Bitcoin and S&P 500 Year-End Bull Run Loading? Vol Metrics Say Yes

Bitcoin and S&P 500–linked implied-volatility measures have sharply cooled after last week’s spike, signaling a return to steadier market conditions. With expectations for Federal Reserve rate cuts rising, traders are positioning for a potential year-end rally across major risk assets. Bitcoin has reclaimed stability above the $91,000 level, suggesting that dip buyers remain active and broader sentiment is turning constructive again.

At the same time, equity-market volatility continues to ease, helping reinforce a more supportive backdrop for stocks and crypto. Historically, lower volatility combined with improving macro expectations tends to encourage renewed risk-taking. As long as rate-cut odds stay elevated and market stress remains contained, traders believe both bitcoin and the S&P 500 could push higher into year-end, building momentum for a stronger finish to the quarter.

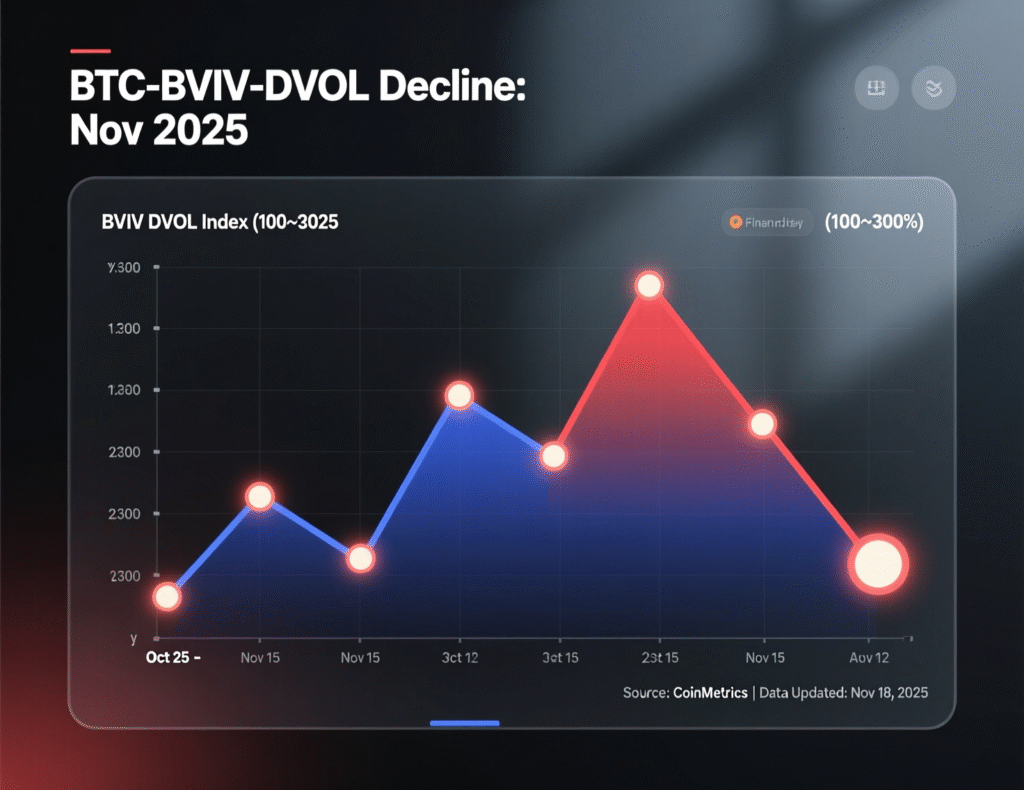

BVIV, DVOL and the VIX: what’s changed

Volmex’s 30-day Bitcoin Volatility Index (BVIV) has fallen back toward the low-50s after jumping near the mid-60s last week, echoing a similar spike-and-fade in Deribit’s DVOL. On the equity side, the VIX retreated into the high-teens after briefly surging in the prior week signaling waning panic and improving risk sentiment.

BTC price recovery and negative vol-beta

Bitcoin’s rebound above $91,000 coincides with the drop in implied vol, underscoring the recent negative correlation between price and volatility. Short-dated put demand has eased alongside calmer markets, reducing downside hedging pressure. The Economic Times+1

