Intellectual Property Tokenization in 2025: How Ideas Become Investable, Compliant Digital Assets

Introduction

Intellectual property (IP) tokenization converts rights in assets like music, film, patents, code, and data into programmable, tradable digital tokens that can automate payouts and expand access to financing. In practice, that means packaging real legal rights (royalties, licenses, security interests) with on-chain records so creators and enterprises can raise capital, share upside, and manage compliance by design.

The world’s most valuable assets are usually ideas songs, software, patents, film rights, datasets. Tokenization lets you turn those rights into auditable, revenue-sharing digital assets. In this guide, you’ll learn what IP tokenization means, how it works end-to-end (from rights packaging to payouts), EU/US rules that apply, where human-capital tokens fit, the monetization models (royalties, licenses, marketplaces), and a pragmatic playbook to launch responsibly.

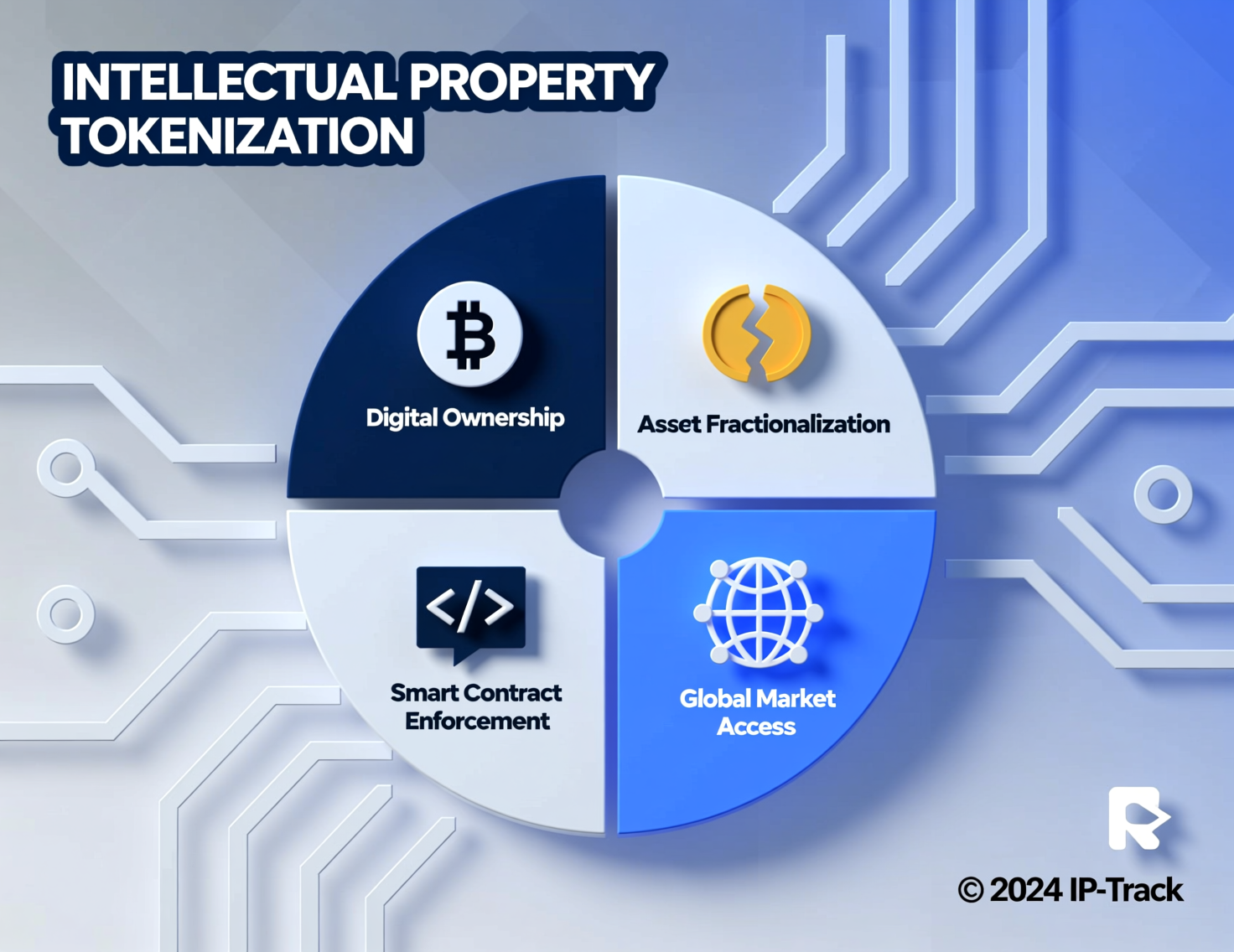

What Is Intellectual Property Tokenization?

