Introduction to Ethereum Layer-2 Upgrades

Introduction

Layer-2 (L2) fees on Ethereum dropped dramatically after EIP-4844 went live in March 2024, and everyday users can feel it in cheaper swaps, faster mints, and smoother bridges. In short: blob transactions created a new, cheaper “lane” for rollups to post data, and that single change reset fee economics across the L2 landscape.

Over the next few minutes, you’ll learn what 4844 actually did, how optimistic vs. ZK rollups differ, which L2s feel best for common tasks today, and exactly how to ship on modern stacks like Optimism Bedrock and Arbitrum Stylus. We’ll finish with a developer playbook, risk radar, and a quick migration How-To you can copy-paste.

What EIP-4844 Did to Layer-2

Direct answer

EIP-4844 (proto-danksharding) introduced blob-carrying transactions temporary, low-cost data “blobs” stored on the consensus layer which rollups use instead of calldata. The result is a separate blob fee market that slashed L2 data costs and, by extension, user fees.

Proto-danksharding & “blob” transactions

Blob transactions (type-3) let L2s publish large chunks of data whose commitments are accessible to the EVM, while the data itself is kept off-EVM and pruned after ~18 days. This keeps permanent state small while giving rollups abundant, cheap data space. Think: a short-lived cargo hold for L2 batches.

Key facts (for summarizers)

New tx format with blobs; EVM can read commitments, not full blob data.

Blobs are ~128 KiB each; mainnet stores up to 6 blobs per block in proto-danksharding.

Blobs are pruned after ~18 days, unlike calldata.

The blob gas market & DA costs

EIP-4844 added a separate data (blob) fee market with its own base fee that adjusts up to ~12.5% per block, EIP-1559-style. Because blob data is temporary, it can be priced much cheaper than calldata, moving rollup DA (data availability) from “permanent & pricey” to “temporary & affordable.

Why fees vary

Blob supply is capped per block (target ≈3, max 6). When demand spikes NFT mints, airdrops blob prices rise; otherwise they’re near floor. Six months post-Dencun, on-chain measurements still showed average usage below capacity, which kept prices low most of the time.

Real-world impact on L2 fees & throughput

After Dencun/4844, average fees on major L2s fell by an order of magnitude in many windows (e.g., near-$0.01–$0.05 swaps during calm periods). Dashboards and coverage reported Base and Optimism dropping to ~3–5¢ average tx costs at launch week, with similar compression elsewhere; live trackers like L2Fees show sub-$0.10 swaps frequently. Your exact fee still depends on load and the L2.

