BTC moves with yen: 90-day correlation tops 0.85

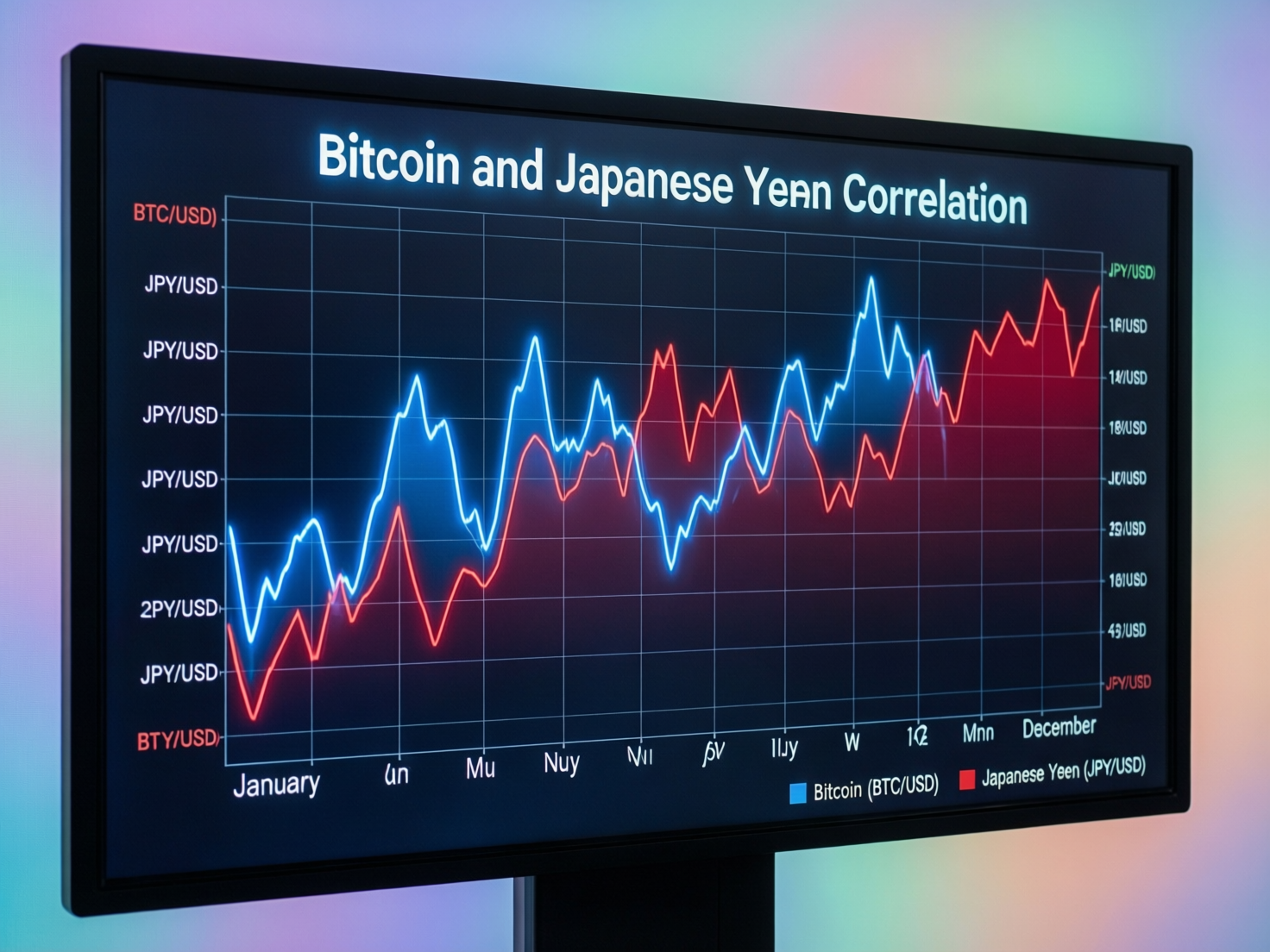

Bitcoin and the Japanese yen are moving together like never before, with the 90-day correlation rising to a record high near 0.86. This unusual alignment suggests bitcoin price swings are, for now, closely tied to yen dynamics, reducing BTC’s appeal as a portfolio hedge.

