JPMorgan Rolls Out JPM Coin Leveraging Coinbase’s Base: Report

JPMorgan has begun deploying its JPM Coin deposit token (JPMD) on Base, extending its digital money network from private to public blockchain infrastructure. The move allows institutional clients to use JPMD, which represents U.S. dollar deposits held at JPMorgan, for faster and more flexible transactions within the crypto ecosystem.

The initiative marks a significant step in merging traditional banking with public-chain innovation. By enabling instant, 24/7 settlement, JPMorgan aims to enhance payment efficiency and liquidity management for large clients. This rollout highlights growing confidence among major banks in blockchain-based systems and may pave the way for broader adoption of regulated deposit tokens in global financial operations.

How the deposit token works

JPM Coin is a permissioned deposit token not a stablecoin issued against funds already held at the bank. Approved institutional users can transfer value on Base with finality measured in seconds, rather than hours or days bound by banking cut-offs. JPMorgan has indicated plans to expand access, including multi-currency support and additional chains, subject to regulatory approvals.

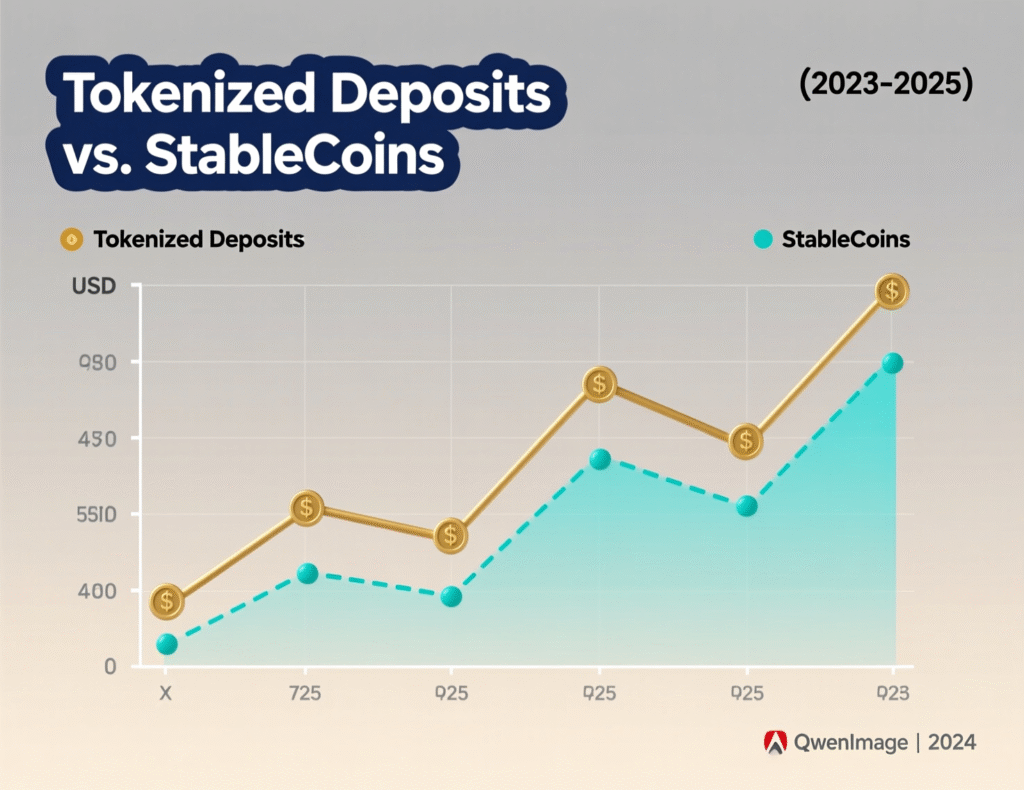

JPM Coin deposit token on Base vs. stablecoins

Backing

Deposit tokens = claims on insured bank deposits; stablecoins = claims on an issuer’s off-bank reserves.

Yield

Deposit tokens can be interest-bearing per bank terms; most stablecoins typically are non-yielding to holders.

Access

JPM Coin operates permissioned access on Base; stablecoins are generally permissionless.