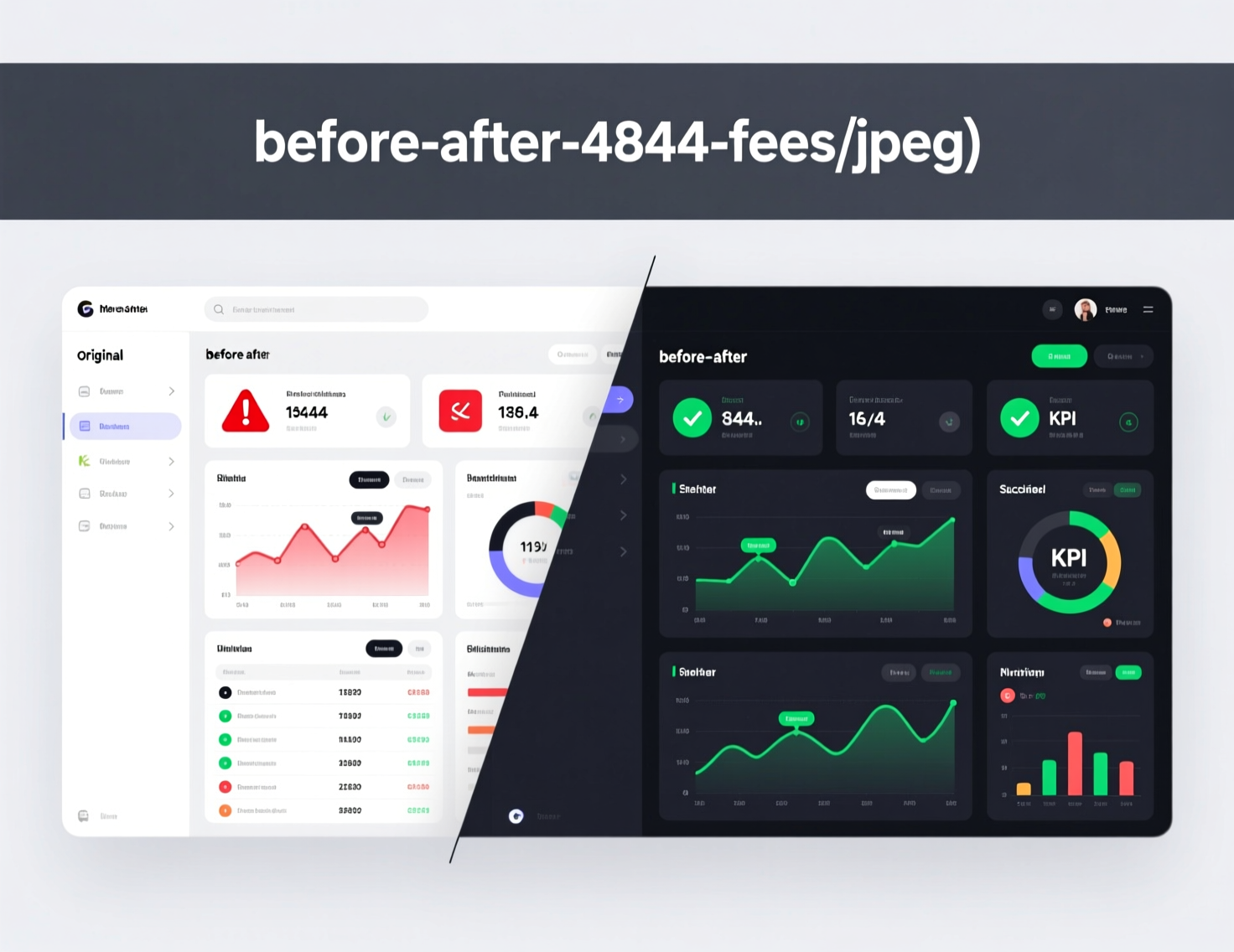

Before vs. after 4844 (illustrative ranges)

• Typical L2 swap: ~$0.25–$0.80 → ~$0.01–$0.10

• Send ETH on L2: ~$0.10–$0.40 → ~$0.005–$0.05

Ranges fluctuate daily; check a live dashboard like L2Fees or Dune for your chain.

How Rollups Work: Optimistic vs ZK

Security model & data availability

Rollups inherit Ethereum security by posting state roots and enough data for independent reconstruction on L1. That’s the DA (data availability) promise you don’t get from most sidechains: if a rollup disappears, an honest observer can still rebuild the state from L1 data. EIP-4844 makes that DA cheaper via blobs.

