Middle East Crypto Market 2025: Trends, Rules, Returns

In 2025, the Middle East crypto market is shaped by fast-growing GCC digital asset hubs like Dubai and Abu Dhabi, rising institutional money and clearer virtual asset regulation. For US, UK and EU investors, the main opportunities sit in regulated exchanges, tokenization projects and payment rails. The real edge comes from navigating fragmented local rules alongside home-market regimes like MiCA, BaFin guidance, FCA promotion rules and SEC/CFTC oversight, rather than treating the region as a loophole.

Introduction

The Middle East crypto market 2025 is no longer a side bet it’s a core research topic for allocators in New York, London and Frankfurt who are hunting for regulated growth outside their home markets. Between July 2023 and June 2024, the broader Middle East & North Africa (MENA) region processed an estimated $338.7 billion in on-chain value, around 7.5% of global crypto transaction volume.

Within that, GCC hubs like the UAE (Dubai and Abu Dhabi), Saudi Arabia, Qatar and Bahrain are racing to build digital asset markets in the Middle East, backed by sovereign wealth funds, fintech sandboxes and ambitious diversification plans. (AMINA Bank)

For US, UK, German and wider EU investors, 2025 is a hinge year: MiCA is fully live in the EU, UK regulators are tightening crypto promotion and tax rules, and GCC frameworks such as Dubai’s VARA and Abu Dhabi Global Market’s (ADGM) virtual asset regime are maturing. This guide gives you a structured, investor-grade view of trends, regulation, institutional adoption and realistic access routes into digital asset markets in the Middle East.

Middle East crypto market 2025 at a glance

In 2025, the Middle East crypto market is driven by pro-fintech policies in GCC hubs, growing institutional interest, remittance use cases and clearer regulation in places like Dubai and Riyadh.

Market size, growth forecasts and 2025 milestones

Chainalysis data suggests MENA is already the seventh-largest crypto market globally, with roughly $330–350 billion in on-chain value received across July 2023–June 2024 and mid-single-digit to low-double-digit annual growth. (Chainalysis) Analysts expect that, if regulatory (directional estimate; check latest reports before investing).

Key 2024–2025 milestones include

Dubai VARA finalizing detailed rulebooks on marketing and virtual asset activities and coordinating with the UAE Securities and Commodities Authority (SCA) on a federal-level framework.

ADGM’s FSRA updating guidance on virtual asset activities and consulting on staking rules, while assets under management in ADGM jumped ~245% in 2024.

Binance becoming the first global exchange to secure a “gold-standard” ADGM license to run its main platform from Abu Dhabi, alongside Circle obtaining a full money services license there.

UAE VAT tweaks exempting most virtual asset transactions from the standard 5% VAT rate from November 2024, signalling official recognition of crypto as part of the financial system.