Simple Definition + Why It Matters

Definition

Intellectual property tokenization is the process of representing legally enforceable IP rights (e.g., a share of royalties, a license, or a lien over a patent) as digital tokens on a blockchain, so those rights can be issued, transferred, and paid programmatically.

Why it matters

Tokenization improves transparency, embeds compliance rules into the asset, and can widen access to financing through fractionalization and automated royalty flows. Institutions now treat tokenization as a serious market infrastructure trend, not a gimmick, with regulators publishing guidance and global bodies studying adoption.

How IP Becomes a Digital Asset

At issuance, the off-chain agreement (license, royalty agreement, pledge, or assignment) defines the rights. On-chain, a token typically an ERC-20 or ERC-721/1155—references those rights via metadata or a legal wrapper (e.g., a master license URL with hash, IPFS/Arweave hash, or an on-chain term sheet). Oracles connect off-chain events (streams, syncs, sales, citations) to on-chain payouts, while registries (USPTO/EPO for patents, performing rights organizations for music, etc.) verify ownership and encumbrances. For example, the USPTO Assignment Center and the European Patent Register provide chain-of-title visibility for patents.

IP vs. Physical RWA: Key Differences

Nature of the asset

IP is intangible and governed by copyright/patent/trademark law; RWAs like real estate or treasuries have tangible/legal title pathways.

Valuation

IP often uses income-based valuation (royalty projections) and comparables; physical RWAs add appraisals.

Enforcement

IP remedies include injunctions and statutory damages; RWA claims focus on title and possession.

Data flows

IP relies more heavily on usage oracles (streams, licensing events), whereas physical RWAs lean on custodians and price oracles.

Regulatory angle

Many IP tokens can resemble securities when they promise profit from others’ efforts requiring disclosures and restrictions whereas some RWA tokens (e.g., tokenized funds or treasuries) have more established regulatory paths in certain jurisdictions.

How IP Tokenization Works End-to-End.

Rights Packaging: Copyrights, Patents, Trademarks, Data

Ownership & encumbrances check

Confirm registries (USPTO/EPO), assignment history, liens, and co-owner consent.

Define the bundle

Examples (a) royalty participation in a master or publishing share; (b) a field-of-use patent license; (c) a trademark co-marketing license; (d) paid access to a dataset or model weight checkpoint.

Encode terms

Attach a signed agreement (hash + URL) and encode key parameters: rate card, payment cadences, split waterfall, KYC/AML gating, and geographic restrictions.

Monitoring

Connect data feeds (DSP statements, PRO distributions, patent license invoices) to oracles that trigger on-chain splits.

Token Design: Utility, Payment, or Security?

Utility tokens grant access or usage (e.g., gated dataset API calls) but should not convey profit expectation.

Payment tokens function as medium of exchange (e.g., fiat-referenced tokens covered under specific regimes).

Security-like tokens represent an “investment contract” under the Howey test if buyers invest money in a common enterprise with an expectation of profits from others’ efforts common for fractionalized royalty streams. The SEC’s 2019 Framework remains the key U.S. reference.

