Stablecoin Crowdfunding: The 2025 Buyer’s Guide

Stablecoin crowdfunding uses price-stable tokens (e.g., USDC) to collect contributions with faster global settlement, lower fees, and programmable escrow compared to card-based platforms. For most teams, the quickest path is a hosted stablecoin checkout plus a non-custodial, multi-sig treasury governed by a simple smart-contract escrow.

Introduction

Stablecoin crowdfunding is quickly becoming a practical way to raise money online without the friction of card intermediaries and international bank delays. By using USDC (and sometimes USDT) on chains like Ethereum, Polygon, or Solana, campaigns get near-instant settlement, transparent on-chain accounting, and programmable controls while backers avoid the FX slippage and chargeback disputes that plague traditional platforms. In this guide from Mak It Solutions, we’ll show you how to evaluate platforms, accept stablecoin payments with KYC + escrow, and stay compliant across the US, UK, Germany/EU with concrete playbooks for New York, London, and Berlin.

What Is Stablecoin Crowdfunding?

Micro-answer

Uses price-stable tokens (e.g., USDC) for contributions, enabling faster global settlement and programmable escrow vs. card rails.

Quick Definition + How It Differs From Traditional Crowdfunding

Stablecoin crowdfunding means collecting contributions in fiat-pegged cryptoassets typically USDC so values remain close to $1 while funds move on public blockchains. Unlike card-based platforms that batch and settle in days, stablecoin contributions settle in minutes, with on-chain receipts and smart-contract escrow enforcing rules (e.g., milestone releases, refunds, or matching grants).

Key differences vs. traditional crowdfunding

Settlement: minutes vs. 2–7 days (cards/ACH).

Global reach: permissionless wallets vs. country-limited card networks.

Programmability: escrow contracts, milestone logic, and verifiable treasuries.

Disputes: no card chargebacks; refunds are policy/contract-driven.

Core Building Blocks: Wallets, Smart Contracts, Escrow, On/Off-Ramps

Wallets

Non-custodial for transparency (e.g., multi-sig using Gnosis Safe) or qualified custodians for operational simplicity and compliance.

Smart-contract escrow

Holds funds until milestones pass; enables automated refunds.

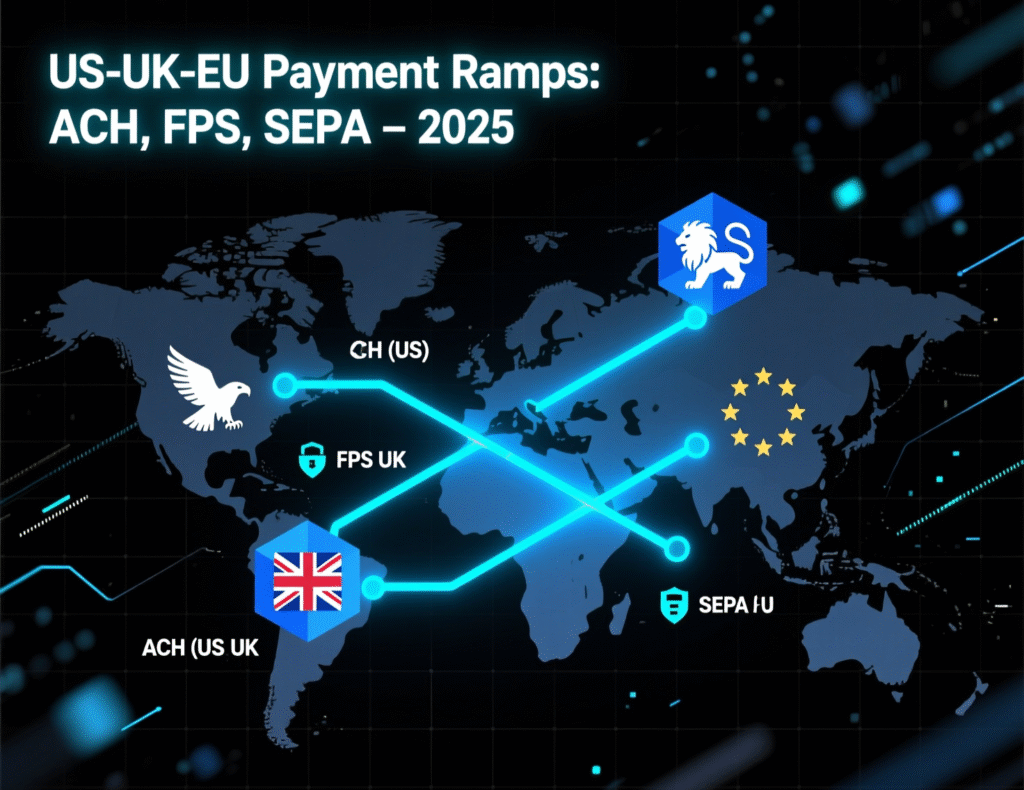

On/Off-ramps

Convert USDC ⇄ fiat via ACH (US), Faster Payments (UK), SEPA (EU).

