Is DeFi Halal? Islamic Crypto Guide 2025

DeFi can be halal for Muslims if specific protocols and activities avoid riba (interest), excessive gharar (uncertainty) and maysir (gambling), and are backed by real assets with fair risk-sharing. In practice, most popular DeFi platforms today still involve interest-like yields, high speculation and weak legal protections, so many scholars class them as haram or at least doubtful unless they’re carefully screened.

Introduction

“Is DeFi halal?” is now one of the most common questions Muslim investors ask — especially in the US, UK, Germany and the wider EU, where crypto is everywhere but Islamic guidance feels fragmented.

On the one hand, DeFi promises permissionless access to finance, experiments in riba-free decentralised finance, and new “Islamic fintech” projects built on-chain. On the other hand, it’s full of hidden riba, meme-coin gambling, extreme volatility and patchy regulation.

In simple terms, DeFi can be halal or haram depending on how it’s structured:

Does it avoid riba, excessive gharar and maysir?

Is it linked to real assets or services, with fair risk-sharing?

Is it transparent, audited and legally recognisable where you live?

Contemporary Islamic finance standards such as AAOIFI and IFSB emphasise these core principles of banning interest, excessive uncertainty and gambling.([IMF][1]) At the same time, regulators like the SEC (US), FCA (UK) and BaFin (Germany), plus EU laws like MiCA and GDPR/DSGVO, now shape how any DeFi app can legally operate in Western markets.

This guide is for educational purposes only. It summarises scholarly debates and regulatory trends; it is not a fatwa or personal financial advice. Always consult a qualified Sharia scholar and a licensed financial adviser before acting.

What Is DeFi in Islamic Finance Terms?

Simple definition of DeFi, blockchain and smart contracts

DeFi (decentralised finance) is a set of financial apps built on public blockchains like Ethereum. Instead of a bank in London, New York or Frankfurt, you interact with smart contracts pieces of code that automatically execute rules (for example, “lend X, charge fee Y”) when certain conditions are met.

From a fiqh perspective, most scholars treat blockchain itself as neutral technology. What matters is the use case:

If smart contracts are used to represent real assets, share risk fairly and avoid riba, they can support halal structures.

If they automate interest-based loans, leveraged betting or pure gambling, the technology doesn’t magically “purify” the transaction.

So instead of asking “Is blockchain halal or haram?”, the better question is: “Is this specific crypto transaction Islamically valid?”

Core Islamic finance concepts.

Islamic finance rests on a few non-negotiable rules:

Riba commonly understood as any guaranteed, interest-based increase on a loan of money. Most contemporary scholars extend the ban to any interest on principal, not just “excessive” usury

Gharar unacceptable uncertainty or ambiguity in a contract (for example, unclear rights, hidden terms, unknown outcomes), especially when it affects the subject matter or price.

Maysir gambling or acquiring wealth purely by chance, such as random betting on price movements.

Asset-backing classical fiqh prefers contracts linked to real assets, services or productive activity, rather than pure money-for-money speculation.

Concrete DeFi examples

Over-collateralised lending pools that pay a variable rate can resemble interest-bearing loans (riba) if the return is capital-guaranteed and not linked to real risk-sharing.

Exotic perpetual swaps, leveraged futures or meme-token casinos often combine high gharar and maysir massive uncertainty plus speculation that looks like gambling with leverage.

Tokens with no clear utility, unclear governance and anonymous teams can fall into severe gharar territory.

DeFi vs conventional and Islamic banking.

Conventional banking in New York or London is usually interest-based: you deposit money, the bank promises fixed interest; borrowers pay fixed or floating interest on loans. This is classic riba under most Islamic opinions.

Islamic banking, by contrast, uses structures like:

Murabaha cost-plus sale (the bank buys an asset and sells it to you with a disclosed markup, often used in Islamic mortgages).

Mudaraba profit-sharing partnership where one party provides capital and the other provides effort/management.

Musharaka joint equity partnership; profit is shared by ratio, losses by capital contribution.

Ijara leasing; the bank owns an asset and leases it to you, sometimes ending in ownership transfer.