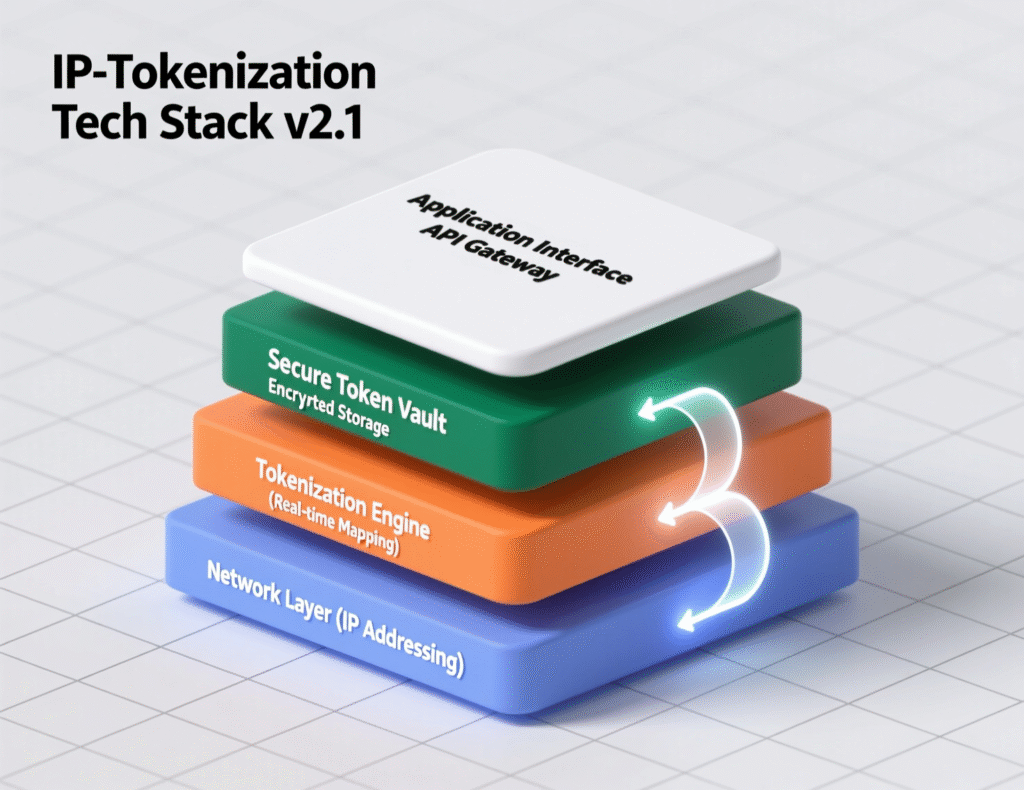

Tech Stack: Minting, Custody, Oracles, Royalty Splits

Minting & metadata

ERC-721/1155 for unique rights, ERC-20 for fungible royalty shares; store legal docs’ hash on-chain.

Compliance & gating

Whitelists, transfer-restrictions, Reg D/Reg S logic, and geographic blocking as needed.

Custody

Qualified custodians (for security tokens) or self-custody wallets with policy controls; institutions increasingly use enterprise custody stacks.

Oracles & data pipelines

Stream counts, sync fees, license invoices; reconcile off-chain statements and trigger payouts.

Royalty splits

Smart-contract splitters route gross receipts to stakeholders, fees, and reserves then to token holders. In 2025, institutional platforms highlight compliant token issuance and custody as adoption accelerators.

Monetization Models: Royalties, Licensing, and Marketplaces.