Analytics & monitoring

Chain analytics (FATF screening), depeg monitors, and treasury dashboards.

When It’s a Fit (Campaign Types: Startups, Creators, Nonprofits)

Startups

Pre-product campaigns that need milestone-based funding and global reach.

Creators

Tokenized perks/NFT editions, transparent revenue splits, community-governed releases.

Nonprofits

Global donations with low fees and end-to-end transparency (public wallet + proofs).

Platforms & Payments Overview

Micro-answer

For fastest go-live, use a hosted checkout + non-custodial treasury with smart-contract escrow.

Comparing Crypto Crowdfunding Platforms (Features, Fees, KYC, Chains)

Below is a snapshot comparison to guide shortlisting. (Always confirm current terms and geography support.)

| Platform | Primary Use Case | KYC/AML | Supported Chains | Escrow Options | Typical Fees | On/Off-Ramp Options |

|---|---|---|---|---|---|---|

| Republic Crypto | Token sales/launches | Yes (issuer & participants) | Ethereum, others | Yes (structured) | Variable | Banking + exchange partners |

| CoinList | Token offerings | Yes (strict) | Ethereum, Solana | Yes | Variable | Exchange off-ramps, eligibility gating |

| Juicebox | Community/creator DAOs | Project-controlled | Ethereum, L2s | Customizable | Platform + gas | Third-party ramps |

| Mirror Crowdfunds | Creative crowdfunds | Typically none for donors | Ethereum | Smart-contract vaults | Creator-defined + gas | Third-party ramps |

| Gitcoin Grants | Grants & public goods | KYC for grantees varies | Ethereum/L2 | Matching pools + rules | Program-based | Limited (crypto-native) |

| Giveth | Nonprofit donations | Minimal for donors | Ethereum, Gnosis | Programmatic | Donation-driven + gas | Third-party ramps |

| Open Collective (Crypto) | Collectives/OSS | KYC for hosts | Multi-chain via partners | Custody/escrow via hosts | Host fees | Bank/crypto integrations |

How to read this

If you need strict KYC + jurisdiction gating (e.g., US securities), shortlist Republic Crypto or CoinList.

If you need creator-friendly crowdfunds with flexible escrow logic, evaluate Juicebox or Mirror and bring your own KYC/analytics stack.

For nonprofits/OSS, Giveth or Open Collective (Crypto) can be a better fit.

