Crypto World Wipes Out $1 Trillion After Latest Bitcoin Drop

Bitcoin has fallen to around $88,522, marking its lowest level since April and extending a widespread sell-off across the crypto market. This recent decline has pushed total losses from the October peak to over $1 trillion, highlighting the scale of the market downturn. The drop has affected a broad range of investors, signaling renewed caution among participants as volatility spikes and market sentiment turns negative.

Both retail buyers and publicly listed crypto-treasury firms have felt the impact, with premiums shrinking and momentum fading across key digital assets. As confidence wanes, investors are reassessing positions, and market activity has slowed, reflecting heightened risk aversion. The ongoing slide underscores the challenges facing the crypto market in sustaining gains amid uncertainty.

What happened and why it matters

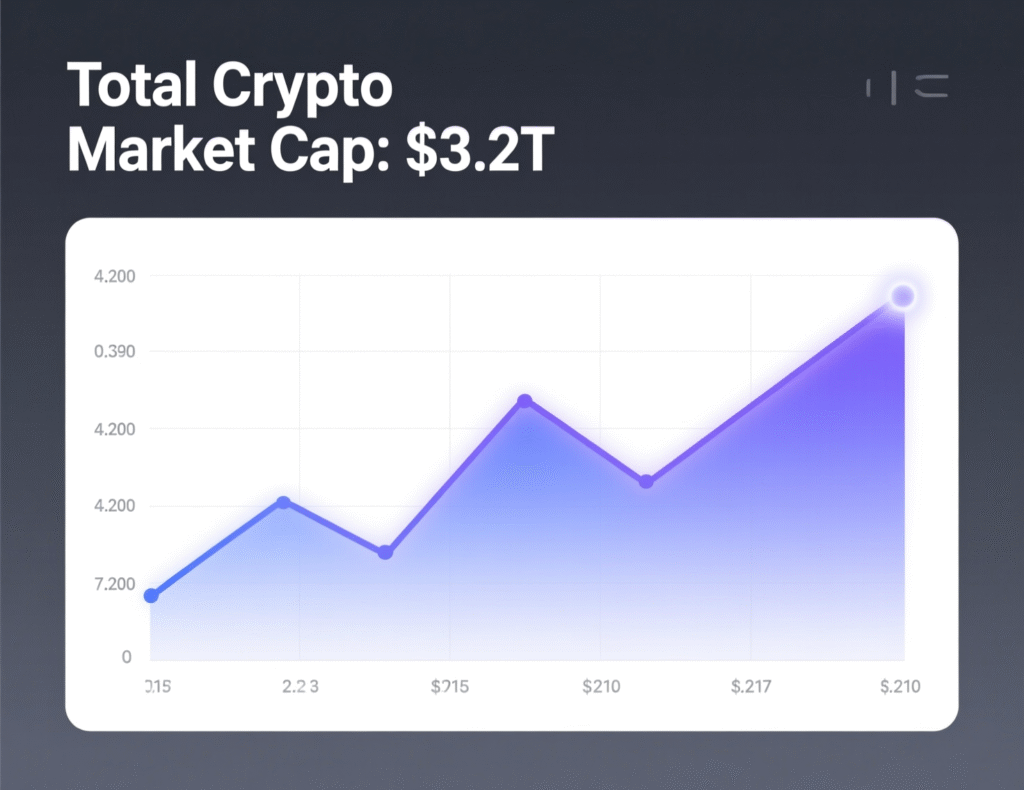

The sell-off accelerated after weeks of fading risk appetite and uncertainty over the path of U.S. rate cuts. The total value of digital assets now sits near $3.2 trillion, versus roughly $4.3 trillion in early October. While prices rebounded modestly alongside upbeat AI-stock sentiment following Nvidia guidance, traders remain focused on the next support levels $85,000 and $80,000 for bitcoin. Bloomberg+1

The leverage unwind behind the slump

Leverage amplified the move: on Oct. 10, crypto venues saw an estimated $19B in liquidations—the largest single-day flush on record triggering margin calls, ETF outflows, and risk controls that curbed fresh buying. That episode revealed how quickly liquidity can evaporate when positioning is crowded.

Ether and majors under pressure

Ether slipped back under $3,000 before stabilizing, giving up a chunk of its summer rebound. Broader majors mirrored the tone, with dominance and correlations shifting as traders reassessed macro drivers and AI-equity spillovers.

Outlook and key levels

Technicians are watching the $85k–$80k area, with April’s trough near $74,425 as a deeper line in the sand. Macro catalysts including policy signals and liquidity conditions—remain central to direction, while positioning and funding rates will dictate the pace of any recovery.

What this crypto market wipeout after latest bitcoin drop means for investors

For long-term allocators, volatility is the cost of exposure to a reflexive asset class. For short-term traders, risk controls matter more than conviction when liquidity thins and basis compresses. Market depth, spreads, and derivatives funding are likely to stay jumpy until leverage normalizes.

Managing risk in a crypto market wipeout after latest bitcoin drop

Stress tends to cluster: when prices gap, liquidity often does too. Use objective triggers (e.g., position sizing, hard stops, collateral haircuts) rather than discretionary “buy-the-dip” instincts that can be overwhelmed by cascade liquidations.

Context & Analysis

Analysts note this downturn follows an October peak above $126k for bitcoin, leaving it nearly 30% below the high. Institutional participation has not insulated the market from classic boom-bust dynamics tied to liquidity, policy expectations, and speculative leverage.

Conclusion

Market sentiment remains fragile, and with leverage still in the process of resetting, near-term volatility is expected to continue. Traders and investors are cautious, reacting to shifts in price and broader market signals, which can amplify short-term swings. The combination of uncertainty and unsettled positions makes price action more unpredictable in the coming days.

For a more durable market base to form, clearer macroeconomic signals will be needed, alongside signs that forced selling has largely subsided. These conditions often take time to materialize, meaning stabilization may be gradual rather than immediate, requiring patience from market participants.

FAQs

Q: What triggered the latest drop?

A : A leverage unwind and weaker macro risk appetite pushed BTC to a seven-month low before a modest rebound.

Q: How big is the loss so far?

A : Roughly $1T in market value has been erased since early October as total cap fell to ~$3.2T.

Q: Did Ether fall too?

A : Yes. ETH briefly slipped below $3,000 amid the broader risk-off move.

Q: Where are the key bitcoin levels now?

A : Traders are watching $85k, $80k, and April’s trough near $74,425.

Q: Is this the start of a bear market?

A : Too early to say; positioning and policy cues will guide trend confirmation.

Q: How do liquidations affect prices?

A : Forced selling can cascade, widening moves and thinning liquidity until leverage resets.

Q: Does the crypto market wipeout after the latest bitcoin drop change long-term theses?

A : Long-term views vary; some institutions remain engaged despite volatility.

Facts

Event

Broad crypto sell-off following bitcoin’s slide to a seven-month lowDate/Time

2025-11-20T13:45:00+05:00Entities

Bitcoin (BTC); Ethereum (ETH); CoinGlass; CoinGecko; Nvidia Corp. (NVDA)Figures

BTC low ~$88,522; total cap ~$3.2T vs. ~$4.3T peak; ~$19B liquidations on Oct. 10 (USD)Quotes

“Largest single-day liquidation event… about $19B.” CoinGlass (data)Sources

Bloomberg; CoinGecko; CoinGlass