Bitcoin energy use myths: what new data really says

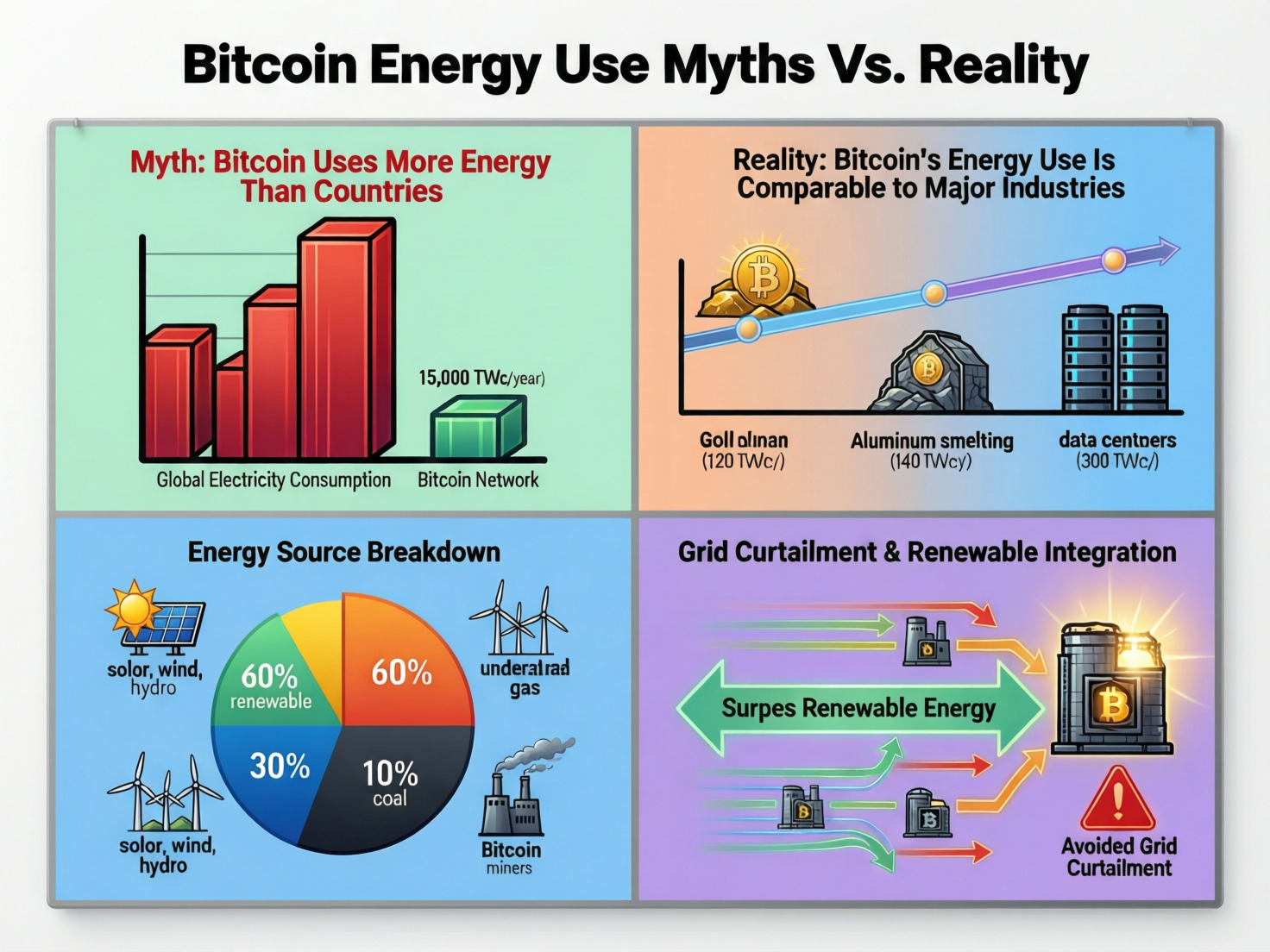

Bitcoin’s environmental impact remains contested, but a new round of data is challenging several long-standing criticisms. In a weekend thread, ESG researcher Daniel Batten argued that Bitcoin energy use myths from “per-transaction” footprints to grid destabilization don’t hold up against peer-reviewed literature and grid-level evidence. His claims intersect with fresh findings from Cambridge and market monitors in Texas.

