Best & Top Altcoins 2025 in the Middle East

In 2025, the top altcoins with visible traction in the Arab world include Ethereum (ETH), XRP, BNB, Solana (SOL), Tron (TRX), Cardano (ADA), and ecosystems tied to major stablecoins such as USDT and USDC. These stand out because they combine deep global liquidity with strong usage on UAE, Saudi, Egyptian and wider MENA exchanges for remittances, DeFi, trading, and dollar access.

Introduction

Search “top altcoins 2025” from New York or London and you’ll mostly see the usual global large caps: ETH, SOL, XRP, BNB, ADA, maybe some meme coins. Search the same topic from Dubai, Riyadh, or Cairo and the picture shifts: remittances, stablecoins, and regionally popular altcoins suddenly matter a lot more.

This guide looks at top altcoins 2025 through that Arab-world lens, focusing on coins with real demand in MENA (especially UAE, Saudi Arabia, Egypt, Qatar) and how investors in the US, UK, Germany and wider EU can access them safely. It’s educational, not financial advice: no price targets, just fundamentals, adoption trends and regulatory context based on public sources such as Chainalysis, Bitget, and major exchanges.

In short: Ethereum, XRP, BNB, SOL, TRX, ADA and stablecoin-linked ecosystems remain core; DeFi and remittance-focused tokens play a rising role; and GCC hubs like Dubai and Abu Dhabi are shaping how these markets work in 2025

Top Altcoins 2025 at a Glance

Quick List Global Leaders vs MENA Favourites

For skimmers and AI overviews, here’s the fast snapshot. These are examples, not recommendations and popularity can change quickly.

| Segment | Altcoins commonly seen in 2025 | Notes for MENA / US & EU access |

|---|---|---|

| Global large caps | ETH, XRP, BNB, SOL, ADA, TRX, DOGE | Widely listed on major US/EU exchanges and GCC-facing platforms; deep liquidity. |

| MENA favourites (examples) | ETH, XRP, BNB, SOL, TRX, selected DeFi/payment tokens, meme coins, and stablecoin-linked ecosystems (USDT/USDC) | Popular on Dubai and GCC exchanges for trading, remittances, and on-chain yield. |

| Stablecoin rails | USDT, USDC (plus regional fiat on/off-ramps) | Used heavily for remittances and dollar access; support altcoin trading pairs in UAE, Saudi, Egypt and Turkey. |

Most of these are accessible to US, UK, German and EU investors via large centralized exchanges that comply with MiCA in Europe, FCA promotion rules in the UK, or US AML/KYC standards. Always verify local availability and legality before trading.

How This Guide Ranks the Best Altcoins 2025

Instead of chasing hype cycles, this guide looks at.

Liquidity & market cap can you enter/exit positions without huge slippage?

On-chain and trading activity is there real usage in DeFi, payments, or remittances?

Regional volume & listings especially on MENA-facing exchanges and Dubai crypto trading platforms.

Regulated exchange support presence on platforms supervised by VARA, ADGM/FSRA, DFSA, BaFin, FCA, MiCA-ready EU CASPs, or US-registered entities.

Use case clarity smart contracts, payments, DeFi, gaming, etc., not just “number go up”.

We don’t do price predictions. Instead, we focus on whether a coin has enough adoption, infrastructure and regulatory clarity to matter to MENA and Western investors in 2025.

Who This Analysis Is For (US, UK, Germany, GCC)

This article is designed for three overlapping groups.

US investors in cities like New York or Austin who are curious about Middle East altcoins 2025 and what’s actually trading in Dubai and Riyadh.

UK and EU/German investors in London, Manchester, Berlin or Munich who want to compare MiCA/FCA/BaFin rules with MENA’s frameworks before wiring funds to GCC platforms.

MENA-based readers in Dubai, Abu Dhabi, Riyadh, Jeddah or Cairo who already trade these coins and want a global perspective on risk, regulation and access.

