How to Buy Bitcoin in UAE (Step-by-Step 2025 Guide)

To buy Bitcoin in the UAE, open an account with a VARA- or FSRA-licensed crypto exchange that supports AED deposits, complete KYC using your Emirates ID and passport, and fund your account from a UAE bank or card. Then place a BTC/AED order, and store your Bitcoin in a secure wallet, keeping records for future bank or tax checks in your home country.

Introduction

If you’re wondering how to buy Bitcoin in the UAE in 2025, you’re far from alone. The UAE is now among the world leaders for crypto ownership, with around a quarter of residents estimated to hold digital assets.

Dubai and Abu Dhabi are marketing themselves as a global crypto hub, backed by specialist regulators like VARA in Dubai and the FSRA in Abu Dhabi’s ADGM. For expats arriving from New York, London, or Berlin, the mix of 0% capital-gains tax for individuals on crypto and clear local rules is very attractive – but it can also be confusing.

This guide is written for beginners and expats from the US, UK, Germany and the wider EU who now live, work or winter in the UAE. We’ll walk through safe exchanges, the step-by-step process to buy your first BTC with AED, payment methods (including how to buy Bitcoin in UAE from a USA bank account or with a UK debit card), how to cash out, and what this all means for IRS, HMRC or BaFin reporting.

By the end, you’ll have a clear, practical checklist to buy Bitcoin with AED safely – without getting wrecked by scams, bad FX, or compliance mistakes.

Why the UAE is a global crypto hub

Dubai and Abu Dhabi have deliberately positioned the UAE as a regulated digital asset hub, not a wild-west jurisdiction. VARA in Dubai was created specifically to oversee virtual assets and promote the emirate as an international virtual asset hub. ADGM’s FSRA in Abu Dhabi launched one of the first comprehensive digital asset frameworks in the region, including trading and custody rules.

Add in DIFC and the DFSA’s crypto-token regime for institutional players, and you get a layered ecosystem that attracts global exchanges, market makers and Web3 companies. Reports suggest daily active crypto traders in the UAE exceed hundreds of thousands, underlining Dubai’s status as a “Dubai crypto hub”.

Who this guide is for

This guide is for you if.

You’re new to Bitcoin and based in Dubai, Abu Dhabi, Sharjah or elsewhere in the UAE.

You’re a US expat (maybe from Austin or San Francisco) trying to understand how UAE rules fit with IRS crypto guidance.

You’re a UK expat from London or Manchester who knows the FCA and HMRC rules at home but isn’t sure how they intersect with VARA and FSRA.

You’re a German or wider EU expat (Berlin, Munich, Paris, Amsterdam, Madrid) asking “Bitcoin in Dubai kaufen als Deutscher – welche Börsen sind sicher?”

We’ll also touch on how more advanced users including fintechs or exchanges who might need secure cloud, web or mobile-app development partners can think about architecture and compliance.

Steps to buy Bitcoin with AED safely

At a high level, the safest process looks like this:

Pick a licensed UAE crypto exchange that supports AED (Binance FZE, Rain, BitOasis, etc.).

Complete KYC using your Emirates ID, passport and visa.

Deposit AED from a UAE bank account (e.g. Emirates NBD, ADCB, FAB, Dubai Islamic Bank).

Place a BTC/AED market or limit order and confirm your purchase.

Move longer-term holdings to a secure mobile or hardware wallet, and keep records for banking and tax.

We’ll now go deeper into each part.

What is the safest way to buy Bitcoin in the UAE as a beginner?

The safest way to buy Bitcoin in the UAE as a beginner is to use a VARA– or FSRA-licensed exchange that supports direct AED deposits and full KYC, rather than unregulated offshore platforms. Avoid informal Telegram/P2P deals you don’t fully understand and anyone asking you to “send crypto first”. Start with small amounts, enable 2FA, and move longer-term holdings to a reputable hardware or non-custodial wallet. Always double-check URLs and never share your seed phrase with anyone.

What’s the difference for UAE buyers?