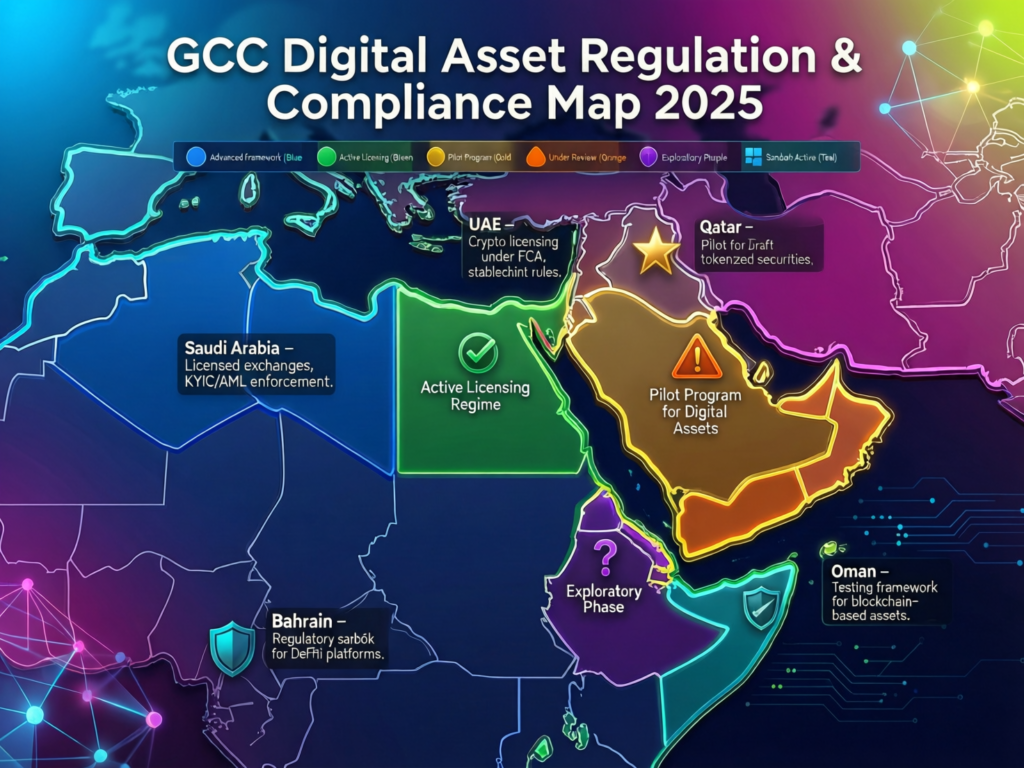

GCC markets (UAE, Saudi, Qatar, Bahrain, Kuwait, Oman) are increasingly the regulatory core; non-GCC MENA countries such as Egypt or Jordan see strong retail usage but more uneven policy and banking support.

Key growth drivers of the Middle East crypto market in 2025

The core growth drivers in 2025 are a mix of policy, demographics and infrastructure. GCC governments are using crypto and broader digital asset markets as part of their oil-to-digital diversification playbook, with sovereign wealth funds in Abu Dhabi and Riyadh investing directly into exchanges, tokenization platforms and AI-linked blockchain projects.

At the same time, you have.

A young, mobile-first population with high smartphone and broadband penetration and strong interest in fintech and Web3 apps. UAE crypto app downloads, for example, grew from around 6.2 million in 2023 to roughly 15 million in 2024.

Remittance and payment corridors between GCC hubs and South Asia/Africa, where stablecoins and other rails can cut costs and settlement times key for cross-border payments and remittances via crypto in MENA.

Regulatory sandboxes and innovation programs in UAE, Saudi Arabia, Bahrain and Qatar supporting the GCC fintech and blockchain ecosystem.

Growing experiments with Sharia-compliant crypto investment products, sukuk tokenization and Islamic finance-friendly stablecoins.

Together, these factors underpin the thesis that digital asset markets in the Middle East will keep growing even through global crypto cycles.

Why 2025 is a decisive year for US, UK and EU investors

2025 is a decisive year because Middle Eastern rules are converging with global standards just as home-market regimes tighten. MiCA is fully applicable to most EU crypto-asset service providers from 30 December 2024, with BaFin now enforcing MiCA-aligned licensing in Germany.

In the UK, the FCA’s financial promotion regime now explicitly covers cryptoassets, including marketing by overseas platforms to UK consumers. In the US, SEC and CFTC enforcement continues to shape which products can be offered to US residents.

On the GCC side, Dubai VARA, ADGM’s FSRA and Bahrain’s CBB are tightening AML, governance and disclosure expectations, while Saudi Arabia explores central-bank-led digital assets with a still-restrictive stance on retail crypto trading.

That combination creates a narrower, but cleaner, entry window: foreign investors who align early with both home and host-country rules can position as first movers in regulated Middle East crypto market 2025 exposure.

Country-level hubs

UAE is currently the primary licensing and trading hub, Bahrain offers niche gateways for regulated exchanges, and Saudi Arabia is cautiously evolving each market suits different business models.

UAE crypto market outlook 2025 Dubai and Abu Dhabi as global hubs

For most foreign allocators, “Middle East crypto market 2025” practically means UAE first. Dubai’s Virtual Assets Regulatory Authority (VARA) is now the dedicated supervisor for virtual assets across most of Dubai, issuing activity-specific licenses and marketing rules for exchanges, brokers, custodians and other virtual asset service providers.

Abu Dhabi Global Market (ADGM), via its Financial Services Regulatory Authority (FSRA), runs a full digital asset framework oriented to institutional products spot markets, derivatives, custody and more. By 2025, ADGM hosts global names like Binance and Circle under rigorous FSRA oversight, alongside other exchanges and tokenization platforms.

