Middle East Crypto Regulations 2025: Investor Guide

Middle East crypto regulations in 2025 combine advanced virtual asset regimes in the Gulf (especially UAE, Bahrain and Oman) with more cautious or restrictive approaches in Saudi Arabia, Qatar, Kuwait and parts of wider MENA. For US, UK and EU investors, the region works best as a selective hub strategy choosing specific regulated centres like Dubai, Abu Dhabi, Manama or Muscat rather than treating “MENA” as a single regulatory zone.

Introduction

Middle East crypto regulations 2025 are no longer a “grey area” story. Over the past few years, the Gulf has shifted from informal experimentation to formal virtual asset regulation in the Gulf, led by Dubai’s VARA, Abu Dhabi’s ADGM FSRA, Bahrain’s CBB and Oman’s new VASP framework.

At the same time, Saudi Arabia, Qatar, Kuwait and several non-GCC markets are taking a cautious or restrictive stance on retail crypto, even as they explore CBDCs and tokenised finance.

This guide gives US, UK and EU/BaFin-regulated funds, family offices, exchanges and sophisticated HNW investors a practical, investor-focused map of the region—plus concrete checklists you can use before opening accounts, launching a platform or moving fund flows into the Middle East.

Middle East Crypto Regulations 2025 What Investors Need to Know First

At a high level, the Middle East now mixes mature crypto hubs (UAE, Bahrain and increasingly Oman), cautious heavyweights (Saudi Arabia, Jordan, Turkey) and partially restrictive markets (including some GCC states and North African jurisdictions). For foreign investors, the safest path is to pick specific regulated venues rather than assume a single, harmonised “MENA” regime.

Who This 2025 Guide Is For

This guide is written for

US SEC / CFTC-supervised funds and exchanges considering a Middle East booking centre.

UK FCA-regulated managers and London family offices.

EU and BaFin-regulated firms navigating MiCA, GDPR/DSGVO and cross-border capital flows.

Scope includes spot trading, derivatives, custody, token issuance, staking and yield, mining and data-driven DeFi access. If you are building your own exchange, analytics stack or compliance tooling, a partner like Mak It Solutions can help with web platforms, Next.js front-ends and business-intelligence dashboards that plug into your regulatory reporting.

Web Development Services makitsol.com

Next.js Development Services makitsol.com

Business Intelligence Services makitsol.com

Quick TL;DR on Middle East Crypto Regulations

If you need an AI-overview-style snapshot

Main hubs

Dubai’s VARA Virtual Assets and Related Activities Regulations, Abu Dhabi’s ADGM FSRAdigital asset regime, Bahrain’s crypto-asset services regulation, and Oman’s emerging FSA / CMA VASP framework now form the region’s clearest virtual asset laws.

Cautious markets

Saudi Arabia, Jordan and Turkey allow limited or sandboxed crypto use, but do not yet offer comprehensive retail frameworks.

Restrictive/ban-leaning jurisdictions

A handful of GCC and wider MENA states still inhibit licensed retail trading or advertising.

Trend

Gulf hubs are aligning with FATF VASP standards on licensing, AML/CTF and travel-rule, while pushing ahead with CBDC and stablecoin pilots.

How the Region Compares to US, UK and EU Rules

Compared with the SEC, FCA and BaFin

UAE and Bahrain regimes explicitly license Virtual Asset Service Providers (VASPs) and crypto-asset services, similar in spirit to MiCA’s CASP approach but tailored to local risk appetites.

Disclosures, conduct rules and custody standards look increasingly like those applied to securities and derivatives in New York, London and Frankfurt.

However, Middle East crypto regulations are a complement, not a replacement, to home-state rules. A US fund using a Dubai exchange still answers to the SEC and IRS; a UK manager routing flow through Manama still sits under the FCA and UK-GDPR; an EU/BaFin-regulated VASP must layer MiCA and GDPR duties on top of any Gulf licence.

