Crypto License in Dubai: Complete VARA & DMCC Guide

A crypto license in Dubai is a regulatory authorisation that allows your company to legally offer virtual asset services (exchange, brokerage, custody, lending, advisory) under regulators such as VARA, DMCC and ADGM.

US, UK and EU founders typically set up a Dubai Free Zone company (DMCC, VARA-aligned entity or ADGM firm), prepare AML/KYC and technology documentation, and then apply for the relevant virtual asset license category before onboarding clients.

Introduction

A crypto license in Dubai is a formal approval allowing your business to provide virtual asset services in the Emirate things like operating an exchange, OTC desk, custodial wallet, or tokenisation platform. In practice, anyone serving clients in or from Dubai with crypto trading, custody, brokerage or advisory services is expected to be authorised by a local regulator such as VARA in Dubai or the FSRA in Abu Dhabi.

Dubai has positioned itself as a global crypto hub, with hundreds of crypto and Web3 firms based in DMCC and a growing list of licensed VASPs under VARA.For founders in New York, London or Berlin, the attraction is clear: specialist virtual asset regulators, competitive tax treatment and a time zone that bridges US and Asian markets.

This guide is informational only and doesn’t replace legal, tax or investment advice. Dubai, UAE, EU and US rules are evolving fast always confirm your structure with a qualified lawyer or compliance advisor.

What a Dubai crypto license actually covers

A Dubai virtual asset / crypto license authorises you to carry out regulated Virtual Asset Service Provider (VASP) activities such as operating an exchange, acting as a broker-dealer, providing custody, or running lending and advisory services for crypto or tokenised assets.

You need it if you are doing these activities “by way of business” for clients in or from Dubai, even if your founders are based in the US, UK or EU.

Key regulators

At a high level

VARA (Dubai Virtual Assets Regulatory Authority) the main specialist crypto regulator for Dubai (excluding DIFC), licensing VASPs such as exchanges, brokers, custodians and lending platforms.

DMCC Free Zone company formation plus “crypto activities” licenses for trading, Web3 studios, proprietary trading and service providers; once you’re client-facing with virtual asset services, you may still fall under VARA.

ADGM (Abu Dhabi Global Market) FSRA a separate financial centre and regulator with its own virtual asset framework; a strong fit for institutional exchanges, brokers and custodians.

There are also other zones like DWTC (Dubai World Trade Centre) and IFZA, often used for holding or tech entities that support your crypto business.

Is crypto legal in Dubai for US/UK/EU founders?

Yes. Crypto is legal and regulated in Dubai, provided you comply with local licensing rules, AML/CFT standards and marketing restrictions. VARA, DMCC and ADGM closely align with FATF guidance on virtual assets, so this is not a “no-rules tax haven” play but a structured regime that can sit alongside MiCA, FCA, BaFin and US expectations.

US founders must still handle US tax and securities issues; UK and German founders must consider MiCA, BaFin and FCA rules if they continue to market into Europe from Dubai.

Why Global Crypto Startups Choose Dubai

Dubai appeals to global crypto teams because it combines dedicated crypto regulators with a relatively clear rulebook, while many founders see US, UK and EU regimes as fragmented or slow.

Between July 2023 and June 2024, the UAE reportedly received around $30–34 billion in crypto inflows and now ranks among the top global crypto economies.For a founder sitting in New York, London or Berlin, that signals genuine ecosystem depth rather than just headline noise.

Regulatory advantages vs USA (SEC/FinCEN) and UK FCA

The US regulatory picture is a patchwork of SEC, CFTC and FinCEN expectations. Many activities potentially touch securities law, money transmission and commodities rules at the same time, with no unified digital assets regulator.

In the UK, the FCA requires cryptoasset firms to register under the AML regime and comply with a strict financial promotions framework.

Dubai’s VARA offers a different model:

A specialised authority with a clear VASP perimeter and activity list.