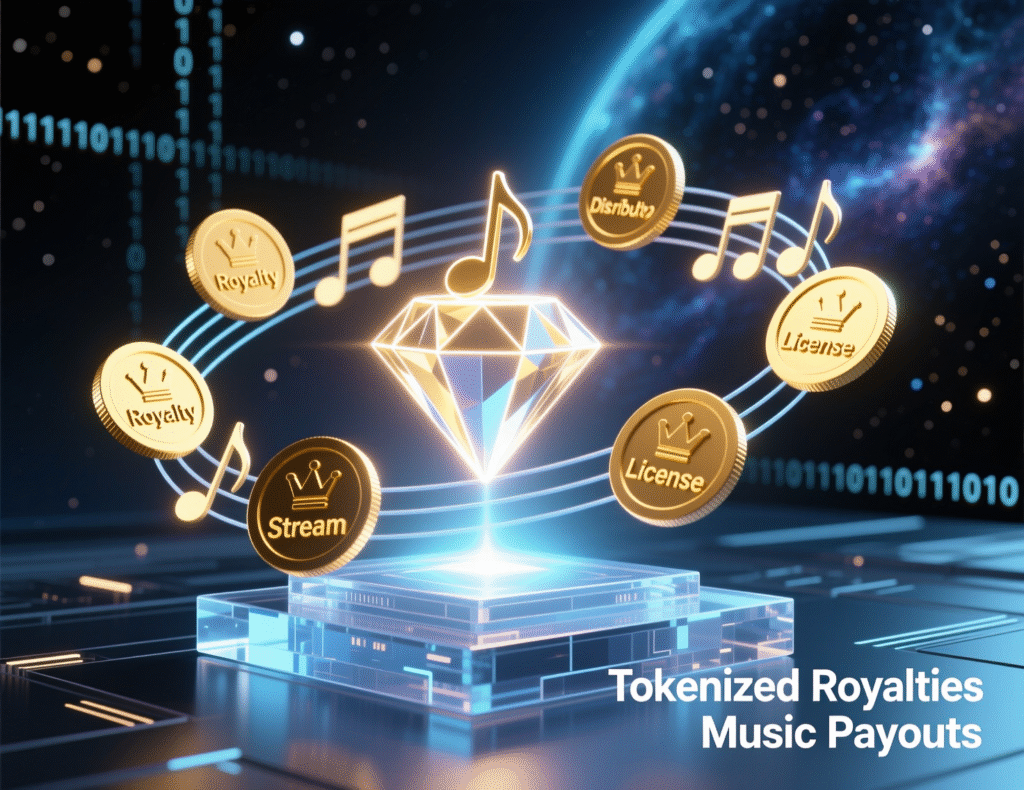

Tokenized Royalties : How Payouts Flow.

Mechanics

A rightsholder sells a fixed percentage of future royalties via tokens. When revenue arrives (DSPs, syncs, theatrical, patent license fees), a distributor or escrow agent posts receipts; the smart contract allocates splits to token holders pro-rata.

Platforms & examples: Royal, anotherblock, and Bolero popularized retail-friendly drops and recurring royalty distributions. Bolero describes Song Shares and Catalog Shares that entitle holders to a fixed share of future royalties within regulatory thresholds; Royal public materials and interviews discuss periodic distributions to token owners.

Enterprise angle

Patent royalties can be similarly fractionalized; IPwe has piloted blockchain-based registries and large-scale patent NFT deployments with enterprise partners.

Statistic

Industry explainers and vendor trackers suggest >$30B in tokenized assets live on-chain by late-2025 across categories (treasuries, funds, private credit) a rising tide that benefits IP-linked cash flows as infrastructure matures.

IP NFT Marketplaces: Fees, Rights Models, Liquidity.

Rights models

Rev-share tokens (royalties)

Usage tokens (access/licensing)

Debt-like receivables (future royalty claims)

Fees

Expect platform fees (1–5%), primary sale fees, payment rails fees, gas, and occasional compliance/KYC costs.

Liquidity

Secondary markets exist, but compliance filters (e.g., only KYC’d buyers in certain regions) can throttle liquidity by design for investor protection. In music, platforms emphasize transparent statements, distribution calendars, and secondary resale support.

Secondary Trading & Compliance Considerations.

Securities laws

If the token is a security, secondary trading typically requires ATS/MTF venues, transfer-restriction logic, and investor eligibility checks.

Royalties timing

Many ecosystems batch payouts monthly/quarterly; for instance, some collecting societies like PRS publish distribution calendars that creators can benchmark against.

Tax & reporting

Track basis, withholding, VAT/GST on licenses, and cross-border rules.

Market conduct

Prevent misleading claims about regulatory status an explicit focus for EU supervisors under MiCA.

Human Capital Tokenization Explained

Talent Tokens vs. Income-Sharing Agreements

Talent tokens represent exposure to an individual’s future earnings or perks (access, benefits). Income-sharing agreements (ISAs) are contractual arrangements where a person shares a % of income for a period. Tokenized ISAs can embed payment logic on-chain, but in the U.S. many such structures may be securities if marketed with profit expectations triggering disclosures and limits on resale.

Credentials & Skills Wallets on-chain

A lower-risk path is tokenizing credentials: diplomas, certifications, portfolios, and verifiable skills (e.g., on-chain attestations). Here, tokens are proof objects rather than investment interests useful for recruitment marketplaces, talent discovery, and automated bounties when combined with escrowed budgets.