For a UAE–US crypto corridor scenario, think of a New York or Austin hedge fund using a US-regulated custodian plus an ADGM-licensed venue to gain exposure to GCC-listed tokens, while respecting US securities and tax rules. UK to Dubai crypto expansion often follows a similar pattern, with London-based funds structuring feeder or master-feeder vehicles and relying on UK-compliant disclosures and the FCA’s promotion rules when marketing to UK investors.

Saudi Arabia’s crypto policy and central bank stance in 2025

Saudi Arabia is more cautious. Officially, a 2018 statement from a standing committee, backed by SAMA and the Capital Market Authority, warned that virtual currencies are unregulated and that no parties are licensed to provide such services.

However, since 2024 SAMA has been actively exploring central bank digital currency (CBDC) pilots and broader tokenization use cases in banking, appointing a dedicated Virtual Assets and CBDC Program Lead. Expect Saudi Arabia crypto regulation 2025 to focus on government-controlled digital assets (CBDC, tokenized deposits, perhaps tokenized sukuk) rather than open retail crypto trading.

For investors, that means.

The Saudi market is currently more relevant for enterprise blockchain and CBDC collaborations than pure crypto trading, and

Exposure often comes indirectly via Saudi-listed banks and fintechs participating in tokenization or payment rails rather than via Saudi-domiciled exchanges.

Qatar, Bahrain and smaller GCC markets.

Bahrain has quietly become a licensing niche for regional exchanges and brokers. The Central Bank of Bahrain’s (CBB) Crypto-Asset Module creates a full licensing regime for regulated crypto-asset services; Bahrain’s national portal now highlights that several licensed platforms operate under CBB supervision. BitOasis’s 2025 launch in Bahrain, backed by a CBB license, is one visible example of this strategy.

Qatar, via the Qatar Financial Centre Regulatory Authority (QFCRA), introduced a 2024 Digital Assets Framework and Digital Asset Regulations that define tokens, tokenization processes, legal rights and custody. This positions Doha’s financial centre as a tokenization and structured-product jurisdiction more than a mass-market retail trading hub.

For EU firms, “Germany to UAE fintech passporting” or broader GCC routes often mean:

structuring under MiCA and BaFin rules in Frankfurt/Berlin, then

using UAE or Bahrain entities for regional execution and liquidity, and

aligning data handling with GDPR/DSGVO and local data residency expectations.

Regulation, compliance and risk in the Middle East crypto market 2025

Regulatory frameworks are tightening but remain fragmented; foreign firms must manage FATF-driven AML/KYC, data rules like GDPR and local licensing differences while monitoring geopolitical and banking risks.

2025 crypto regulation overview across major Middle East jurisdictions

There is no single “Middle East crypto law.” Instead, you face a patchwork:

UAE

Dubai VARA, ADGM FSRA and federal SCA rules together form one of the world’s more detailed crypto regimes.

Saudi Arabia

Crypto trading remains effectively prohibited for the public, while SAMA and CMA focus on CBDC and tokenized financial instruments.

Bahrain

CBB’s crypto-asset regulations govern licensing of exchanges, brokers and custodians.

Qatar

QFC Digital Asset Regulations 2024 and related investment token rules define a legal basis for tokenization and custody in the financial centre.

Kuwait and Oman

More restrictive, with prohibitions or strong warnings limiting local crypto businesses but leaving room for some institutional experimentation.

For investors, this means each GCC market carries different licensing, marketing and product-eligibility profiles, even when using the same exchange brand.

AML/KYC, FATF alignment and links to MiCA, GDPR and BaFin rules

The Financial Action Task Force (FATF) updated its recommendations on virtual assets and VASPs in 2023 and again in 2025, urging countries to apply AML/CFT controls and the “Travel Rule” to crypto. GCC regulators explicitly position their frameworks as FATF-aligned, so VASPs in UAE, Bahrain or Qatar must run robust KYC, transaction monitoring and Travel Rule compliance.

For EU and German investors, MiCA plus BaFin guidance now define crypto-asset service categories and authorization requirements, including for firms offering services into Germany from abroad. Any Middle East platform targeting EU clients must reconcile MiCA obligations (e.g., whitepapers, market abuse rules) with local licensing.