Regulatory Map of the Middle East and MENA

At a regional level, MENA combines fully regulated hubs, cautious “wait-and-see” markets and outright or de-facto restrictions. Investors must distinguish where trading, custody and marketing are clearly permitted from jurisdictions where crypto is merely tolerated or discouraged.

MENA Crypto Regulation Map by Country

A simple working map for 2025

“Welcome / regulated hubs”

UAE (Dubai / Abu Dhabi)

Dedicated VA regimes (VARA and ADGM FSRA), federal SCA oversight and multiple free zones (DIFC, DMCC).

Bahrain

CBB’s Crypto-Asset Module licenses exchanges, custodians, brokers and token advisors.

Oman

CMA/FSA announcing a full Virtual Assets Regulatory Framework and VASP licensing to regulate exchanges and mining.

“Cautious / sandbox”

Saudi Arabia

Regulatory sandbox, but banks are generally barred from crypto unless specifically authorised; retail trading remains unregulated and officially discouraged.

Jordan, Turkey, Egypt:

Varied mixes of FX-style restrictions, warnings and partial permissions; Turkey ranks high on adoption but with uneven consumer protection.

“Restrictive / bans”

Some GCC and North African states effectively ban licensed exchanges, marketing or bank interaction, pushing activity offshore.

Israel (Tel Aviv) and Turkey (Istanbul) also matter: both show high adoption, but crypto regulation largely plugs into existing securities and AML frameworks rather than dedicated virtual asset laws.

Welcome vs. Cautious vs. Restrictive Jurisdictions

Welcome

UAE, Bahrain and Oman actively court foreign VASPs, with clear licensing, prudential rules and public registers. For investors, that means more visibility into who is authorised to hold your assets and what services they can legally provide.

Cautious

Saudi Arabia, Jordan and Turkey often allow innovation in sandboxes but restrict banks, marketing or retail leverage. This is fine for B2B or institutional pilots, but risky for mass-market apps.

Restrictive

In outright or de-facto ban jurisdictions, crypto might still be technically used but without local licences, bank rails or enforceable investor protections.

The implications differ if you hold, market or operate a platform. Holding via a foreign exchange may be tolerated where local marketing is forbidden; running a platform or on-ramping local fiat usually triggers the heaviest scrutiny.

Crypto Adoption and Regulation Trends in MENA by 2025

Chainalysis estimates that between July 2023 and June 2024, MENA users received around $330–340 billion in on-chain crypto value, roughly 7–8% of global transaction volume.

An earlier period (mid-2022 to mid-2023) was even higher, near $390 billion and around 7% of global activity, highlighting sustained interest despite price cycles.

By late 2024, monthly flows peaked above $60 billion, and although 2025 volumes have cooled slightly, year-on-year growth remains robust for both retail and institutional flows.

Regulatory trends to track:

CBDC pilots and cross-border projects (e.g., mBridge with UAE and Saudi Arabia)

Dirham- and rial-backed stablecoin experiments.

Energy & mining

Oman and parts of the GCC exploring structured mining, with environmental and grid-impact controls baked into licences.

GCC Crypto Hubs UAE, Bahrain and Oman Compared

For most foreign investors and exchanges, the realistic 2025 hub shortlist is Dubai/Abu Dhabi (UAE), Manama (Bahrain) and Muscat (Oman), with each offering distinct strengths for trading, custody, funds and mining.

Dubai VARA, ADGM FSRA and Federal SCA Rules

Dubai’s Virtual Assets Regulatory Authority (VARA) is the dedicated regulator for virtual assets in Dubai (excluding DIFC). It issues VA activity licences (exchange, custody, broker-dealer, lending/borrowing, advisory, payments) and enforces compulsory rulebooks on company, compliance, technology and market conduct.

ADGM’s FSRA in Abu Dhabi has one of the earliest institutional-grade digital asset frameworks, recently updated to refine accepted virtual assets, capital requirements and proposed staking rules.

