Bitcoin (BTC) Weekly Update Price Analysis This Week Around $89K (2 Jan 2026)

Bitcoin (BTC) weekly update: BTC is trading around $89.4K, up roughly +1% over the last 7 days, with a weekly range between about $86,979 and $90,064. According to CoinGecko and CoinMarketCap, market cap is near $1.78T and 24h volume is around $28–31B.

The main drivers this week are record U.S. spot Bitcoin ETF outflows over November–December, thinner holiday liquidity and a reset in derivatives leverage.Short-term, the key areas traders are watching are support near $87K–$86K and resistance around $90K–92K. (Data as of 2 Jan 2026, 13:57 UTC.)

Key Data Snapshot

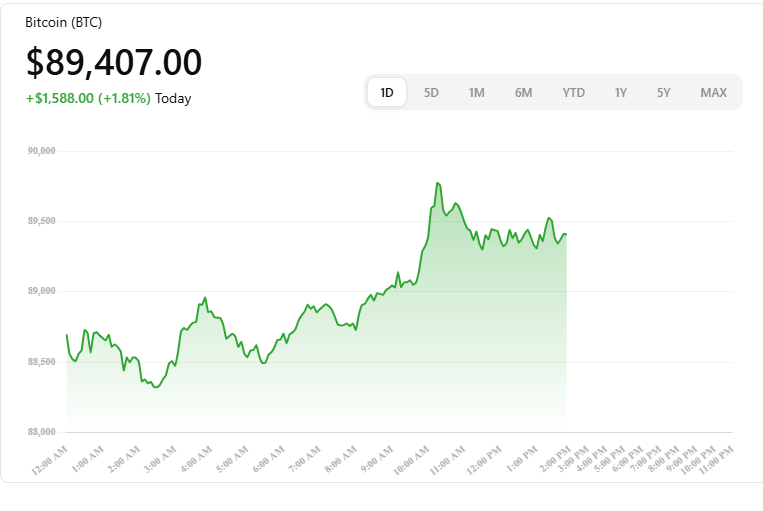

Data as of: 2 Jan 2026, 13:57 UTC

Current price: ≈ $89,407

24h change: ≈ +1.8%

7d change: ≈ +1.0% (CoinGecko 7d performance)

7d high / low: $90,064.22 / $86,979.26 (7d range)

Market cap: ≈ $1.78T–$1.79T

24h volume: ≈ $28–31B across major trackers

BTC dominance: ≈ 57.3% of total crypto market cap

Main sources: CoinGecko, CoinMarketCap, Binance, CoinDesk, Investing.com

Stock Market Information for Bitcoin (BTC)

Bitcoin is a crypto asset in the CRYPTO market.

The price is $89,407.0 USD currently, with a move of about $1,588.00 from the previous close.

The intraday high is $89,797.0 USD and the intraday low is $87,722.0 USD.

Bitcoin (BTC) Weekly Update –Quick Summary

Over the past week, Bitcoin has spent most of its time consolidating just below $90K, trading in a relatively tight band between roughly $86.9K and $90.0K.On the surface, the chart looks calm, but under the hood the market is busy digesting record U.S. spot Bitcoin ETF outflows over November–December, plus a sharp drop in futures open interest since October more of a de-leveraging reset than a new wave of speculation.

In short, BTC looks range-bound but structurally resilient: dominance is above 57%, sentiment is cautious rather than euphoric, and the market is waiting to see whether early-2026 flows confirm a new trend or extend the current sideways chop.

Bitcoin Price Action & Key Levels

Weekly Performance

Price now: ≈ $89.4K

7d change: Around +1%

7d range: $86,979 – $90,064

Daily wraps from FXStreet, The Economic Times and other desks repeatedly note that BTC has been oscillating around the $89K mark for nearly three weeks, with spikes toward $90K getting sold into and dips toward the high-$86Ks attracting buyers.

At the post this time

Short-Term Technical View

This is a descriptive overview, not a trading signal.

Trend

Short term (days–weeks), BTC is trading in a sideways range between roughly $87K and $90K–92K, after failing several times in December to hold above $90K.

Key resistance

$90K top of the recent 7d range and a psychological round number.

$92K–$95K widely cited as the next potential supply zone in near-term outlooks.

Key support

$87K–$86K recent dips have attracted buyers here, with several analysts pointing to “holiday demand” stepping in around this band.

$82K–$80K a deeper support area tied to prior consolidation and multi-month structure. (Approximate, based on broader charts and recent commentary.)

Volatility: Realized volatility remains moderate and declining, consistent with a compressing range. Derivatives desks generally describe cooling momentum rather than a confirmed downtrend. (Bitcoin CounterFlow)

For readers who want to zoom out further, this range analysis pairs well with a broader Bitcoin market cycle overview.

(Internal link placeholder: insert link to your long-term Bitcoin cycle guide here.)