Why the Arab World Matters for Altcoins in 2025

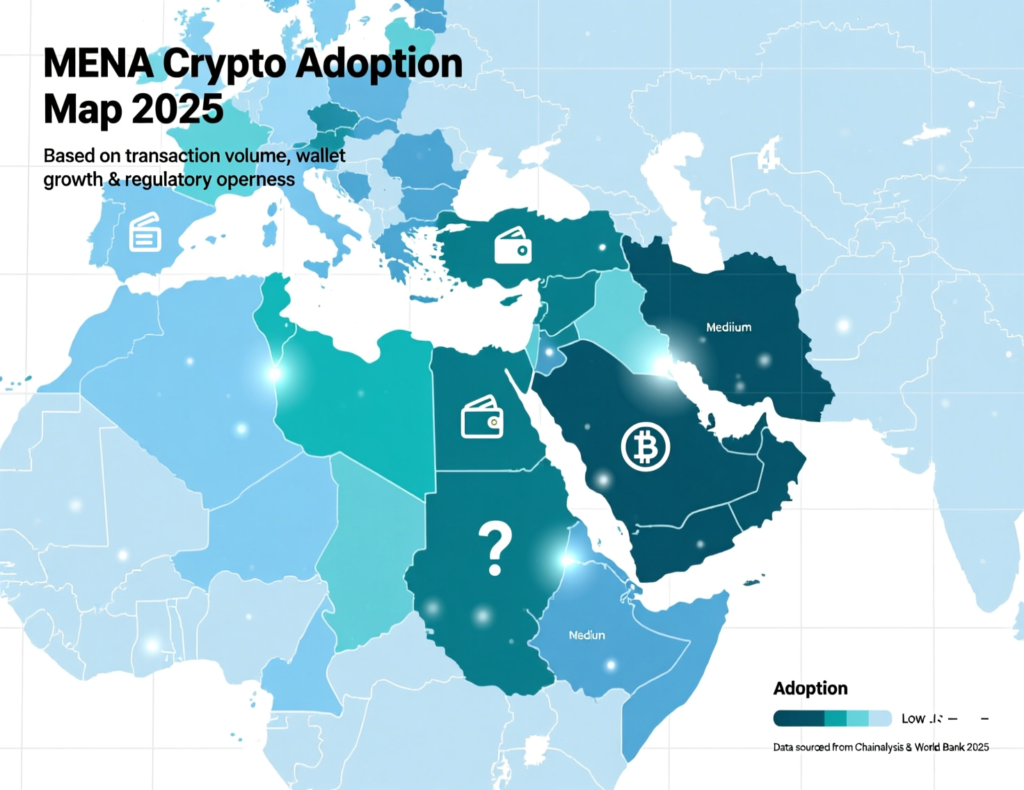

MENA Crypto Adoption 2025 Key Stats & Demographics

MENA has quietly become a heavyweight in the global crypto market. Chainalysis estimates the region handled roughly $330–340 billion in on-chain value between mid-2023 and mid-2024, about 7–8% of global crypto transaction volume.

Another breakdown shows Turkey leading with nearly $200 billion in annual transactions, followed by the UAE (~$50+ billion) and Egypt (~$50 billion)

What’s driving this?

Young, mobile-first populations in the GCC, Egypt, Jordan and Morocco.

Heavy reliance on remittances from Gulf cities like Dubai, Abu Dhabi, Riyadh and Doha to Egypt, Pakistan, the Philippines and elsewhere.

A growing number of crypto-friendly policies in hubs like UAE and Bahrain that attract exchanges, OTC desks and fintech startups.

Stablecoins vs Altcoins in the Middle East

In the MENA crypto market, stablecoins often come first, altcoins second. Workers in Dubai or Doha may be more interested in USDT or USDC to send money back to Cairo or Beirut than they are in buying NFTs. PwC estimates the UAE received around $30 billion in digital assets in the year to June 2024, much of it stablecoin-denominated.

This matters for altcoins because.

Stablecoin pairs (e.g., SOL/USDT, XRP/USDT) dominate trading on Gulf Cooperation Council cryptocurrency exchanges.

DeFi protocols popular in the region often use stablecoins as collateral to generate yield, pulling demand into associated governance or utility tokens.

Ecosystems with strong stablecoin liquidity tend to have more active local order books, making their altcoins more practical for MENA investors.

Why Altcoins Can Look More Attractive Than Bitcoin in MENA

For many investors in the Middle East, altcoins can appear more attractive than Bitcoin because they:

Often have a lower per-unit price, which feels “more affordable” even when market cap is similar.

Power smart contracts, DeFi yield, faster and cheaper payments, and emerging real-world asset platforms.

Offer higher perceived upside, especially for speculative segments of Arab youth crypto adoption.