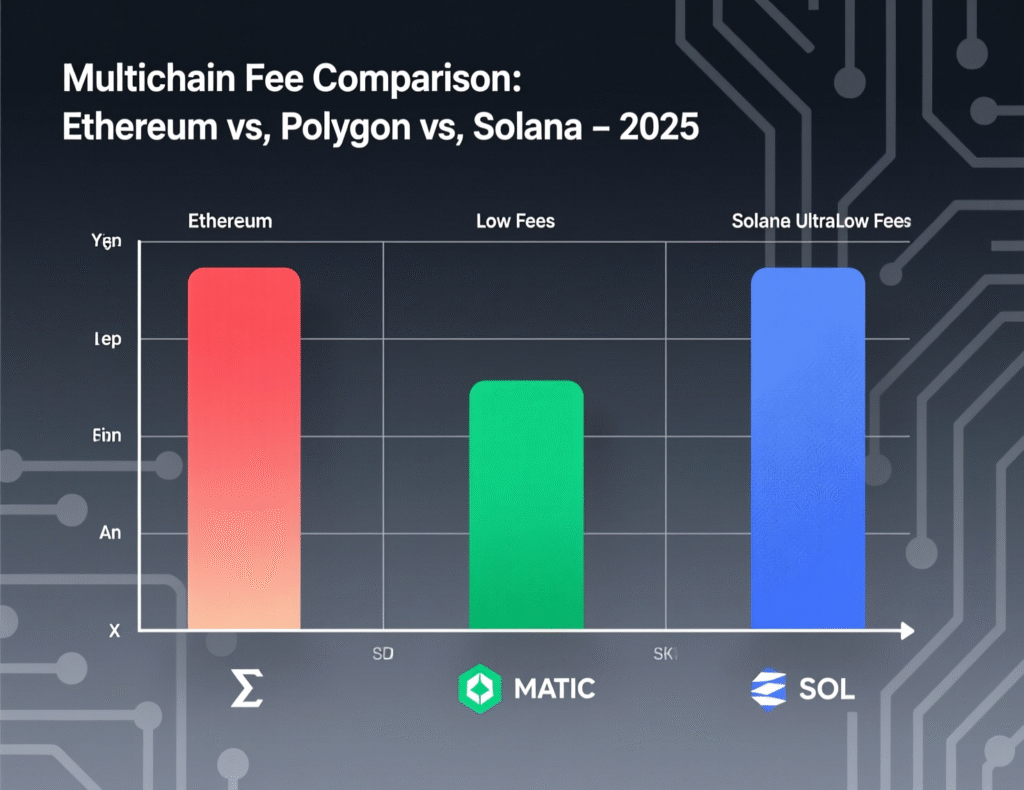

Multi-Chain Options (Ethereum, Polygon, Solana) + Gas Fee Trade-offs

Ethereum (mainnet)

Highest security and ecosystem; gas can spike best for high-value, lower-frequency transactions.

Polygon (PoS / zkEVM)

Low fees and broad wallet support great for retail-scale campaigns.

Solana

High throughput, very low fees good for micro-donations and interactive UX.

L2s (Arbitrum/Optimism/Base)

Low fees with Ethereum security balanced choice for campaigns wanting EVM tooling.

Payment Rails: USDC/USDT Acceptance, Coinbase Commerce/Circle, BitPay

USDC first for transparency and fiat-backed reserves; accept USDT only if your audience requires it.

Hosted checkouts

Coinbase Commerce, Circle (Checkout & APIs), BitPay fastest integration, built-in invoicing, and payment notifications.

Non-custodial treasury

Direct the checkout to a multi-sig controlled by your team; layer smart-contract escrow between checkout and treasury for milestone releases.

Fraud/AML

Add wallet screening and Travel Rule coverage for higher-risk geographies.

How To Launch a Stablecoin Campaign

Micro-answer

Keep rewards as utility/perks; avoid financial-return language unless using a compliant securities path.

Compliance Quick-Check (sidebar)

Are any rewards “profit-sharing” or “return-bearing”? If yes, treat as securities and follow Reg CF/Reg D/Reg A+ (US) or prospectus rules (EU/UK).

Will you market in the UK? Check FCA financial promotions rules.

Targeting Germany/EU? Review MiCA and prospectus triggers.

Set Up USDC Wallets (Team Roles, Multi-Sig Treasury, Custody Choices)

Decide custody

Non-custodial multi-sig (e.g., Gnosis Safe) for transparency and community trust.

Qualified custodian if you need institutional controls, SOC 2 reports, or segregated accounts.

Define roles

Ops signer(s)

Daily disbursements.

Finance signer(s)

Reconciliation, reporting, tax support.

Compliance signer(s)

Approvals for high-risk flows.

Treasury structure

Primary USDC multi-sig (L2 or Solana for fees).

Separate escrow contract holding contributions until milestones pass.

Emergency refund function + timelock on admin changes.