Ethical, Legal, and Reputational Risks

Agency & autonomy

Avoid perpetual claims on a person’s future income.

Investor mismatch

Retail speculation on human earnings invites regulatory scrutiny.

Privacy

Biographical and financial data must be minimized and consented.

Discrimination & fairness

Governance must prevent exploitative terms and provide exit options.

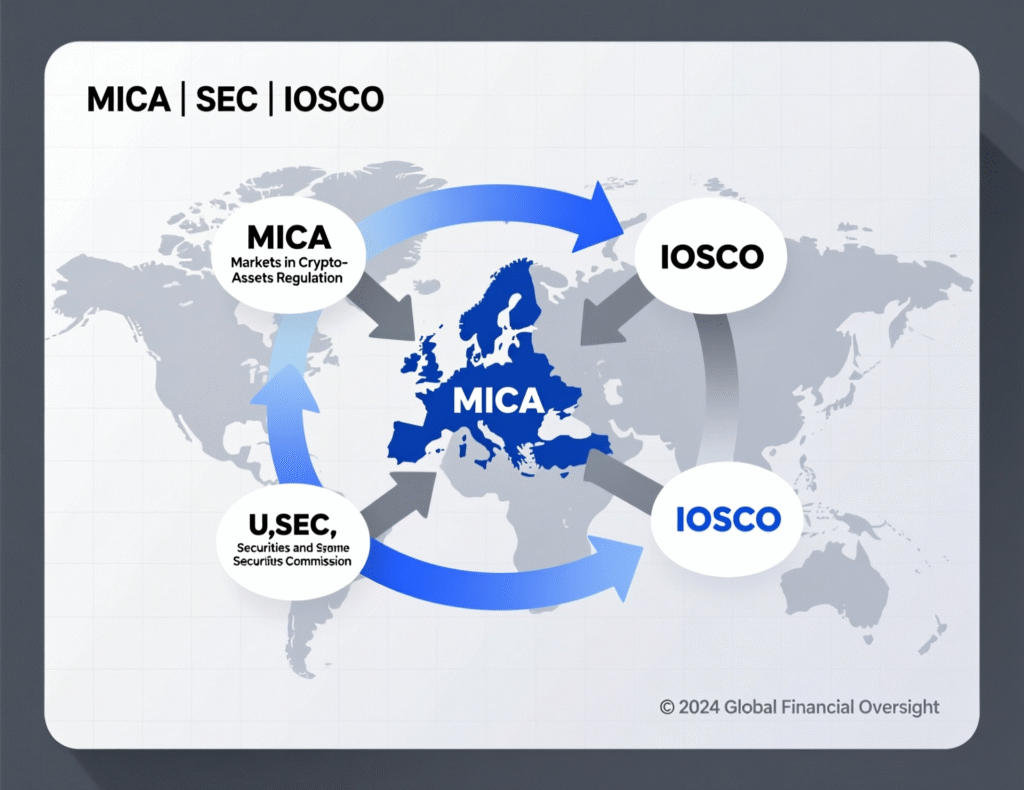

Regulation & Compliance: US vs. EU

EU: MiCA Scope, Asset Classification, and Investor Protections

The EU’s MiCA framework sets uniform rules for crypto-assets not already covered by existing EU financial law, including issuer disclosures, authorization of CASPs, and conduct rules; asset-referenced tokens and e-money tokens face specific requirements. ESMA is actively guiding implementation and warning against misleading claims by firms regarding their regulatory status.

US: Securities Tests, Royalties, and IP-Linked Tokens

In the U.S., analysis starts with Howey: an investment of money, in a common enterprise, with an expectation of profits from others’ efforts. Tokenized royalty or revenue-share instruments often implicate securities laws; structures may rely on exemptions (e.g., Reg D/Reg S) with transfer restrictions and investor limits. The SEC’s published Framework remains the primary reference for digital-asset analysis.

Global Signals: IOSCO Notes, UK FCA, MAS Singapore, ADGM UAE

IOSCO

Issued recommendations for crypto/digital-asset markets and, in 2025, a report on tokenization adoption in capital markets signaling supervisory convergence on principles-based, technology-neutral oversight.

UK FCA

Advancing fund tokenisation and exploring broader tokenization models; in late-2025, the FCA proposed allowing tokenized funds on public chains.