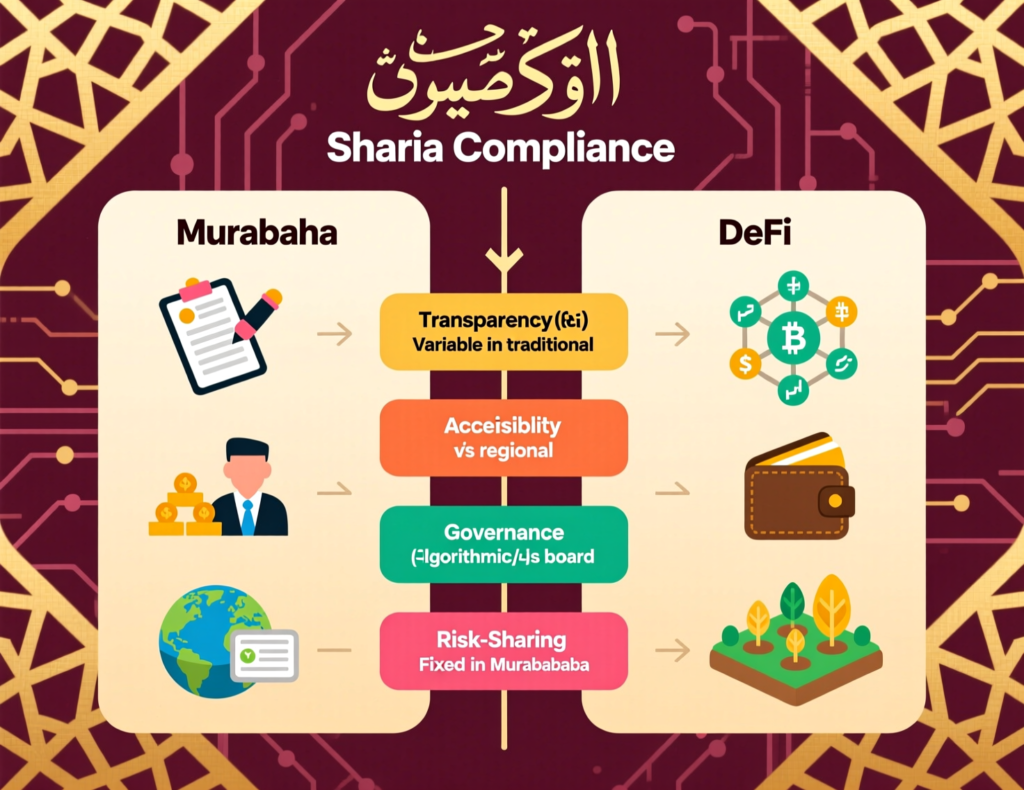

How do these compare to typical DeFi lending/borrowing?

Murabaha vs lending pool

✔ Murabaha: real asset, fixed markup, documented sale.

✖ DeFi lending: often a pure money loan with algorithmic interest.

Mudaraba/Musharaka vs liquidity provision

✔ PLS pools could resemble mudaraba if returns are profit-linked and losses shared, with no capital guarantee.

✖ Many DeFi “staking” products promise “low-risk” yield that behaves like interest on a deposit.

Ijara vs “renting liquidity”

✔ Ijara leases specific, tangible assets.

✖ DeFi protocols often “rent” tokens for leverage, which is closer to borrowing money than leasing an asset.

Islamic banks in London, Dubai, Kuala Lumpur or Frankfurt operate under Sharia boards and national regulators. DeFi, by contrast, runs globally with code, but increasingly touches regulators like the SEC, FCA and BaFin when users in the US, UK or Germany are involved.

Is DeFi Halal or Haram? Scholarly Views in 2025

Conditions that can make DeFi closer to halal

Many contemporary scholars approach DeFi with cautious openness. They don’t give a blanket yes or no; instead they look at conditions.

Real asset backing or clear utility tokens represent real assets (for example, tokenised sukuk, real estate, commodities) or provide genuine network utility, not just meme hype.

Profit-loss sharing instead of guaranteed interest returns are tied to actual performance, and losses are possible, similar to mudaraba/musharaka.

Transparent, audited smart contracts with low uncertainty code is open source and externally audited; risks are disclosed in plain language.

No haram industries no investment in conventional alcohol, gambling, adult entertainment or interest-based financial services.