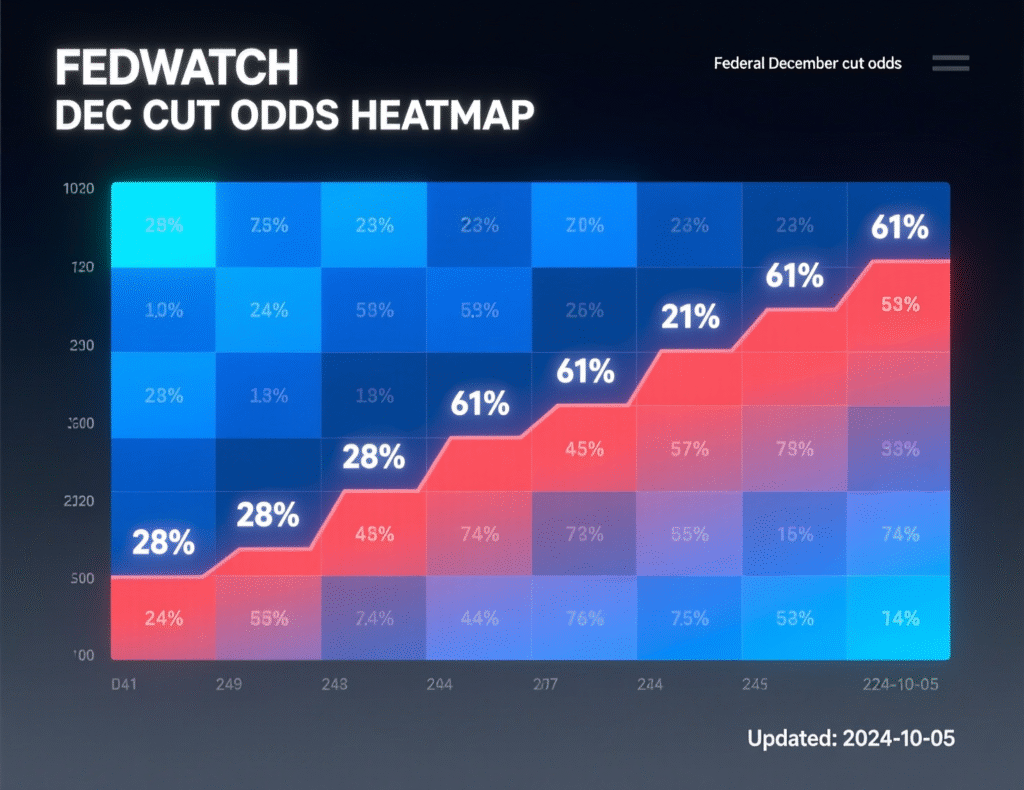

Fed expectations: liquidity impulse returns

Traders now assign roughly 85%–87% odds to a 25 bp Fed cut in December, a sharp swing from about 39% a week earlier. Easier policy expectations typically support risk assets and compress implied volatility, strengthening the setup for a year-end climb in BTC and U.S. equities.

Signals for a bitcoin and S&P 500 year-end bull run

Crypto vol

BVIV and DVOL rolled over from last week’s peaks.

Equity vol

The VIX cooled to ~17–18 after a late-November spike.

Macro

Fed-cut odds surged; the dollar softened both supportive for risk.

Trading implications for a bitcoin and S&P 500 year-end bull run

Lower implied vol, narrower put skews, and improving breadth favor buy-the-dip and call-spread structures over crash protection, though tail-risk hedges may still be prudent into event risk.

Context & Analysis

CoinDesk reports reduced put demand and quotes Derive’s research lead noting sentiment stabilization and cooling volatility. In parallel, Reuters shows rate-cut odds jumping back above 80%, consistent with the decline in implied vol. While seasonality often helps in December, liquidity around holidays and macro headlines can still inject bursts of volatility.

Conclusion

With implied volatility easing and bitcoin holding firmly above $91,000, market conditions are turning more supportive for a continued risk-on move. Rising expectations for a potential December rate cut have strengthened sentiment, giving traders confidence that the broader macro backdrop may stay favorable into the final stretch of the year.

Still, the outlook depends on incoming economic data and Federal Reserve communication. Any surprising signals that revive volatility could slow momentum. But as long as policy expectations remain steady and markets avoid fresh shocks, the bias appears tilted higher, keeping bitcoin and other risk assets positioned for a constructive year-end.

FAQs

Q : Why does falling implied volatility matter?

A : Lower implied vol often signals easing fear and can coincide with rising asset prices as risk appetite returns.

Q : Is bitcoin still above $91,000?

A : Yes, intraday reports show BTC trading north of $91k on Nov. 28, 2025.

Q : What is BVIV and DVOL?

A : They’re 30-day implied-volatility indices for BTC from Volmex (BVIV) and Deribit (DVOL).

Q : Did the VIX really cool off?

A : Data show the VIX back in the high-teens after last week’s spike.

Q : Are Fed rate-cut odds driving the move?

A : Markets price a high chance of a December cut, supporting risk assets and damping vol.

Q : Does this guarantee gains?

A : Non event risk and liquidity can reverse trends quickly; use prudent sizing and hedges.

Q : Where does the phrase “bitcoin and S&P 500 year-end bull run” come in?

A : It describes the potential synchronized rally implied by cooling volatility and higher rate-cut odds, not a certainty.

Facts

Event

Volatility spike fades in BTC and U.S. equities; markets tilt risk-onDate/Time

2025-11-28T11:45:00+05:00Entities

Bitcoin (BTC); S&P 500 (SPX); CBOE Volatility Index (VIX); Volmex BVIV; Deribit DVOL; U.S. Federal Reserve; CME FedWatchFigures

BTC > $91,000; BVIV ~low-50s; VIX ~17–18; Fed cut odds ~85%–87% (Dec meeting) Reuters+5The Economic Times+5CoinDesk+5Quotes

“Volatility is cooling as well… reduced fear and a partial unwind of defensive hedging as rate-cut odds firm.” Dr. Sean Dawson, Derive (via CoinDesk). CoinDeskSources

CoinDesk (feature) + link; Reuters (rate-cut odds) + link; Volmex (BVIV) + link; FRED/YCharts (VIX) + link.