Thai Crypto Exchange Bitkub Weighs Hong Kong IPO: Report

Thailand’s largest cryptocurrency exchange, Bitkub, is exploring the possibility of a public listing in Hong Kong. The company aims to raise approximately $200 million through an initial public offering (IPO), which could take place as early as next year, according to sources cited by Bloomberg. This move highlights Bitkub’s ambition to expand its footprint beyond Thailand and tap into broader international capital markets.

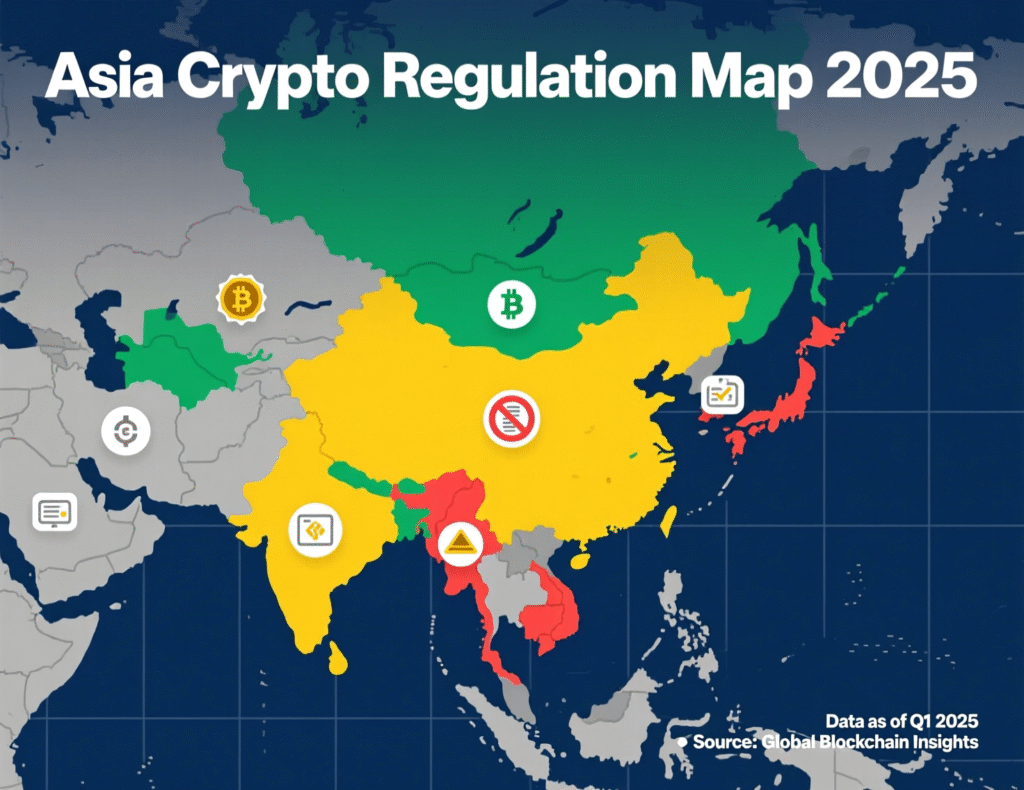

The potential Hong Kong IPO also underscores changing market conditions and regulatory landscapes across Asia. As governments and regulators adapt to the growing influence of digital assets, exchanges like Bitkub are seeking strategic opportunities to secure funding and enhance their visibility. The listing could position Bitkub to better navigate Asia’s evolving cryptocurrency ecosystem while attracting global investors.

Why Hong Kong, Why Now

Bitkub previously explored a domestic IPO, but Thailand’s equity market has underperformed this year, with the SET down about 10% YTD as of late November. Meanwhile, Hong Kong has sought to reassert itself as a regional digital-asset hub, with regulators recently easing rules to allow licensed platforms to share global order books a change aimed at improving liquidity. Bloomberg

What We Know About the Deal

Size & Timing

Roughly $200 million, potentially 2026 (exact timing TBD).

Status

Early-stage; details may change as discussions continue.