Some fatwa bodies and scholars have permitted crypto in limited ways (for example, treating Bitcoin as a digital asset or commodity) where speculation is controlled and the use is lawful.

Why many scholars still consider most DeFi impermissible

At the same time, a growing number of national councils — for example in Indonesia and parts of the Arab world have declared mainstream crypto trading or certain tokens haram due to.

High speculation and leverage perpetual swaps, 10x–100x leverage and meme-token casinos resemble gambling (maysir) more than investment.

Interest-like yield “low-risk” staking or lending products that effectively pay fixed or semi-fixed returns on deposited coins.

Lack of regulatory protection anonymous teams, unaudited contracts and no clear recourse in case of fraud or hacks (severe gharar).

Systemic security risk recent estimates suggest crypto theft has reached several billion dollars annually, with DeFi protocols a significant target.

In Muslim communities in the UK and across the EU, these stricter views often dominate mosque and community discussions, especially where people have seen relatives lose money in rug pulls or failed exchanges.

Case-by-case rulings and the “mixed environment” approach

Most serious Sharia scholars now argue that “DeFi” is too broad for a single ruling. Instead, each protocol, use case and token must be evaluated individually.

You can think of three zones:

Halal clear real-world utility or asset backing; no interest; no haram industries; transparent risk; reasonable volatility.

Haram explicit interest-based lending, leveraged gambling-style trading, or tokens tied to haram sectors.

Shubha (doubtful) unclear structure, mixed opinions from scholars, or incomplete information.

When should you treat DeFi as doubtful and seek a personal fatwa?

When a product’s yield structure is complex or vaguely described (“auto-compounding”, “delta-neutral farming”) with no clear Sharia explanation.

When different credible scholars or fatwa bodies give conflicting rulings.

When the project’s documentation, team or audits are incomplete or anonymous.

When your own heart feels uneasy, even after learning the technical details.

In these cases, stepping back or seeking a personalised ruling from a trusted scholar in your madhhab is often the safer path.

Is Crypto Halal? Bitcoin, Ethereum and DeFi Tokens

Bitcoin and Ethereum in Islamic analysis.

The question “Is DeFi halal?” rests on a deeper one: “Is crypto itself halal?”

Scholarly opinion is still polarised: some councils classify Bitcoin-like cryptocurrencies as haram due to volatility, lack of central backing and high gharar, whereas others allow them as digital assets or commodities if used responsibly.

Three broad views

Prohibition crypto is too speculative and unstable to count as money or a valid asset.

Conditional permissibility treat Bitcoin/Ethereum like high-risk commodities: halal in principle, but certain trading strategies (for example, leverage, pure day-trading) can become maysir.

Broader permissibility particularly among tech-savvy scholars who see Bitcoin as a scarce digital commodity with legitimate use.

Your stance here will directly affect whether you see DeFi tokens built on Ethereum, or stablecoins backed by US dollars or euros, as acceptable.

Utility, governance and stablecoins in Islamic analysis

Not all tokens are equal

Utility tokens give access to services (for example, gas fees, storage, voting). These may be easier to justify when backed by real network utility and fair pricing.

Governance tokens allow voting on protocol parameters and fees. Sharia analysis often focuses on whether these represent genuine ownership or just speculative “governance chips”.

Stablecoins tokens pegged to USD, EUR or sometimes gold. From a Sharia perspective, key questions are.

Are reserves real, segregated and audited?

Is there any riba-based lending or interest-bearing investment of reserves?

Is the peg mechanism transparent and legally enforceable in the US, UK or EU?

For Muslims in the US or Europe, USD/EUR-pegged stablecoins can be useful for cross-border payments or parking value, but only if you’re comfortable with the reserve model and legal risk.

Gold-backed or “Islamic” coins (including some Shariah-labelled Ethereum and DeFi funds) try to add clearer asset backing and Sharia oversight, but must still be screened for real audits and Sharia governance.

Speculation, leverage and maysir in trading and yield strategies

Even if you decide Bitcoin and major coins are halal in principle, how you trade them can still become haram.

Behaviours Muslim investors should generally avoid to keep crypto closer to halal:

Margin trading and high-leverage futures (for example, 10x–100x) on centralised or DeFi exchanges.

