MENA Crypto Regulation: Why Investors Are Moving In

MENA crypto regulation in 2025 mixes mature, FATF-aligned frameworks in the UAE, Bahrain and (increasingly) Saudi Arabia with stricter or still-evolving regimes in Qatar, Turkey, Egypt and Morocco. For US, UK and EU investors, the safest hubs are typically Dubai/Abu Dhabi and Manama, where clear VASP licensing, AML/Travel Rule enforcement and alignment with global standards make it easier to build scalable, compliant structures.

Nothing in this guide is legal, tax or investment advice. Always get jurisdiction-specific professional advice before acting.

Introduction

MENA crypto regulation has shifted from bans and grey zones to some of the world’s most ambitious virtual asset frameworks, especially in the UAE and Bahrain. For US, UK and EU investors, understanding how MENA crypto regulation compares to SEC/CFTC oversight, EU MiCA and FCA rulebooks is now a core part of allocation, residency and exchange-selection decisions.

By late 2024, the EU’s MiCA regime became fully applicable to crypto-asset service providers (CASPs), while the UAE consolidated a nationwide virtual asset architecture spanning VARA in Dubai, ADGM’s FSRA in Abu Dhabi, and the federal SCA/Central Bank layer. Over roughly the same period, MENA crypto transaction volumes surged past an estimated $60 billion, underlining the region’s importance for on-chain flows and stablecoin usage.

This guide is a practical playbook for global investors: where crypto is legal, how MENA licensing really works, how it stacks up against MiCA, SEC, FCA and BaFin expectations, and how to build a risk-aware entry plan that won’t shock your compliance team.

MENA Crypto Regulation in 2025

The MENA region is not a single regime. Some states (UAE, Bahrain, and increasingly Saudi Arabia and Turkey) actively license virtual asset service providers, while others (Qatar, Egypt, Morocco for now) maintain partial or full prohibitions or only allow tightly controlled pilots.

Is Crypto Legal in MENA Today?

In 2025, crypto is broadly legal but regulated in the UAE, Bahrain, Saudi Arabia, Turkey, Israel, Jordan, Kuwait, Oman, and key hubs like Istanbul, Tel Aviv, Dubai, Abu Dhabi, Riyadh and Manama subject to licensing and AML rules.

Other states remain restrictive.

Qatar institutional crypto and virtual asset services in the Qatar Financial Centre were banned in 2020, with newer digital asset regulations still cautious and tightly scoped.

Egypt continues to appear on global lists of countries where crypto is restricted or effectively prohibited.

Morocco crypto has been banned since 2017, but a draft law is moving through the process to replace the outright ban with a licensing regime.

For investors, “Middle East = Dubai rules” is a dangerous assumption. Each jurisdiction has its own stance on spot trading, DeFi, NFTs and stablecoins, and even within the GCC the detail can be very different.

Why MENA Crypto Regulation Matters for US, UK and EU Capital

For US, UK and EU allocators, MENA offers something increasingly rare: pro-innovation regulation that still aligns with FATF standards and global AML/Travel Rule expectations. The UAE, Bahrain and Turkey all now run comprehensive regimes for VASPs, allowing New York, London or Frankfurt-based institutions to onboard to licensed exchanges and custodians with clearer risk frameworks.

As MiCA pushes EU firms (including German BaFin-supervised funds) into CASP licences and whitepaper-heavy issuance processes, MENA frameworks can feel more flexible while still requiring Travel Rule compliance, on-chain analytics and robust governance. For many EU and UK firms, the decision is less “MiCA or MENA” and more “MiCA at home plus selective MENA exposure through clearly licensed hubs.”

Key MENA Hubs at a Glance

UAE (Dubai, Abu Dhabi) Multi-layered regime: VARA (Dubai), SCA + Central Bank at federal level, FSRA (ADGM) and DFSA (DIFC) in financial free zones.

Bahrain (Manama) Central Bank of Bahrain (CBB) runs a dedicated Crypto-Asset Module and stablecoin rules, with early VASP licensing and Bahrain FinTech Bay as a visible hub.

Saudi Arabia (Riyadh, Jeddah) SAMA and CMA operate sandboxes and pilot programs; crypto remains tightly supervised, with an emphasis on CBDCs and institutional pilots rather than retail speculation.

