Grab deepens stablecoin push with StraitsX Web3 wallet and settlements

Grab has signed a memorandum of understanding (MOU) with StraitsX to explore building a Web3-enabled settlement layer and Grab StraitsX Web3 wallet stablecoin settlement across Asian markets.

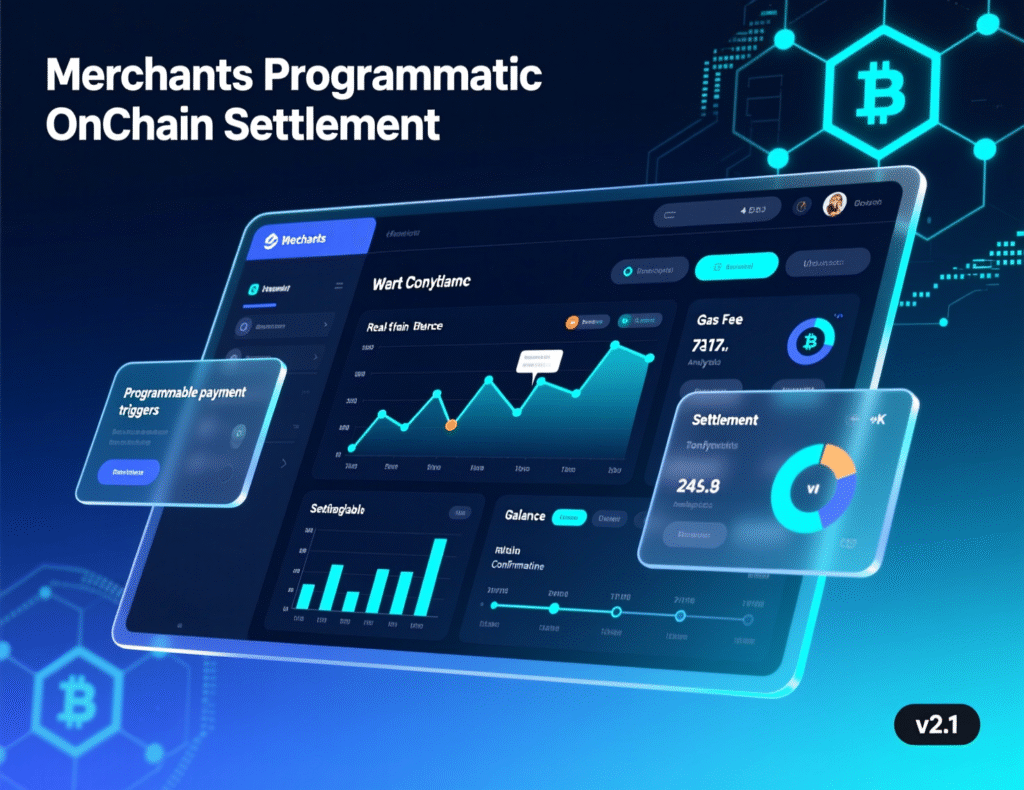

Within the Grab app, users could eventually hold and spend regulated stablecoins (including XSGD and XUSD), while merchants receive programmable, onchain payouts subject to regulatory clearance in each jurisdiction.