Micro-answer

Altcoins appeal to many Middle Eastern investors because they combine lower entry prices with practical use cases like remittances, DeFi and faster payments while Bitcoin is often seen more as “digital gold” or long-term store of value than a day-to-day utility coin.

Top Altcoins 2025 with Strong Demand in the Arab World

“What are the most popular altcoins in the Arab world in 2025?”

In 2025, some of the most widely traded altcoins in the Arab world include Ethereum (ETH), XRP, BNB, Solana (SOL), Tron (TRX) and Cardano (ADA), alongside ecosystems built around USDT and USDC stablecoins. These coins dominate order books on major MENA-facing exchanges because they offer deep liquidity, fast settlement for cross-border payments, and integration with DeFi protocols used by traders in the UAE, Saudi Arabia, Egypt, Qatar and beyond. Specific rankings vary by country and exchange and change over time.

Large-Cap Altcoins with Deep Liquidity.

A few large-cap altcoins anchor most MENA crypto market activity:

Ethereum (ETH)

Base layer for DeFi, NFTs and L2s; heavily used on global and regional exchanges for staking and DeFi.

XRP

Favoured in some remittance corridors for fast transfers and low fees.

BNB

Utility token for the BNB Chain ecosystem and Binance platform, which has a strong presence in the region.

Solana (SOL)

High-throughput chain used for DeFi, memecoins and payments experiments.

Cardano (ADA)

Smart contract platform with active retail communities in Europe and parts of MENA.

Tron (TRX)

Popular for USDT transfers and high-volume stablecoin movement, especially in emerging markets.

For US, UK and German investors, deep liquidity on regulated venues is crucial: it reduces slippage, supports better pricing, and makes it easier to exit positions if regulations or market conditions change.

Payments, Remittances & DeFi-Focused Altcoins

In corridors like GCC–Egypt, GCC–Pakistan, GCC–Philippines, traders often prefer altcoins and L1/L2 tokens that:

Settle quickly with low network fees.

Are widely integrated into regional DeFi platforms and P2P markets.

Pair well against USDT/USDC for flexible rebalancing.

Examples (not recommendations) include:

L1 and L2 tokens that underpin cross-border apps or regional remittance products.

Governance tokens for DeFi protocols popular with Arab traders.

Utility tokens tied to on/off-ramp fintechs in Dubai or Abu Dhabi.

For US/EU readers searching “best altcoins for the next bull run” or “top altcoins to watch in 2025”, the key takeaway is: coins that sit on major payment and stablecoin rails in MENA often see sticky volumes, even when global hype shifts elsewhere.

Higher-Risk Trend Altcoins Popular on GCC Exchanges

UAE- and Saudi-focused exchanges also list.

Meme coins with viral social media communities.

Micro-cap DeFi and gaming tokens.

New tokens attached to regional AI, metaverse or RWA narratives.

These can move quickly and are prone to:

Low liquidity and thin order books.

High whale concentration and team allocations.

Sudden regulatory or listing changes.

Approach these as speculative lottery tickets, not core holdings. Never allocate money you cannot afford to lose, and remember that US, UK or EU rules might restrict access or marketing for such tokens at short notice.

Country Snapshots Where Each Altcoin Is Hot

Popular Altcoins in UAE 2025 (Dubai & Abu Dhabi)

The UAE is now consistently ranked among the top global crypto hubs, placing fifth worldwide for crypto-friendliness in one 2025 wealth report.

Dubai (VARA) and Abu Dhabi (ADGM/FSRA) support a growing ecosystem of:

Global exchanges with regional headquarters.

OTC providers and prop trading firms.

Web3 startups building on Ethereum, BNB Chain, Solana and other L1s.

On many Dubai crypto trading platforms, you’ll see heavy turnover in:

Large caps like ETH, XRP, BNB, SOL, TRX, ADA.

Stablecoins (USDT, USDC) as the primary quote currency.

Selected DeFi, AI and gaming tokens during narrative cycles.

Popular Altcoins in Saudi Arabia 2025 (Riyadh & Jeddah)

Saudi Arabia’s crypto stance remains cautious and evolving, with SAMA and the CMA emphasising risk warnings and exploring CBDCs and regulated digital assets.

In practice, Saudi retail traders often:

Use global exchanges accessible from Riyadh and Jeddah.