Qatar (Doha) bans unlicensed virtual asset services in the Qatar Financial Centre; select “digital asset” initiatives exist but do not yet amount to a full retail crypto regime.

Turkey (Istanbul) a 2024 law (No. 7518) created a national crypto assets regime, licensing crypto-asset service providers and exchanges under the Capital Markets Law.

How MENA Crypto Frameworks Are Built

MENA crypto frameworks combine specialised virtual asset regulators (e.g., VARA, FSRA) with central banks, securities regulators and national AML/CTF bodies. The default pattern is to treat VASPs like financial institutions: licensing, capital, governance, Travel Rule and ongoing supervision.

Core Regulators and Rulebooks

VARA (Dubai) world-first dedicated VA regulator; its 2023 Virtual Assets and Related Activities Regulations set out a full framework across Dubai (excluding DIFC).

ADGM FSRA (Abu Dhabi) – runs a mature Digital Asset Regulatory Framework with specific guidance for trading, custody, NFTs and stablecoins, now being expanded to cover staking.

SCA (UAE federal) since 2023, SCA has a unified rulebook for virtual asset platforms and VASPs, coordinating with VARA and the Central Bank.

CBB (Bahrain) its Crypto-Asset Module and related rules cover licensing, capital, governance and client asset protection for crypto-asset service providers.

SAMA & CMA (Saudi Arabia) central bank and securities regulator jointly run fintech sandboxes and are gradually defining rules for VASPs and CBDC experiments.

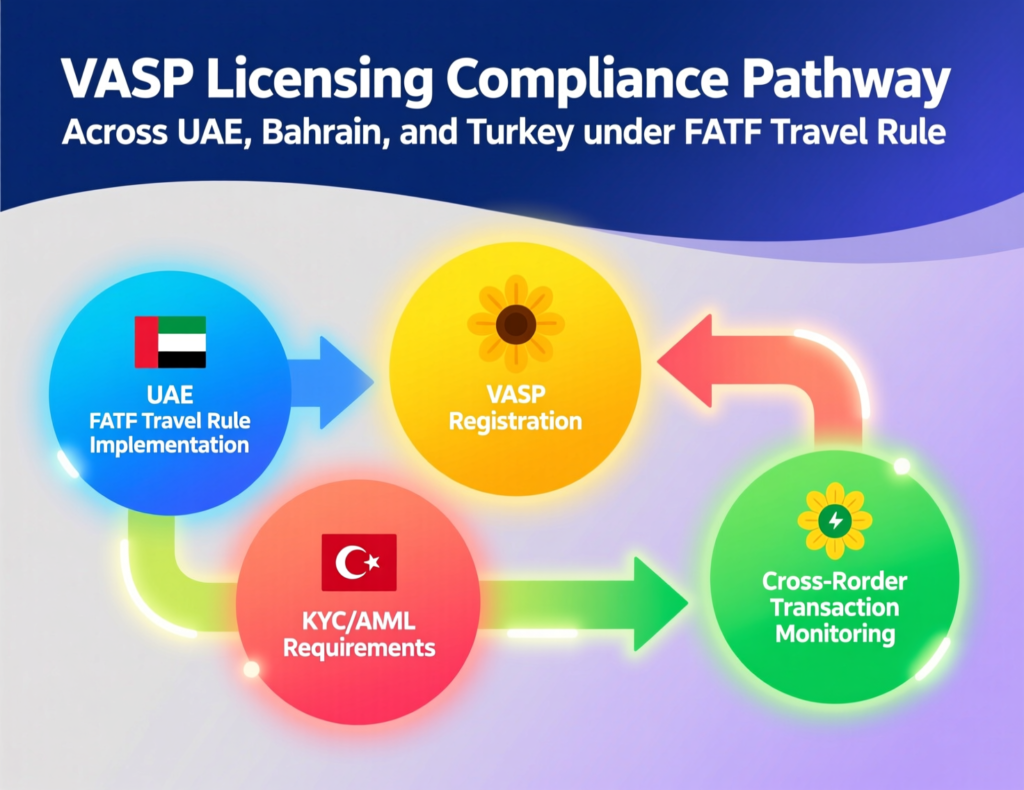

Virtual Asset Service Provider (VASP) Licensing Across MENA

Across leading MENA hubs, VASP licensing typically requires.

