Bernstein Says U.S. Crypto Framework Positions Nation as Global Leader

Bernstein highlights that the U.S. crypto regulatory landscape has reached a mature stage in 2025. This development is largely driven by the enactment of the GENIUS Act on stablecoins, providing clear rules for issuers and users. In addition, the pending CLARITY Act aims to define the broader market structure, offering certainty on trading, custody, and compliance standards. The SEC’s Project Crypto further strengthens oversight, focusing on transparency and investor protection. Together, these measures signal a more robust and predictable environment for digital assets in the United States.

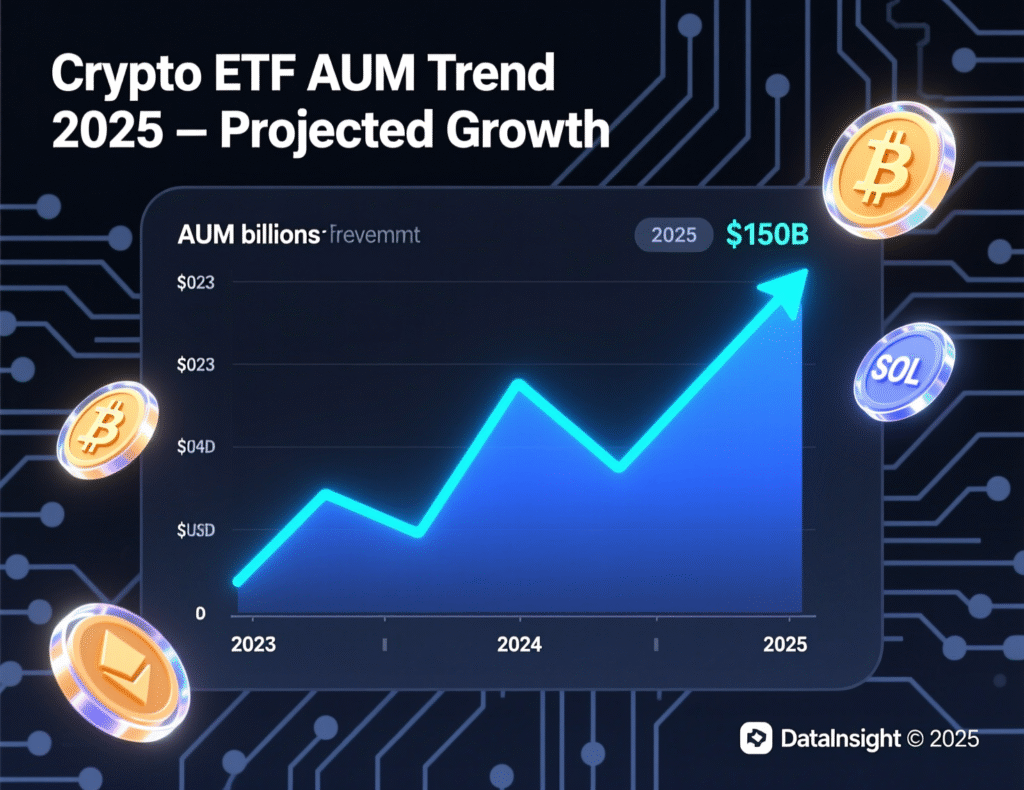

Coupled with the growth of crypto ETFs and a recently reopened IPO window, Bernstein argues that these factors position the U.S. as a leading global hub for digital asset investment. Market participants now have greater confidence to innovate, launch products, and expand, potentially solidifying the country’s dominance in the evolving crypto ecosystem.

What the GENIUS Act changes

The GENIUS Act signed into law on July 18, 2025 establishes federal rules for payment stablecoins, including 1:1 backing in cash and short-term Treasuries and regular reserve disclosures. Policymakers cast it as the first national framework for dollar-backed tokens, aiming to reduce run risk and support adoption in payments and settlements.

How the CLARITY Act would define market structure

The Digital Asset Market CLARITY Act of 2025, advancing in Congress, proposes clearer dividing lines between the SEC and CFTC, expedited registrations, and asset classifications meant to resolve years of uncertainty over when tokens are securities versus commodities. Sponsors have circulated summaries outlining the bill’s three-tier approach and supervisory mechanics.