Perpetual swaps and options when used for pure directional betting, not genuine hedging.

Meme-coin chasing and “pump & dump” schemes driven by viral hype rather than fundamental value.

High-APY yield farms where returns are opaque, unsustainable or clearly funded by new entrants rather than real economic activity.

These patterns combine gharar and maysir, and often amplify greed and FOMO, which classical Islamic ethics strongly discourage.

Islamic DeFi Products and Halal Crypto Investing

What makes an Islamic DeFi platform or wallet “Sharia-compliant”?

“Shariah compliant crypto” and “Islamic DeFi” have become powerful marketing slogans but not every project using them is credible. A genuinely Islamic DeFi platform or wallet typically has.

Sharia board or advisory committee named scholars with verifiable credentials and a track record in Islamic finance, ideally familiar with blockchain.

Documented fatwa(s) publicly available rulings describing what assets and structures are permissible, what is excluded, and under which conditions.

Alignment with AAOIFI/IFSB principles especially around riba-free contracts, transparency, risk-sharing and screening of haram industries.

On-chain activity screening filters that exclude interest-bearing lending, casino-style dApps or tokens from prohibited sectors.

You’ll also see the phrase “riba-free decentralised finance” used by some platforms to describe their interest-free structures; the key is to confirm this in the contract logic, not just in marketing copy.

Examples of Islamic DeFi ecosystems in US/UK/Germany/Europe

Without endorsing any specific project, some commonly cited Islamic DeFi ecosystems include

MRHB / Marhaba DeFi a self-described “world’s first halal DeFi ecosystem”, focusing on interest-free products like ethical staking alternatives, halal NFT markets and liquidity solutions.([Medium][14])

HAQQ Network / Islamic Coin (ISLM) a Sharia-compliant Layer-1 blockchain with its own Sharia Oracle and fatwa, aiming to host a full Islamic DeFi stack and ethical Web3.

RAFAH Halal Crypto Fund – a Sharia-compliant crypto fund domiciled for European investors, screening out interest-based platforms and haram sectors.

Access for Muslims in the US, UK, Germany and wider EU will depend on:

Each project’s KYC and residency rules (some exclude US persons due to SEC risk).

Local licensing regimes for example, FCA permissions in the UK, BaFin crypto licences under MiCA in Germany, and passporting within the EU.

Always treat these examples as starting points for research, not endorsements or fatwas.