Fit-and-proper tests for directors and MLROs

Capital requirements, local “substance” and approved compliance frameworks

Robust AML programs, Travel Rule implementation and on-chain monitoring

Regimes are largely FATF-aligned: UAE, Bahrain and Turkey explicitly reference FATF Recommendation 15 and its interpretive note on virtual assets.

For US, UK or German entities, this feels familiar: conceptually similar to money services business registration, a MiCA CASP licence or FCA/MiFID supervision, but scoped specifically to “virtual assets” rather than generic securities.

Sandboxes, Sharia-Compliant Structures and Stablecoin Pilots

MENA regulators use sandboxes and pilots to test DeFi and tokenisation in the region, including tokenised sukuk, gold-backed tokens and Sharia-screened digital assets:

Saudi SAMA and CMA sandboxes admit blockchain and crypto-asset experiments, often with Sharia boards involved.

Bahrain and ADGM have hosted tokenisation, stablecoin and DeFi pilots under restricted licences.

The UAE has become a leading stablecoin and virtual asset hub, with roughly $30bn in digital assets flowing into the country in the year to June 2024 creating favourable conditions for regulated stablecoin growth.

For faith-compliant investors in Dubai, Riyadh or Doha, the key is ensuring that Sharia-compliant digital assets and stablecoins have both regulatory approval and Sharia certification, often via local Islamic finance institutions.

MENA vs Global Crypto Regulation.

Here’s how MENA crypto regulation lines up against the main Western rulebooks your board will ask about.

MENA vs US SEC/CFTC.

US crypto oversight remains fragmented between the SEC (securities) and CFTC (derivatives and certain spot markets), with enforcement-heavy clarity emerging via cases like SEC v. Ripple and major CFTC settlements in digital asset markets.

By contrast, MENA hubs tend to.

Define “virtual assets” more broadly and license activities first, rather than litigating token-by-token.

Provide centralised VA rulebooks (VARA, FSRA, CBB) instead of multiple overlapping agencies.

For a New York-based fund, this often means clearer licensing for exchanges and custodians, but less case law on specific token classifications and Howey-style analyses.

MENA vs EU MiCA and BaFin

MiCA introduces a single EU regime for issuers and CASPs, requiring whitepapers, reserve rules for stablecoins and CASP licensing with EU-wide passporting.

Key differences for a Frankfurt- or Berlin-based firm

Passporting

MiCA CASPs can serve the whole EU once authorised; MENA regimes are jurisdiction-by-jurisdiction (Dubai vs Abu Dhabi vs Manama vs Istanbul).

Stablecoins

MiCA includes strict ART/EMT rules from mid-2024; MENA regulators are still evolving stablecoin-specific rules, often focusing on fiat-backed or gold-backed coins and CBDC links.

Whitepapers

MiCA mandates standardised whitepapers; MENA frameworks typically require disclosure, risk statements and marketing controls, but not an EU-style template.

MENA vs FCA/UK Rules.

The UK FCA applies a risk-based approach to crypto, with a strong focus on promotions and consumer protection. Since October 2023, qualifying cryptoassets fall under the FCA’s financial promotions regime, with strict rules on who can approve ads and how risks are presented.

MENA regimes mirror this in some ways.

VARA has detailed marketing rules, restricting unlicensed promotion of virtual asset services into Dubai.

UAE and Bahrain require clear risk disclosures and Travel Rule-ready AML programs, but are generally more open to institutional products and “qualifying investor” structures than mass-market UK retail campaigns.

Why MENA Is Attracting Crypto Investors

Economic Diversification and Zero-Tax Regimes.

The UAE, Qatar and Saudi Arabia are using digital assets to support Vision 2030-style diversification away from hydrocarbons. For investors, that translates into:

Many UAE free zones (e.g., DMCC, ADGM) offering 0% corporate tax on qualifying income, no local capital gains tax on crypto for individuals, and flexible HNWI residency options subject to home-country tax rules.

