Bitcoin Rebounds Past $91K as XRP ETFs Continue to Grab Attention

Bitcoin surged back above $91,000, showing renewed strength during Asian trading hours after the sharp pullback seen in November. The rebound came as market confidence improved, with traders taking advantage of discounted levels and positioning ahead of potential year-end momentum. The broader crypto market also reacted positively, signaling a shift in sentiment as major assets attempted to recover lost ground.

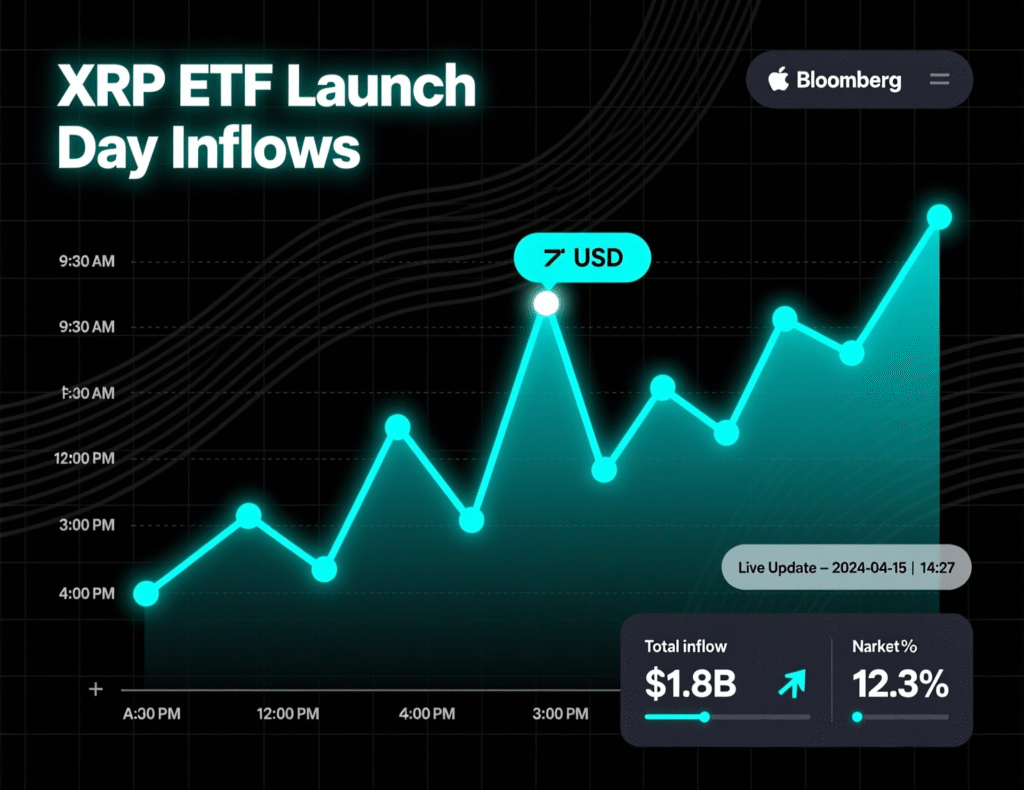

At the same time, newly launched spot XRP ETFs in the U.S. recorded steady capital inflows, adding fresh energy to the altcoin market. These inflows highlighted growing institutional interest in XRP and helped support the overall market tone. Together, Bitcoin’s recovery and XRP ETF demand contributed to a more optimistic outlook, suggesting that investors are gradually regaining confidence after the recent volatility.

Market snapshot: BTC steadies above $91,000

Bitcoin traded around $91,000 in Thursday’s Asian session as global risk appetite improved on expectations of easier U.S. financial conditions. Ether advanced and several large-cap altcoins firmed alongside equities in the region.