Why it matters now

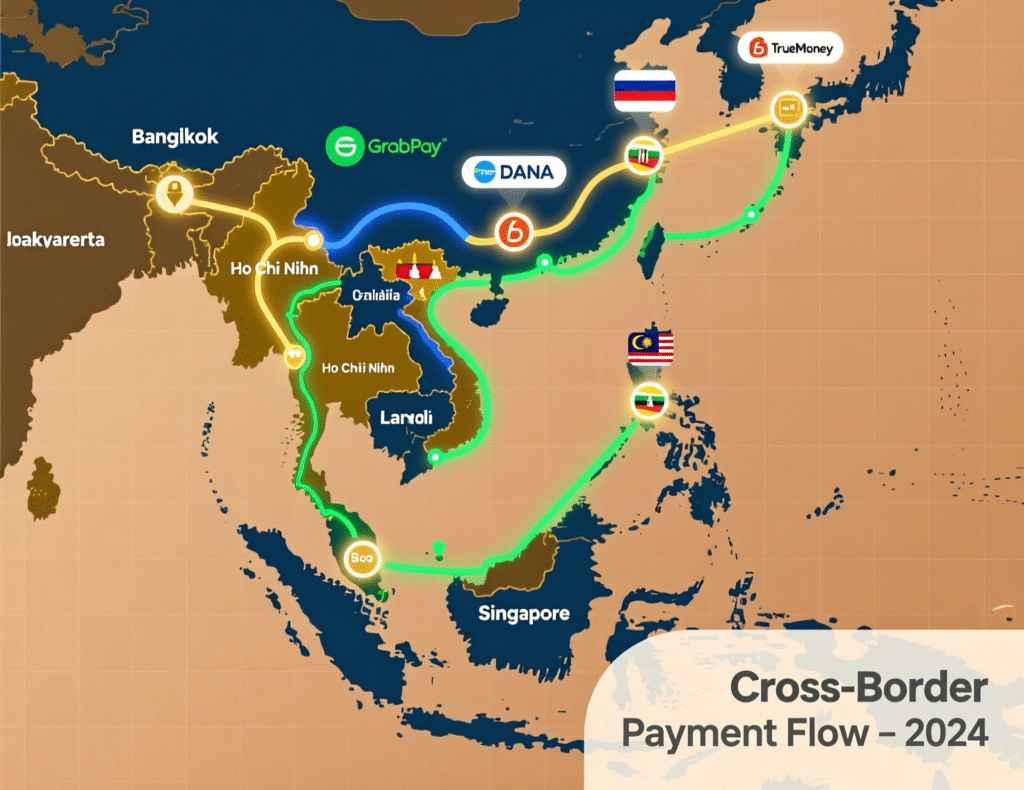

The MOU shifts Grab’s crypto efforts from limited pilots to infrastructure. With operations in eight Southeast Asian markets, Grab’s adoption of a stablecoin-based rail could streamline cross-border retail payments, reduce card fees, and improve liquidity via real-time settlement and treasury tools for merchants. Grab+2The Business Times+2

What the Grab StraitsX Web3 wallet stablecoin settlement means

Under the exploratory plan, Grab would embed a Web3 wallet letting users convert between fiat and stablecoins, pay merchants, and receive funds from external Web3 wallets. StraitsX would support compliant, programmable functionality (e.g., smart-contract clearing), while maintaining custody models aligned with local rules. Exact chain support and go-live timelines were not disclosed.

Timeline and scope for the Grab StraitsX Web3 wallet stablecoin settlement

Now (MOU)

Technical exploration; regulatory engagement in priority markets.

Previous groundwork

2023

Circle x Grab pilot in Singapore introduced the Grab Web3 Wallet and NFT vouchers.

2025

Grab PH enabled crypto/stablecoin top-ups via PDAX/Triple-A, signaling rising consumer readiness.

Next

Phased rollouts contingent on approvals; merchant tooling for programmable settlement and treasury. (No formal dates announced.)

Market and regulatory context

Southeast Asia’s payment landscape remains fragmented; stablecoin rails promise lower-cost, near-instant cross-border transactions. But licensing, e-money rules, and stablecoin frameworks vary by country, so any multi-market launch will hinge on aligning with local supervision.

Background: Grab’s Web3 experiments

Beyond the Circle pilot and PH crypto top-ups, Grab has explored blockchain-based rewards and mapping. In May 2025, Grab partnered with NATIX (a Solana-based DePIN project) on blockchain-powered mapping and AI camera hardware separate from payments but indicative of broader Web3 interest.

Context & Analysis

A unified, StraitsX-powered stablecoin layer could give Grab tighter control over cross-border flows, merchant fees, and settlement risk versus third-party card networks. The key swing factors are regulatory acceptance and interoperability with non-StraitsX wallets and chains. If approvals progress, expect phased merchant categories and corridors starting where stablecoin rules are most mature. (Inference based on stated MOU scope and regional policy trends.)

Conclusion

Grab’s recent MOU highlights its ambition to standardize on-chain payment infrastructure across Asia. The company aims to streamline digital transactions by integrating a seamless and compliant Web3 wallet, enabling users to manage their funds more efficiently while ensuring regulatory adherence. This move reflects Grab’s broader strategy to embed blockchain solutions into mainstream financial services, making digital payments more accessible across its ecosystem.

The successful execution of this initiative, however, will hinge on regulatory approvals and the willingness of merchants to adopt the new system. By enabling programmable stablecoin settlements, Grab envisions a future where everyday transactions are faster, more secure, and more versatile. This development signals a clear commitment to advancing Web3-based payment solutions throughout the region.

FAQs

Q : What is the Grab–StraitsX MOU about?

A : An exploration of Web3 wallets and a stablecoin settlement layer to enable on-chain payments and merchant settlements within Grab, subject to approvals.

Q : Which stablecoins might be supported?

A : StraitsX’s XSGD and XUSD are cited; final support depends on regulatory and technical decisions.

Q : When will users get access?

A : No timeline announced; any launch will be market-by-market after regulatory clearance.

Q : Does Grab already have Web3 experience?

A : Yes. Grab ran a Circle pilot in 2023 (Singapore) and enabled crypto top-ups in the Philippines in 2025.

Q : How could this affect fees and settlement times?

A : Programmable, on-chain settlement could lower acceptance costs and enable near-real-time clearing compared with card networks; details TBD.

Q : Will it work with external Web3 wallets?

A : The MOU envisions interoperability with partner wallets, but supported standards/chains are not yet listed.

Q : Is the Grab–StraitsX Web3 wallet stablecoin settlement safe?

A : Safety will depend on compliance, custody design, and market regulations; StraitsX notes a compliant approach.

Facts

Event

Grab and StraitsX sign MOU to explore Web3 wallets and a stablecoin settlement layerDate/Time

2025-11-18T00:00:00+05:00Entities

Grab Holdings; StraitsX (issuer of XSGD/XUSD)Figures

Tokens referenced: XSGD, XUSD (no volumes disclosed)Quotes

“The MOU outlines plans to collaborate in developing Web3 Wallets that will enable Grab users to spend across markets.” — Grab press statementSources

Grab press release https://www.grab.com/sg/press/others/grab-and-straitsx-sign-mou-to-explore-the-development-of-web3-wallets-and-stablecoin-based-settlement-layer-across-asia/ ; Business Times https://www.businesstimes.com.sg/wealth/crypto-alternative-assets/grab-xsgd-issuer-straitsx-develop-digital-asset-wallets-accept-stablecoin-payments