Federal authorities (notably the SCA) still shape securities and derivatives treatment, especially for tokenised securities and structured products, while free zones like DMCC and DIFC provide specialist licensing for ecosystem players.

Why global funds base themselves in the UAE

Deep banking, legal and advisory ecosystem (including Big-4 and global law firms).

Regional access to Riyadh, Doha, Cairo, Istanbul and beyond.

Clear VA licensing map and marketing regulations that spell out what can be promoted to UAE residents.

CBB Crypto-Asset Framework and Manama’s Role

Bahrain’s Central Bank of Bahrain (CBB) introduced a comprehensive Crypto-Assets Module (CRA) in its Financial Institutions Rulebook (Volume 6). It regulates crypto-asset exchanges, custodians, brokers, portfolio managers and token advisors, including licensing, capital, governance and risk rules.

Compared to the UAE

Speed & cost

Smaller pipeline and often faster approvals for high-quality applicants.

Intensity

Strong but arguably less complex than juggling VARA vs ADGM vs SCA in the UAE.

Start-up friendliness

Manama positions itself as a nimble gateway for MENA and India-Gulf flows, supported by the Bahrain Economic Development Board and recent exchange launches.

For lean exchanges or fintechs, Bahrain can be an attractive “first licence” before expanding to Dubai or into the EU under MiCA.

Oman and Other GCC Options for Mining and VASP Licensing

Oman’s Capital Market Authority / FSA has announced a dedicated Virtual Assets Regulatory Framework aiming to cover all virtual asset activities, define VASP categories and set up supervisory mechanisms to monitor market abuse and ongoing risk.

Muscat is also emerging as a regulated host for mining operations, leveraging energy supply under structured permits and potentially sharia-informed governance for local investors.

Elsewhere in the GCC

Qatar and Kuwait remain selective focusing on wholesale, payments or pilot projects while keeping tight controls on retail trading and marketing.

Saudi Arabia explores CBDCs and tokenised finance via sandbox structures, but banks remain heavily constrained on crypto unless specifically authorised.

UAE vs Bahrain for foreign investors

UAE offers multiple regimes (VARA, ADGM, DIFC, SCA), giving choice but also complexity.

Bahrain offers one unified crypto-asset framework under the CBB.

UAE usually wins on ecosystem depth and capital access; Bahrain often wins on simplicity and speed.

Both aim to be FATF-aligned and suitable for institutional-grade VASPs.

Licensing, AML/CTF and Marketing Rules for Crypto Businesses

Across the main hubs, FATF-aligned VASP licensing is now the norm: local licences, robust AML/CTF controls, travel-rule implementation and increasingly strict marketing and influencer rules.

VASP Licensing Pathways for Exchanges, Brokers and Custodians

In practice, “MENA virtual asset service provider (VASP) licensing” means.

Authorisation to provide specific VA services (exchange, brokerage, custody, lending, portfolio management, payments) under VARA, ADGM FSRA or CBB modules.

Capital and liquidity thresholds calibrated to your business model.

Fit-and-proper tests for shareholders, directors and key persons.

Governance, risk, reporting and tech/cyber requirements.

Typical structures

Local licensed entity

Full VA licence, local board, substance and staff common for larger exchanges and neobanks.

Rep office + partner exchange

Foreign platform with a locally licensed partner providing front-end or custody.

Integrated stack

For firms building their own exchange, analytics, mobile apps and marketing, Mak It Solutions can support front-end, back-end and mobile workstreams so engineers stay focused on protocol and risk engines.

Front-End Development Services makitsol.com

Back-End Development Services makitsol.com

FATF-Aligned AML/CTF, Travel Rule and On-Chain Monitoring

FATF’s updated guidance on virtual assets requires countries to license VASPs, apply a risk-based AML/CTF regime and implement the travel rule for cross-border transfers.

In UAE and Bahrain, expect

Full KYC, beneficial-ownership and sanctions-screening processes.

Transaction monitoring using blockchain analytics vendors.