Bahrain positioning Manama as a regional financial centre with pragmatic tax policies and early CBB licensing.

For HNWIs in London, New York or Munich exploring crypto tax residency and zero-tax regimes in the UAE, the real challenge is avoiding surprise exit taxes, loss-of-residency issues or CFC complications back home.

Institutional Adoption, On-Chain Flows and “Crypto Hub” Status

By late 2024, MENA monthly crypto flows were estimated at over $60bn, with Turkey, Saudi Arabia and the UAE among the top destinations

Several factors make hubs like Dubai, Abu Dhabi and Istanbul compelling:

A growing number of licensed exchanges and custodians onboarding institutional capital.

Strong stablecoin usage for remittances and B2B flows, especially between the GCC, Europe and Asia.

Proximity to both European and Asian time zones, making hubs like Dubai and Manama natural bases for 24/7 trading desks.

Safest MENA Countries for Crypto Investors

For regulated funds, exchanges and family offices from the US, UK and Germany, a conservative shortlist often includes:

UAE (Dubai, Abu Dhabi) mature, multi-layered regulation, FATF-aligned AML, and now a unified SCA–VARA framework for VASPs

Bahrain (Manama) early CBB rulebook, strong financial sector and sandbox-driven innovation under clear rules.

Turkey (Istanbul) new but comprehensive CASP licensing regime under Law 7518, with clear Capital Markets Board oversight.

More experimental or higher-risk jurisdictions (for example, those with partial bans or unclear enforcement) can still be used, but usually via structured products rather than direct exposure.

Compliance, AML and Travel Rule in MENA

FATF Travel Rule and AML Expectations for MENA VASPs

MENA regulators largely treat VASPs like banks from an AML perspective. FATF’s 2024 and 2025 updates show only a minority of jurisdictions worldwide fully implementing VA/Travel Rule standards, with MEA results “mixed” but UAE, Bahrain and a few others among the leaders.

Key expectations in hubs like Dubai, Abu Dhabi and Manama include:

Collecting and transmitting originator/beneficiary data for transfers above defined thresholds (for example, AED 3,500 in the UAE).

Maintaining robust sanctions screening, PEP checks, risk-based scoring and SAR/STR reporting.

On-Chain Analytics and Risk Monitoring for MENA-Facing Exchanges

Given FATF pressure and regional risk profiles, regulators expect exchanges to use on-chain analytics providers and blockchain forensics vendors to:

Detect sanctioned addresses, mixers, darknet markets and ransomware flows

Apply enhanced due diligence to high-risk DeFi protocols or bridges

This is where firms like Mak It Solutions can support with data pipelines, BI dashboards and integrations into on-chain analytics APIs combining technical MENA expertise with broader business intelligence and cloud architectures for regulated entities in Dubai, London or Frankfurt.

Cross-Border Data, GDPR/DSGVO and Arabic-Language KYC

US, UK and EU-regulated firms operating in MENA must reconcile

GDPR/DSGVO or UK-GDPR requirements for EU/UK persons

Local data-residency preferences (e.g., hosting KYC databases in UAE or Saudi cloud regions)

Arabic-language KYC, screening against local sanctions lists and managing local script variations in names

Practically, many exchanges run dual stacks: EU data processed in Frankfurt or Amsterdam; MENA KYC and transaction monitoring in Dubai, Abu Dhabi or Riyadh then consolidate BI at a group level using modern analytics platforms.

UAE Crypto Regulation for Foreign Investors.

Choosing Between Free Zones

UAE crypto regulation for foreign investors is fragmented by design. Each major free zone has its own sweet spot

DMCC (Dubai Multi Commodities Centre)

attractive for trading firms and Web3 projects, often pairing DMCC company formation with VARA licensing when activities fall under the VA regime.

DIFC (Dubai International Financial Centre)

DFSA regulates investment tokens and traditional financial services; often a good fit for funds and structured products with limited retail crypto.

ADGM (Abu Dhabi Global Market)

FSRA’s digital asset rulebook suits exchanges, custodians and tokenisation platforms, with global players obtaining licences under a clear framework.

Your choice depends on whether you are a fund, spot exchange, derivatives venue, DeFi protocol or infrastructure provider, and on where your main client base sits.