XRP ETF flows stand out

Newly launched U.S. spot XRP ETFs attracted significant early demand. Grayscale’s GXRP and Franklin Templeton’s XRPZ drew notable launch-day subscriptions, while total XRP ETF assets quickly climbed into the high-hundreds of millions, according to fund and dashboard data. Yahoo Finance+2SoSoValue+2

Bitcoin rebounds past $91K as XRP ETFs gain inflows: why it matters

ETF flows have been a key transmission channel for crypto market sentiment in 2025. XRP’s strong debut contrasts with softer conditions in BTC after October’s peak, and suggests investors remain willing to rotate into large-cap alternatives when vehicles open.

Positioning and risk appetite

Institutional desks were reported to have reduced BTC risk into year-end, but derivatives positioning shows leveraged traders leaning into a bounce. Market research also notes BTC’s risk-reward profile is the strongest since mid-2023 historically a precursor to accumulation rather than deep capitulation though not a guarantee.

Range expectations into early 2026

Despite the rebound, some banks expect consolidation. Citi analysis cited in recent market commentary points to an $82K–$90K range into early 2026 as sentiment resets following the autumn sell-off.

Context & Analysis

The combination of macro tailwinds (easing yields, firmer equities) and product-specific flow catalysts (XRP spot ETFs) helped stabilize crypto after November’s deleveraging. Sustained upside likely depends on whether ETF inflows broaden back to BTC and ETH and whether macro easing translates into renewed spot demand rather than short-covering.

Conclusion

Bitcoin’s rebound above $91,000 on Thursday, alongside strong initial demand for newly launched XRP ETFs, signaled a cautious improvement in market sentiment. These developments suggested that risk appetite may be stabilizing, offering the market a brief pause after recent volatility and encouraging traders to reassess near-term direction.

Even so, major banks continue to project a range-bound BTC outlook into early 2026, keeping expectations tempered. Traders will now focus on whether the current ETF inflows can maintain momentum and eventually extend to Bitcoin ETFs. Sustained demand would help confirm a more meaningful and lasting shift in the broader crypto trend.

FAQs

Q : What pushed Bitcoin back above $91,000?

A : Improved risk sentiment in Asian markets and supportive macro signals coincided with modest crypto-wide gains.

Q : Which XRP ETFs attracted early inflows?

A : Grayscale’s GXRP and Franklin Templeton’s XRPZ saw meaningful launch-day subscriptions, bringing cumulative XRP ETF assets into the hundreds of millions.

Q : Are flows the main driver of recent price action?

A : Yes. Flows remain a key influence; positioning and desk activity point to tactical trading rather than a long-term structural shift.

Q : How do I track XRP ETF assets over time?

A : Use ETF data platforms like SoSoValue and issuer disclosures for AUM and holdings, then cross-check with exchange volume and flow data.

Q : Will Bitcoin stay range-bound into 2026?

A : Some bank research projects BTC consolidating within the $82K–$90K zone into early 2026 unless fresh catalysts emerge.

Q : Did XRP’s ETF debut outperform Solana’s earlier this year?

A : Early indications suggest stronger initial demand for XRP ETFs compared to Solana’s launch, though comparisons vary by timeframe and methodology.

Q : Is this a new bull phase or just a bounce?

A : It appears to be a bounce for now; confirmation of a new bull phase requires sustained spot demand and broader, consistent ETF inflows.

Facts

Event

BTC rebounds above $91K while U.S. spot XRP ETFs see strong early inflowsDate/Time

2025-11-27T13:10:00+05:00Entities

Bitcoin (BTC); XRP; Grayscale Investments (GXRP); Franklin Templeton (XRPZ); Canary Capital (XRPC)Figures

BTC ~$91K; XRP ETF day-one inflows in tens of millions per fund; cumulative XRP ETF AUM ≈ $600M–$700M range (varies by source/date)Quotes

None verified for direct quotation in this reportSources

CoinDesk (market update), Reuters (macro backdrop), SoSoValue (ETF dashboard), Yahoo Finance (GXRP launch)