Travel-rule messaging for transfers above local thresholds.

BaFin-regulated or FCA-regulated firms outsourcing operations to Middle East platforms must show that equivalent AML standards are applied often via service audits (SOC 2), detailed policies and strong oversight.

Marketing, Promotions and Cross-Border Targeting of UAE Investors

Dubai and the wider UAE now have explicit Marketing Regulations for virtual assets, covering online advertising, influencer campaigns, airdrops and referral programmes.

Key points

Only licensed entities may market virtual asset services to UAE residents.

Risk warnings, disclosures and approvals are required for most promotions.

Influencers and KOLs need appropriate media licences and must avoid implying unlicensed products are “approved” or risk heavy fines.

For EU or UK managers, GDPR/DSGVO and UK-GDPR continue to apply to investor data, even when infrastructure sits in Gulf data centres.

Risk, Tax and Structuring for US, UK and EU Investors

Middle East hubs can reduce operational and tax friction for some structures, but investors must model home-country tax and reporting, as well as on-the-ground risk, AML, data protection and sharia-compliant crypto investing in the Middle East.

Middle East Crypto Regulations for US Investors and Funds in 2025

For US allocators, “middle east crypto regulations for us investors in 2025” usually surface in two contexts:

A Delaware or Cayman fund investing via accounts at a UAE or Bahrain exchange.

A US-managed SPV incorporated in ADGM, DIFC or Bahrain to raise regional capital.

You still face

IRS reporting plus FATCA/FBAR-style obligations on foreign accounts and entities.

SEC/CFTC views on whether portfolio assets are securities, commodities or something in between.

US sanctions filters on Middle East flows, especially if your strategy touches high-risk jurisdictions.

Middle East Cryptocurrency Regulations for UK Investors Post-Brexit

For London managers, “middle east cryptocurrency regulations for uk investors post-brexit” is about overlaying:

FCA rules on marketing, promotions and financial instruments.

UK-GDPR data-protection duties for UK clients.

Local Gulf regimes (VARA/ADGM/CBB) governing the exchange or fund vehicle.

Watch for

Reverse-solicitation: regulators are sceptical if a “passive” Middle East platform heavily markets into the UK.

MiCA vs non-MiCA mix in investor portfolios if you also market to EU investors.

Nahost Krypto-Regulierung 2025 für deutsche und EU-Anleger

For German and EU investors, “nahost krypto-regulierung 2025 leitfaden für deutsche anleger” means comparing

MiCA and BaFin’s crypto custody / CASP rules in Frankfurt or Berlin.

VARA/ADGM/CBB requirements for exchanges and custodians in Dubai, Abu Dhabi and Manama.

Key themes

Steuer- und Meldepflichten: income and gains on GCC crypto assets must still be reported under national tax law.

EU travel-rule duties: CASPs in Germany or the wider EU sending funds to a UAE/Bahrain platform must collect originator/beneficiary data, even if the Gulf counterparty is not in the EU.

How to Choose a Jurisdiction and Diligence a Crypto Platform

In practice, you should shortlist jurisdictions based on your strategy (exchange vs fund vs mining or staking) and then run a structured checklist on licensing, custody, data, governance and tax before wiring funds or incorporating.

