Crypto-Friendly Countries Regulations: A 2025 Guide

Introduction

Crypto founders and funds in 2025 want one thing: predictability. The most crypto-friendly countries pair clear rules with workable licensing and fair tax. This guide compares the EU’s MiCA passporting, the UK’s stablecoin plans, Switzerland’s FINMA framework, and Portugal’s 2025 tax rules then adds Dubai VARA and a US bonus (Wyoming) with a simple selection matrix and 5-step checklist.

In short

if you’re choosing a base this year, you’re balancing regulatory clarity, licensing scope, and tax outcomes across a handful of leading hubs.

What Makes a Country “Crypto-Friendly”?

Two-sentence answer (AEO)

A crypto-friendly country provides clear, enforced rules for issuance, exchanges, custody, and stablecoins plus a fair tax regime on gains, staking, and NFTs. In 2025, founders should prioritize regulatory clarity, passporting reach, prudential standards, and predictable taxation over mere “permissiveness.”

Regulatory clarity vs. permissiveness

Think of a “friendly” jurisdiction as one where you can get authorized and stay authorized. Clarity beats laxity: the EU’s MiCA sets uniform rules, timelines, and transitional paths; Dubai’s VARA publishes activity-specific rulebooks and a public register; Switzerland codified DLT-securities and bankruptcy-remote custody.

In contrast, regimes that are “easy” but vague often create bankability and investor-confidence problems later. For example, ESMA has emphasized consistent authorizations and transitional measures under MiCA to avoid uneven standards across the EU.

Actionable rubric (2025)

Is there a single, official licensing path for exchanges/custody/issuance?

Can authorization be reused across borders (passporting)?

Are prudential, conduct, market-abuse, and whitepaper rules explicit?

Is there a live public register of licensed firms?

Are tax rules for short-/long-term gains and staking clear?

Licensing scope: exchange, custody, token issuance (VASP/CASP)

Scope matters. Under MiCA, “crypto-asset service providers” (CASPs) cover exchange, custody, execution, advice, and more with harmonized authorization across 27 EU states and a transitional path to 1 July 2026 for firms active pre-30 Dec 2024 (subject to each Member State’s choice).

In Dubai, VARA licenses distinct activities Advisory, Broker-Dealer, Custody, Exchange, Lending & Borrowing, Management & Investment, Transfer & Settlement, and Issuance through modular rulebooks and paid-up capital tiers. Switzerland uses FINMA licensing under existing financial laws plus the DLT-trading facility category introduced by the DLT Act.

Tax treatment: gains, staking, NFTs, DeFi

Tax is increasingly standardized: Portugal taxes short-term gains (<365 days) at 28%, exempts gains on assets held ≥365 days, and generally taxes staking “investment income” at 28% when converted to fiat while business activity can be taxed under Category B with specific simplified-regime bases. Similar clarity is emerging elsewhere, but founders should still verify local staking/NFT/DeFi nuances and reporting triggers each year.

EU MiCA Regulation Explained

Two-sentence answer (AEO)

MiCA (Regulation (EU) 2023/1114) harmonizes EU rules for crypto issuance and services, applying stablecoin (ART/EMT) rules from 30 June 2024 and the remainder from 30 December 2024. CASPs authorized in one Member State can “passport” across the EU, with transitional provisions up to 1 July 2026 for pre-existing firms (subject to national choices).

Who MiCA applies to and what’s in scope

MiCA applies to issuers of crypto-assets (including asset-referenced tokens ARTs and e-money tokens EMTs) and to CASPs (exchange, custody, execution, advice, portfolio management, transfer services, etc.). It sets conduct, governance, prudential, market-abuse, and disclosure duties, alongside whitepaper obligations for public offers/admissions. Titles III–IV (ARTs/EMTs) have applied since 30 June 2024; remaining provisions apply from 30 December 2024.

Stat/Entity context (GEO): ESMA coordinates authorization practices; the EBA issues RTS/ITS and supervises significant ARTs/EMTs (sARTs/sEMTs) and non-EU currency usage reporting; the ECB and ESRB weigh systemic risks and monetary-policy effects of stablecoins.