For UAE residents, the biggest safety difference is whether the platform is regulated under local UAE frameworks

Regulated platforms (VARA, FSRA, DFSA supervised) must follow AML/KYC rules, segregate client assets, and meet capital and conduct requirements.

Unregulated offshore platforms can disappear, block withdrawals, or run risky practices without meaningful recourse.

For a beginner in Dubai or Abu Dhabi, that often means prioritising a UAE crypto exchange list including Binance FZE, Rain, BitOasis or other entities that have at least a minimum approval from VARA or FSRA – rather than chasing tiny fee savings on obscure sites.

Using licensed exchanges (VARA in Dubai, FSRA in Abu Dhabi) for maximum protection

VARA in Dubai and the FSRA in ADGM each run formal licensing regimes for virtual-asset service providers.

Fit-and-proper checks on key individuals

Requirements to segregate client assets

Ongoing AML, sanctions and transaction-monitoring duties

Mandatory disclosures and incident reporting

If you’re unsure, look for

A Dubai VARA crypto license in the footer or legal section

FSRA licensing disclosures for ADGM-based exchanges

A DIFC/DFSA license if the platform is serving more professional or institutional clients

On the B2B side, exchanges often work with specialist web development and cloud consultancies to meet these obligations. If you operate or plan a crypto product yourself, firms like Mak It Solutions can help with secure web development services and business intelligence dashboards so compliance reports are not a spreadsheet nightmare. makitsol.com+2makitsol.com+2

Basic security checklist for beginners.

At user level, some simple rules go a long way:

Use a unique, strong password for your exchange and email (long passphrases > short complex gibberish).

Turn on 2-factor authentication (2FA) using an authenticator app, not SMS.

Bookmark the official exchange URL, and never log in via random email or Telegram links.

Treat any “support agent” DM asking for your seed phrase or remote access as a scam.

For larger holdings, consider a hardware wallet and store the seed phrase offline in two secure locations.

Many of these good practices overlap with general cybersecurity and SOC 2-style controls that Mak It Solutions helps enterprises implement for cloud and AI workloads – the principles are similar, just scaled up. makitsol.com+1

How can I buy Bitcoin in the UAE step by step using an AED bank account?

To buy Bitcoin in the UAE with an AED bank account, first choose a licensed UAE exchange that supports AED deposits and open an account. Complete KYC using your Emirates ID, passport and residency documents, then link your bank (for example Emirates NBD, ADCB, FAB, Dubai Islamic Bank) and transfer AED via bank transfer or local payment rail. Once your funds arrive, place a market or limit order for BTC/AED, then decide whether to keep it on the exchange or move it to a personal wallet. Keep screenshots and transaction records for your own tracking and any future tax reporting in your home country.

Choose a UAE crypto exchange that supports AED

Shortlist regulated platforms that:

Offer a BTC/AED spot pair

Accept AED bank transfers

Are licensed/registered with VARA, FSRA or DFSA

Names you’ll commonly see in a UAE crypto exchange list include Binance FZE (Binance UAE), BitOasis, Rain, OKX, Bybit, Crypto.com and MEXC, plus more niche players. Each has different fee structures, KYC flows and app UX.

If you ever run a crypto product or fintech yourself, a partner like Mak It Solutions can support front-end development, back-end services, and mobile app development for compliant trading and wallet interfaces serving US, UK and EU users. makitsol.com+3makitsol.com+3makitsol.com+3

Create your account and complete KYC

When you sign up, expect to provide:

Emirates ID

Passport

UAE residence visa (if applicable)

Proof of address (DEWA/ADDC bill, bank statement, tenancy contract)

Many platforms now require a selfie or short liveness video, plus declarations about your source of funds (salary, savings, business income, etc.). This isn’t optional: UAE regulators treat Bitcoin as a virtual asset within their AML/KYC perimeter, just like securities or FX.

Deposit AED from your UAE bank account

Once verified, go to “Deposit / Funding” and select AED.

Common options.

Local bank transfer (Emirates NBD, ADCB, FAB, Dubai Islamic Bank, Mashreq, etc.)