News & Narratives That Moved BTC This Week

Over the last 7–10 days, the main Bitcoin stories keep coming back to a few core themes:

Record ETF outflows into year-end

U.S. spot Bitcoin ETFs saw about $4.57B in net outflows across November and December, the largest two-month exodus since launch.This has dulled marginal demand, even as some banks and institutions quietly add BTC exposure in the background.

Sideways price into 2026

Daily market wraps from FXStreet, TMGM and The Economic Times all highlight that Bitcoin has been stuck near $89K, with thin year-end liquidity and mixed risk appetite keeping both bulls and bears from fully taking control.

Regulation: 2025 wrap-up, 2026 expectations

Round-ups from Chainalysis and CryptoSlate frame 2025 as a year of more structured crypto regulation (MiCA in Europe, clearer frameworks in the U.S., Asia’s licensing regimes), with 2026 expected to bring more ETF approvals and tighter compliance.That backdrop supports the long-term institutional thesis even while ETF flows chop around in the short term.

Macro & liquidity

Coverage of Fed policy points to ongoing liquidity operations (including sizeable repo interventions) and shifting expectations around rate cuts. BTC continues to behave as a macro-sensitive risk asset, although correlations with equities and the dollar have faded in some windows.

Forward-looking forecasts

Some research desks still talk about six-figure BTC by end-2026, but the ultra-aggressive “$200K in 2025” style calls have mostly been toned down after a choppy 2025. The focus now is more on path and volatility than on precise end-of-cycle targets.

On-Chain, Derivatives & Sentiment

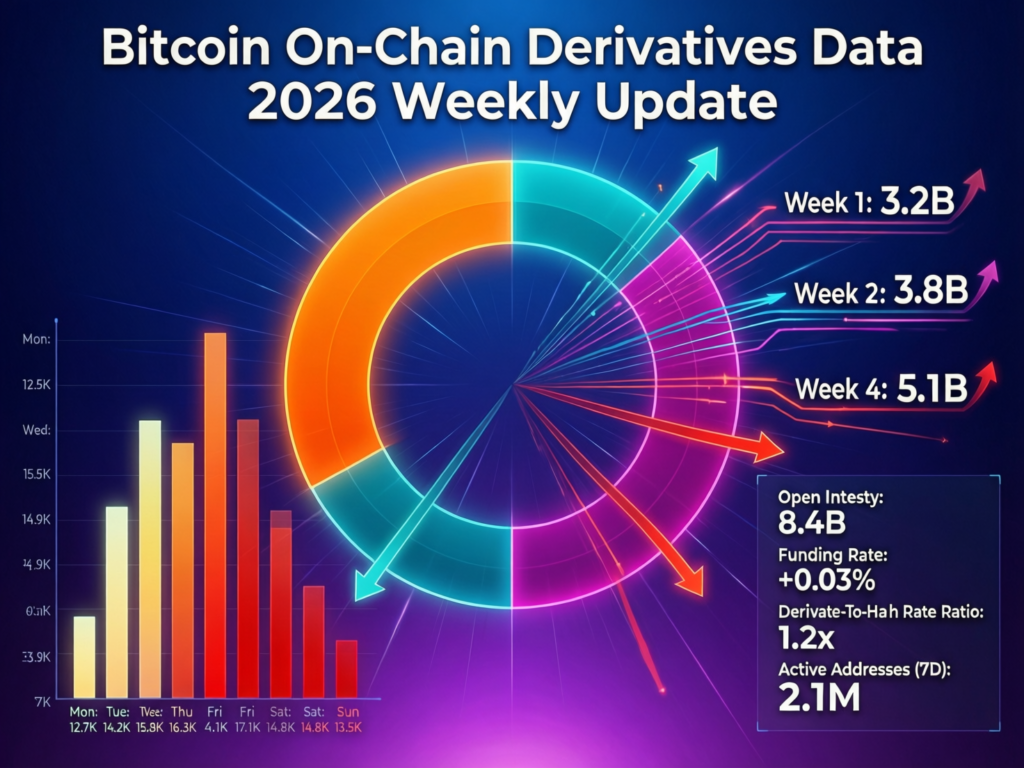

Futures open interest

CME and broader futures venues show open interest down more than 40% from early October (~$94.1B) to the start of 2026 (~$54.6B).That suggests leverage has been taken off the table, rather than a fresh build-up of speculative positions.

Funding & positioning

Aggregate funding-rate dashboards are hovering around neutral – no big positive or negative extremes – which implies no heavily crowded one-sided trade in perpetual futures right now. This tends to reduce the odds of sudden, purely liquidation-driven spikes.

On-chain activity & reserves

CryptoQuant and similar analytics platforms highlight modest net outflows from exchanges and broadly stable on-chain activity. That’s consistent with long-term holders sitting tight, while shorter-term traders express views via derivatives and ETFs rather than spot on exchanges. (Cryptoquant)

Sentiment

CoinGecko’s community gauge shows around 81% of submitted votes as “bullish” on BTC today, even though price continues to chop sideways.This mix of optimistic long-term sentiment and cautious positioning is typical of late-cycle consolidations in previous Bitcoin cycles.