MAS (Singapore)

Finalized a stablecoin framework and continues tokenization pilots in payments and capital markets.

ADGM (UAE)

Refined digital-asset rules and consulted on fiat-referenced tokens useful context for structuring payment legs in royalty systems.

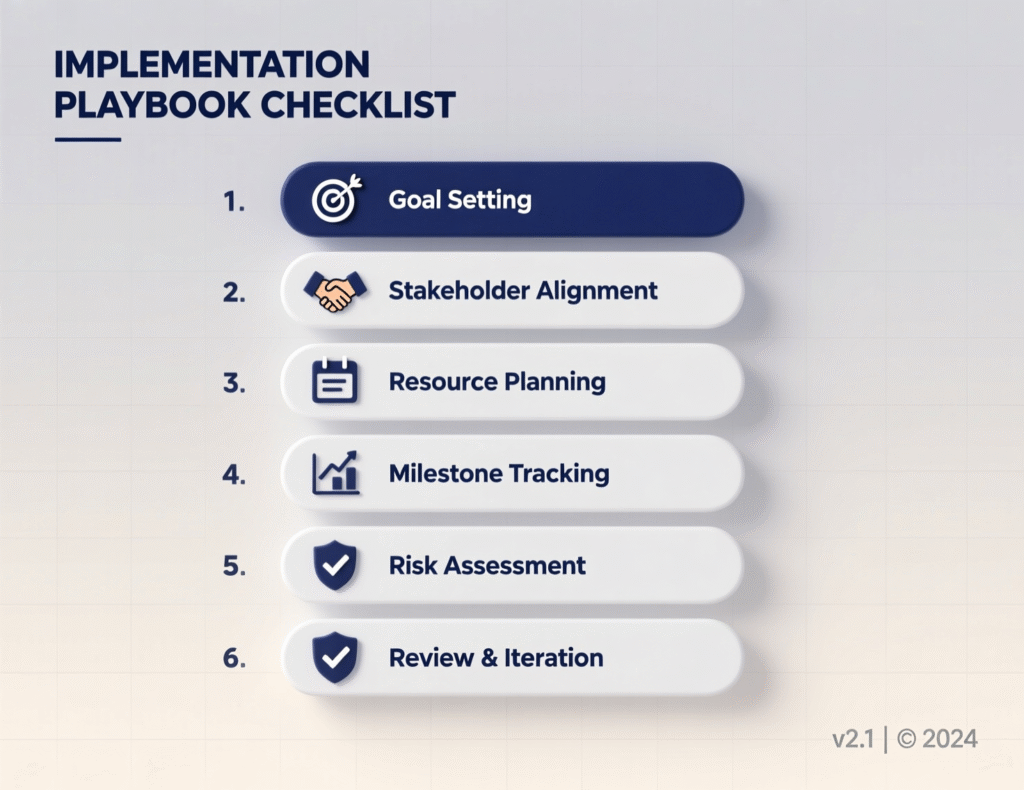

Implementation Playbook

Due Diligence: Ownership, Encumbrances, and Valuation

Checklist

Chain-of-title

USPTO Assignment Center / EPO Register; confirm licenses, liens, or co-authors.

Royalty history

Past DSP statements, sync records, mechanicals, performance payouts.

Valuation

Income approach (discounted royalty flows), comps, and scenario analysis.

Data integrity

Evidence trails for streams, sales, infringements, or litigation.

Risk register

Regulatory classification, KYC/AML exposure, sanctions screening.

Example

For a U.S. patent-backed token, pull the USPTO assignment history, confirm maintenance fees, then attach a non-exclusive field-of-use license as the token’s legal wrapper.

Structuring the Offer: Rights, Disclosures, and Waterfalls

Define the bundle

e.g., 15% of net streaming royalties for 36 months; or a patent license with 2% of net sales.

Waterfalls

Gross → platform fee → admin → reserves → tokenholder pool → creator remainder.

Disclosures

risks (market, regulatory, clawbacks), revenue dependency, price volatility, and governance.

Compliance path

If security-like, use a compliant exemption/registration; embed transfer restrictions; implement investor accreditation checks.