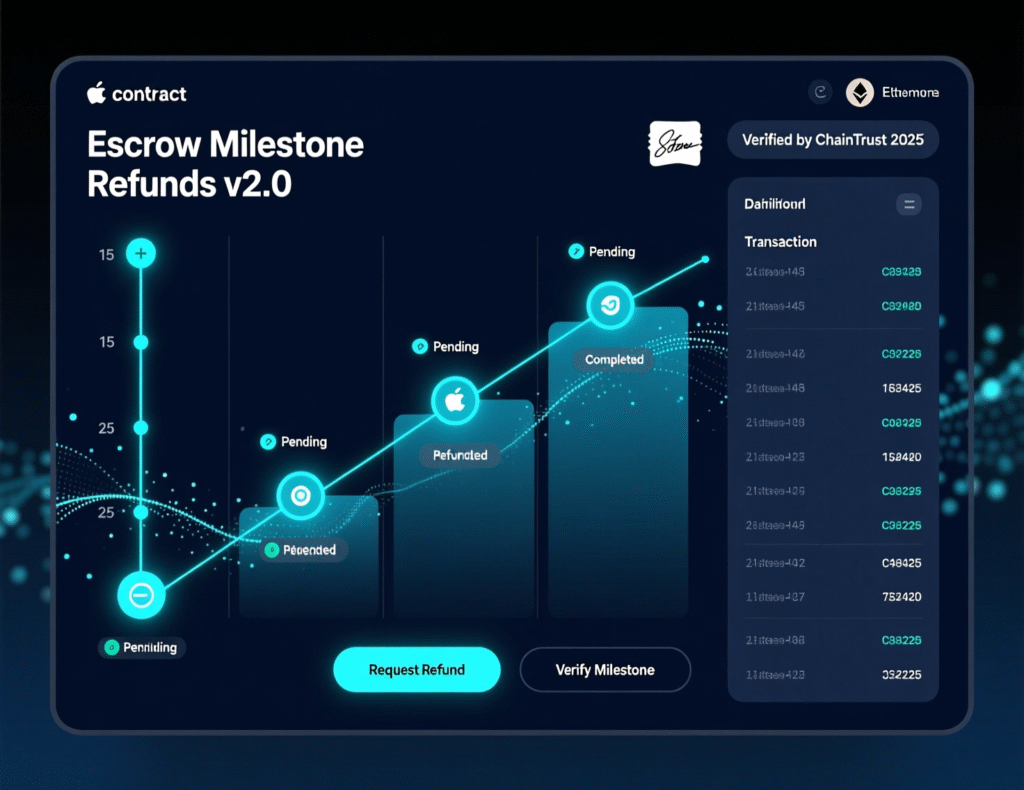

Configure Smart-Contract Escrow, Milestones, and Refund Logic

Milestones

e.g., “Prototype”, “Beta”, “General Release”. Each unlocks a percentage of funds.

Refund paths

Campaign fails

automatic pro-rata refunds.

Scope change:

backers can opt-in or request refunds by deadline.

Compliance triggers:

Pause transfers if sanctions or KYC issues are flagged; use allow-lists for restricted sales.

Audits

Get an independent smart-contract audit; enable continuous monitoring (bug bounties + real-time alerts).

Rewards: Tokenized Perks/NFT Tiers vs. Equity/Revenue-Share Considerations

Best practice

Keep rewards utility-based early access, credits, licenses, NFT badges with perks.

Avoid language implying financial returns, unless you run a compliant securities offering (e.g., Reg CF via a registered portal, Reg D for accredited investors, or Reg A+ with offering circular).

Delivery

Use NFTs or on-chain receipts to track perks; include off-chain fulfillment hooks (e.g., license keys, download links).

HowTo Step Summary

Choose custody (non-custodial multi-sig vs. qualified custodian).

Stand up USDC wallets on your chosen chain/L2.

Deploy audited escrow with milestones + refund logic.

Connect a hosted checkout (Coinbase Commerce/Circle/BitPay).

Layer KYC/AML screening and Travel Rule support.

Publish policy pages (refunds, disputes, risks).

Run a small test round; then open the public campaign.

Fees, Risk & Security

Micro-answer

Use audited contracts + multi-sig signers; enable AML screening and Travel Rule coverage for higher-risk geos.

Total Cost Model: Platform %, Gas, KYC/AML, Audit/Monitoring vs. Stripe

Platform fees

Some platforms take 2–10% of funds raised, depending on features.

Gas/network fees

From fractions of a cent (Solana/L2s) to a few dollars (Ethereum mainnet) per transaction, depending on congestion.

KYC/AML & Travel Rule

Identity verification, sanctions screening, and message-travel obligations can add $1–$5+ per verification depending on vendor and geography.

Audit & monitoring

Smart-contract audit plus continuous monitoring can range from low five to low six figures annually for production programs.

Benchmark vs. Stripe

For international cards, effective fees can exceed 3–5% after cross-border/FX; stablecoin rails often land lower at scale but require compliance tooling.

Fees Calculator (sidebar)

Inputs: target raise, avg contribution, chain (gas), platform %, KYC cost/contributor, audit amortization → Output: blended effective fee % vs. Stripe/PayPal.

Depeg & Volatility Risk Management (Diversification, Real-Time Monitoring)

Diversify

Hold majority in USDC, maintain small buffer in chain gas tokens.

Automations

If a depeg threshold (e.g., 0.995) is detected, pause draws and route to alternative stablecoins or fiat off-ramp.