Occasionally instant payment rails or internal account numbers

Sometimes third-party payment processors (check their reputation)

If you’re a US expat with a Chase or Bank of America account, you can:

Send USD wire to your UAE bank

Convert USD to AED, then fund your exchange

Watch for MCC crypto blocks on US cards if you try to pay exchanges directly

For UK expats, Revolut, Monzo or Lloyds can send GBP to the UAE, where it’s converted to AED; German and EU expats often rely on SEPA transfers from banks like Deutsche Bank or N26 to a UAE account, then AED into the exchange. Just factor in FX spreads and transfer fees.

Place a BTC/AED order (market vs limit) and confirm your first purchase

With AED in your account.

Find the BTC/AED pair.

Market order = you buy instantly at the best available price (simple, but spreads may be wider).

Limit order = you set the maximum price you’re willing to pay (more control, but may not fill immediately).

For a first purchase, many beginners use a small market order to get comfortable. Check the all-in cost: trade fee + spread + any funding/withdrawal fees.

Move Bitcoin to a secure wallet

For small “test” amounts, leaving BTC on your exchange is ok. For larger or long-term holdings:

Consider a mobile wallet like a reputable open-source wallet for everyday use.

Use a hardware wallet (offline device) for savings.

More advanced users can explore multi-sig setups so no single key compromise loses everything.

Always back up your seed phrase, never photograph it, and remember: if someone can see or type your seed phrase, they can empty your wallet.

Best Crypto Platforms in the UAE

Binance FZE, BitOasis, Rain, OKX, Bybit, Crypto.com, MEXC & more

The “best” exchange in the UAE depends on your priorities (fees, UX, banking, supported assets). In practice, most beginners in Dubai and Abu Dhabi look at:

Binance FZE (Binance UAE) local entity, deep liquidity, strong BTC/AED markets.

BitOasis long-standing regional exchange with dirham support.

Rain Bahrain-based but serving the GCC, with regulated operations.

OKX, Bybit, Crypto.com, MEXC more advanced features, derivatives, and global liquidity.

Check each platform’s licensing status with VARA, FSRA or DFSA and whether you’re being onboarded to the UAE entity or a foreign one.

Comparing fees, spreads, and liquidity for BTC/AED pairs

When you compare exchanges, don’t just look at headline trade fees.

Maker/taker fees e.g. 0.1–0.2% vs tiered VIP pricing.

Spreads on a quiet exchange, BTC/AED spreads can be wider, pushing up real cost.

Funding fees deposit and withdrawal charges for AED, USD, EUR and GBP.

Hidden FX especially when sending funds from US, UK or EU cards.

In active markets like Dubai, deep liquidity on BTC/AED usually gives competitive pricing, but during volatility you can briefly see noticeable gaps between UAE and global platforms until arbitrage closes the difference.

Features that matter for beginners.

For a first-time buyer, focus on.

Simple, clean mobile apps (iOS and Android) with clear order forms.

Good English-language support and, ideally, Arabic and German where relevant.

Clear fee schedules and a transparent BTC/AED order book.

Multiple funding options: UAE bank transfer, card, and possibly Apple Pay / Google Pay.

Security features: whitelisting withdrawal addresses, device approvals, 2FA, and incident history.

Behind the scenes, many of these apps are powered by modern front-end frameworks, scalable back-end APIs and cloud architectures the same stack Mak It Solutions uses when building financial and analytics platforms for clients in the USA, UK, Germany and EU. makitsol.com+3makitsol.com+3makitsol.com+3

US/UK/German/EU expats.

As an expat, you’ll often have a choice:

Use your existing home-country platform (eToro, Kraken, Coinbase, etc.) with USD/EUR/GBP cards or wires.

Or switch to a UAE exchange, funding with AED and benefiting from local on/off-ramps.

Trade-offs:

Home-country platforms may be easier for IRS, HMRC or BaFin reporting, since they align with your tax residency tools.

UAE exchanges make it easier to move money in and out of UAE banks and prove source of funds to local compliance teams.

