61% of institutions plan to boost crypto exposure despite October crash: Sygnum

Institutional interest in digital assets remains strong despite October’s market pullback. According to Sygnum’s 2025 Institutional Crypto Survey of 1,000 firms, 61% plan to increase their crypto exposure in the coming months, signaling sustained confidence in the asset class even amid recent volatility.

The survey also highlights improving sentiment, with 55% of respondents expressing a bullish near-term outlook. Additionally, 73% said their primary motivation for investing in digital assets is the potential for higher long-term returns. These findings suggest institutions continue to view crypto as a key part of their growth and diversification strategies heading into 2025.

Drivers and near-term outlook

Return expectations dominate

73% of respondents are in crypto for anticipated upside, despite the early-October market crash.Macro & policy overhang: Sentiment is tempered by delays to U.S. market-structure legislation and ETF approvals during the government shutdown.TradingView

Measured risk-taking

Sygnum researcher Lucas Schweiger describes 2025 as “measured risk… and powerful demand catalysts,” with institutions pursuing diversified, long-term exposure.

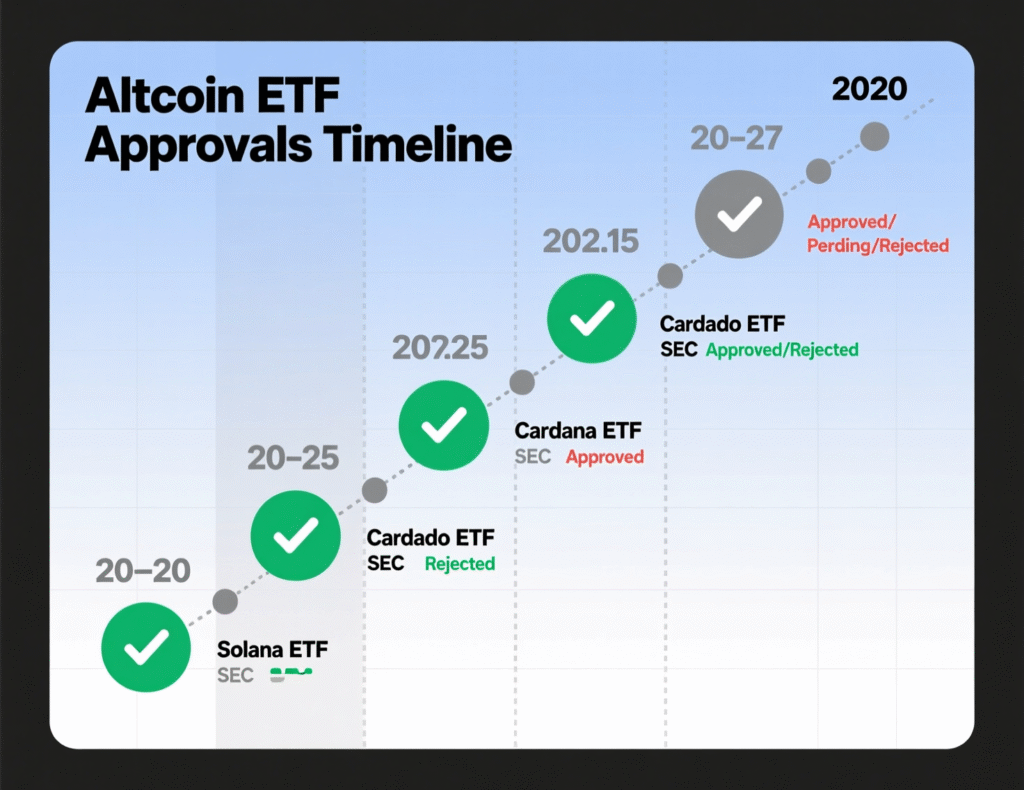

ETFs: from altcoins to staking

Institutional participation is increasingly routed through regulated wrappers. Sygnum notes interest beyond Bitcoin and Ether, with altcoin ETF applications in the queue and staking ETFs viewed as a potential next catalyst; 70% would start or add if staking rewards were enabled. Shutdown-related SEC delays have slowed decisions, but an end could bring “bulk approvals.”

How institutions are positioning (context)

Broader industry data indicate hedge funds and other professional allocators have been adding exposure through 2025, often via derivatives and regulated vehicles consistent with Sygnum’s findings.

What the Sygnum institutional crypto survey 2025 signals for flows

Allocation intent

Majority plan to increase, few to reduce; near-term buying is possible once policy bottlenecks clear.

ETP pipeline

Multiple altcoin ETP/ETF proposals remain pending; shutdown-related delays have been widely reported.

Historical baseline

Sygnum’s 2024 report showed >50% planning to increase allocations this year’s figure is higher, suggesting maturation.

Inside the Sygnum institutional crypto survey 2025 methodology and quotes

Sygnum reports surveying 1,000 institutional investors globally. Lucas Schweiger: “Discipline has tempered exuberance, but not conviction, in the market’s long-term growth trajectory.”

Context & Analysis

The survey’s stronger allocation intent vs. 2024 aligns with broader institutional adoption trends. Yet execution depends on U.S. regulatory throughput: ETF decisions, market-structure legislation, and any staking-related product greenlights. A synchronized “approval window” could accelerate flows into diversified ETPs; prolonged delays would likely keep positioning cautious and derivative-heavy.

Conclusion

Institutional conviction in digital assets remains firm despite October’s market setback. Many investors appear unfazed by recent volatility, focusing instead on structural improvements and the broader adoption of blockchain-based financial products.

If regulatory delays and operational bottlenecks ease, and ETF approvals extend beyond Bitcoin and Ethereum to include staking-based assets, the Sygnum survey suggests a new wave of institutional inflows could emerge in 2025. This momentum could further solidify crypto’s position within diversified institutional portfolios.

FAQs

Q : What does the Sygnum institutional crypto survey 2025 say?

A : It reports that 61% of institutions plan to increase crypto exposure and 55% are short-term bullish.

Q : Why are institutions investing more after October’s crash?

A : Mostly for expected future returns (73%), despite ongoing market volatility.

Q : Will altcoin ETFs drive new inflows?

A : They could, pending approvals that were delayed during the U.S. shutdown; once resolved, bulk decisions may follow.

Q : What about staking ETFs?

A : Sygnum notes strong interest 70% of institutions would start or add positions if staking rewards are included.

Q : How does this compare with last year?

A : Sygnum’s 2024 report also showed most institutions planning increases, but 2025 intent appears even stronger.

Q : Are hedge funds part of this trend?

A : Yes, separate surveys indicate rising hedge fund participation in 2025.

Q : What risks remain?

A : Regulatory timing, market volatility, and product design especially staking mechanics remain key risk factors.

Facts

Event

Sygnum survey finds majority of institutions plan higher crypto allocationsDate/Time

2025-11-11T12:00:00+05:00Entities

Sygnum Bank; Lucas Schweiger (Research); U.S. SECFigures

61% plan to increase; 55% short-term bullish; 73% invest for higher returnsQuotes:

“The story of 2025 is one of measured risk… and powerful demand catalysts.” Lucas SchweigerSources:

Cointelegraph via TradingView (news) TradingView; Cointelegraph follow-up on shutdown & ETFs TradingView