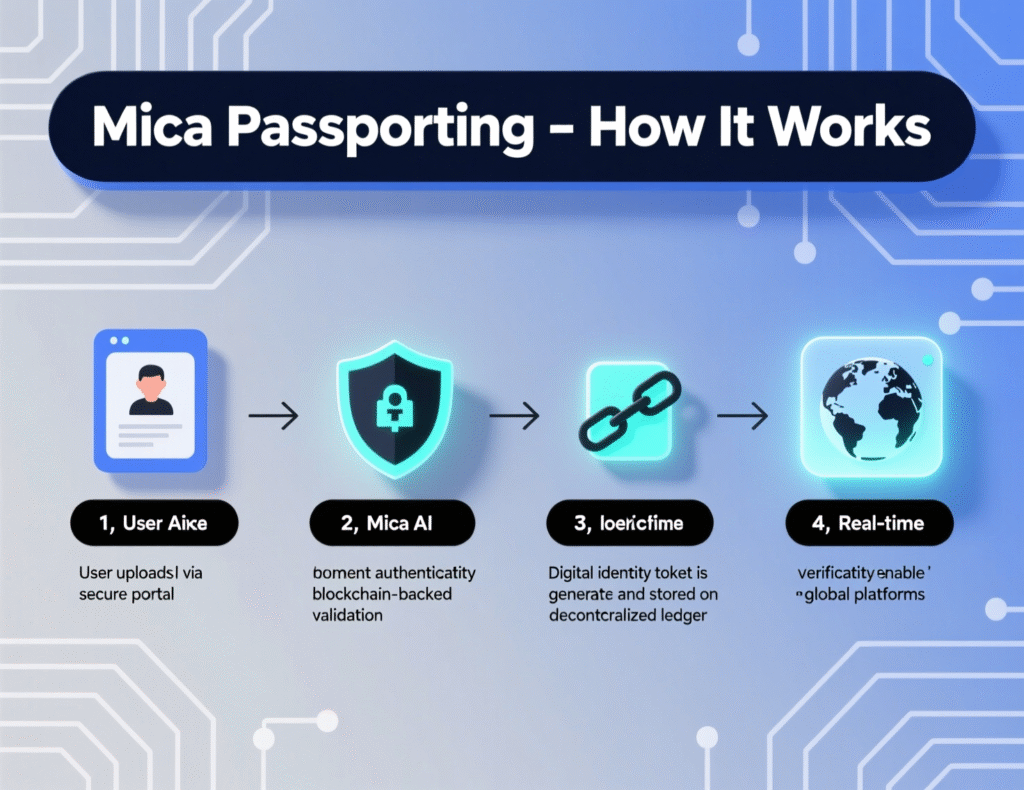

Passporting & authorization: how it works

Authorize once, access the whole EU market: a CASP license obtained in one Member State enables cross-border services (“passporting”) across the EEA. During the transitional regime (Article 143), firms already operating under national regimes before 30 Dec 2024 may keep operating until 1 July 2026 or until authorization is granted/refused though Member States can shorten or opt out, so deadlines vary. Strategy: prepare full CASP documentation early to avoid NCA bottlenecks and inconsistent national cut-offs.

Prudential, conduct & whitepaper duties

Expect own-funds (capital) requirements, governance/fit-and-proper, conflicts and market-abuse controls, and whitepaper disclosures for offers/admissions. ART/EMT issuers face reserve, redemption, and reporting rules, with the EBA publishing RTS/ITS (e.g., for non-EU currency use, supervisory colleges, significant issuers). Compliance teams should map these duties to product scope (e.g., spot exchange plus staking) and ensure internal control functions are resourced.

UK Stablecoin Regulation 2025

Two-sentence answer (AEO)

The UK proposes a dual-regime: FCA supervises non-systemic fiat-backed stablecoin issuance and custody, while Bank of England (BoE) oversees systemic stablecoins (recognized by HM Treasury), jointly with the FCA on conduct. Draft Statutory Instruments were published in April 2025, followed by FCA and BoE consultations setting out authorization, prudential, and payment-chain obligations.

Systemic vs. non-systemic: BoE vs. FCA roles

Non-systemic issuers/custodians

authorized and supervised by the FCA (issuance, custody, conduct, safeguarding).

Systemic

(HMT-recognized): BoE prudential/financial-stability regime + FCA conduct oversight a joint model aimed at payment-system resilience. The BoE’s November 2025 consultation outlines expectations for sterling-denominated systemic stablecoins.

Example

A UK wallet/custody provider dealing only with “qualifying” sterling stablecoins would fall to the FCA; if the token scales to systemic importance, it transitions into the BoE regime (with the FCA retaining conduct supervision)

Issuance, custody, and payment-chain obligations

April–September 2025 materials (HMT draft SI, FCA CP25/14 and CP25/25) set the perimeter: new RAO activities for issuing qualifying stablecoins, safeguarding qualifying cryptoassets, and custody plus rules for use in the payment chain. Firms should prepare safeguarding/segregation models, redemption mechanics, and operational resilience aligned to BoE/FCA expectations.