Rulebooks tailored for exchanges, brokers, custodians, lending platforms and token issuers.

A more collaborative approach to shaping Web3, while still enforcing AML/CFT standards.

For a US exchange in New York or a London-based broker, a Dubai entity can offer clearer licensing for global (non-US/UK) flows, while still building a compliance stack that maps back to SEC/FCA expectations.

Dubai vs Germany/EU MiCA and BaFin expectations

The EU MiCA Regulation introduces a harmonised CASP (Crypto Asset Service Provider) license for exchanges, brokers and custodians across the EU.Germany’s BaFin has its own digital asset expectations layered on top.

Dubai’s VARA regime is structurally similar:

MiCA’s CASP ≈ VARA’s VASP.

Both require governance, capital, AML/KYC and ongoing reporting.

MiCA gives you passporting across the EU; VARA anchors you in the GCC and broader MENA.

For a Berlin or Frankfurt team, it often makes sense to keep a MiCA CASP license for EU clients and add a Dubai VASP entity for rest-of-world flows and institutional partnerships in the Middle East.

Tax, ownership and lifestyle benefits for founders

For founders, Dubai combines.

0% tax on personal income and capital gains for individuals (subject to your home-country rules, e.g., US worldwide taxation).

Potential 0% corporate tax on qualifying Free Zone income if you structure as a Qualifying Free Zone Person (QFZP) and meet substance rules; non-qualifying income is taxed at 9%.

100% foreign ownership, world-class infrastructure and direct flights to New York, London and Berlin.

For many founders, that’s a compelling alternative to higher tax and regulatory friction in the US and parts of Europe.

VARA Crypto License in Dubai

A VARA VASP license is required for any business offering virtual asset services to or from Dubai, including exchanges, brokers, custodians, lenders and advisors. VARA maintains a public register of licensed and in-principle approved VASPs so users can see who is authorised and for what activities.

Who needs a VARA VASP license?

If your company conducts virtual asset activities by way of business in or from Dubai such as running an exchange, OTC desk, custodial wallet, crypto lending protocol, tokenisation platform or paid advisory you are generally expected to be authorised by VARA as a VASP.

This applies whether your shareholders live in Austin, London or Munich. Marketing into Dubai from abroad can also trigger VARA rules, especially under the 2024 marketing regulations.

VARA license categories: exchange, broker-dealer, custodial, advisory, lending

VARA’s regime is built around Virtual Asset Activities, which broadly include.

VA Exchange Services centralised exchanges (CEXs), order-book platforms, crypto-fiat gateways.

Broker-Dealer Services OTC desks, agency brokers, RFQ platforms.

Custodial Services hot/cold wallets, institutional custody, key management.

Lending & Borrowing margin lending, collateralised loans, staking-style yield products where you intermediate risk.

Advisory & Management investment advice, portfolio management, token selection, research with execution.

Your application must clearly describe your planned activities, tokens, counterparties and risk profile especially if you’re building DeFi, tokenisation or NFT infrastructure.

Core VARA requirements.

While exact thresholds vary by activity, expect to show.

Minimum capital typically paid-up share capital in the six-figure AED range, increasing with risk (exchange > advisory).

Real substance in Dubai an office or flex desk, local directors or senior managers, plus an MLRO/Compliance Officer.

AML/CFT & KYC framework customer due diligence tiers, sanctions screening, transaction monitoring and Travel Rule compliance aligned with FATF.

Technology & security controls policies for key management, change management, incident response and alignment with frameworks like SOC 2 and PCI DSS if you touch card data.

For US, UK and EU teams, the win is that one global compliance stack can often be mapped across VARA, MiCA, FCA, BaFin and FinCEN with careful design.

Free Zones Compared: DMCC, ADGM & Other UAE Options

Different UAE jurisdictions support different pieces of your structure: trading, tech, holding, or full financial services.

DMCC crypto license Dubai.