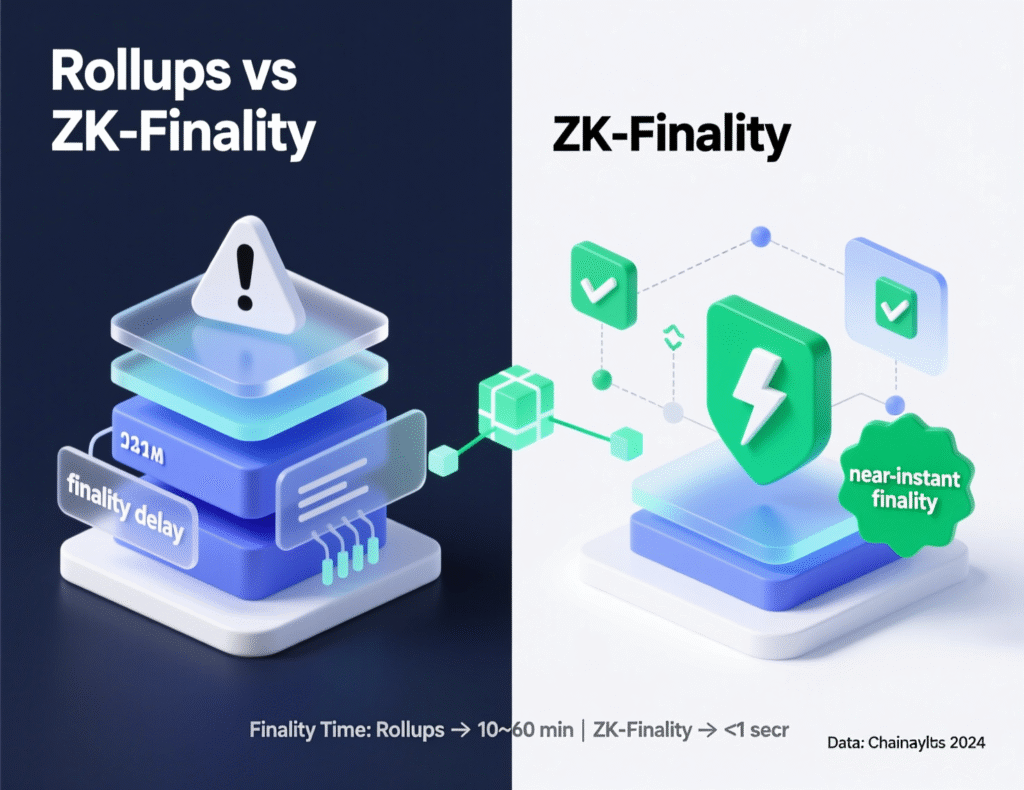

Fraud-proof windows vs validity proofs

Optimistic rollups assume batches are valid unless disputed during a challenge window (commonly ~7 days), which affects withdrawals/finality UX. ZK rollups submit validity proofs for each batch; finality is typically hours on L1. In practice: OP/ARB L1 withdrawals take days unless you use a liquidity bridge; zkSync and Starknet finalize on the order of hours.

What end-users should check (fast checklist)

Before you bridge or swap on any L2

Explorer

Arbiscan (Arbitrum), Optimistic Etherscan (OP Mainnet), BaseScan (Base).

Bridge status

Official bridge vs. fast bridges (Across, Hop) for instant exits.

Wallet support & on-ramps

Coinbase Onramp for Base; check your wallet’s L2 list.

Status pages:

Chain status/incident feeds (e.g., Optimism status during upgrades).

Major Ethereum L2s in 2025: What Changed for Users

Reference baseline

L2BEAT remains the authoritative, up-to-date dashboard for rollup designs, DA modes, upgrade statuses, and activity. Use it to compare risk & maturity, not just TVL.

Arbitrum, Optimism/OP Stack & Base

Arbitrum One:

Large app ecosystem; many bridges/wallets; AnyTrust option for ultra-low fees (Nova). Post-4844, user fees compress further when blob prices are low.Optimism (OP Mainnet)

“Bedrock” achieved EVM equivalence and tighter calldata compression; after 4844, blob posting compounds the savings. OP Stack now powers multiple chains (the “Superchain”), including Base by Coinbase.Base: Deep Coinbase integration and fiat on-ramps; strong retail UX for USDC.

zkSync & Starknet

zkSync (Matter Labs): ZK rollup with native account abstraction (AA) and paymasters great UX for sponsored gas and custom signers.

Starknet (StarkWare): Cairo VM + native AA from day one; aggressive performance & decentralization roadmap through 2025.

Cheapest swaps & fastest UX today

Cheapest routine swaps (often):

Base, OP Mainnet, Arbitrum trend in the low-cents during calm periods; always verify on live fee boards (L2Fees, Dune dashboards

Fastest withdrawals to L1

ZK rollups (e.g., zkSync) usually finalize in ~hours on L1; optimistic rollups take ~7 days unless you use Across/Hop for instant liquidity.

