SBI Holdings yen-pegged stablecoin to debut with Startale in Q2 2026

SBI Holdings, in partnership with blockchain firm Startale Group, plans to launch a yen-pegged stablecoin in the second quarter of 2026. The token will be positioned as a fully regulated digital currency, designed to support cross-border settlements and drive adoption among institutional users. By aligning with Japan’s regulatory framework, the initiative aims to offer a compliant and trusted stablecoin alternative for global financial transactions.

The collaboration will combine SBI Holdings’ strong domestic financial network with Startale Group’s advanced Web3 infrastructure. This includes integrations connected to Sony-backed Soneium, strengthening the project’s technological foundation. Together, the firms seek to bridge traditional finance and blockchain, enabling scalable, enterprise-grade digital payments and expanding the role of stablecoins in mainstream financial markets.

What’s new

SBI said the token will be issued and redeemed by Shinsei Trust & Banking, a subsidiary of SBI Shinsei Bank, while licensed exchange SBI VC Trade will facilitate circulation. Startale framed the yen coin and its new dollar token, Startale USD (USDSC), as a “complementary currency stack” that can power 24/7 settlement and potential tokenized asset distributions.

Yoshitaka Kitao, Chairman and President of SBI Holdings, described the shift toward a tokenized economy as “irreversible,” adding that circulating the yen stablecoin domestically and globally could accelerate digital finance integrated with traditional banking. Startale CEO Sota Watanabe said the yen token will support agent-to-agent payments and tokenized asset payouts in a “fully on-chain world.”

Market context: Japan’s regulated push

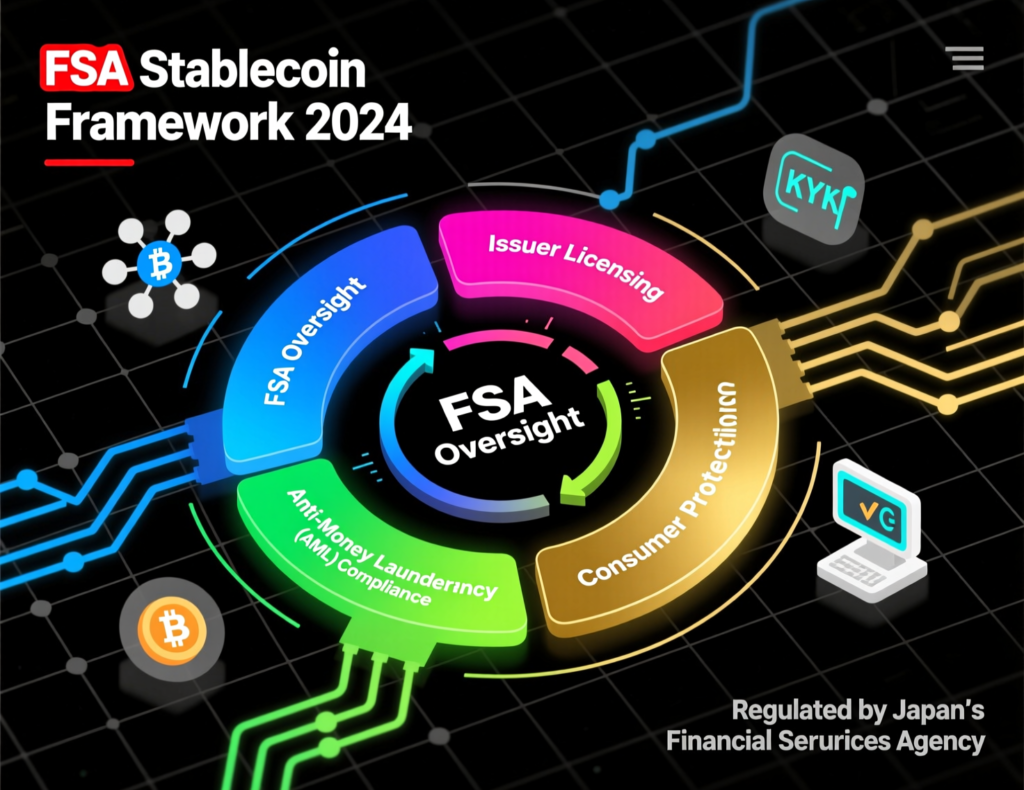

Japan’s Financial Services Agency (FSA) has paved the way for regulated stablecoins. JPYC recently secured FSA approval as the country’s first yen-pegged stablecoin, and the government signaled support for a joint stablecoin initiative by the three megabanks—MUFG, SMBC, and Mizuho to pilot cross-border uses. Separately, Ripple and SBI aim to distribute Ripple USD (RLUSD) in Japan by 2026, broadening the fiat-onchain mix available to local institutions.