A DMCC crypto license is typically used for

Proprietary trading of crypto with your own balance sheet.

Web3 / gaming studios, NFT projects and advisory or development firms.

Service companies supporting exchanges or protocols (marketing, dev shops)

DMCC offers

Fast company formation and 0% corporate tax on qualifying Free Zone income under the right conditions.

Competitive office packages and ecosystems like the Crypto Centre with 700+ members.

However, once you start holding client funds, running an exchange or offering custody, you generally move into VARA or ADGM licensing territory; a basic DMCC license alone is not enough.

ADGM FSRA and DWTC

Abu Dhabi’s ADGM FSRA has its own mature virtual asset framework designed for institutional players – think exchanges, custodians and brokers dealing with banks, funds and high-net-worth clients.

You might choose ADGM if.

You’re building a global institutional exchange or derivatives venue.

You want to align closely with an English-law common law court and international banking relationships.

Dubai World Trade Centre (DWTC) is being developed as a specialised digital asset and events zone that works closely with VARA often useful for large ecosystems or conferences rather than early-stage startups.

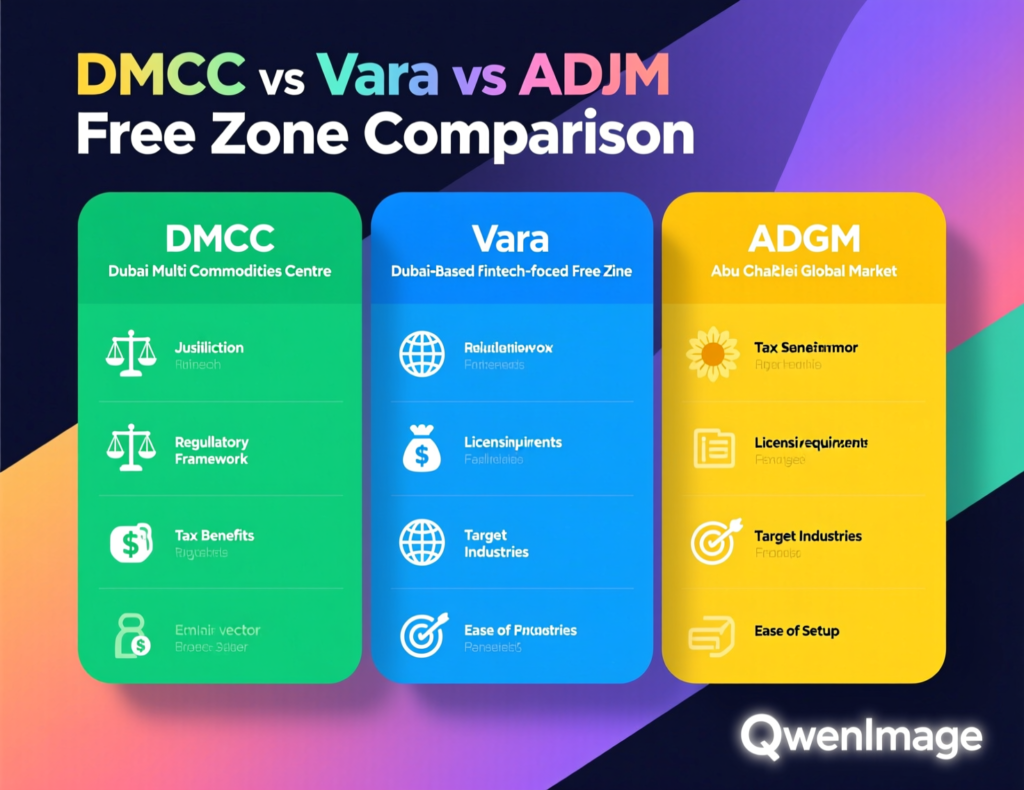

DMCC vs VARA vs ADGM

Very roughly.