Focus on Bitcoin, ETH and large-cap altcoins such as XRP, BNB, SOL and TRX.

Speculate in trending meme or gaming tokens via offshore platforms (with legal and counterparty risk).

Searches like “popular altcoins in Saudi Arabia 2025” will typically surface the same major caps as the UAE, but local payment rails, remittance needs and regulatory messaging can shift behaviour quickly.

Emerging Trends in Egypt, Qatar and Wider GCC

Egypt

High inflation and significant remittance flows from GCC countries mean strong demand for stablecoins and payment-focused altcoins, often via P2P markets.

Qatar, Kuwait, Bahrain, Oman

More conservative on licensing, but residents still access global exchanges; trading skews toward BTC, ETH and mainstream altcoins.

Jordan, Lebanon

Remittance and capital-control pressures drive interest in stablecoins and fast-settlement altcoins despite regulatory caution.

Maghreb (Morocco, Tunisia, Algeria) and Iraq

Adoption is uneven and often informal, but youth and freelancer communities experiment with DeFi and cross-border payments, again favouring liquid, payment-oriented altcoins.

Across these markets, remittances vs speculation determine which altcoins gain traction: stablecoin-linked ecosystems, DeFi payment tokens and cheap L1s tend to dominate.

Regulation, Halal Considerations & Investor Protection

UAE, Saudi & GCC Crypto Regulations in 2025

Dubai / VARA

A dedicated Virtual Assets Regulatory Authority overseeing VASPs across most of Dubai, setting licensing, compliance and marketing rules.

Abu Dhabi / ADGM (FSRA)

One of the first in the region with a comprehensive digital asset framework, now expanding into areas like staking regulation.

DIFC / DFSA

Separate regime for financial institutions within Dubai’s financial free zone.

Saudi Arabia / SAMA & CMA

No detailed retail crypto law yet; crypto trading operates in a grey, high-risk area with strong official warnings.

Regulatory fragmentation means “Gulf Cooperation Council cryptocurrency” rules are far from harmonised, so you must always check the specific jurisdiction your exchange operates in.

Is Crypto and Altcoin Trading Halal? Key Viewpoints

Scholarly opinion on crypto’s Sharia status is not uniform.

Some scholars see speculative, leveraged trading as problematic (gharar, maysir).

Others treat major cryptocurrencies as permissible assets if used transparently and without interest (riba).

A growing niche of Sharia-screened funds and indices attempt to filter tokens by use case, transparency and governance.

This article does not provide a fatwa. Instead, treat halal questions as part of your risk and values framework: consult recognised scholars or Sharia boards, and favour transparent, well-governed projects and platforms.

MiCA, BaFin, FCA and US Rules for Buying MENA Altcoins

For US, UK and EU/German investors, regulation shapes how you can buy Arab-world altcoins:

EU / MiCA

Creates a unified regime for crypto-asset service providers (CASPs), focusing on transparency, disclosure and market abuse prevention.

Germany / BaFin

Licenses custody and trading services; German investors should check whether a platform is BaFin-regulated before wiring EUR.

UK / FCA

Strict financial promotion rules for cryptoassets, applying even to overseas firms marketing to UK consumers.

US

Fragmented landscape (SEC, CFTC, state regimes); focus on AML/KYC, securities classification, and consumer protection.

New rules like MiCA and strengthened UAE VARA frameworks mean investors face more KYC, AML and Travel Rule checks, but also better disclosure and recourse if something goes wrong.

How US, UK & EU Investors Can Access Arab World Altcoins

“How can investors in the US or Europe safely get exposure?”

US, UK and EU investors typically access altcoins popular in the Arab world through regulated global exchanges that list MENA-favoured coins like ETH, XRP, BNB and SOL, often paired against USDT or USDC. A safer approach is to choose platforms licensed under MiCA, BaFin or FCA regimes, or authorised in UAE hubs like VARA or ADGM, fund accounts in USD, GBP or EUR, complete full KYC, and then decide on secure custody (hardware wallet, institutional custodian, or carefully managed exchange accounts). Always check local tax rules and avoid unlicensed offshore platforms.

Choosing Regulated Exchanges (VARA, ADGM, FCA, BaFin)

When picking a venue to trade top altcoins 2025 with a MENA angle, look for.