Project structure and intended use

Issuer/Trustee

Shinsei Trust & Banking (issuance and redemption).

Distributor/Exchange

SBI VC Trade (licensed crypto-asset exchange).

Target users

Institutional treasuries, fintechs, exchanges, and on-chain market infrastructure.

Primary use cases

Global settlement rails, institutional liquidity management, tokenized asset distribution, and automated payments.

What the SBI Holdings yen-pegged stablecoin could enable

Intraday and 24/7 settlement

Reduce cut-off risks, align with tokenized markets that run continuously.

FX and treasury efficiencies

Pair with USDSC for natural hedging and liquidity routing.

Interoperability

Startale’s infrastructure aims to connect the yen coin with Soneium ecosystems and broader EVM-compatible rails.

Timeline for the SBI Holdings yen-pegged stablecoin

Now–H1 2026

Buildout, audits, and regulatory coordination.

Q2 2026

Targeted launch window, subject to approvals, integrations, and market-readiness.

Post-launch

Expansion to cross-border corridors and integration with tokenized asset platforms.

Context & Analysis

Japan’s regulatory clarity trust structures, segregated reserves, and oversight gives the SBI–Startale effort a credible path to institutional adoption. Pairing a JPY coin with USDSC can reduce conversion frictions across JPY/USD corridors and bolster liquidity for tokenized securities platforms. Execution risk remains (interoperability, bank integrations, and distribution depth), but 2026 could mark a pivotal year if megabank pilots and RLUSD distribution launch on time.

Conclusion

If launched on schedule, the SBI–Startale yen stablecoin could play a key role in enabling 24/7 settlement across Japan-linked financial markets. A regulated JPY-backed token may improve efficiency in payments and settlements, especially for institutions seeking real-time, always-on transaction infrastructure tied to Japan’s financial system.

Key factors to monitor include integration progress with Shinsei Trust & Banking and SBI VC Trade, as well as pilot programs involving major Japanese banks. Market participants will also watch how liquidity from stablecoins such as USDSC and RLUSD interacts with a regulated yen token and whether it supports deeper cross-border adoption.

FAQs

Q : What is the SBI Holdings yen-pegged stablecoin?

A : A regulated digital token pegged 1:1 to the Japanese yen, designed for global settlement and institutional use.

Q : Who will issue and distribute it?

A : Shinsei Trust & Banking will manage issuance and redemption, while SBI VC Trade will support circulation and trading.

Q : When will it launch?

A : The planned launch window is Q2 2026, subject to regulatory approvals and system integrations.

Q : How does it relate to Startale USD (USDSC)?

A : USDSC supplies U.S. dollar liquidity on Soneium; together with the yen stablecoin, it creates a complementary currency stack.

Q : Will this interact with bank-led stablecoin projects?

A : Japan’s megabanks are piloting a joint stablecoin; interoperability and corridor design will shape how these systems connect.

Q : Is RLUSD coming to Japan?

A : Ripple and SBI aim to distribute RLUSD in Japan by 2026, broadening fiat stablecoin options for institutions.

Q : What are the compliance requirements?

A : Trust-based issuance, segregated reserves, and travel rule–aligned KYC/AML under Japan’s FSA oversight are expected.

Facts

Event

SBI Holdings partners with Startale to launch a regulated yen-pegged stablecoin targeting Q2 2026Date/Time

2025-12-16T02:38:00+05:00Entities

SBI Holdings, Startale Group, Shinsei Trust & Banking, SBI VC Trade, Japan Financial Services Agency (FSA), JPYC, MUFG/SMFG/Mizuho, Ripple (RLUSD)Figures

Launch target Q2 2026; use cases global settlement, institutional liquidity, tokenized asset payoutsQuotes

: “The transition to a ‘token economy’ is now an irreversible societal trend.” — Yoshitaka Kitao, Chairman & President, SBI Holdings

“Our yen-denominated stablecoin is not just a means of everyday payment—it will play a central role in a fully on-chain world.” Sota Watanabe, CEO, StartaleSources

See below (SBI–Startale announcements; Reuters/Coindesk context)