What studies say about energy intensity and transactions

Critics often divide network energy by daily transactions. Independent researchers caution this is the wrong denominator because Bitcoin’s security spend (hashrate) doesn’t scale with payments processed. The EU Blockchain Observatory has explicitly called “energy per transaction” a misleading metric; scaling via layers (e.g., Lightning) wouldn’t proportionally raise energy demand. EU Blockchain Observatory and Forum

Sustainable energy share and emissions intensity

Cambridge Judge Business School’s 2025 Digital Mining Industry Report estimates miners’ sustainable energy mix at 52.4% and notes a shift from coal toward natural gas, renewables, and nuclear indicators that emissions intensity is trending down despite cyclical hashrate growth. Cambridge Judge Business School+2Cambridge Judge Business School+2

Grid stability

Another myth is that mining destabilizes power grids or raises retail bills. ERCOT’s market monitor reports that Large Flexible Loads (a category that includes crypto miners) increasingly curtail during scarcity, with data showing up to ~75% load reductions when system prices spike behavior consistent with demand-response that helps balance renewable-heavy grids. Policy updates in Texas now also require registration and reporting to improve visibility. Potomac Economics+1

Equity concerns and public criticism persist

Mainstream outlets continue to question Bitcoin’s social and environmental footprint. Bloomberg argued in July 2025 that mining “devours electricity meant for the world’s poor,” while MarketWatch/Morningstar criticized Harvard’s BTC exposure as environmentally irresponsible. These critiques spotlight unresolved debates around opportunity cost and indirect emissions.

Mining as a catalyst for new renewables

Case studies suggest miners can underwrite otherwise-uneconomic generation. Gridless partners with mini-grids in Africa, acting as an “anchor” offtaker and buyer of last resort; its white paper outlines how colocated micro-data centers can expand rural electrification.

IPCC framing.

The IPCC’s AR6 emphasizes that cutting energy-sector emissions requires rapid decarbonization of supply, efficiency, and smart demand management context that favors evaluating the sources of electricity, not just gross consumption.

Analysis

The strongest evidence-backed corrections target two specific Bitcoin energy use myths: per-transaction energy and grid destabilization. Cambridge’s methodology and ERCOT’s curtailment data substantiate Batten’s points on these fronts. However, distributional fairness and indirect emissions remain legitimate areas of study, as highlighted by critical op-eds and ongoing academic work.

Concluding Remarks

Recent research shows that cryptocurrency mining does consume significant energy, but its environmental impact depends largely on the source of that energy. When mining uses renewable or low-carbon power, the overall damage to the environment is much lower. Location, energy mix, and efficiency all play a major role in shaping its real impact.

The debate around mining and sustainability is expected to continue as more transparent and reliable data becomes available. Flexible energy use that supports power grids could improve outcomes, but concerns will remain until cleaner energy adoption becomes more widespread.

FAQs

Q: Does Bitcoin raise household electricity bills?

A: Not universally. Independent grid data show that Bitcoin miners can act as curtailable (flexible) loads, reducing demand during peak-price periods. The impact on household bills varies by market design, local supply constraints, and policy choices.

Q: Is “energy per transaction” a valid way to measure Bitcoin’s impact?

A: No. Researchers widely regard it as misleading because Bitcoin’s total energy use is not directly tied to the number of transactions processed.

Q: How much sustainable energy does Bitcoin mining use?

A: Cambridge estimates approximately 52.4% sustainable energy based on its 2024 survey data.

Q: Do Bitcoin miners destabilize power grids?

A: Evidence from Texas suggests the opposite can occur. Large flexible loads including miners often curtail during scarcity events, which can help stabilize the grid.

Q: What about the claim that Bitcoin “steals” power from the poor?

A: This is largely a normative debate about opportunity cost. While concerns exist, there are also documented cases where mining has helped anchor new renewable generation and improve project economics.

Q: Is Ethereum’s proof-of-stake (PoS) automatically “better” for the environment?

A: PoS uses far less electricity than proof-of-work, but overall environmental impact depends on broader system factors such as energy sourcing and what alternatives the system enables.

Q: Where can I track real-time Bitcoin energy estimates?

A: Cambridge’s CBECI (Bitcoin Electricity Consumption Index) and CBNSI dashboards provide ongoing estimates and updates.

Facts

Event

ESG researcher challenges nine Bitcoin energy myths with recent dataDate/Time

2026-01-05T10:00:00+05:00Entities

Cambridge Centre for Alternative Finance (CCAF); ERCOT & Potomac Economics (market monitor); Daniel Batten; GridlessFigures

52.4% sustainable energy share (Cambridge 2025); up to ~75% curtailment at extreme prices (ERCOT monitor)Quotes

“Energy per transaction is not a good metric.” — EU Blockchain Observatory (report)Sources

Cambridge Digital Mining Industry Report (PDF) jbs.cam.ac.uk; ERCOT 2024 State of Market (PDF) potomaceconomics.com