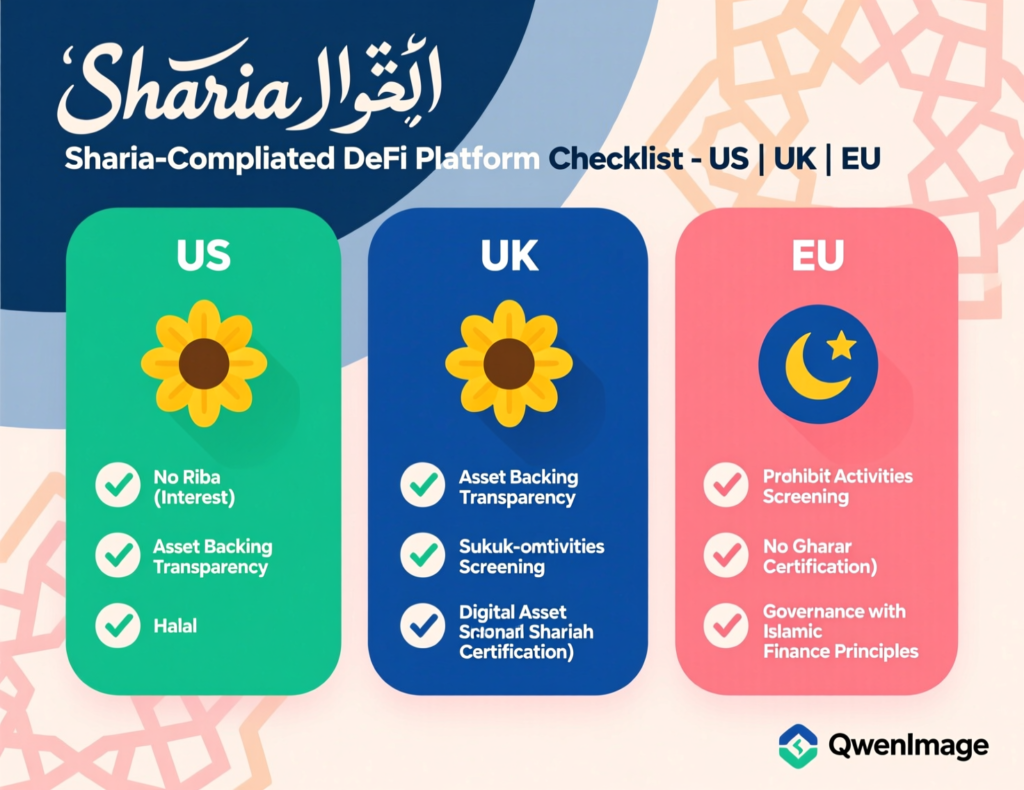

Step-by-step guide to halal crypto investing (US, UK, Germany, Europe)

This is a practical funnel from informational → commercial for cautious, compliance-minded Muslim investors:

Clarify your risk level and Sharia stance

Decide whether you follow stricter or more lenient scholarly views on crypto.

Agree upfront how much volatility you can tolerate, and how much money you can truly afford to lose.

Decide asset types (BTC/ETH vs DeFi tokens vs funds)

Many start with major assets (Bitcoin, Ethereum) treated as commodities, then optionally add carefully chosen DeFi tokens or Sharia-screened funds.

Screen platforms for Sharia disclosure and regulatory status

Look for Sharia boards, fatwas, AAOIFI/IFSB references and detailed methodology.

Check regulation.

US: how does the SEC/CFTC treat the platform (security vs commodity), and does it comply with FinCEN AML/KYC rules?

UK: is the on-/off-ramp FCA-registered, and how does it handle UK-GDPR and “high-risk investment” marketing warnings?

Germany/EU: does the platform or its custodian hold a BaFin or MiCA-compatible licence, and how are crypto taxes reported?

Start small, diversify, and avoid leverage and meme speculation

Begin with small allocations you can mentally write down to zero.

Diversify across assets and providers rather than chasing single “moonshots”.

Explicitly avoid margin, perpetual futures and meme-coin pumps that feel like gambling.

If you’re building an Islamic DeFi app or wallet, Mak It Solutions can help with compliant architecture (for example, secure APIs, microservices and headless front-ends) using capabilities like web development services, front-end development and business intelligence services for risk dashboards.

Sharia & Secular Compliance.

Sharia compliance checks: scholars, standards and certifications

Think of an “Islamic DeFi compliance checklist” in three parts:

Who issued the Sharia certificate?

Named scholars or boards with recognisable credentials (not an anonymous “Sharia team”).

Evidence of actual crypto literacy, not just generic Islamic finance.

What exactly does the fatwa cover?

Just the token? The entire protocol? Only certain features (for example, staking but not liquidity farming)?

Are haram sectors and prohibited strategies clearly listed?

How often is it reviewed?

Crypto evolves quickly. A one-off fatwa from a few years ago may not cover tokenomics changes, new yield products or updated regulatory regimes.

Crypto regulation for Muslim investors in the US, UK, Germany and EU

Regulation doesn’t make something halal, but it reduces gharar and protects investors.

Key themes in 2025

United States

The SEC and CFTC classify many tokens as securities or commodities based on the Howey test, with dedicated crypto enforcement efforts, while FinCEN enforces AML/KYC on exchanges and custodians.

United Kingdom

The FCA regulates cryptoasset promotion and certain firms, while UK-GDPR and the Data Protection Act 2018 govern how platforms handle personal data and financial profiling.

Germany & EU

Under MiCA, crypto asset service providers (CASPs) need authorisation, with BaFin as Germany’s national regulator. Full MiCA rules for CASPs are phasing in from late 2024 into 2025.

Minimum regulatory facts a Muslim should know before using a DeFi app:

In which country is the company or foundation based (if any)

Which regulator, if any, supervises its fiat ramps or custody services (FCA, BaFin, SEC-registered entity, etc.)

Does it fall under GDPR/UK-GDPR and issue a clear privacy notice?

Does the provider publish risk warnings and explain that you can lose all your capital?

Data, privacy and platform risk.