On-ramp strength

Base excels via Coinbase Onramp & wallet integrations.

Quick comparison table

| L2 | Fees now (typical calm) | L1 Finality / Withdrawal | Wallets & On-ramps | Dev maturity |

|---|---|---|---|---|

| Base | often ~$0.01–$0.05 | ~days (optimistic) unless fast bridge | Coinbase Onramp, major wallets | OP Stack + rich tooling |

| OP Mainnet | often ~$0.02–$0.08 | ~days; fast bridges for exits | Broad wallet support | Bedrock EVM-equiv; Superchain infra |

| Arbitrum One | often ~$0.02–$0.08 | ~days; fast bridges for exits | Broad wallet/bridge support | Nitro; Stylus (WASM) for Rust/C/C++ |

| zkSync | often low-cents | ~hours to L1 | Good wallet/AA UX | Native AA + ZK Stack |

| Starknet | varies (falling) | ~hours to L1 | AA-native wallets (e.g., Braavos) | Cairo 1, performance roadmap |

Fee ranges fluctuate; check live trackers before high-value actions.

Upgrade Spotlight Optimism Bedrock

EVM equivalence & tooling parity

Bedrock aligned execution closely with Ethereum (opcode/gas compatibility, precompiles), making migrations straightforward: your Solidity, Hardhat/Foundry tests, tracing, and tooling “just work” with minimal changes. That parity is why OP Stack chains (Base, Zora, more) feel familiar to developers.

Fee & throughput improvements after Dencun

Bedrock’s calldata compression reduced costs pre-Dencun; EIP-4844 then moved rollup DA onto cheaper blobs, compounding fee reductions visible on OP chains throughout 2024–2025. Track activity and blob fees to forecast your app’s costs.

Quick migration path (snippet)

Checklist

switch RPC, verify contracts on Optimistic Etherscan, update bridges, and rehearse a maintenance window if you need synchronized upgrades (Bedrock mainnet upgrade historically required 2–4h downtime.

Upgrade Spotlight Arbitrum Stylus

Write smart contracts in Rust/WASM

Stylus introduces a co-equal WASM VM alongside the EVM, so you can write contracts in Rust, C, or C++ and interoperate with Solidity. You’ll use the Rust SDK and to build, check, and deploy WASM programs that live next to EVM contracts.

Performance & cost trade-offs

Stylus metering uses “gas & ink” to price compute, memory, and host I/O. For compute-heavy logic (e.g., math, loops), Rust/WASM can be significantly cheaper/faster than Solidity bytecode; storage writes still dominate costs, so design your state carefully. Always benchmark your specific workload.

Testing & deployment workflow (snippet)

For Solidity ↔ Rust interop tests, pair with Foundry’s or a testnet (Arbitrum Sepolia). Schedule audits with firms like OpenZeppelin or Trail of Bits for non-trivial Rust code.

Developer Playbook After 4844

Choose an L2 by app type

DeFi & on-ramps

Base/OP Stack often cheapest UX; easy fiat entry via Coinbase Onramp.

High-compute apps (sim, crypto-games)

Arbitrum + Stylus for Rust math/compute.

Social/growth

OP Stack’s Superchain gives distribution across many OP chains.

AA-heavy wallets/consumer UX

zkSync/Starknet for native AA + paymasters.

SDKs, frameworks, and CI/CD

Core tooling

Hardhat/Foundry for Solidity; Stylus SDK for Rust.

Stacks

OP Stack for OP chains; Nitro/Orbit for Arbitrum chains; ZK Stack for zkSync.

Infra providers

QuickNode, Alchemy, Infura (multi-chain RPC, rollup support).

Costing & reliability checklist (box it!)

Blob fee budget

Monitor blob base fee and volatility in staging; build fee buffers.