For UK firms, the FCA’s extended financial promotion regime applies to marketing crypto to UK consumers, regardless of where the firm is based a direct constraint on UAE- or Bahrain-licensed exchanges running UK acquisition campaigns.

On data protection, GDPR/DSGVO and UK-GDPR still govern how EU/UK personal data can be processed and where it can be stored. Serving Berlin or London clients via a Dubai or Manama platform requires careful use of EU-compliant cloud regions, SCCs and local data residency rules (for example, Saudi PDPL, UAE data laws).

Legal fragmentation, geopolitics, banking access and Sharia compliance

Key risks you should underwrite explicitly.

Legal fragmentation & change risk: GCC rules are evolving fast what is permissible in Dubai today may be tightened tomorrow, especially around leverage, DeFi and retail marketing.

Banking and fiat on/off-ramps: regional banks sometimes “de-risk” crypto exposure, making USD, GBP and EUR settlement harder even for licensed VASPs. Structure redundancy into your banking stack.

Geopolitics: regional tensions can influence capital flows, sanctions exposure and correspondent banking relationships this matters if you’re routing funds through certain corridors.

Sharia-compliant expectations: in Saudi Arabia, Qatar and parts of the UAE, investors may expect Sharia-screened or sukuk-backed products. Mis-labelling “Sharia-compliant crypto investment products” is both a reputational and regulatory risk.

Mitigation usually means multi-jurisdictional structuring, conservative counterparty selection and active legal/compliance monitoring.

Institutional adoption and digital asset infrastructure in the GCC

Institutional crypto adoption in the region.

Institutional adoption in the GCC is no longer hypothetical. ADGM reports a 32% year-on-year increase in registered firms and a 245% surge in assets under management in 2024, with global managers such as BlackRock and Morgan Stanley expanding in Abu Dhabi alongside crypto and AI players.

Regional banks, asset managers and family offices in Dubai, Abu Dhabi and Riyadh are experimenting with:

tokenized money-market and sukuk products

fund structures with small allocations to BTC/ETH plus regional tokens

partnerships with global stablecoin issuers and exchanges.

Sovereign wealth funds and quasi-sovereign vehicles are a special vector. Abu Dhabi’s MGX, tied to Mubadala, invested around $2 billion in stablecoins into Binance in 2025, signalling state-backed conviction in regulated digital asset infrastructure.

Exchanges, custody providers and tokenization platforms in UAE and Saudi Arabia

The UAE now hosts a layered ecosystem of:

ADGM-licensed exchanges and custodians targeting institutional traders

Dubai VARA-regulated platforms focusing on a mix of retail and professional clients

specialist tokenization and digital securities platforms working on real estate in Dubai, Abu Dhabi and Ras Al Khaimah.

Crypto-friendly banks in the Middle East often based in UAE or Bahrain are starting to provide fiat accounts and settlement to VASPs serving US, UK and EU clients, though access is selective and heavily compliance-driven.

In Saudi Arabia, infrastructure is more bank-centric and focused on pilots: CBDC experiments, permissioned blockchain rails for interbank settlement, and tokenized deposit projects. Direct spot crypto infrastructure for public trading remains limited under the current stance.

Cross-border payments, remittances and on/off-ramp infrastructure

Crypto-enabled remittances and B2B cross-border payments are some of the clearest real-world use cases. MENA-focused reports show that a significant share of regional crypto volume relates to transfers, often in stablecoins, between GCC and South Asian or African corridors.

For US, UK and EU enterprises, stablecoin-based rails between London or Berlin and Dubai or Manama can reduce settlement friction in trade finance, SaaS billing and treasury flows so long as underlying VASPs are licensed and banking is robust.

On/off-ramp quality varies: in UAE and Bahrain, card, bank transfer and local wallet options are maturing; in more restrictive markets, access may depend on cross-border structures or non-local entities.

Access routes for US, UK and EU investors in 2025

Foreign investors typically access Middle East crypto through regulated exchanges, ETFs/ETPs, local partnerships and EU/UK/US-compliant custody, balancing tax and licensing considerations in each home market.

Best ways for US investors to access Middle East crypto markets

For US allocators, the best way for US investors to access Middle East crypto markets in 2025 usually isn’t opening a retail account on a random offshore exchange. Instead, think in three layers (always with US tax and securities advice)

US-listed or 40-Act vehicles (ETFs/ETPs, funds) that provide indirect exposure to counterparties or tokens with strong Middle East footprints.