For many expats, the solution is a mix: use UAE exchanges for dirham cash-flow, and keep long-term cold storage on platforms or wallets you already track for home-country tax.

Why should I use a VARA- or FSRA-licensed crypto exchange when buying Bitcoin in Dubai?

Using a VARA- or FSRA-licensed exchange means the platform is supervised under UAE virtual-asset rules, must segregate client funds, follow AML/KYC standards and meet capital requirements. This greatly reduces counterparty and fraud risk compared with unregulated offshore sites and makes it easier to prove the source of your funds to banks or tax authorities in the US, UK, Germany or other EU states. In a dispute, you have a local regulator and legal framework instead of a faceless entity in a distant jurisdiction.

What documents do I need to open a crypto exchange account in the UAE?

Most UAE exchanges require an Emirates ID, a valid passport, a UAE residence visa and proof of address such as a utility bill or bank statement. Some platforms also ask for a selfie or short video for identity verification and may request information about your source of funds. Non-resident or visiting users may face stricter limits or have to prove tax residency in another country. Have your documents ready in digital form (PDF/JPEG) to speed up onboarding.

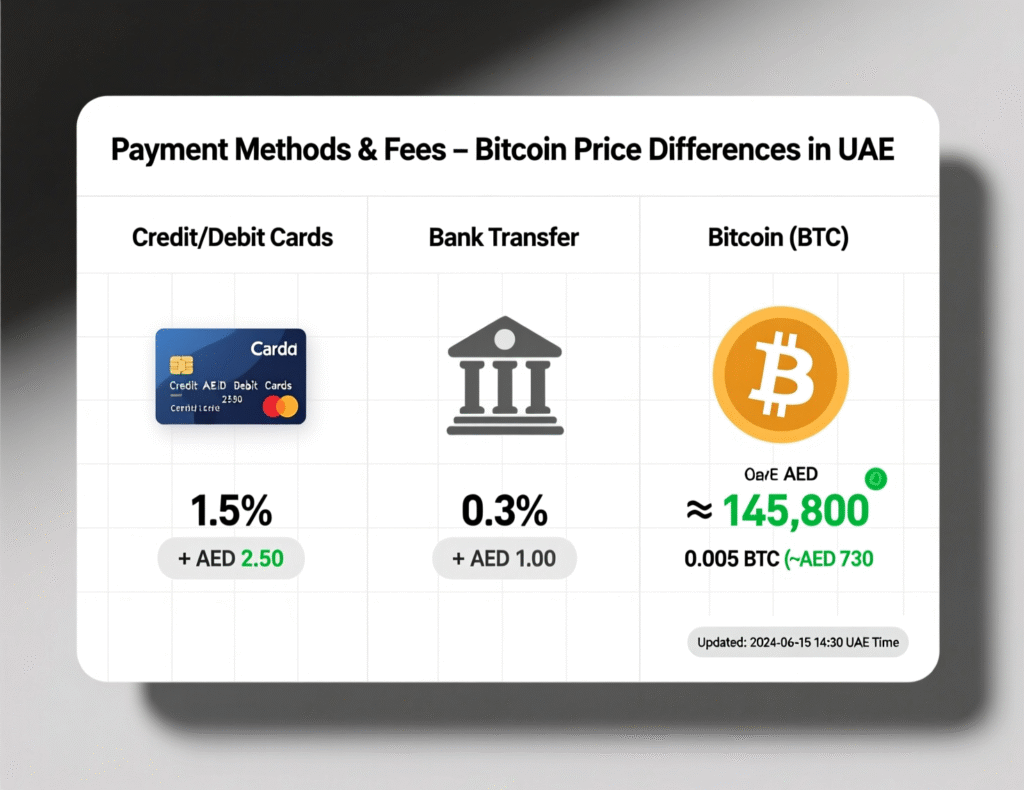

Payment Methods, Fees & Bitcoin Price Differences

Buy Bitcoin in UAE with credit card, debit card, Apple Pay and Google Pay

Many exchanges let you buy Bitcoin directly with credit/debit cards or wallets like Apple Pay and Google Pay. Pros and cons.