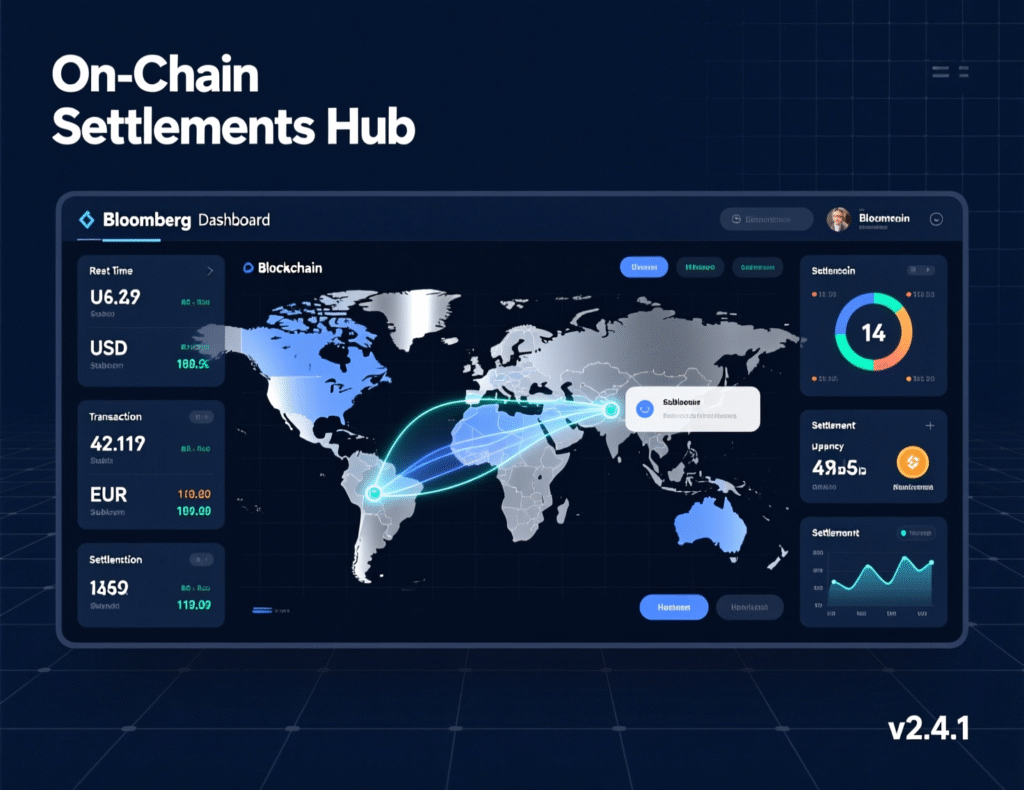

Why Base, and what “permissioned on a public chain” means

Base offers Ethereum-compatible throughput and tooling. JPM Coin’s design gates issuance, holding, and transfer to KYC’d entities, even while transaction data ultimately settles on a public L2. This approach seeks the operational benefits of public networks while preserving bank-grade compliance controls.

Market context and use cases

Large corporates, brokers, and payment providers have tested deposit tokens for T+0 treasury moves, intraday liquidity, and collateral mobility. The launch follows pilots with firms including Mastercard and crypto market participants, with stated plans to accept JPM Coin as collateral on Coinbase for certain activities.

Policy & regulatory backdrop (Analysis)

The GENIUS Act (signed July 18, 2025) created federal standards for payment stablecoins reserves, disclosures, and supervision which, while not directly governing bank deposit tokens, frames the broader policy shift toward tokenized money. Ongoing rulemaking will determine interoperability and prudential treatment alongside deposit insurance mechanics.

What’s next

JPMorgan indicates future multi-currency support and broader network deployment, contingent on regulators. Watch for integration with treasury systems and collateral workflows as banks and market infrastructures test on-chain settlement rails at scale.

Conclusion

JPMorgan’s launch of the JPMD deposit token on Base brings traditional bank money to public blockchain infrastructure while maintaining permissioned oversight. The initiative lets institutional clients benefit from real-time settlement and continuous access to on-chain liquidity.

By combining 24/7 finality with potential returns on tokenized cash, JPMorgan offers an alternative to third-party stablecoins for regulated transactions. The project’s long-term growth, however, will depend on how swiftly regulators define rules for deposit tokens and how effectively systems achieve cross-chain interoperability to support broader institutional adoption.

FAQs

Q : What is JPM Coin?

A : A JPMorgan deposit token representing client deposits, enabling fast, on-chain transfers for approved institutions.

Q : Is it a stablecoin?

A : No. It’s a claim on bank deposits, not a token backed by off-bank reserves.

Q : Where does it operate?

A : On Base with permissioned access for KYC’d clients; broader chains may follow.

Q : Can the token earn interest?

A : Deposit tokens can be interest-bearing per bank terms, unlike most stablecoins.

Q : Will JPM Coin be used as collateral?

A : JPMorgan and partners have indicated plans for collateral use on Coinbase, subject to venue rules and approvals.

Q : How does the GENIUS Act affect this?

A : It sets a federal framework for stablecoins; it shapes the policy environment but doesn’t itself issue rules for bank deposit tokens.

Q : Why choose a public chain like Base?

A : EVM tooling and liquidity, combined with permissioned controls, can deliver speed and interoperability with compliance.

Facts

Event

JPMorgan rolls out JPM Coin (JPMD) deposit token for institutions on BaseDate/Time

2025-11-12T10:27:00+05:00Entities

JPMorgan Chase & Co.; Kinexys by J.P. Morgan; Coinbase (Base)Figures

24/7 settlement availability; permissioned access; potential interest-bearing design (bank-determined)Quotes

“Deposit products offer a compelling alternative for institutional clients. They can generate income.” Naveen Mallela, Global Co-Head, Kinexys (reported) ForkLogSources

Bloomberg; CoinDesk; JPMorgan (Kinexys)