Platform Selection & Go-Live: KYC/AML, Custody, and Reporting

Vendor criteria

Issuance & compliance

support for whitelists, transfer rules, jurisdiction gates, audit logs.

Custody

regulated custody or policy-controlled wallets (multi-sig, hardware enclaves).

Data & oracles

integrations to DSPs, PROs, invoice systems, oracles; automated payout splits.

Reporting

dashboards for receipts, on-chain distributions, and tax exports.

Institutional vendors and explainers (e.g., XBTO, RWA.io) emphasize custody/compliance layers as key to adoption.

Market Signals & 2025 Use Cases.

Patents/Data as Collateral & Revenue Streams

IP-rich firms are exploring patent pools and data licenses with tokenized receivables faster financing against predictable royalties. IBM-linked case studies and IPwe’s deployments highlight enterprise-grade patent registries and tokenization experiments.

Creator Economy: Music, Film, Gaming IP

Royal, anotherblock, and Bolero show how fractionalized royalties can fund releases and engage fans while providing reporting and secondary market options. These platforms describe how distributions are scheduled and how rights are carved (song vs. catalog shares)

Enterprise & Institutional Participation (RWA convergence narrative)

Global organizations like the World Economic Forum continue to publish tokenization primers, and market infrastructure is consolidating around custody, compliance, and settlement standards supporting spillover into IP-linked flows.

Summary & Key Takeaways.

IP tokenization turns enforceable rights into programmable tokens with embedded rules.

For music/patents, tokens can fractionalize royalties and automate payouts via split contracts and oracles.

Compliance hinges on whether the token is a security (Howey in the U.S.) or captured under MiCA in the EU.

Implementation requires chain-of-title checks (USPTO/EPO), clean disclosures, and platform KYC/AML.

Institutions and regulators are converging on standards; 2025 adoption spans funds, payments, and RWAs supporting IP use cases.

Risks to Watch vs. Advantages to Capture

Risks

securities classification, misleading marketing claims, illiquidity, data/oracle errors, privacy/ethics for human-capital tokens.

Advantages

faster financing, broader investor access, auditability, programmable compliance, and downstream royalty transparency.

Get expert help to tokenize your IP responsibly. Mak It Solutions designs compliant token architectures, builds payout automations, and integrates custody/KYC so you can launch with confidence in the US or EU. Get a free consultation today we’ll map your rights, structure the offer, and stand up a pilot in weeks.( Click Here’s )

FAQs

Q : Is an IP token always a security under US law?

A : No. The U.S. analysis uses the Howey test: if buyers invest money in a common enterprise with an expectation of profits from others’ efforts, it’s likely a security. Many royalty-share or revenue-share tokens fit this profile and require exemptions/registrations and transfer restrictions. Access-only or utility tokens (no profit expectation) may be non-securities, but facts matter always document rights and marketing language carefully.

Q : How are off-chain contracts linked to on-chain tokens for IP rights?

A : The off-chain agreement (license/royalty contract) is signed and then cryptographically referenced in token metadata (e.g., IPFS/Arweave hash + URL). The token points to that immutable reference, while oracles feed usage/revenue data for payouts. This hybrid model keeps the legally binding text off-chain but verifiable, and it’s a common pattern in regulated token issuance stacks.

Q : Can trademarks or trade secrets be tokenized, and how is access controlled?

A : Yes trademarks via limited licenses (territory/channel) and trade secrets via access tokens (confidential data rooms, API keys) with NDAs and revocation logic. The token confirms entitlement; the actual secret remains off-chain with strict access controls, logging, and revocation. If any investment return is marketed, U.S. securities analysis re-applies.

Q : What fees and gas costs should creators expect when minting IP tokens?

A : Plan for: platform fees (1–5%), payment rails, KYC checks, and gas. Music platforms disclose fee and distribution structures and often offer secondary markets. Gas can be minimized via L2s or batched distributions (monthly/quarterly), similar to collecting society schedules.

Q : How do secondary market trades affect downstream royalty waterfalls?

A : Properly designed splitters route royalties to the current token holder of record. That means your on-chain registry must update ownership before distribution. Secondary trades in security-like tokens usually occur on compliant venues with transfer restrictions to ensure payouts go to KYC’d owners and to preserve investor protections.