Pros

Fast – often instant BTC credit.

No need to pre-fund with a bank transfer.

Cons

Higher fees (sometimes 2–5% plus spreads). [VERIFY LIVE]

For US/UK/EU cards, there may be FX fees and “cash advance” style MCC coding.

Some banks (especially in the US and parts of the EU) still block direct crypto card payments.

For regular investing, many UAE residents prefer lower-cost bank transfers, using cards only for small, urgent purchases.

Bank transfer, SEPA/GBP/USD wires & P2P options for expats

Bank transfer is usually the cheapest way to fund AED balances.

UAE residents: move AED from Emirates NBD, ADCB, FAB, Dubai Islamic Bank, Mashreq via local transfer.

US expats: send USD from Chase or Bank of America to your UAE bank, then convert to AED and fund the exchange; this keeps you inside mainstream rails and makes FBAR/IRS reporting easier.

UK expats: send GBP via Revolut, Monzo, Lloyds, HSBC, let your UAE bank convert, then transfer on.

German/EU expats: use SEPA transfers from Deutsche Bank, N26, etc., then convert EUR to AED.

Peer-to-peer (P2P) marketplaces are an option, but for beginners we strongly recommend sticking to on-platform escrow systems (no off-app WhatsApp deals) and only after you fully understand the risks.

Why does the Bitcoin price differ between UAE exchanges and global platforms?

Bitcoin prices vary between UAE exchanges and global platforms due to liquidity, local demand, AED-FX rates and each platform’s fee structure or spread. Smaller or newer exchanges may quote slightly higher prices to compensate for lower liquidity or to cover costs. In volatile markets, price gaps can widen for short periods until arbitrage traders close the difference. Always compare the “all-in” cost (price + fees + FX) before deciding where to buy, rather than obsessing over the AED to BTC exchange rate today on a single app.

Legality, Safety & Crypto Tax in UAE vs US/UK/Germany/EU

Is Bitcoin legal in the UAE and Dubai? Overview of VARA, FSRA and DFSA rules

Bitcoin itself is not illegal in the UAE; instead, the country has built a multi-layered regulatory system

Dubai VARA regulates virtual-asset activities in most of Dubai outside DIFC, with dedicated Virtual Assets and Related Activities Regulations.

ADGM FSRA runs a detailed Virtual Asset Framework covering exchanges, custodians and intermediaries.

DIFC / DFSA covers crypto tokens within the financial free zone and its capital-markets regime.

For individual investors, this means: yes, you can legally buy and hold Bitcoin via licensed providers, but you must respect KYC, AML and sanctions rules.

Crypto tax in UAE vs US/UK/Germany/EU

For now, the UAE does not levy personal capital-gains tax on individuals disposing of crypto, which is why many traders relocate. [VERIFY LIVE]

However, for expats

USA

IRS treats crypto as property, so selling BTC usually triggers capital-gains tax, even if you live in Dubai.

UK

HMRC’s Cryptoassets Manual explains that UK residents are liable for capital gains on disposals; moving to the UAE may change your residency, but you’ll still have to consider UK rules around deemed domicile, split years, etc.

Germany / EU

German tax offices (Finanzamt) often apply the 1-year holding rule: after one year, some private crypto disposals may be tax-free, but rules are complex and subject to change.

US persons may also face FBAR/FATCA reporting for foreign accounts; UK and EU residents need to watch local reporting thresholds. Always get professional advice.

KYC, AML and data protection.

Licensed UAE exchanges must implement strong KYC/AML controls aligned with global standards. When they process personal data for EU or UK customers, they may also fall within GDPR/DSGVO or UK-GDPR scope, which governs how your data is stored and protected.

Top platforms increasingly adopt frameworks like PCI DSS (for card data) and SOC 2 (for controls over security, availability and confidentiality). This is similar to what strict sectors like the NHS or European public bodies expect from their vendors, and it’s an area where Mak It Solutions frequently helps organisations design compliant cloud, analytics and AI architectures. makitsol.com+2makitsol.com+2

How to avoid crypto scams in the UAE and secure your Bitcoin wallet

Common red flags in Dubai and Abu Dhabi include

“Guaranteed returns” or “VIP signals” promising 20–30% per month.