Licensing

MiCA-ready authorisation in the EU, BaFin registration in Germany, FCA-registered cryptoasset businesses in the UK, or VARA/ADGM approvals in the UAE.

Security posture

Proof-of-reserves, SOC 2–style audits, strong operational security, and PCI DSS-compliant payment processing.

Transparent fee schedules and clear delisting policies.

Many investors will start on large global exchanges and only later consider Dubai crypto trading platforms directly regulated by VARA or ADGM once they understand the additional onboarding and cross-border constraints.

Buying GCC Altcoins from the US, UK & Germany

Here’s a high-level “how-to” for queries like “how to invest in Middle East altcoins from USA”, “best exchanges to buy UAE altcoins from the UK” or “wie deutsche Anleger in VAE-Altcoins investieren können”:

Complete KYC on a compliant exchange

Choose a platform regulated in your home market (e.g., MiCA/BaFin in Germany, FCA in the UK, or strong US compliance).

Upload identity documents and proof of address; enable 2FA.

Deposit in your home currency (USD/GBP/EUR)

Use bank transfers or cards via secure, PCI DSS-compliant payment gateways.

Avoid wiring funds to unknown offshore accounts, even if they advertise “GCC altcoin access”.

Trade into your target altcoins

Start with major pairs like ETH/USDT, XRP/USDT, BNB/USDT or SOL/USDT that mirror Arab-world activity.

Decide whether to hold on-exchange or withdraw to a self-custody wallet with secure backups.

Monitor regulation and liquidity

Watch for MiCA updates, FCA enforcement news, and licensing changes at MENA exchanges.

Be ready to exit positions that become illiquid or face regulatory pressure.

Tax, KYC & Risk Checklist Before You Invest

Before you chase trending GCC altcoins.

Tax

In the US, crypto trades are typically taxable events (capital gains/losses).

In the UK and Germany/EU, expect capital gains treatment, record-keeping duties, and potential reporting thresholds.

Always consult a qualified local tax advisor; this article cannot replace professional advice.

KYC & AML

Legitimate platforms will ask for KYC and sometimes source-of-funds checks.

Be wary of exchanges that let you move large sums with no verification.

Scam & counterparty checks

Avoid platforms on regulator warning lists.

Be cautious of high-yield “investment programmes”, Telegram tips groups and unlicensed “advisers” targeting MENA-focused altcoins.

Key Risks Before Buying Trending MENA Altcoins

Volatility, Liquidity & Token Concentration

MENA-trending micro caps and some DeFi tokens often have:

Thin order books, leading to big price swings on modest volume.

High whale concentration, where a few wallets can move markets.

Low circulating float, amplifying volatility.

Even large caps like SOL or BNB can see double-digit daily moves, so sizing and diversification are more important than trying to outguess every pump.

Regulatory, Sharia and Counterparty Risks

Regulations in Saudi Arabia, Egypt and parts of the GCC are still evolving; sudden crackdowns or clarifications can reshape access.

Different Sharia interpretations may affect local appetite for certain tokens or products.

Exchanges can lose licenses, face enforcement, or suffer hacks especially if they operate offshore with limited oversight.

Building a Diversified Altcoin Strategy for 2025

A more resilient 2025 strategy generally means:

Making large-cap altcoins (ETH, XRP, BNB, SOL, etc.) and possibly Bitcoin your core, if you choose to invest at all.

Limiting high-risk, regionally trending tokens to a small, capped share of your portfolio.

Setting clear rules for position sizing, time horizon and exit triggers, instead of all-in bets on a single “GCC gem”.

Remember: not investing is also a valid choice, especially if you don’t fully understand the risks.

Concluding Remarks

MENA is now a top-tier crypto region, with hundreds of billions in annual transaction volume and major hubs in Dubai and Abu Dhabi.

UAE and Saudi Arabia are hotspots for altcoin trading, even if their legal frameworks look very different.

Stablecoins and payments are the backbone of the region, shaping which altcoins matter for remittances and DeFi.

Regulation (MiCA, VARA, ADGM, FCA, BaFin) and halal considerations heavily influence which platforms and products are suitable.

Investors in the US, UK, Germany and EU can access many MENA-favoured altcoins via regulated global exchanges, but must manage volatility, legal and tax risk.

What to Research Next Before You Buy

Before acting on any top altcoins 2025 list especially one with a Middle East twist take time to.

Compare multiple exchanges on licensing, fees, security and asset coverage.