Treasury policy

Set caps per stablecoin, per exchange, and per bank partner; require multi-sig for any swap/off-ramp events.

Reporting

Public dashboard showing wallet balances, escrow state, and risk status.

Security Controls: Smart-Contract Audits, Multi-Sig, Chain Analytics, SOC 2

Audited contracts with published reports; run bug bounties.

Multi-sig + hardware keys for signers; enforce role-based policies.

Chain analytics for AML and behavioral risk.

Vendors with SOC 2 (and PCI DSS where fiat/card touchpoints exist).

Compliance by Region

Micro-answer

If offering “investment-like” tokens, consult counsel for securities/prospectus rules; keep marketing within local promo laws.

United States: Reg CF/Reg D/Reg A+, SEC/FINRA, FinCEN/OFAC, IRS Basics

Securities

If rewards imply returns, use Reg CF (through a registered funding portal), Reg D (accredited investors), or Reg A+ (public mini-offerings).

BSA/AML

If operating as a money services business, consider FinCEN registration and AML program requirements; always screen for OFAC sanctions.

Tax

The IRS treats crypto as property; contributions may be income or donations depending on facts keep detailed records.

City note (New York)

Some partners may require BitLicense or limited purpose trust co support; plan banking early.

United Kingdom: FCA Financial Promotions, UK-GDPR, HMRC Treatment

Financial promotions

Comms that invite investment need to comply with FCA rules or exemptions; use an authorized approver when required.

Data

Follow UK-GDPR for personal data collected during KYC.

Tax

HMRC guidance covers crypto receipts and VAT implications for perks.

City note (London/Manchester)

Consider Open Banking and Faster Payments for GBP ramps; add .co.uk policy pages for clarity.

Germany/EU: MiCA/ESMA Guidance, BaFin Prospectus & Custody, DSGVO, BMF

MiCA

Sets EU-wide rules for crypto-assets and e-money tokens; check issuer/offeror obligations.

Prospectus/BaFin

If rewards are investment-like, prospectus or securities rules can apply; contact BaFin early.

DSGVO

Handle KYC data under GDPR principles; use EU-hosted vendors if data residency is required.

City note (Berlin/Frankfurt/Paris)

Plan SEPA Instant ramps and local language flows (DE/FR/NL/PT).

GEO Payments & Ops Playbooks

Micro-answer

Offer local ramp options (ACH, Faster Payments, SEPA) + localized KYC flows to boost conversion.

USA (New York, Miami, Austin, SF): On-/Off-Ramps, Banking Partners, Tax Tips

Ramps

ACH (Plaid links) to USDC via regulated partners; instant settlement for backers with Coinbase accounts.

Banking

Prefer crypto-literate banks with clear KYB onboarding; segregate client funds when appropriate.

Tax

Issue year-end summaries; track basis for asset dispositions when swapping to USD.

UK (London/Manchester): Open Banking, Faster Payments, GBP Stablecoins

Faster Payments for quick GBP in/out; explore GBP-backed stablecoins if liquidity fits your audience.

Open Banking can improve conversion and minimize card declines; show GBP pricing next to USDC.

Germany/EU (Berlin, Frankfurt, Paris, Amsterdam, Lisbon): SEPA to USDC, eIDAS 2.0 Signatures, Multilingual KYC

SEPA Instant for near-real-time transfers; convert to USDC via compliant partners.

eIDAS 2.0 trust services for signatures on campaign terms/milestones.

Localization

Provide DE/FR/NL/PT KYC screens and support to lift completion rates.

Trust & Conversion Boosters

Micro-answer

Publish audit badges and a public wallet; add a live escrow progress bar and refunds policy for instant trust.

Proof Points: Audits, SOC 2, GDPR/DSGVO, PCI DSS for Fiat Touchpoints

Host smart-contract audit reports and SOC 2 letters from core vendors.

Show GDPR/DSGVO commitments and PCI DSS scope for any fiat checkout.

Add public wallet addresses and use read-only dashboards for transparency.

Transparent Policies: Refunds, Chargebacks (Card vs. Stablecoin), Dispute Flow

Refund policy

Clear conditions and timelines; automate on-chain execution.

Chargebacks

None on-chain; emulate fairness via dispute resolution and escrow states.

Disputes

Publish a simple, time-boxed process with escalation paths.

Conversion UX: Fees Calculator, Risk Disclosures, Live Chain Analytics Badges

Real-time gas estimator and a blended fees widget.