New York exchange

VARA or ADGM for the regulated platform, plus DMCC for a tech/dev entity.

London fintech

Keep or pursue FCA registration for UK flows, add a VARA or ADGM entity for non-UK clients.

Berlin Web3 studio

DMCC for core studio operations, with optional VARA/ADGM licensing if you later handle client assets.

Because the mix is so specific to your product and investor base, this is where a tailored regulatory gap analysis plus banking plan is worth paying for rather than guessing.

How to Start a Crypto Business in Dubai Step by Step

Here’s a practical step-by-step path from idea to licensed Dubai entity. This is the part most founders bookmark and send around internally.

Define model, pick jurisdiction, choose license category

Define your business model

Are you a CEX, OTC desk, algorithmic prop trader, DeFi protocol, tokenisation platform, custodian or advisory firm?

Map exactly how money, tokens and data flow between New York/London/Berlin and Dubai.

Pick the jurisdiction

DMCC for prop trading, Web3 studios, dev and marketing companies.

VARA (Dubai) or ADGM (Abu Dhabi) for client-facing exchange, custody, lending or advisory.

Choose license category

Match your activities to VARA VA Activities or ADGM FSRA permissions (exchange, broker, custody, lending, advisory)

Company formation, shareholder structure and key documents

Incorporate your UAE entity

Form a Free Zone company (e.g., DMCC, ADGM, DWTC) with the right shareholding – Delaware LLC, UK Ltd or German GmbH shareholders are all common.

Lock shareholder & governance structure

Finalise UBOs, board members, authorised signatories and senior management roles (including MLRO and CTO).

Prepare the documentation pack

Typically includes

Detailed business plan and financial projections.

UBO/KYC files and clean source-of-funds evidence.

AML/CFT policy, risk assessment and Travel Rule approach.

Tech architecture diagrams, data-flow maps, cloud hosting details (AWS, Azure, GCP regions for EU/US).

Information security and data protection policies aligned with GDPR/DSGVO and UK-GDPR if you serve EU/UK residents.

For help structuring cloud workloads and data controls, you can lean on modern practices similar to those used for regulated web apps and portals – for example, those described in Mak It’s headless CMS and Middle East web development guides.

Submit to VARA/Free Zone, respond to queries, go live

Submit your application

File your VARA/ADGM license application or DMCC crypto activity request along with supporting documents and fees.

Respond to regulator queries

Expect multiple rounds of Q&A on AML, governance, tech security and sometimes token economics. Missing or inconsistent answers are a common cause of delays.

Implement conditions and go live

Once approved, implement any pre-launch conditions (e.g., appointing certain roles, completing penetration tests, updating risk policies), then onboard a limited beta of clients before scaling.

DMCC crypto licenses are often granted in around 4–6 weeks, while full VARA or ADGM VASP licenses are more often a 4–9 month journey depending on complexity.

Costs, Timelines & Banking

Typical cost range for DMCC and VARA crypto licenses

Realistically, your total cost stack will include:

Government & Free Zone fees DMCC crypto license packages publicly start around AED 30–35k, plus additional fees for visas and offices.

Advisory & legal anything from mid-five figures USD upwards, depending on complexity and how much drafting you outsource.

Ongoing operations local staff, office space or flex desks, audit and compliance tooling.

A lean DMCC prop-trading setup is often in the low five-figure USD range for year one; a fully regulated VARA or ADGM exchange can run into low six figures USD in setup and first-year costs.

How long it takes: from first call to live license

Best case for a straightforward DMCC crypto company:

1–2 weeks scoping, KYC, document prep.

3–6 weeks incorporation and license issuance.

For VARA or ADGM VASP licenses:

4–8 weeks strategy, structuring, documentation, draft policies.

3–6 months formal application, regulator Q&A, conditions and approvals.

Regulators worldwide – including FCA, BaFin and VARA – commonly extend timelines when applications are incomplete or change direction mid-process.