Read whitepapers, tokenomics breakdowns and independent audits for any project you consider.

Track MiCA, VARA, ADGM, SAMA and FCA updates, plus local guidance in your home country.

Subscribing to a sober, research-focused newsletter or working with regulated advisors will almost always beat decisions driven by memes and FOMO.

Key Takeaways

MENA is a fast-growing crypto region, with significant transaction volume and young, mobile-first users.

Top altcoins 2025 in the Arab world are dominated by large caps like ETH, XRP, BNB, SOL, TRX and ADA, plus stablecoin ecosystems used for remittances and DeFi.

UAE (VARA, ADGM) and Saudi Arabia (SAMA, CMA) strongly influence which altcoins and platforms are accessible across the GCC.

US, UK and EU investors should prioritise MiCA/BaFin/FCA or US-compliant exchanges and robust custody over chasing obscure high-yield tokens.

A sensible 2025 strategy balances large-cap exposure with modest allocations to regional trends, backed by clear risk limits and exit plans.

If you’re exploring how Arab-world altcoin trends fit into your broader digital strategy, you don’t need to figure it out alone. The team at Mak It Solutions combines web development, cloud, mobile apps and business intelligence to help clients turn noisy crypto data into clear dashboards and scenarios.

You can start by discussing an analytics PoC, a secure trading or reporting dashboard, or a data pipeline that tracks MENA altcoin flows alongside your existing systems. When you’re ready, reach out via the Services or Business Intelligence Services pages to map a solution that fits your risk, tech stack and compliance needs.

FAQs

Q : Which Middle East altcoins have the highest trading liquidity on global exchanges in 2025?

A : In 2025, the most liquid “Middle East altcoins” on global exchanges tend to be general large caps that are also popular in MENA, such as ETH, XRP, BNB, SOL, TRX and ADA, typically paired against USDT or USDC. These coins are listed on multiple Tier-1 platforms serving the UAE and GCC, as well as regulated exchanges in the US, UK and EU, which concentrates liquidity and tightens spreads. Exact rankings change daily, so always check live order books and volumes before trading.

Q : Are Arab world altcoins generally riskier than altcoins popular in the US or Europe?

A : They’re not inherently “riskier” just because they’re popular in the Arab world, but many regionally hyped tokens are smaller, newer and less liquid than global large caps. That means bigger price swings, higher rug-pull risk and more sensitivity to regulatory news in GCC countries. Conversely, large caps like ETH or SOL trade heavily across US, EU and MENA, so their risk profile is more global than regional. Treat region-specific micro caps as speculative and size them accordingly.

Q : How do remittance flows in Egypt and Lebanon influence which altcoins gain traction in the region?

A : Remittances from Gulf cities to countries like Egypt and Lebanon are a major driver of crypto use. Workers often convert local salaries into USDT or other stablecoins, then move funds via chains with low fees and fast confirmation, such as Tron or certain L2s. That reinforces liquidity in tokens that act as cheap settlement rails and in DeFi protocols that provide on/off-ramps or yield on idle stablecoins. As long as remittance and capital-control pressures persist, payment-friendly altcoins and stablecoin ecosystems are likely to remain central in these markets.

Q : Are there Sharia-compliant crypto funds or ETFs that include altcoins alongside Bitcoin and Ethereum?

A : A small but growing number of Sharia-focused crypto products have emerged, typically screening assets based on transparency, leverage, underlying business activity and governance. Many concentrate on Bitcoin and Ethereum, but some include carefully selected altcoins that pass their internal Sharia screening. Availability varies by country and regulator, and there is no single global standard, so Muslim investors should review each product’s methodology and consult trusted scholars or Sharia boards rather than assuming any “Islamic” label guarantees compliance.

Q : What should I look for in an exchange before buying GCC-focused altcoins with USD, GBP or EUR?

A : Focus on regulation, security and transparency. Prefer exchanges licensed under MiCA/BaFin in the EU, FCA rules in the UK, strong US AML/KYC regimes, or UAE supervisors like VARA or ADGM/FSRA. Check for proof-of-reserves, robust security practices (2FA, SOC 2-style audits), clear terms on delistings and withdrawals, and responsive customer support. Avoid platforms on regulator warning lists or those that encourage bypassing KYC in favour of “quick GCC altcoin exposure” via sketchy payment channels.