Institutional accounts with ADGM- or VARA-licensed venues, used via US-regulated entities or separately managed accounts, with clear KYC and reporting.

Co-investment or JV structures with UAE- or Bahrain-based managers who source and manage regional deal flow.

Tax-wise, US residents must consider worldwide income rules, PFIC issues for offshore funds and reporting of foreign financial assets—plus any withholding or treaty impacts when investing via UAE, Bahrain or Qatar. Always get US tax counsel before scaling allocations.

UK investors and London-based funds.

For opportunities for UK investors in the Middle East crypto market 2025, the primary vectors are.

UK-regulated funds that allocate a small share of their crypto sleeve to UAE-listed tokens or tokenization projects.

London-based managers establishing Dubai or Abu Dhabi branches under VARA or ADGM, using them as regional trading and structuring hubs while keeping fundraising and investor protection under FCA oversight.

Structured notes or certificates listed in EU/UK markets but referencing indices of GCC digital asset markets in the Middle East.

Saudi exposure is more likely to come via public-market holdings in banks and fintechs participating in CBDC pilots than via Saudi-domiciled exchanges.

German and EU investors.

For German and wider EU investors, BaFin guidance for investing in Middle East crypto markets is effectively “MiCA first.” You must.

ensure any crypto-asset service provider you use into the EU has the right MiCA license or passport

map whether a Middle East venue is serving you under reverse-solicitation or active marketing

keep custody with EU-regulated CASPs where possible (often in Frankfurt, Berlin or Luxembourg) even if execution is routed to Dubai or Manama.

MiCA’s rules on whitepapers, stablecoins and market abuse apply regardless of where underlying assets originate. In practice, German and EU allocators often combine EU-based custody with exposure to GCC fintech and blockchain ecosystem plays either tokens listed on UAE exchanges or equity in regulated regional platforms.

Scenarios, portfolio roles and practical next steps

Bull, base and bear scenarios for the Middle East crypto market (2025–2027)

Bull case

GCC continues liberal but well-regulated growth; ADGM and Dubai solidify as global top-3 hubs; tokenization of real estate, sukuk and private credit scales; MENA transaction volumes grow >15–20% annually.

Base case

Steady growth, periodic enforcement waves, limited leverage; MENA share of global crypto stabilizes around 8–10%; cross-border payment and tokenization rails become mainstream in trade between Europe/US and GCC.

Bear case

Major enforcement or geopolitical shock hits one or more hubs; banking access tightens; growth stalls or reverses for several years.

Portfolio roles and sample allocation ideas for different investor types

Nothing here is investment advice, but conceptually Middle East digital assets can play roles like.

US multi-strategy crypto funds: 5–15% of the crypto sleeve in GCC-listed assets or UAE-linked infrastructure tokens.

UK family offices: small satellite allocation (1–3% of total portfolio) to regulated Middle East digital asset funds plus equity stakes in regional infrastructure.

German institutions: pilot-size exposure (≤1% of AUM) via MiCA-compliant ETPs or funds that include Middle East crypto market 2025 themes alongside global BTC/ETH and tokenization.

Blending these exposures with global crypto and traditional assets can diversify regulatory and geographic risk provided counterparty and legal risk are tightly managed.

Due diligence checklist and when to engage local partners or advisors

Before committing capital, run at least this checklist.

Regulation & licensing

Which regulator (VARA, FSRA, CBB, QFCRA) oversees each counterparty? Are licenses current and activity-appropriate.

AML/KYC & FATF alignment

How does the platform implement Travel Rule, sanctions screening and transaction monitoring.

Banking & settlement

Which on/off-ramp banks do they use? Are they Tier-1/2 institutions or thinly regulated PSPs?

Data protection

Where is personal and trading data stored? Is it compatible with GDPR/DSGVO, UK-GDPR and any sector rules (e.g., HIPAA, PCI DSS for certain use cases)

Tax & reporting

How will gains and income be treated in your home country? What reports can the platform provide (1099 equivalents, MiCA-driven disclosures, etc.)?