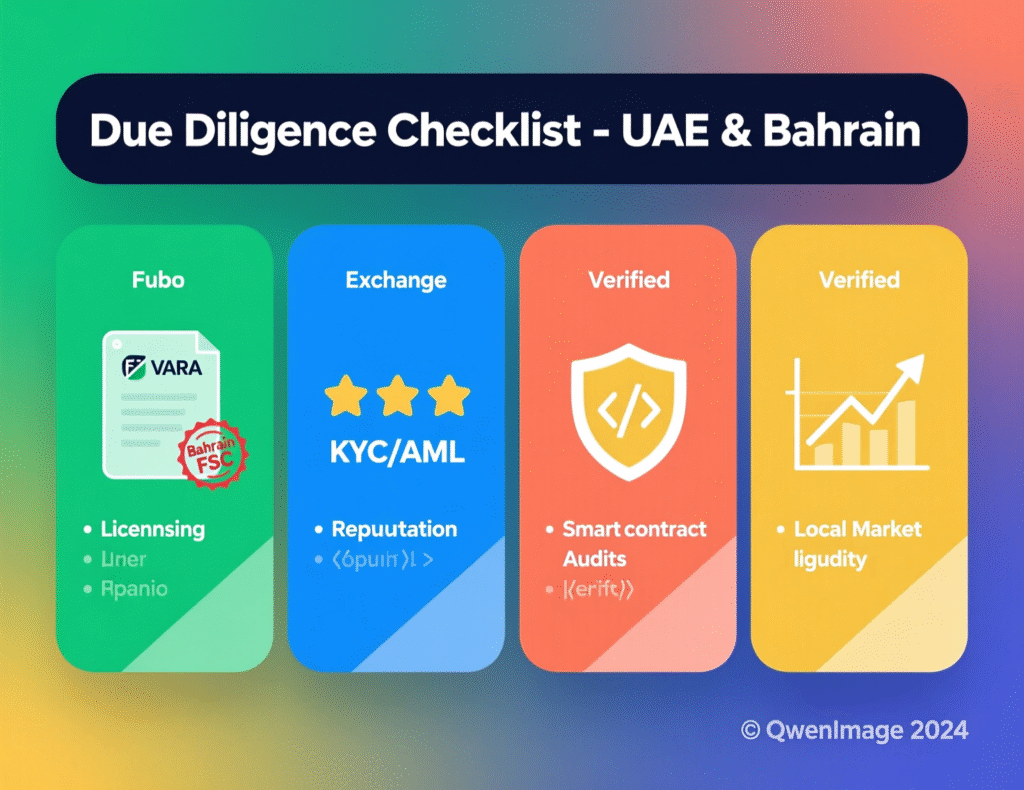

How to Check if a Dubai, Abu Dhabi or Manama Platform Is Properly Licensed

How can US, UK and EU investors check if a crypto platform in Dubai, Abu Dhabi or Manama is properly licensed and compliant?

A practical step-by-step

Identify the regulator VARA in Dubai, ADGM FSRA in Abu Dhabi, CBB in Bahrain.

Search the public register confirm the legal entity name appears as an authorised VASP/exchange/custodian.

Check licence category & permissions make sure the licence actually covers the services you use (e.g., spot, derivatives, custody, staking).

Review AML/sanctions posture ask for policies, on-chain monitoring tools and details on travel-rule implementation.

Confirm complaints & dispute mechanisms understand how to escalate disputes, and whether there’s an ombudsman or financial-services tribunal.

Operational, Custody and Data-Protection Questions to Ask Before Funding

Before you deposit serious capital, ask

Custody model: cold vs hot wallet mix, third-party vs in-house custody, segregation of client assets.

Controls & assurance: incident history, insurance, penetration-testing and SOC 2 reports; PCI DSS where card rails are involved.

Data protection: hosting location, encryption, data-retention and breach response; alignment with GDPR/DSGVO, UK-GDPR and HIPAA-style thinking where sensitive KYC/health-related data is collected.

If you’re building your own stack, Mak It Solutions can help align e-commerce flows, digital marketing funnels and analytics with these requirements.

E-Commerce Solutions makitsol.com

Digital Marketing Services makitsol.com

When to Engage Local Counsel, Tax Advisors and Compliance Vendors

You should bring in local law firms, tax advisors and regtech vendors when:

Incorporating a UAE, Bahrain or Oman entity for exchange or fund operations.

Onboarding GCC investors into US, UK or EU funds.

Launching new activities (staking, lending, token issuance) that regulators treat differently from spot trading.

This is also a good moment to engage a technical partner like Mak It Solutions to design compliant onboarding flows, reporting dashboards and automated monitoring freeing your internal team to focus on investment decisions rather than plumbing.