Fake support agents on Telegram or WhatsApp asking for 2FA codes or seed phrases.

“Investment managers” who want you to deposit AED into a random personal bank account.

To stay safe

Only download apps from official iOS/Android stores.

Never share private keys or seed phrases – not with friends, not with “VARA inspectors”, not with anyone.

For meaningful amounts, use a hardware wallet, keep off-line backups, and test small withdrawals before trusting any new off-ramp.

How do I withdraw my Bitcoin profits to a UAE bank account and convert them to AED?

To withdraw Bitcoin profits to a UAE bank, first sell your BTC for AED on a licensed exchange using a market or limit order. Once the sale settles, initiate a withdrawal to your linked UAE bank account (for example Emirates NBD, ADCB, FAB, Dubai Islamic Bank), ensuring the account name matches your KYC profile. Expect standard compliance checks for larger amounts, and keep records of trades in case your bank or foreign tax authority asks for proof. For US/UK/German/EU expats, consider how FX and home-country capital-gains rules affect your net profit.

Selling BTC for AED on UAE exchanges

When you’re ready to take profit:

Use a limit order if you have a target price and can wait.

Use a market order for faster execution, but be aware of short-term volatility.

Avoid panic-selling on thin liquidity spreads can widen briefly.

Some investors dollar-cost average out of positions over several days or weeks to smooth volatility.

Withdrawing to UAE banks.

Once you hold AED on the exchange

Go to Withdraw / Cash out.

Choose your linked UAE bank (Emirates NBD, ADCB, FAB, Dubai Islamic Bank, Mashreq, etc.).

Ensure the name on the bank account matches your KYC name exactly to avoid delays.

Larger withdrawals may trigger a quick compliance review where you might be asked for trade history or source-of-funds documents.

Cashing out to US/UK/German/EU bank accounts and managing FX fees

If you want profits back in your home-country account:

Sell BTC to AED on a UAE exchange.

Move AED to your UAE bank.

Use international transfers or multi-currency fintechs (Revolut, Wise, etc.) to send funds to the US/UK/EU.

This route lets you shop around for better FX and fees, rather than accepting whatever a crypto exchange offers.

Typical withdrawal limits, compliance reviews and how to avoid account freezes

Every exchange and bank has its own daily/monthly withdrawal limits, often linked to your verification level. To avoid problems:

Don’t mix personal and business flows in the same account.

Keep clear records of deposits, trades and withdrawals.

Avoid sudden, unexplained six-figure transfers from unknown sources.

If in doubt, speak to your relationship manager or compliance team before moving large sums.

Advanced Tips, Common Mistakes & Next Steps for UAE Bitcoin Buyers

Common mistakes beginners make in Dubai and Abu Dhabi

Frequent pitfalls

Jumping into Bitcoin during a FOMO spike without a plan.

Over-leveraging on futures or perpetual swaps right away.

Chasing obscure altcoins instead of understanding Bitcoin first.

Using unregulated Telegram P2P trades for large amounts.

Start small, use spot markets, and learn the basics before exploring leverage or altcoins.

Safely diversifying into other crypto assets

Once you’re comfortable with BTC, you may consider

ETH for exposure to smart-contract ecosystems.

Stablecoins (USDC, USDT, etc.) for parking value in USD-linked assets.

Treat each asset as a separate investment with its own risks, regulatory treatment and potential tax consequences in the US, UK, Germany or EU.

Long-term holding vs active trading for expats

Long-term holders (especially Germans thinking about the 1-year rule) may prefer cold storage and rare rebalancing.

Active traders must track every disposal for capital-gains purposes in jurisdictions like the US and UK, which can be admin-heavy.

Whichever you choose, make sure your strategy matches your risk tolerance, time horizon and reporting obligations.

Ready to buy Bitcoin in UAE today?

Quick pre-flight check.

I understand Bitcoin can go to zero and I can lose money.