Business Footprint

Bitkub, founded in 2018, dominates Thailand’s crypto trading; recent 24h volume typically ranges $55–67 million, led by THB pairs.

Market Backdrop and Competitive Positioning

Thailand’s equities slump and policy uncertainty have weighed on local listings. By contrast, Hong Kong’s Securities and Futures Commission (SFC) and HKMA have articulated a licensing regime for virtual-asset trading platforms, and are refining it to boost market depth. This contrast strengthens the strategic case for a Hong Kong float.

Regulatory Landscape in Hong Kong

Hong Kong runs a mandatory licensing framework for centralized platforms under the SFC, with evolving guidance on custody, KYC, and retail access. Operators must either be licensed or appear on SFC public lists; several global firms recalibrated applications in 2024–2025, underscoring the framework’s rigor.

Potential Implications for Thailand

A Hong Kong listing could diversify Bitkub’s investor base while keeping core operations in Thailand. It may also test cross-border cooperation on supervision and disclosures between Thai and Hong Kong authorities if investor demand spans both markets. (Analysis)

What the Bitkub Hong Kong IPO Could Mean for Investors

Liquidity & Valuation

Access to Hong Kong’s capital pools and VA policy signaling may support pricing.

Regulatory Clarity:

Listing within a mature disclosure regime could enhance governance perceptions.

Risks

Policy shifts, crypto market volatility, and licensing outcomes remain key variables.

Timeline Scenarios for the Bitkub Hong Kong IPO

Base Case

File in 2025–H1/2026 window pending market conditions.

Flex Scenario

Slippage if markets or rules tighten; fund-raising size may adjust. (Analysis)

Context & Analysis

Hong Kong’s recent pivot allowing licensed VATPs to tap overseas order books—targets a core friction: thin local liquidity during risk-off periods. For an issuer like Bitkub, which already has meaningful THB-market depth, a Hong Kong venue could broaden institutional reach while subjecting it to stringent oversight potentially a net positive for investor confidence.

Conclusion

Bitkub’s potential Hong Kong IPO highlights the changing landscape of crypto finance in Asia. With Thai equity markets showing softer sentiment, the exchange is exploring new avenues to raise capital and expand its regional presence. Hong Kong’s regulatory framework for virtual assets, though tightening, remains relatively supportive, making it an attractive option for the listing.

Key upcoming steps include a formal IPO filing, engagement with the Securities and Futures Commission (SFC), and monitoring market conditions heading into 2026. These developments will be closely watched, as they could set the tone for regional crypto investment trends and broader market confidence

FAQs

Q : What is Bitkub considering?

A : A potential Hong Kong IPO to raise about $200 million.

Q : Why choose Hong Kong over Thailand?

A : Weaker Thai equities and clearer VA policy/liquidity incentives in Hong Kong.

Q : When could the IPO happen?

A : As early as next year, subject to markets and approvals.

Q : How large is Bitkub’s trading activity?

A : Recent 24h volume around $55–67 million, varying intraday.

Q : What rules govern Hong Kong crypto exchanges?

A : SFC licensing for VATPs; evolving guidance on custody, KYC, and retail access.

Q : How will the policy change on order-book sharing help?

A : It may improve liquidity by linking to overseas books.

Q : Does the FAQ include the exact term?

A : Yes this potential deal is widely referred to as the Bitkub Hong Kong IPO.

Facts

Event

Bitkub explores Hong Kong IPO (~$200M)Date/Time

2025-11-24T13:30:00+05:00Entities

Bitkub Group; Securities and Futures Commission (Hong Kong); Hong Kong Monetary Authority; Stock Exchange of Thailand (SET)Figures

$200m target; SET ~-10% YTD (Nov 24, 2025); Bitkub 24h volume ~$55–67m (as checked)Quotes

“Bitkub may launch the Hong Kong IPO as early as next year to raise about $200 million.” Bloomberg source (reported) BloombergSources

Bloomberg (report), CoinDesk (coverage), SFC (VATP lists), Reuters (HK rule change) Reuters+3Bloomberg+3CoinDesk+3