Even “decentralised” apps usually have centralised parts: web front-ends, KYC providers, analytics and custody rails.

In the EU, GDPR/DSGVO sets strict rules on how personal data is collected, stored and shared by these services.

In the UK, UK-GDPR mirrors many of these principles and is enforced by the ICO.

For card payments, frameworks like PCI DSS 4.0 and security standards like SOC 2 are strong signals that a provider takes payment data security seriously.

On-chain, the main risks are:

Smart contract exploits bugs in code allowing hackers to drain funds.

Rug pulls malicious teams mint tokens, pump them and vanish with liquidity.

Bridge hacks cross-chain bridges are frequent attack points, with billions lost globally over recent years.

From a Sharia lens, opaque code, anonymous teams and unaudited contracts all increase gharar and undermine the trust and transparency required in Islamic contracts.

Practical due-diligence checklist before using any DeFi protocol

Use this checklist before you deposit a single dollar, euro or pound:

Sharia screen

Is there a named Sharia board or fatwa?

Are riba, maysir and haram industries explicitly excluded?

Regulatory screen

Where is the entity registered?

Which regulator (if any) authorises its fiat ramps or custody? (SEC/CFTC, FCA, BaFin, etc.)

Technical screen

Is the code open source and independently audited?

Any public bug bounty or security disclosures?

Reputation screen

How do credible Islamic finance organisations, security auditors and long-term users talk about it?

Personal screen

Can you afford to lose this money entirely?

Are you acting out of greed/FOMO, or a well-researched thesis?

For larger, compliance-heavy builds (for example, an Islamic DeFi wallet or platform serving EU and UK customers), partnering with an engineering firm like Mak It Solutions for back-end services, mobile apps and microservices architecture can help align technical design with legal and Sharia requirements.

Future of Islamic DeFi in the US, UK, Germany and Europe

How Islamic banks and fintechs might integrate DeFi and tokenisation

We’re already seeing tokenised sukuk and real-world assets in places like Malaysia and the GCC; similar models could emerge in London, Luxembourg and Frankfurt.

Potential use-cases.

Tokenised sukuk and real estate for Muslim investors in the EU, using Luxembourg or Dublin fund structures and MiCA-regulated issuers.

Waqf and zakat platforms using open banking (PSD2/UK Open Banking) to connect bank accounts with on-chain donation and micro-finance tools.

Digital ID-style solutions applied to KYC/AML, letting users prove identity and residency without oversharing personal data.

Opportunities and challenges for Muslim investors in Western markets

US

Massive crypto market and innovation hub (New York, Austin, San Francisco), but fragmented rules and limited explicitly Islamic branding.

UK

London is already a major Islamic finance centre with several Islamic banks and a growing cluster of Islamic fintechs; Islamic DeFi is still early but open banking and FCA-regulated rails create strong infrastructure foundations.

Germany/EU

BaFin-regulated Islamic fintechs and Luxembourg Sharia funds are emerging, but there is still a German-language education gap around Islamic finance and DeFi.

Ethical impact, zakat and waqf use-cases in Islamic DeFi

DeFi doesn’t have to be about hype cycles. Potential high-impact Islamic use-cases include:

Automated zakat calculators for crypto portfolios in Berlin or Manchester, integrated with local charities.

On-chain waqf projects funding schools, health clinics or micro-SMEs in emerging markets.

Impact investing in tokenised green sukuk or social housing projects for Muslim communities in Europe

Zakat on crypto and DeFi positions is a specialised topic: scholars differ on whether certain staked or locked assets are zakatable every year, so this is another area where you should seek a personalised ruling.

Concluding Remarks

So, is DeFi halal or haram?

It is more likely halal when it avoids riba, keeps gharar and maysir low, links to real assets or services and is transparent, audited and fairly regulated.

It is clearly haram when it mimics interest-bearing loans, encourages leveraged speculation or funds haram industries.

It is doubtful (shubha) when structures, audits, Sharia governance and regulation are unclear.

Before you allocate a single dollar, euro or pound:

Use the due-diligence checklist above.

Speak to a qualified Sharia scholar and a licensed adviser who understands your local rules (SEC/IRS, FCA/HMRC, BaFin/local tax office).