You should engage local legal, tax and licensing advisors when:

planning to onboard more than a test allocation

marketing any product with Middle East crypto exposure to external investors

setting up local entities or seeking direct VARA/FSRA/CBB/QFCRA licenses.

Mak It Solutions can support the technical and data side of this journey from building compliant analytics and reporting pipelines to integrating GCC exchanges and custody providers into your existing cloud and BI stack. (Mak it Solutions)

Key Takeaways

The Middle East crypto market 2025 is already a top-10 global region by transaction volume, with GCC hubs driving most institutional-grade activity.

UAE (Dubai VARA, ADGM FSRA) and Bahrain (CBB) are the main licensing gateways; Saudi remains cautious, focusing on CBDC and tokenization rather than open retail crypto.

Regulation is tightening under FATF, MiCA, BaFin and FCA regimes, so cross-border structures must satisfy both home-market and GCC rules.

Institutional adoption is real: ADGM’s AUM is surging, and sovereign-linked entities are backing large exchanges and stablecoin issuers.

Practical access for US, UK and EU investors usually means regulated ETFs/ETPs, MiCA-aligned funds, and carefully structured relationships with GCC-licensed exchanges and custodians.

If you’re evaluating Middle East crypto exposure for a fund in New York, a family office in London or an institutional desk in Frankfurt, you don’t need a dozen disparate advisors you need a clear technical and regulatory map. Mak It Solutions can help you design compliant architectures, integrate GCC exchanges and custody into your existing cloud stack, and build the analytics you need for MiCA, BaFin, FCA and IRS reporting.

Reach out to our team to scope a focused assessment of your current infrastructure and we’ll help you define a realistic, risk-aware roadmap into the Middle East crypto market 2025 and broader digital asset markets in the region.( Click Here’s )

FAQs

Q : Is crypto legal for foreign investors to trade in Dubai and Abu Dhabi in 2025?

A : Yes crypto trading is permitted in Dubai and Abu Dhabi as long as it happens through properly licensed platforms. In Dubai, the Virtual Assets Regulatory Authority (VARA) oversees virtual asset activities across most of the emirate, while in Abu Dhabi the ADGM Financial Services Regulatory Authority (FSRA) regulates exchanges, brokers and custodians. Foreign investors must still follow their home-country rules (MiCA, FCA, SEC/CFTC) and platform-specific onboarding, but there is a clear path to legal, regulated participation.

Q : Do US and UK companies need a local entity to launch crypto services in the UAE or Saudi Arabia?

A : Often yes. To obtain a VARA or ADGM license in the UAE, firms typically incorporate a local entity within the relevant free zone and meet substance, governance and capital requirements. In Saudi Arabia, where retail crypto remains restricted, foreign firms usually pursue enterprise or CBDC-related projects in partnership with local banks or fintechs rather than launching direct-to-consumer services. Always confirm specifics with UAE and Saudi counsel.

Q : How do Middle East crypto tax rules differ from those in the USA, UK and Germany?

A : Several GCC states, including the UAE, operate with low or no personal income tax, and virtual asset transactions in the UAE are now generally exempt from the standard 5% VAT. By contrast, the US taxes worldwide gains, the UK is tightening HMRC reporting under the Cryptoasset Reporting Framework, and Germany treats many crypto transactions as taxable under specific conditions. Most investors structure so that GCC tax rules and home-country obligations are both satisfied get jurisdiction-specific tax advice before moving size.

Q : Which Middle Eastern country is currently considered the most crypto-friendly for regulated exchanges?

A : The UAE is generally seen as the most crypto-friendly for regulated exchanges, thanks to its dedicated VARA and ADGM frameworks, relatively quick licensing timelines, and strong banking and infrastructure. Bahrain is also attractive for certain business models, with the CBB’s crypto-asset regulations and a proactive stance on attracting digital asset firms.

Q : What due diligence steps should institutional investors take before partnering with a Middle East crypto platform?

A : Start with regulator and license verification (VARA, FSRA, CBB, QFCRA), then review AML/KYC controls, Travel Rule implementation, sanctions screening and transaction-monitoring capabilities. Assess banking partners and fiat on/off-ramps, confirm how client assets are custodied and segregated, and examine audit reports or SOC certifications where available. Finally, map data flows against GDPR/DSGVO or UK-GDPR and have tax counsel confirm how gains and income will be treated in your home jurisdiction