Brazil classifies stablecoin payments as foreign exchange under new rules

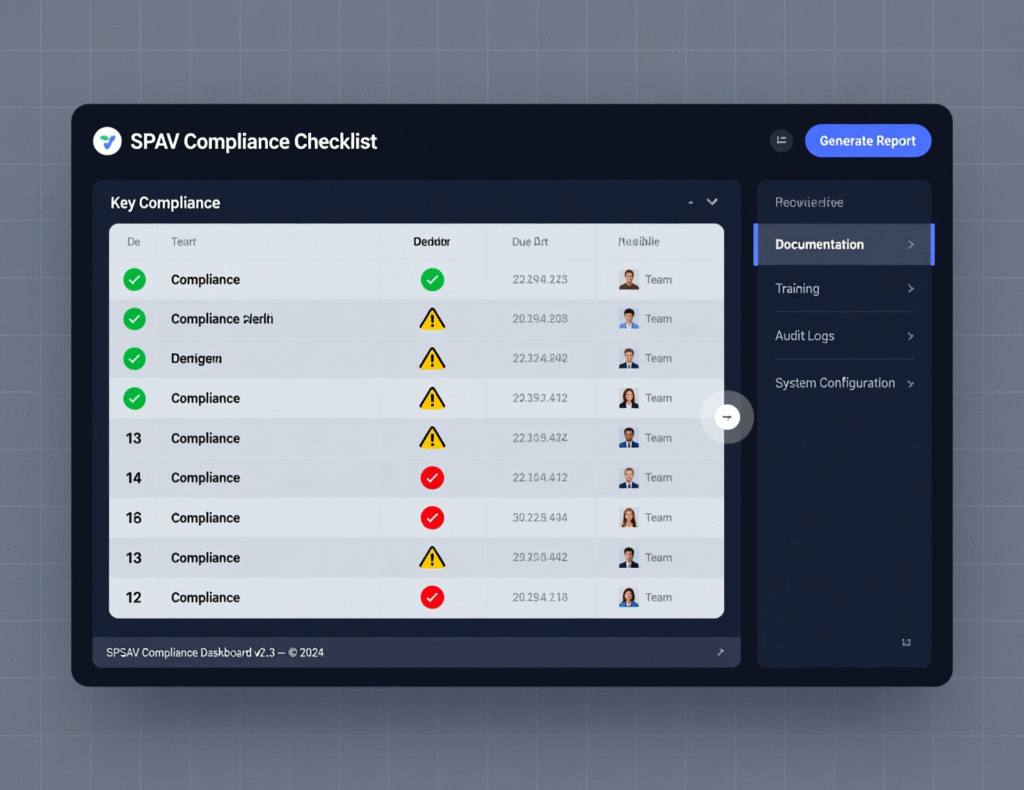

Brazil’s central bank has introduced a comprehensive framework to regulate virtual-asset service providers (SPSAVs) and clarify how fiat-backed stablecoins are managed within the financial system. The move aims to bring greater transparency, oversight, and security to the rapidly growing crypto market, ensuring that digital asset activities align with national financial standards.