I’ve chosen a VARA/FSRA/DFSA-regulated exchange with BTC/AED.

My Emirates ID, passport, visa and address proof are ready.

I’ve planned how to fund (UAE bank, card, or FX from US/UK/EU).

I know where I’ll store BTC (exchange for small amounts, hardware wallet for savings).

I have a basic idea of my home-country tax implications.

If that’s all true, you’re in a good position to make your first small Bitcoin purchase in the UAE.

Key Takeaways

The UAE is a regulated crypto hub, not a free-for-all: VARA, FSRA and DFSA each supervise different zones and activities.

For beginners, the safest path is via a licensed exchange, AED bank transfer, and secure wallet – not anonymous P2P deals.

US/UK/German/EU expats enjoy the UAE’s current 0% capital-gains environment, but usually still owe taxes back home.

Total cost matters more than headline fees: always compare price + spread + funding and FX fees.

Clear records, good security hygiene and compliant off-ramps help avoid bank account issues and tax headaches later.

If you ever build your own crypto or fintech product, partnering with specialists for secure web, mobile and analytics platforms can make regulation and scaling far easier.

If you’re planning a serious Bitcoin position or building a crypto-adjacent product, you don’t have to navigate all the tech, data and compliance questions alone. Mak It Solutions helps organisations in the US, UK, Germany and across the EU design secure, compliant web, cloud, analytics and mobile architectures that play nicely with regulators and banks.

Reach out via the Mak It Solutions Services page to discuss your roadmap, or share your current stack and we’ll help you design a safer, more scalable way to operate around Bitcoin and digital assets. ( Click Here’s )

FAQs

Q : Can foreigners or tourists buy Bitcoin in Dubai without a UAE residence visa?

A : Yes, some exchanges allow non-resident or tourist accounts, but you’ll usually face stricter limits and more manual checks. Expect to provide a passport, proof of address in your home country and sometimes tax-residency details. You may not be able to use all AED funding methods, and P2P platforms can be especially risky for short-term visitors. If you plan to invest more than a token amount, it’s usually easier to wait until you have a UAE bank account and Emirates ID.

Q : Which UAE banks are most crypto-friendly and least likely to block transfers to exchanges?

A : Policies change, but large banks like Emirates NBD, ADCB, FAB, Dubai Islamic Bank and Mashreq generally process transfers to recognised, licensed exchanges – especially where you can show clear source-of-funds and trade history. Some may still automatically block or review card payments coded as “crypto”. To reduce friction, keep amounts proportionate to your income, avoid mixing business and personal flows, and talk to your relationship manager if you intend to move bigger sums.

Q : Are Bitcoin ATMs in Dubai and Abu Dhabi safe to use, and what are their fees?

A : Bitcoin ATMs in malls or near tourist areas can be convenient for small purchases, but they typically charge much higher fees and spreads than licensed exchanges sometimes 5–10% or more. Many also have lower KYC thresholds, which can make it harder to prove your source of funds later. If you do use an ATM, keep receipts and treat it as a convenience, not your main on-ramp. For regular investing, regulated online exchanges with AED funding are usually safer and cheaper.

Q : What is the minimum amount of AED I realistically need to start buying Bitcoin in the UAE?

A : From a technical perspective, you can often start with as little as 50–200 AED worth of Bitcoin, depending on the platform’s minimum order size and fees. It’s sensible to start with a small amount you can fully afford to lose, test deposits and withdrawals, and get used to price swings. Once you’re comfortable with the platform, KYC and wallet operations, you can scale up gradually rather than trying to time the market with a single large buy.

Q : Can I fund a UAE crypto exchange with Revolut, Monzo or N26 and still keep fees low?

A : Yes, many UK and EU expats use Revolut, Monzo, N26 or similar fintechs to send GBP or EUR to a UAE bank, then convert to AED and fund an exchange. The key is managing FX spreads and transfer fees: sometimes sending EUR/GBP and converting at your UAE bank is cheaper; other times, using the fintech’s own FX is better. Test small transfers first, compare effective rates, and always ensure the sender name matches your UAE account and exchange KYC details.