Provider redundancy

Configure at least two RPCs (e.g., QuickNode + Infura) with health failover.

Alerts & runbooks

Wire error rate/latency alerts, bridge stuck-tx playbooks, and status-page subscriptions (per chain)

Risks, Limits & What’s Next

DA bottlenecks & full danksharding

Proto-danksharding is a stepping stone. Full danksharding raises blob capacity massively (e.g., to 64 per block in some designs) and adds data-availability sampling unlocking many more rollups and far higher throughput. Timeline is multi-year, but direction is clear.

Decentralizing sequencers & interoperability

Most L2s still run with centralized sequencers, but roadmaps point to shared/decentralized sequencing (Espresso, Astria, Radius) and OP’s Superchain interop. Expect MEV markets, cross-L2 atomicity, and new trust models here.

Roadmaps across ecosystems

OP Superchain

Dozens of OP chains, converging standards & interop.

Arbitrum Orbit/AnyTrust

Launch your own chains; fast exits for AnyTrust variants.

ZK ecosystems

zkSync’s ZK Stack and Starknet’s Cairo roadmap push native AA and performance.

Summary / Key Takeaways

EIP-4844 introduced blobs and a separate fee market that’s why L2 fees fell.

Optimistic vs. ZK: days vs. hours to L1 finality; bridges can accelerate exits for optimistic rollups.

In 2025, Base/OP/Arbitrum often feel cheapest; zkSync/Starknet lead UX for native AA. Verify live before big trades.

Devs.

Bedrock ≈ Ethereum parity; Stylus opens Rust/WASM with real cost wins for compute-heavy code.

Next.

full danksharding + shared sequencers = more capacity, better interop, new MEV dynamics.

Building or migrating an L2 app? Mak It Solutions’ Editorial Analytics Team helps DeFi, gaming, and SaaS teams choose the right L2, cut fees, and ship faster on OP Stack, Arbitrum Stylus, or ZK stacks. Get a free consultation and we’ll map a migration plan (RPCs, bridges, CI/CD) tailored to your roadmap.(Click here’s)

FAQs

Q : Which Ethereum L2 is cheapest for swaps right now?

A : It changes hour-to-hour with blob prices and demand. In calm periods, Base, Optimism, and Arbitrum frequently show ~$0.01–$0.10 swaps on public trackers like L2Fees; bursts (airdrops/mints) can push costs higher. Always check a live board before executing, especially for on-chain DEX routing where failed swaps still burn gas.

Q : Is a ZK rollup more secure than an optimistic rollup for everyday users?

A : Both inherit Ethereum security. ZK rollups publish validity proofs for each batch, yielding faster L1 finality (hours). Optimistic rollups rely on fraud proofs with a ~7-day challenge period; that’s a UX difference more than a “security downgrade,” but it impacts withdrawals and reorg risk windows. Bridges can offer instant liquidity for optimistic exits if you can accept third-party risk.

Q : How long do withdrawals take on Optimism, Arbitrum, zkSync, and Starknet?

Optimism/Arbitrum

Canonical L1 withdrawals ≈7 days (challenge period). Fast bridges (Across/Hop) can exit in minutes for a fee.

zkSync/Starknet:

Validity proofs finalize on L1 in hours; zkSync cites ~3 hours typical.

Q : Do I need to rewrite Solidity contracts to use Arbitrum Stylus and Rust?

A : No. Stylus adds a WASM VM alongside the EVM. You can keep Solidity where it’s best and write new, compute-heavy modules in Rust, calling between them bi-directionally. Start with interop tests in Foundry. Benchmark before you rewrite.

Q : How will full danksharding differ from today’s proto-danksharding (4844)?

A : Proto-danksharding adds a small number of blobs with a separate fee market. Full danksharding targets dramatically more blob capacity (e.g., ≈64 blobs per block) plus data availability sampling enabling many more rollups at much lower marginal costs. It’s a multi-year path, but it’s the core of Ethereum’s scaling roadmap.