Opening a corporate bank account for a crypto company in the UAE

Banking is often the hardest part. Crypto is still seen as higher risk, so UAE banks will expect:

Very clear source of funds and historic transaction trails.

Clean shareholder and director backgrounds.

A coherent compliance framework with Travel Rule and sanctions controls.

Many founders use a multi-bank strategy for example, one UAE bank for local operations plus EU/UK EMIs or digital banks for customer payments. The same playbooks Mak It uses for e-commerce and SaaS clients (separating acquirers, EMIs and local accounts) apply here.

Compliance, Risk & Cross-Border Operations

Aligning VARA rules with FATF AML/CFT, MiCA, FCA, BaFin

The good news: if you build AML/CFT once, properly, you can re-use most of it across regulators:

Start from FATF virtual asset guidance (risk assessment, CDD tiers, Travel Rule, PEP and sanctions screening).

Map those controls onto VARA’s Company, Compliance & Risk Management and Technology Rulebooks.

Cross-reference with MiCA CASP, FCA AML registration and BaFin expectations for suspicious transaction monitoring and reporting.

Many teams maintain a single global policy set and then add short local annexes per jurisdiction.

Data protection and security

If your Dubai entity serves clients in the EU or UK, GDPR/DSGVO and UK-GDPR still apply to that processing.

Clear legal bases, data mapping and cross-border transfer safeguards.

DPO or data-lead ownership and DPIAs for higher-risk analytics.

On the security side, many VASPs pursue SOC 2 attestation and implement PCI DSS controls where they accept card payments. (PCI Security Standards Council) Hosting on AWS, Azure or GCP in EU and UAE regions helps you respect data residency and latency requirements for London, Berlin and Gulf users alike – a pattern Mak It already applies for regulated web platforms in KSA and UAE.

Serving global clients from Dubai

Operating from Dubai doesn’t exempt you from US, UK or EU rules:

You may need to geo-block US retail customers if you don’t have SEC/CFTC or state-level approvals.

Marketing to UK or EU residents can still trigger FCA financial promotion or MiCA CASP rules even if your servers are in Dubai. (FCA)

A sensible “no surprises” strategy includes.

A regulatory matrix (country × activity × license/registration status).

Geo-blocking or enhanced disclosures where you are not licensed.

A roadmap for adding local registrations when traction justifies them.

Choosing the Right Partner to Get a Crypto License in Dubai

What a serious advisor should handle.

A serious Dubai crypto licensing partner should:

Run a regulatory gap analysis across VARA, DMCC, ADGM, MiCA, FCA, BaFin, SEC/FinCEN.

Help you pick the right jurisdiction mix and entity structure.

Draft or review business plan, AML/CFT, risk, IT and governance documents.

Liaise with VARA/DMCC/ADGM during Q&A and assist with banking introductions.

Red flags: “guaranteed license approvals”, no mention of FATF, MiCA or FCA, and advisors who never ask about your tech stack or data flows.

Sample playbook for US, UK and German founders

NYC exchange keep US compliance for domestic clients; launch a VARA-licensed Dubai exchange focused on MENA, Africa and parts of Asia, supported by a DMCC dev entity.

London fintech maintain or seek FCA registration, add a DMCC or DWTC company for product and engineering, and a VARA/ADGM VASP license to serve non-UK markets.

Berlin Web3 studio use DMCC or IFZA for the studio, keep BaFin/MiCA options open if you issue tokens to EU residents, and add a Dubai VASP license if you later hold client assets or run an exchange.

From free assessment to full application

In practice, most founders start with a discovery call and document review, then move into a scoped project for regulatory mapping, drafting and application management. From there, it’s about execution: delivering the right documents, tech controls and governance so your first interaction with VARA or ADGM is a strong one.