Artificial Intelligence & Analytics makitsol.com

Webflow CMS & content ops for legal/compliance hubs makitsol.com

Key Takeaways

Pick hubs, not “MENA” treat UAE, Bahrain and Oman as specific, regulated venues; don’t assume regional harmonisation.

Follow FATF first, then local detail licensing, AML/CTF and travel-rule are converging, but each hub implements them differently.

Overlay home-state rules SEC, FCA, BaFin, MiCA, GDPR/DSGVO and UK-GDPR still govern your investors, marketing and data.

Tax and reporting drive structure model US, UK and EU tax plus reporting (FATCA/FBAR, CRS, local filings) before choosing your hub.

Platform due diligence is non-negotiable always verify licences, custody, data protection and complaints channels before wiring funds.

If you’re evaluating UAE, Bahrain or Oman as a crypto hub and need help turning this regulatory overview into a concrete platform or data strategy, Mak It Solutions can help. Our team works with SaaS, fintech and analytics-heavy businesses across the US, UK, Germany and wider Europe to design compliant web platforms, BI dashboards and mobile apps that integrate directly with your chosen VASP stack. Share your current architecture and target jurisdictions, and we’ll help you sketch a practical plan from proof-of-concept to production.( Click Here’s )

FAQs

Q : Is it legal for a US or UK resident to hold crypto on a UAE or Bahrain exchange without a local entity?

A : Yes, in many cases US and UK residents can legally hold crypto on properly licensed UAE or Bahrain exchanges, as long as those exchanges accept foreign clients and comply with their own local rules. You still need to meet home-country tax and reporting obligations (like US FATCA/FBAR or UK capital-gains reporting) and respect any local restrictions on promotions or derivatives. When in doubt, check both the platform’s terms and your domestic regulator’s guidance.

Q : Do Middle East crypto regulations apply to DeFi protocols or only to centralised exchanges and custodians?

A : Most Middle East regimes are written with centralised exchanges, brokers, custodians and token issuers in mind, but they increasingly capture intermediaries that front-end DeFi (for example, a licensed VASP offering yield products sourced from on-chain protocols). Purely decentralised, non-custodial protocols may sit outside direct licensing, yet on-ramps, aggregators and marketing entities are often regulated. If your business wraps DeFi into a user-friendly product, assume you may be treated as a VASP.

Q : Can an EU or BaFin-regulated VASP “passport” services into the Middle East, or is a local licence always required?

A : MiCA and BaFin authorisations do not automatically passport into Gulf markets. An EU or BaFin-regulated VASP generally needs a local licence (or to work through a locally licensed partner) to actively market and provide services in UAE, Bahrain or Oman. MiCA and BaFin credentials are still valuable: they can speed up local approvals, support risk assessments and give Gulf regulators comfort on your governance, but they don’t replace local authorisation.

Q : How do sharia-compliant crypto funds in the Middle East treat staking, yield farming and lending products?

A : Sharia-compliant crypto funds typically work with Islamic finance scholars and advisory boards to classify assets and structures. Many prefer spot crypto, screened tokens and asset-backed stablecoins, while approaching staking, yield farming and lending with caution especially where returns resemble interest (riba) or involve excessive gharar (uncertainty). Some structures treat staking rewards as network fees or participation income rather than interest, but interpretations vary, so each fund’s sharia board position matters.

Q : What documents and timelines should a crypto exchange expect when applying for a VARA, ADGM or CBB licence?

A : Expect a multi-month process involving a detailed business plan, financial projections, ownership and control information, governance and risk frameworks, AML/CTF policies, tech and cybersecurity documentation, and sometimes on-site interviews or sandboxes. VARA, ADGM FSRA and CBB typically operate in phases (initial approval, in-principle licence, then full authorisation once conditions are met). Well-prepared applicants with experienced teams and strong compliance documentation usually move faster than those treating licensing as an afterthought.