Licensing, Substance and Bank Accounts for US, UK and German Entities

For entities from New York, London or Frankfurt.

Expect to demonstrate real economic substance: local directors, office, staff and governance.

Banking can be the bottleneck: UAE banks rely heavily on Travel Rule compliance, sanctions controls and transparent beneficial ownership. German or UK parent entities with strong SOC 2 / PCI DSS programs tend to onboard faster.

Partnering with a local BI and integration specialist such as Mak It Solutions to map data, reporting and AML workflows across US/EU and UAE entities can materially reduce onboarding friction.

Crypto Tax Residency, Relocation and Home-Country Obligations

The UAE’s lack of local capital gains tax on individuals is attractive but.

US citizens are taxed on worldwide income regardless of where they live (FATCA still bites).

UK and German residents must navigate exit taxes, treaty rules and anti-avoidance frameworks when moving to Dubai or Abu Dhabi.

Sophisticated investors usually combine UAE residency + home-country tax advice, and avoid aggressive schemes that promise “zero tax forever” on MENA crypto gains.

How to Evaluate MENA Regulatory and Investment Risk

Red-Flag Jurisdictions

Red flags for allocators in London, New York or Berlin include.

Jurisdictions with full or quasi-bans (for example, Qatar’s past blanket prohibition, Egypt and still-banned Morocco pending its new law).

Platforms serving the region without any VARA, FSRA, CBB or MiCA/BaFin authorisation.

Lack of Travel Rule implementation or on-chain analytics usage, especially for high-risk DeFi flows.

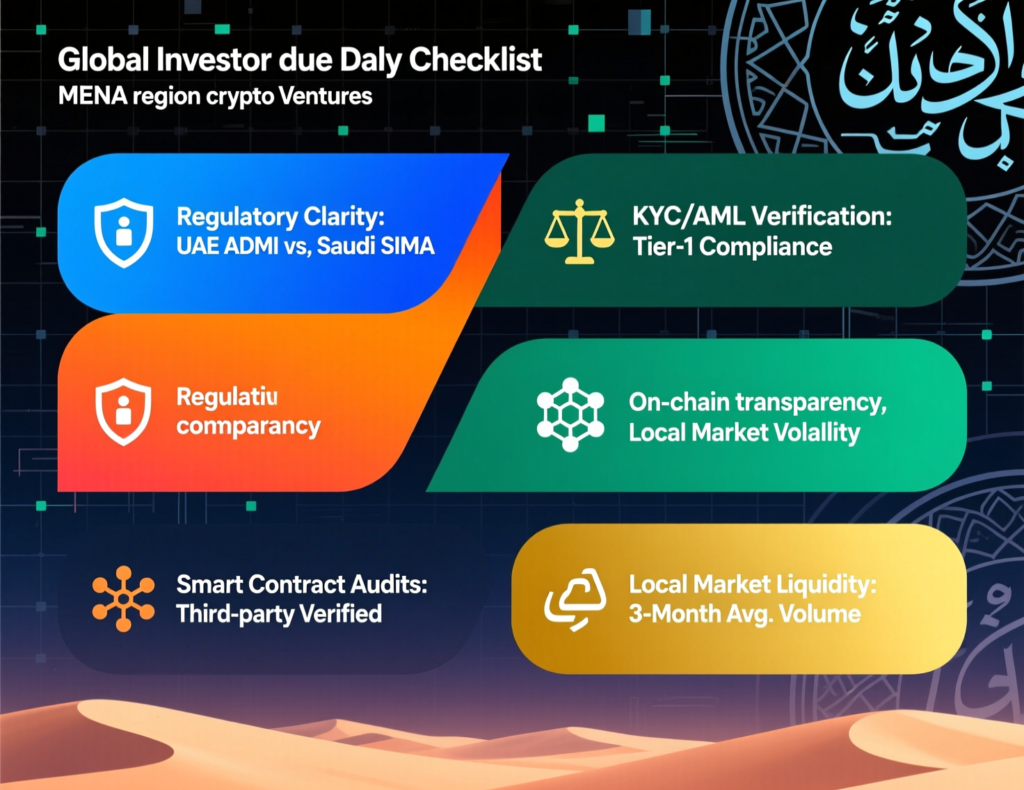

Due Diligence Framework for MENA Crypto Investments

A simple institutional framework

Regulatory footing

Is the firm licensed by VARA, FSRA, CBB or another recognised regulator?