Bitcoin vs. the Wider Crypto Market

With BTC dominance around 57.3%, Bitcoin still clearly leads the broader crypto market.

Over the last week, BTC’s ~+1% performance has been roughly in line with, or slightly behind, some large altcoins (for example, Solana and a few ETF-linked L1s)

Spot ETFs for ETH and other majors have also seen outflows, while flows into XRP and SOL ETFs have been more positive, pointing to selective rotation at the margin.

Net result.

BTC remains the benchmark asset. Altcoins are finding room for selective rallies, but they still trade largely under Bitcoin’s macro and ETF narrative.

If you follow multiple majors, you may want to pair this update with a weekly altcoin overview to see how sector themes are evolving relative to BTC.

What This Means for Traders & Long-Term Holders

For short-term traders (days–weeks):

The $87K–$90K band is the active short-term range most desks are watching.

Breaks and retests around $90K–92K on the upside or $86K–82K on the downside could become hotspots for volatility, depending on which side eventually gives way.

De-leveraged futures markets and neutral funding suggest fewer “forced” liquidations and more organic moves.

ETF flows remain a key trigger: persistent outflows have capped upside recently, while a turn back to net inflows could quickly improve momentum.

For longer-term holders (months–years)

Despite the current chop, BTC trades well above prior cycle highs and still dominates crypto market cap and liquidity, reinforcing its role as a kind of “reserve asset” within crypto.

The regulatory progress of 2025 and the continued build-out of ETF and custody infrastructure are gradually de-risking Bitcoin’s structural adoption story, even if cyclical drawdowns remain part of the journey.

Through 2026, macro conditions (rates, liquidity, risk appetite) and ETF flows are likely to stay front-and-center drivers, layered on top of Bitcoin’s usual cycle narratives and halving-driven supply dynamics.

Holding BTC still involves high volatility and regulatory uncertainty in some jurisdictions, which long-term investors need to reflect in position sizing, diversification and time horizon.

Risks, Scenarios & Closing Thoughts

Bullish scenario

ETF flows stabilize and turn sustainably net positive, macro remains supportive, and BTC breaks upward through $90K–92K, opening the door to a potential re-test of six-figure territory over the medium term.

Neutral / base scenario

ETF flows stay mixed, leverage remains muted, and BTC continues to consolidate between roughly $80K and $95K, as the market digests the 2025 rally and 2026’s regulatory roll-out.

Bearish scenario

A combination of renewed macro stress, further ETF outflows or negative regulatory surprises could see BTC lose the mid-$80Ks, inviting a deeper corrective leg back into prior support zones.

This BTC weekly update is for information only.

This is not financial advice. Always do your own research and consult a licensed professional before making any investment decisions.

To Sum Up

This Bitcoin (BTC) weekly update shows a market that is pausing rather than breaking, with price consolidating just below $90K as ETF outflows, lighter leverage and thin liquidity all pull in different directions. For active traders, that means respecting key levels and catalysts instead of forcing trades into a sluggish tape.

For longer-term holders, the bigger picture has not changed: Bitcoin still dominates crypto market cap, regulatory clarity is slowly improving, and institutional rails are thicker than in past cycles. Navigating 2026 will likely mean balancing macro risks, ETF flows and your own risk tolerance rather than chasing any single headline.

FAQs

Q : Why is Bitcoin (BTC) trading sideways around $89K this week?

A : BTC is consolidating near $89K because ETF outflows, thinner year-end liquidity and reduced futures leverage are broadly offsetting each other. Demand from some institutions and long-term holders is still there, but not yet strong enough to punch cleanly through the $90K–92K resistance zone.

Q : What are the key Bitcoin support and resistance levels right now?

A : Short-term, many analysts are watching support around $87K–$86K and deeper support in the $82K–$80K region. On the upside, $90K is immediate resistance, followed by $92K–$95K as the next potential supply area if fresh momentum returns.

Q : How are Bitcoin ETFs affecting BTC price this week?

A : U.S. spot Bitcoin ETFs recorded record net outflows over November and December, and flows have stayed fragile into the new year. That has dampened upside pressure, as ETF selling – or simply a lack of fresh inflows reduces one of the largest demand channels for BTC compared with early-2025.

Q : What does derivatives data say about Bitcoin’s risk right now?

A : Futures open interest has dropped by over 40% from early October highs, and aggregate funding rates are not at extreme levels. This paints a market with less leverage and fewer crowded positions, which can lower the risk of violent liquidations but also means strong directional moves may need fresh capital, not just short squeezes or long wipes.

Q : Is Bitcoin considered “safe” to hold in early 2026?

A : Bitcoin remains the most liquid and widely held crypto asset, with a dominant share of total market cap and growing institutional infrastructure. It is still a high-volatility, high-risk asset class, sensitive to regulation, macro conditions and market sentiment; how “safe” it is depends heavily on individual risk tolerance, time horizon and overall portfolio construction.