Wrapping It Up

Dubai is usually the right move when you’re serious about regulated global crypto operations, want a specialist virtual asset regulator, and see MENA and Asia as core markets alongside the US, UK and EU. If you’re just looking for a tax workaround or a license “badge” with no substance, VARA, DMCC and ADGM will be the wrong audience.

Key Takeaways

Dubai offers a specialised crypto regulatory regime via VARA, DMCC and ADGM that aligns with FATF, MiCA, FCA and BaFin expectations.

A VARA VASP license is required for client-facing exchange, brokerage, custody, lending and advisory services conducted in or from Dubai.

DMCC, VARA and ADGM serve different roles from prop trading and Web3 studios to fully regulated exchanges and custodians.

Costs range from low five-figure USD for simple DMCC setups to low six-figure USD for complex VARA/ADGM platforms, with timelines of several months.

Global compliance, data protection (GDPR/UK-GDPR) and security frameworks (SOC 2, PCI DSS) must be built in from day one to avoid surprises with EU/UK/US regulators.

If you’re weighing up a crypto license in Dubai from the US, UK or Europe, the next step isn’t another night of tab-surfing regulations it’s a clear, scoped plan. Mak It Solutions can help you map your product, data flows and tech stack to VARA, DMCC and ADGM requirements, and align them with MiCA, FCA, BaFin and US rules.

Share your current structure and roadmap, and we’ll outline a practical Dubai licensing and architecture plan you can take to your legal counsel or implementation team.( Click Here’s )

FAQs

Q : Is a DMCC crypto license enough, or do I also need VARA approval for my business model?

A : A DMCC crypto license is usually enough for proprietary trading, Web3 studios and service companies that don’t hold client assets or operate an exchange. Once you start providing regulated virtual asset services – like running a CEX, OTC desk, custodial wallet or lending platform you typically fall under VARA’s VASP regime and must seek authorisation on top of your DMCC company. The exact answer depends on your flows, contracts and marketing, so most founders get a formal perimeter analysis before committing to DMCC-only.

Q : Can a Dubai crypto company legally serve clients in the US, UK and EU under one license?

A : No single Dubai license gives you a free pass to market unrestricted crypto services in the US, UK and EU. A VARA-licensed VASP can serve global clients, but US, UK and EU regulators still care about who you target and how you market. You may need to geo-block certain jurisdictions, rely on reverse-solicitation only, or obtain additional approvals such as MiCA CASP or FCA AML registration. Many teams run a Dubai hub for the rest of the world and maintain separate entities or registrations for highly regulated markets.

Q : What are the main reasons VARA rejects or delays crypto license applications?

A : Common issues include unclear business models, incomplete AML/CFT and risk documentation, weak governance (no experienced MLRO/Compliance Officer), and tech stacks without sufficient security controls or audit trails. Regulators also look closely at token models, leverage, yield products and cross-border flows. If your application changes direction mid-process, or you can’t substantiate your source of funds or historic activities, expect additional questions or delays. Strong preparation and realistic scoping usually matter more than aggressive timelines.

Q : Do I need to relocate to Dubai personally to hold a crypto license, or can I run it remotely?

A : You don’t always need every founder physically in Dubai, but regulators expect real local substance. That usually means at least some senior management and control functions (like MLRO and Operations) are based in the UAE, plus a genuine office or flex-desk presence. Many US, UK and German founders split their time – spending part of the year in Dubai while keeping product or engineering teams in Europe or North America but treat the Dubai entity as a genuine operational hub, not just a mailbox.

Q : How does a UAE crypto license affect my personal taxes as a US, UK or German founder?

A : A UAE crypto license mainly affects your company’s regulatory and tax position, not your personal tax obligations at home. Dubai does not tax personal income or capital gains, but US citizens are taxed on worldwide income, UK residents may still owe tax on overseas income and gains, and German residents face their own rules on capital gains and controlled foreign corporations. You’ll need coordinated advice across UAE and home-country tax advisors to understand residency, double-tax treaties and how to structure salaries, dividends and carry.