Timelines, consultations, and who should prepare now

Now–H1 2026 (indicative)

Expect final SIs and Handbook changes to stage in; firms planning UK issuance/custody should gap-assess policies and capital.

Practical tip

Treat “systemic designations” as a moving target plan for BoE-grade reserve governance even if you launch non-systemic. Watch ECB/ESRB commentary too, since cross-border flows can ripple into the UK market.

Switzerland’s Crypto Regulation

Two-sentence answer (AEO)

Switzerland’s “Lex DLT” updated ten laws to enable ledger-based securities and DLT trading facilities, while FINMA guidance clarifies bankruptcy-remote custody and staking segregation. This legal certainty plus deep banking/wealth infrastructure makes “Crypto Valley” a favorite for tokenization and custody startups.

DLT-securities & DLT trading venues

The DLT Act introduced ledger-based securities (Registerwertrechte) in the Swiss Code of Obligations (Art. 973d et seq.) and a DLT trading facility license under FMIA. In March 2025, FINMA granted the first DLT trading facility license to BX Digital (Boerse Stuttgart Group) a milestone for on-chain market infrastructure.

FINMA licensing & custody guidance

FINMA’s bankruptcy segregation framework (Dec 2023) clarifies that properly custodied cryptoassets are segregable from a bankrupt estate; staking guidance underscores segregation expectations and potential banking-license touchpoints. 2025 supervisory communications further refine disclosure/reporting for “cryptobased assets.” These rules give institutions and clients confidence on custody risk a key board-level concern.

Why “Crypto Valley” attracts startups

Beyond rules, Switzerland offers

A stable banking system with growing digital-asset services;

Experienced service providers (audit, legal, tokenization);

A pragmatic, principle-based regulator (FINMA) with public guidance on staking, custody, and AML. For founders targeting tokenized equity/debt and institutional custody, Switzerland’s mix of clarity and prestige is hard to beat. For a comparative overview, see GLI’s Switzerland chapter.

Portugal Crypto Tax 2025

Two-sentence answer (AEO): Portugal taxes short-term crypto gains (<365 days) at 28%, while long-term gains (≥365 days) are exempt for individuals; staking income is generally taxed at 28% when converted to fiat, and business activity can be taxed under Category B with specific bases. Reporting rules and transitional provisions stem from the 2023 State Budget Law (Law 24-D/2022) and subsequent Finance Ministry instruments.

Short- vs long-term gains and rates

<365 days: 28% flat capital-gains tax (option to aggregate at progressive rates).

≥365 days: Exempt from IRS for individuals

Crypto-to-crypto and NFT disposals

Commonly not taxed until conversion to fiat, per professional summaries and recent AT clarifications; always check current AT guidance.

Example

An investor buys ETH on 1 Jan 2024 and sells on 2 Jan 2025 gain is exempt (held ≥365 days). Sell instead on 1 Dec 2024 and the gain is at 28%. (Law 24-D/2022 created the crypto regime; IRS Article 10 and AT materials address holding-period counting.)

Staking/yield, NFTs, and business activity

Staking/yield

Often classed as investment income (Category E) taxed at 28% when converted to fiat; DeFi nuances vary by fact pattern.

Professional/business trading or mining (Category B)

Simplified regime may tax a percentage base (e.g., 15% of gross for trading; higher base for mining).

Stamp tax

Can apply to gratuitous transfers (donations), with exemptions for close family. Keep FIFO records; note IRS reporting schedules.

Residency, NHR/alternative regimes & compliance

Portugal’s special regimes evolve; NHR has been narrowed. Before relocating, model worldwide income, ensure banking on-ramp/off-ramp, and confirm reporting obligations (e.g., foreign accounts). Practical move: engage a local tax advisor versed in the 2023-2025 crypto changes and verify any “exemption” claims against AT’s latest circulars.

Global Snapshot & Decision Framework

Dubai VARA licensing: categories, steps, supervision

Why Dubai

A single virtual-asset regulator (VARA) covering most of Dubai (outside DIFC), activity-specific rulebooks, public VASP register, and published paid-up capital ladders. Activities include Advisory, Broker-Dealer, Custody, Exchange, Lending & Borrowing, Management & Investment, Transfer & Settlement, and Issuance. Applicants follow a two-step licensing process; enforcement actions and notices are public. As of Dec 2024, third-party trackers counted ~23 licensed VASPs

Example

Tokenization studio + custody partner can combine VA Issuance (Category) with Custody (either in-house if licensed or via a licensed custodian), meeting minimum capital per rulebook.