Project Crypto: the SEC’s modernization push

SEC Chair Paul S. Atkins has launched Project Crypto, a program to align securities infrastructure with blockchain (tokenized stocks/bonds, unified broker-dealer permissions, 24/7 settlement experiments). The SEC and legal commentators describe the effort as a strategic turn toward on-chain market plumbing.

Adoption signals: stablecoins, ETFs, IPOs

Stablecoins

Dollar-backed supply surpassed ~$260B in 3Q25 as issuers expanded under clearer rules.

Crypto ETFs/ETPs

U.S. products hold roughly $150–160B at/near recent peaks in 2025, led by spot Bitcoin ETFs.

Listings & indices

Coinbase (COIN) and Robinhood (HOOD) entered the S&P 500 in 2025, signaling mainstream investor acceptance.

IPO window

Multiple crypto-native firms (e.g., Circle, Gemini, Figure, Bullish) tapped U.S. markets in 2025 as proceeds rebounded from a two-year lull.

Why Bernstein says the U.S. could lead

Bernstein contends that enforceable stablecoin rules, pending market-structure legislation, and an activist SEC modernization agenda reduce policy risk, attract institutional capital, and integrate tokenization into mainstream finance. The firm highlights growing ETF ownership by institutions and increased public-market financing for crypto companies as evidence of a new, more durable cycle.

Context & Analysis

The legal path isn’t finished: CLARITY must pass, and rulemakings will follow. But with the GENIUS Act enacted, the center of gravity for dollar stablecoins is decisively U.S.-anchored. If Project Crypto’s pilots mature into rules, tokenized securities and 24/7 settlement could compress costs but also shift operational risk to always-on markets.

Conclusion

If Congress passes the CLARITY Act and the SEC fully implements Project Crypto, the U.S. will establish a clear and cohesive regulatory framework for digital assets. Enforceable standards for stablecoins combined with a defined market structure would provide transparency, compliance certainty, and investor protection, creating a more predictable environment for all market participants.

Bernstein argues that these conditions could drive sustained institutional adoption of cryptocurrencies. With strong regulatory foundations in place, the U.S. has the potential to become the global hub for digital assets, attracting innovation, capital, and long-term growth in the rapidly evolving crypto ecosystem.

FAQs

Q : What is the GENIUS Act?

A : A U.S. law setting federal rules for payment stablecoins, including 1:1 liquid-asset reserves and disclosures.

Q : What will the CLARITY Act do?

A : It aims to define market structure and split SEC/CFTC oversight for digital assets.

Q : Who leads Project Crypto at the SEC?

A : SEC Chair Paul S. Atkins; the initiative targets tokenization and modernized settlement.

Q : How big is the stablecoin market now?

A : Around the mid-$200 billions in 3Q25, led by USDT and USDC.

Q : How large are U.S. crypto ETFs?

A : Roughly $150–160B AUM at/near 2025 peaks.

Q : Did crypto firms join the S&P 500?

A : Yes Coinbase and Robinhood entered the index in 2025.

Q: Does the U.S. crypto regulatory framework 2025 change for non-U.S. firms?

A : Non-U.S. firms serving U.S. users will still need to comply with U.S. rules on issuance, disclosures, and market access once applicable. (General)

Facts

Event

Bernstein says U.S. framework positions nation as global crypto leaderDate/Time:

2025-11-12T13:54:00+05:00Entities

Bernstein; U.S. Congress (GENIUS Act; CLARITY Act); U.S. SEC (Paul S. Atkins); CFTC; Coinbase (COIN); Robinhood Markets (HOOD)Figures

Stablecoins > ~$260B market cap; U.S. crypto ETPs ~$150–160B AUMQuotes

“Project Crypto” SEC Chair Paul S. Atkins (initiative title); “positions the United States as the global leader in crypto markets” — Bernstein (report characterization)Sources

AP (GENIUS Act signed) https://apnews.com/article/94fa3c85e32ec6fd5a55576cf46e58ea; Congress.gov (CLARITY bill text) https://www.congress.gov/bill/119th-congress/house-bill/3633/text