Treat any Islamic DeFi product as high-risk until proven otherwise.

If you’re exploring an Islamic DeFi product, wallet or analytics platform, Mak It Solutions can help with secure architecture, cloud and app development across the US, UK, Germany and wider EU using services like web development, front-end development and headless CMS builds.This is not financial or Sharia advice; always do your own research and seek qualified guidance.

Key Takeaways

Technology is neutral; contracts are not.

Blockchain and smart contracts can support Islamic finance or violate it, depending on how they handle riba, gharar and maysir.

Most current DeFi is not Sharia-compliant by default.

Many protocols still rely on interest-like yields, speculation and leverage, which most scholars view as haram or doubtful.

Sharia compliance requires real governance.

Look for credible Sharia boards, public fatwas, AAOIFI/IFSB alignment and clear exclusion of haram sectors.

Regulation reduces gharar.

Understanding SEC, FCA, BaFin and MiCA rules plus GDPR/UK-GDPR and PCI DSS is essential for US/UK/EU Muslim investors using DeFi apps.

Security and due diligence are non-negotiable

With DeFi TVL rebounding to well over $100B and hacks still costing billions globally, security audits, open-source code and strong custody are critical.

Personal taqwa matters

When in doubt, avoid questionable strategies and focus on long-term, ethically aligned investing that you can explain to your Lord, your family and your future self.

If you’re a Muslim investor or founder in the US, UK, Germany or elsewhere in Europe and you’re exploring Islamic DeFi, don’t do it in the dark. Book a conversation with Mak It Solutions to discuss how to architect Sharia-aware, regulation-ready crypto and fintech products from secure back ends and analytics to compliant front-end experiences. Together you can scope a practical roadmap or code review that respects both DeFi innovation and Islamic finance principles.( Click Here’s )

FAQs

Q : Can I use DeFi only for sending money and still keep my finances halal?

A : Yes, using DeFi purely as a cheaper, faster payment rail can be closer to halal, especially when you avoid interest-bearing products and gambling-style tokens. Think of it like using a payment network instead of a bank loan. However, you still need to check the stablecoin or token you’re using (reserves, audits, legality in your country) and make sure any fees are transparent and not disguised interest. When in doubt, seek a scholar’s advice on your specific use-case.

Q : Is crypto staking always considered riba, or are there halal structures?

A : Not all “staking” is the same. Protocol-level staking that simply pays you a share of network fees for securing the chain (for example, proof-of-stake validation) can be viewed differently from centralised platforms promising fixed yields on deposits. Some scholars see certain staking models as closer to service fees or profit-sharing, while others still treat them as interest-like. The key is whether returns are guaranteed, how risk is shared, and whether underlying activities are Sharia-compliant.

Q : Are gold-backed “Islamic” cryptocurrencies really safer from a Sharia perspective?

A : Gold-backed or commodity-backed tokens can reduce gharar by linking value to a tangible asset, but they are not automatically halal. You need to verify that the gold is actually held in audited vaults, that ownership rights are clear, that there’s no interest-bearing lending behind the scenes, and that the token structure itself is approved by credible scholars. Jurisdiction (for example, London, Luxembourg or Dubai) and regulation also matter for enforceability and investor protection.

Q : Do I need a separate Islamic wallet, or can I use mainstream exchanges in a halal way?

A : You can often use mainstream exchanges in a more halal way by limiting yourself to permitted assets and turning off interest-bearing products like margin or yield accounts. An Islamic wallet or DeFi app adds value when it actively screens tokens and blocks haram categories, but you should still check its Sharia governance and regulation. For many Muslims in the US, UK and EU, a combination of a reputable centralised exchange for on/off-ramps and a carefully curated self-custody wallet can strike a practical balance.

Q : How much speculative risk is too much in halal crypto investing and trading?

A : Islam doesn’t forbid risk; it forbids excessive, gambling-like risk detached from real economic value. If your strategy depends on wild swings, leverage or meme hype without understanding the project’s fundamentals, you’ve likely crossed into maysir. A more halal-aligned approach is to treat crypto like a small, high-risk allocation in a diversified portfolio, using no leverage, focusing on assets you understand and setting clear loss limits in line with your financial and spiritual comfort. When you’re unsure, err on the side of caution.