US bonus: Wyoming (DAOs, sandbox, state initiatives)

Wyoming recognizes DAO LLCs (Wy. Stat. §17-31-101 et seq.), allowing member-managed or algorithmically managed forms with smart-contract identifiers in articles. You don’t need to live in Wyoming, but you do need a registered agent; filing fees and specifics are published by the Secretary of State. Caveat: this is state-level entity law, not a federal token-offering safe harbor securities and money-transmission laws still apply.

Comparison matrix + 5-step selection checklist

| Factor | EU (MiCA) | UK (Stablecoins) | Switzerland (FINMA) | Dubai (VARA) | Portugal (Tax) |

|---|---|---|---|---|---|

| License scope | Full CASP menu | Stablecoin issuance/custody focus; broader crypto coming | DLT-facility + existing licenses | 8 VA activities + Issuance | Tax regime only |

| Cross-border reach | EEA passporting | UK only; BoE systemic layer | Global reputation; no passport | Regional hub; public register | EU resident tax rules |

| Stablecoin rules | ART/EMT since 30 Jun 2024 | Dual: FCA vs BoE systemic | Emerging CHF initiatives; custody clarity | Activity-based + capital tiers | — |

| Custody clarity | Yes (CASP + market-abuse) | Yes (safeguarding/custody) | Bankruptcy segregation (2023) | Custody Rulebook + capital | — |

| Tax headline | Member-state tax | UK tax (separate) | Swiss tax (separate) | UAE tax (separate) | 28% <365d, 0% ≥365d |

Map your stack

Issuance, exchange, custody, staking, payments.

Choose passport vs. hub

Need EU-wide reach (MiCA) or a single hub (UK/CH/Dubai)?

Model prudential & ops

Capital, safeguarding, governance, tech risk.

Run tax scenarios

Trading vs. treasury vs. staking income (Portugal or alternatives).

Sequence licenses

E.g., start Dubai issuance + EU CASP; or Swiss custody + EU distribution.

Summary & Key Takeaways

Crypto-friendly countries 2025 are those with clear, enforceable rules not necessarily the loosest.

MiCA = EU-wide clarity + passporting; stablecoin titles already live; main CASP rules fully applicable since Dec 2024 with transitional paths to July 2026.

UK splits stablecoins: FCA (non-systemic) vs BoE (systemic) plan for both tracks.

Switzerland leads on DLT-securities and custody segregation, now with a live DLT venue (BX Digital).

Portugal offers a simple tax logic: 28% short-term; exempt long-term; staking taxed on fiat conversion.

Building in or relocating to a crypto-friendly jurisdiction in 2025? Mak It Solutions helps founders map licensing, product scope, and tax exposure into an actionable go-to-market plan. Get a free 30-minute consultation with our compliance specialists or request our jurisdiction comparison matrix + readiness checklist. Contact us through the form below.( Click Here’s )

FAQs

Q : Do I need an EU entity to benefit from MiCA passporting?

A : Yes MiCA authorization is obtained from an EU/EEA national competent authority; a CASP license in one Member State enables cross-border services via passporting. Transitional provisions let pre-existing firms operate to 1 July 2026 (subject to national choices), but you still need to apply for full authorization and meet capital, governance, and conduct standards. If you’re non-EU, plan for an EU subsidiary, local leadership, and on-shore compliance functions to satisfy NCAs.

Q : Are crypto-to-crypto trades taxed differently in Portugal in 2025?

A : Typically, crypto-to-crypto trades are not taxed until you convert to fiat; short-term fiat disposals (<365 days) are taxed at 28%, while long-term (≥365 days) gains are exempt for individuals. Staking income generally becomes taxable when converted to fiat. Keep FIFO records and confirm annual AT circulars before filing.

Q : Can a UK firm serve EU clients without MiCA authorization?

A : Only in limited circumstances (e.g., reverse solicitation within tight bounds). As a rule, actively serving the EU market requires MiCA authorization or operating via an EU-authorized entity. For stablecoins, watch EBA/ECB expectations on non-EU issuers and redemption cross-border arrangements draw scrutiny.

Q : What are typical timelines and costs for a Dubai VARA license?

A : Timelines vary by activity (Advisory vs Exchange vs Custody) and readiness. Expect a staged process (In-Principle Approval → full license), paid-up capital by activity (e.g., AED 100k Advisory; higher for Exchange/Custody), and audits/policies per rulebooks. Always consult the public register and rulebooks for current conditions.

Q : Is Wyoming still advantageous if my users are outside the US?

A : Wyoming’s DAO LLC gives entity clarity (governance on-chain, smart-contract references, registered agent), but it does not replace US federal securities/money-transmission analysis. It’s attractive for governance DAOs or treasury entities; global product launches still require compliance where users reside.