continue to pressure prices. A swift shift back to net inflows, along with consolidation above the $90,000–$93,000 range, would reinforce confidence in the broader bullish trend and attract renewed investor interest.

However, the outlook remains cautious. Extended ETF outflows or rising demand for traditional assets such as bonds and equities could limit upside momentum. In that scenario, Bitcoin may struggle to sustain rallies, with near-term performance closely tied to macro signals, liquidity conditions, and shifts in institutional positioning across global markets.

FAQs

Q : Why did Bitcoin fall today?

A : ETF outflows of around ~$486 million and profit-taking pressure outweighed the positive impact of lower bond yields.

Q : What does it mean when Bitcoin drops below $90,000?

A : Falling below this level can trigger stop-losses and liquidations, while also testing overall market risk appetite until capital flows stabilize.

Q : Are bond yields helping crypto?

A : Lower 10-year U.S. yields (around 4.12–4.14%) can support risk assets like crypto, but ETF and liquidity flows remain more influential.

Q : How did other coins perform?

A : DOGE led weekly gains at roughly 22%, XRP declined on the day but stayed positive week-to-date, while ETH softened day-over-day.

Q : Did ETFs start 2026 strong before turning negative?

A : Yes, early-week inflows of about $697 million on Jan. 5 reversed into outflows on Tuesday and Wednesday.

Q : Where can I track live Bitcoin prices?

A : Platforms like CoinGecko and similar aggregators offer real-time prices and weekly performance data.

Q : Will Fed rate cuts lift crypto?

A : Rate-cut expectations often support risk assets, but sustained ETF inflows and ample liquidity are crucial for lasting upside.

Facts

Event

Bitcoin fell under $90,000 amid ETF outflowsDate/Time

2026-01-08T18:00:00+05:00Entities

Bitcoin (BTC); U.S. spot bitcoin ETFs; Federal Reserve; ADP Research; U.S. Treasury 10-year noteFigures

~$486.1m ETF outflows (Jan. 7); 10-year yield ~4.12–4.14%; ADP +41,000 jobs; BTC −~2–3% 24h, still +WTDQuotes

“Macroeconomics is a crucial factor… crypto [is] a risk asset that depends heavily on bitcoin-led sentiment.” B2BINPAY (email commentary reported in coverage) Yahoo FinanceSources

Yahoo Finance (CoinDesk syndication) “Bitcoin drops below $90,000…”; Farside Investors “Bitcoin ETF Flow (US$m)”; Bloomberg U.S. 10-year around 4.14%, ADP +41k; CoinGecko BTC price/weekly change. CoinGecko+3Yahoo Finance+3Farside+3