The surge is measured against Pepperstone’s JPY Index (JPYX) and observed on TradingView. In statistical terms, a 0.86 correlation implies roughly 73% of BTC’s recent variance mirrors the yen’s moves. Primary keyword used once here: bitcoin and japanese yen correlation.

Record highs in bitcoin and japanese yen correlation

Market data show the BTC–JPY relationship tightened through Q4 2025, peaking in early January 2026 as both assets stabilized after selling pressure into mid-December. The correlation is calculated on rolling 90-day returns, highlighting how macro currents can align crypto with fiat markets in short bursts.

Why the bitcoin and japanese yen correlation surged

Analysts point to Japan’s macro backdrop. Despite two BoJ hikes in 2025 bringing the policy rate to a multi-decade high the yen remained weak into year-end amid fiscal concerns and higher domestic yields, keeping FX volatility elevated. A soft yen can coincide with risk-asset indigestion, linking BTC performance to JPY shifts. Reuters+2Reuters+2

What JPYX measures

Pepperstone’s JPYX is a currency index/CFD tracking yen strength against a basket of major peers; traders commonly monitor it on TradingView for cross-market context. While not an official benchmark, JPYX offers a consolidated view beyond USD/JPY alone. Pepperstone+1

Diversification impact

A correlation above 0.85 reduces bitcoin’s short-term diversification edge versus JPY-sensitive holdings. Historically, such tight linkages in crypto are episodic; correlations can mean-revert as macro drivers change. Still, for risk management, BTC may currently behave more like a yen-beta than a “digital gold” hedge.

Macro context: yen weakness and Japan’s debt load

Japan’s gross government debt hovers around 240% of GDP often cited in market narratives about yen vulnerability though net debt is considerably lower. As policymakers normalize after ultra-easy settings, JGB yields and currency moves remain focal points for global traders.

Context & Analysis

The record correlation likely reflects overlapping macro forces—yen weakness tied to policy normalization and fiscal optics, plus crypto’s sensitivity to global liquidity. If the BoJ tightens further or the U.S. growth path shifts, the correlation could ease, restoring BTC’s standalone behavior.

Final Thoughts

For now, Bitcoin’s record correlation with the Japanese yen highlights its growing sensitivity to yen-driven macroeconomic trends. Movements in the currency are increasingly influencing BTC price action, suggesting that global FX dynamics, not just crypto-specific factors, are shaping market behavior.

Traders should keep a close eye on JPYX levels, Bank of Japan policy signals, and key correlation thresholds. At the same time, history shows that such strong BTC-yen linkages tend to fade, making risk management and flexibility essential as macro conditions evolve.

FAQs

Q: What are Binance silver perpetual contracts?

A: These are perpetual futures on silver (XAGUSDT) with no expiry date. They offer up to 50x leverage, use USDT for margin and settlement, and apply a four-hour funding mechanism.

Q: When did XAGUSDT perpetuals launch on Binance?

A: Binance launched XAGUSDT perpetual futures on Jan. 7, 2026 at 10:00 UTC.

Q: What is the funding rate and frequency?

A: Funding settles every four hours, with a ±2% cap at launch.

Q: Why add silver now?

A: Silver was one of the top performers in 2025, rising about 147% and hitting record highs above $83/oz, driving strong demand for metals exposure.

Q: Can I copy trade silver perpetuals?

A: Yes. Binance states that Futures Copy Trading support is expected within 24 hours of launch.

Q: How risky is 50x leverage on metals?

A: Extremely risky. Even small price moves can cause rapid liquidations. Traders should fully understand funding, margin requirements, and risk controls before using high leverage.

Q: Are gold perpetuals available too?

A: Yes. XAUUSDT perpetual contracts were listed on Binance in December 2025.

Facts

Event

Record BTC–JPY 90-day correlation near 0.86Date/Time

2026-01-07T13:30:00+05:00Entities

Bitcoin (BTC); Japanese yen (JPY); Bank of Japan (BoJ); Pepperstone JPY Index (JPYX) TradingView; CoinDeskFigures

Correlation ≈0.86 (R² ≈0.73); USD/JPY near 157 late-2025 (context) CoinDesk+1Quotes

“The 90-day correlation… has risen to 0.86, the highest ever.” CoinDesk (reporting TradingView/JPYX data) CoinDeskSources

CoinDesk (story) + URL; Reuters (yen macro) + URL