Risk disclosures (depeg, network risk) above the fold.

Live badges

“Address screened,” “Escrow funded X%,” “Next milestone in N days.”

Implementation Checklist & RFP Template

20-Point Checklist (Security, Compliance, Ops, GEO)

Select chain/L2 and stablecoin (USDC primary).

Configure multi-sig treasury + hardware keys.

Deploy audited escrow with milestones/refunds.

Choose hosted checkout + webhook integration.

Add KYC/KYB, sanctions, and Travel Rule support.

Set depeg monitors and pause rules.

Draft refunds/disputes policy.

Publish risk disclosures and audit artifacts.

Localize KYC and pricing for US/UK/DE/EU.

Integrate on/off-ramps (ACH/Faster Payments/SEPA).

Configure analytics and public dashboards.

Establish incident response runbook.

Enable bug bounty.

Vendor SOC 2/PCI reviews.

Data retention under GDPR/UK-GDPR.

Tax categorization and year-end reporting.

Communications reviewed for FCA/SEC implications.

Test end-to-end refunds.

Run a closed beta with 25–50 backers.

Launch and monitor in real time.

RFP Questions for Platforms & KYC Providers

Platforms

Do you support escrow milestones? What KYC/AML depth and Travel Rule coverage? Which chains and stablecoins? Published audit? Fees breakdown? Jurisdiction restrictions?

KYC Providers

Coverage for US/UK/EU? eIDAS signatures? GDPR data residency? False-positive rate and manual review SLAs? Watchlist sources and sanctions updates?

Integration Map: Wallet, Escrow, KYC, On/Off-Ramp, Analytics

Front-end

Checkout + wallet connect, language switcher.

Back-end

Webhooks → escrow controller → analytics → notifications.

Vendors

KYC/KYB, chain analytics, ramps, audit monitor, logging/alerting.

FAQs

Q : Can nonprofits accept USDC donations and issue tax receipts?

A : Yes Many nonprofits accept USDC and issue donation receipts; the treatment depends on jurisdiction and whether a custodian or fiscal host is used. In the US, a 501(c)(3) can provide tax receipts in USD terms at the time received; in the UK, Gift Aid rules may apply; in the EU, national charity laws vary. Use a compliant ramp or custodian and keep on-chain + fiat records aligned.

Q : Do I need a prospectus for tokenized rewards in Germany?

A : If rewards are purely utility/perk (no profit rights), a prospectus typically isn’t required. If tokens imply returns or redemption at a premium, you may trigger securities or prospectus obligations under BaFin oversight. When in doubt, restrict marketing, avoid return language, or pursue a compliant route with counsel.

Q : What’s the refund policy best practice for stablecoin campaigns?

A : Publish a simple, enforceable policy and encode it in the escrow contract: auto-refund if funding target isn’t met, pro-rata refund on scope changes, and a clear timeframe for manual review. Provide a self-service status page and document how refunds are processed (on-chain address or fiat off-ramp).

Q : Which chains have the lowest gas fees for crowdfunding?

A : Fees fluctuate, but Solana and EVM L2s (e.g., Base, Arbitrum, Optimism) are generally lowest, with Polygon also competitive for consumer-scale campaigns. Ethereum mainnet offers the highest security but higher average fees best for higher-value txns or escrow settlement.

Q : How do Travel Rule requirements affect cross-border backers?

A : For certain cross-border transfers above local thresholds, Travel Rule frameworks require the transmission of originator/beneficiary info between VASPs. Practically, you’ll screen and collect required payer/payee data and may restrict unsupported jurisdictions. Choose vendors with global Travel Rule support to minimize friction.

Key Takeaways

USDC-first with a hosted checkout and multi-sig escrow gets you live fast with strong controls.

Keep rewards utility-only; for return-bearing tokens, use a compliant securities path (Reg CF/Reg D/Reg A+ or EU prospectus).

Blend costs across platform, gas, KYC, and audits; benchmark against Stripe/PayPal with a simple calculator.

Localize ramps (ACH, Faster Payments, SEPA) and KYC to lift conversion in US/UK/EU.

Publish audits, refunds policy, and a live escrow dashboard to boost trust and conversion.

Ready to launch stablecoin crowdfunding with USDC the right way? Our team at Mak It Solutions can blueprint your escrow, compliance stack, and localized ramps in two weeks or less from wallet architecture to refunds logic. Book a free consultation or request a scoped estimate and get a launch-ready plan tailored to US/UK/EU. (Click Here’s )