AML/Travel Rule

Does it implement FATF Travel Rule, sanctions screening and on-chain analytics?

Tech & data

Are systems SOC 2-aligned, with PCI DSS for card flows and, where relevant, HIPAA-style controls for sensitive data?

GEO stack

Where is data stored (EU, UAE, KSA), and how do GDPR/DSGVO or UK-GDPR apply?

Mak It Solutions can help operationalise this with BI dashboards, risk scoring models and data pipelines that combine on-chain and off-chain risk factors.

Building a MENA-Ready Compliance Stack for US/EU-Regulated Firms

If you already comply with PCI DSS, SOC 2, HIPAA or MiCA at home, you’re halfway there. The remaining work is to.

Map existing controls to VARA/FSRA/CBB/SAMA expectations.

Extend monitoring to include local sanctions lists and Arabic-language screening.

Ensure reporting, logging and analytics cover all VASP relationships and fiat on/off-ramps across New York, London, Berlin, Dubai and Riyadh.

Entering MENA Crypto Markets Without Surprises

Step-by-Step Expansion Roadmap for Funds, Fintechs and Exchanges

Define your footprint

Decide whether you’re targeting only the UAE (Dubai/Abu Dhabi), a GCC multi-hub strategy (UAE + Bahrain + KSA) or a broader MENA exposure including Turkey and Egypt.

Pick your hub

Choose between DMCC, DIFC or ADGM (or Bahrain, Istanbul) based on your activity: exchange, fund, DeFi protocol, custody or infrastructure.

Design the compliance stack

Align Travel Rule, AML, CTF and sanctions controls to FATF and local expectations; integrate on-chain analytics early.

Build the data layer

Implement reliable BI and reporting across US/EU and MENA entities with help from a specialist partner like Mak It Solutions.

Phase in products

Start with spot, custody or OTC, then expand into DeFi, staking or tokenisation as regulators clarify expectations (e.g., ADGM staking framework, VARA updates).

When to Engage Law Firms, Consultants and On-Chain Analytics Partners

Law firms at jurisdiction selection and licence-application stages.

RegTech / on-chain analytics before onboarding institutional flows or DeFi exposure.

Technology partners such as Mak It Solutions for integrating KYC tools, Travel Rule gateways and BI platforms into your core stack.

Monitoring Regulatory Change.

Regimes like VARA, FSRA, CBB and Turkey’s CMB update their rules frequently (for example, ADGM’s 2025 digital asset amendments, proposed VA staking frameworks and SCA–VARA unification steps in the UAE).

In practice, that means.

Setting up regulatory watchlists for VARA, ADGM, SCA, CBB, SAMA, CMA, FCA, SEC, BaFin and ESMA

Running internal “reg change” sprints to adjust product, marketing and AML processes at least quarterly.

Key Takeaways

MENA has moved from patchy crypto rules to globally competitive virtual asset regimes, led by the UAE, Bahrain, Saudi sandboxes and Turkey’s 2024 crypto law.

For US, UK and German investors, UAE (Dubai/Abu Dhabi), Bahrain and Turkey are currently the most practical entry points for MENA crypto regulation, offering clear VASP licensing and FATF-aligned AML controls.

MiCA, BaFin, FCA and SEC rules still apply to your home entities, so you need a joined-up compliance and data model bridging New York/London/Frankfurt with Dubai/Manama/Istanbul.

A robust on-chain analytics and BI stack is now non-negotiable for Travel Rule, sanctions and DeFi risk monitoring across MENA.

Working with local specialists (law firms plus a technology partner such as Mak It Solutions) reduces time-to-market and helps you avoid silent regulatory “gotchas” across VARA, FSRA, CBB, SAMA and others.

If you’re exploring MENA crypto exposure from setting up a Dubai or Abu Dhabi entity to onboarding to licensed exchanges in Manama or Istanbul the right regulatory and data architecture will decide whether you scale smoothly or spend a year firefighting.

Mak It Solutions helps funds, fintechs and exchanges in the USA, UK and Europe design MENA-ready data, BI and integration stacks that match VARA/FSRA/CBB expectations while staying aligned with MiCA, FCA and SEC rules.

Share your current stack, target hubs (UAE, Bahrain, Saudi, Turkey) and risk appetite, and the team can outline a phased roadmap for your expansion covering data flows, analytics, KYC integrations and reporting before you commit capital or relocate your team. ( Click Here’s )

FAQs

Q : Which Middle East country is currently the most crypto-friendly for institutional investors?

A : For institutional investors, the most crypto-friendly environments are typically the UAE and Bahrain, followed by Turkey. Dubai and Abu Dhabi offer dedicated virtual asset regulators (VARA and FSRA) with clear licensing routes for exchanges, custodians, funds and tokenisation platforms. Bahrain’s CBB has one of the region’s longest-standing crypto-asset rulebooks, with early VASP licences and sandbox support. Turkey, meanwhile, introduced Law 7518 in 2024, giving Istanbul a more mature framework for CASPs. Investors still need to assess bank relationships, Travel Rule implementation and governance at each venue, but those hubs generally provide the clearest institutional pathways. ([DLA Piper][4])

Q : Can US or UK residents legally trade on UAE-regulated crypto exchanges, and what tax rules apply at home?

A : In most cases, US and UK residents can trade on UAE-regulated exchanges if local laws don’t prohibit cross-border retail crypto access and the platform’s terms accept them. However, this doesn’t change home-country tax treatment: US citizens are taxed on worldwide income, and UK residents must report capital gains, regardless of whether trades occur in Dubai or Abu Dhabi. Depending on your structure, you may also trigger reporting under OECD’s Crypto-Asset Reporting Framework (CARF) and existing CRS/FATCA rules. Any move to UAE for tax residency should be planned with US IRS or HMRC advice to avoid surprise liabilities or exit charges.

Q : How does MENA crypto regulation affect DeFi protocols and stablecoin issuers targeting global users?

A : DeFi protocols and stablecoin issuers targeting MENA users are increasingly treated as regulated financial infrastructure, particularly where there are identifiable teams, front-ends or revenue. UAE, Bahrain and Turkey expect VASP-style licensing for fiat on/off-ramps, custodial wallets and certain centralised DeFi access points, even if the smart contracts are on public chains. Stablecoin issuers must meet AML, reserve and disclosure standards, with the UAE positioning itself as a major hub for stablecoin activity and tokenised payments.In practice, most global DeFi teams either work via licensed local partners or build permissioned/enterprise versions tailored to MENA compliance.

Q : What should German BaFin-supervised funds check before allocating capital to UAE or Bahrain-based crypto assets?

A : BaFin-supervised funds in Germany should treat UAE or Bahrain exposure like any other third-country allocation under MiCA and German law. First, verify that the counterparty exchange, custodian or issuer holds appropriate licences (VARA/FSRA/CBB) and mirrors EU-style safeguards for segregation of client assets, governance and reporting. Second, assess whether the structure still fits your MiCA, AIFMD and local investment restrictions, including any limits on crypto exposure in UCITS or Spezialfonds. Third, check data-protection and outsourcing arrangements so that GDPR/DSGVO and BaFin outsourcing circulars are respected when using MENA-based service providers. Finally, ensure your internal risk and valuation models reflect differences in legal recourse, local insolvency regimes and FX/transfer risk across the GCC.

Q : How often do MENA regulators like VARA, ADGM and CBB update their virtual asset rulebooks, and how can firms stay informed?

A : VARA, ADGM’s FSRA and the CBB update their digital asset frameworks regularly, often issuing consultation papers and guidance at least annually as new business models (staking, tokenisation, DeFi, stablecoins) emerge. Recent examples include FSRA’s 2024–2025 digital asset updates and proposed staking framework, VARA’s continued refinements of the 2023 regulations, and incremental CBB amendments to its Crypto-Asset Module. Firms should subscribe to regulator mailing lists, monitor legal and Big-4 alerts and run a quarterly “regulatory change” review ideally with help from external counsel and a technical partner like Mak It Solutions to translate new rules into product and data changes.