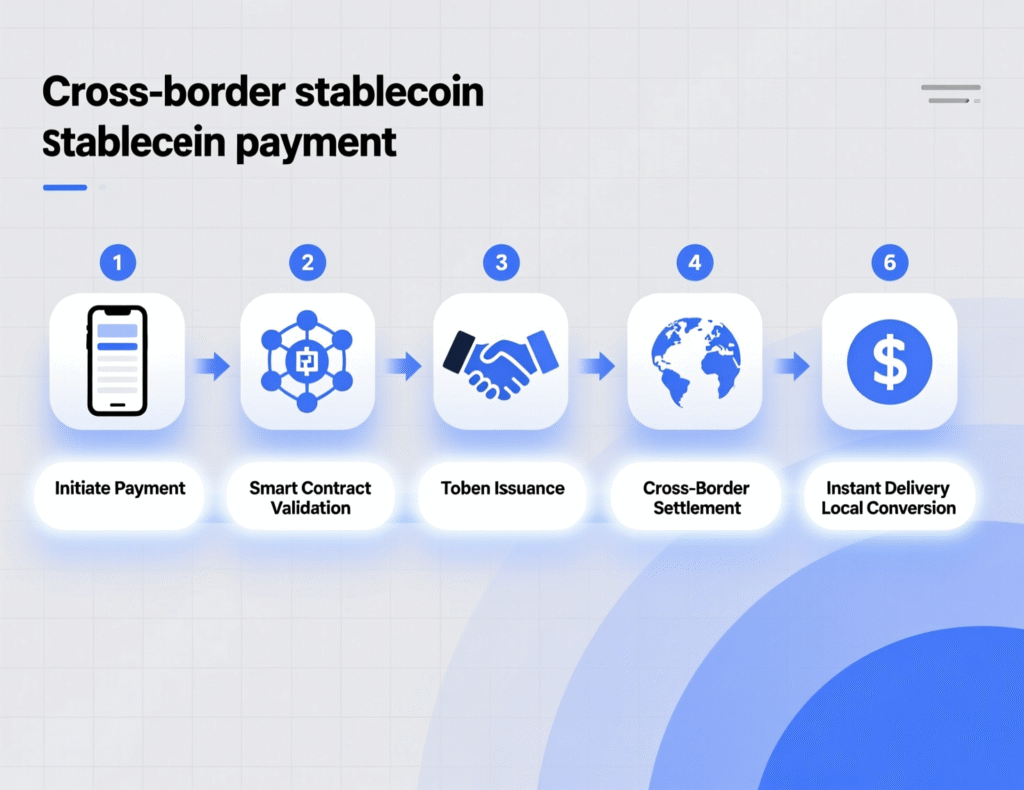

Under the new rules, transactions involving stablecoins including purchases, sales, exchanges, and specific wallet operations will now be treated as foreign exchange (FX) operations. This classification extends banking-style obligations such as anti–money laundering (AML) measures, consumer protection protocols, and detailed reporting requirements to crypto firms. The framework effectively integrates stablecoins into Brazil’s regulated financial ecosystem while tightening oversight of cross-border digital currency flows.

Oversight expands to SPSAVs

The Banco Central do Brasil (BCB) published Resolutions 519, 520 and 521 establishing:

Operational standards for SPSAVs.

Authorization processes akin to other supervised financial institutions; and

The scope of crypto activities captured under FX and international-capital rules.

The framework mirrors obligations applied to banks and brokers governance, internal controls, transparency and AML/CFT.

Brazil stablecoin foreign exchange rules: what’s in Resolution 521

Resolution 521 specifies that buying, selling or exchanging fiat-pegged virtual assets and international payments/transfers using such assets are FX operations. It also brings self-custody wallet flows into scope when intermediated by a provider, requiring owner identification and origin/destination checks. For operations with foreign counterparties that are not authorized FX institutions, individual transfers are capped at US$100,000; other value limits apply to FX-authorized firms.

Which firms can execute FX-classified stablecoin activity?

Licensed FX institutions and SPSAVs operating under the new regime may conduct these operations, subject to documentation and value ceilings. Non-authorized entities are restricted.

Reporting & dates

The rules take effect on Feb. 2, 2026. From May 4, 2026, reporting to the BCB becomes mandatory for FX and international-capital statistics, aligning stablecoin flows with Brazil’s balance-of-payments accounts.

Market impact and compliance themes

The regime is expected to raise compliance costs and standardize practices across exchanges, brokers and custodians. Smaller firms may need to partner with FX-licensed institutions or obtain SPSAV status to access global liquidity while meeting identification and documentation duties for wallet interactions. Officials say the goal is to reduce scams, prevent regulatory arbitrage, and increase legal certainty. Poder360+2Poder360+2

Brazil stablecoin foreign exchange rules and payments behavior

BCB leadership has warned that ~90% of Brazil’s crypto activity involves stablecoins used primarily for payments raising AML and tax oversight challenges. The classification as FX embeds these flows within established supervision and cross-border data channels.

Context & Analysis

Brazil’s move consolidates crypto oversight into existing FX and capital-flows infrastructure, similar to approaches in jurisdictions emphasizing transparency of cross-border stablecoin payments. By aligning with FX reporting, the BCB can incorporate stablecoin activity into balance-of-payments statistics while tightening AML guardrails. The trade-off is heavier compliance for smaller platforms and stricter handling of self-custody interactions areas previously outside traditional reporting.

Conclusion

Brazil’s new crypto framework makes clear that digital assets are welcome but will be regulated with the same rigor as traditional finance. The rules, taking effect in February 2026, aim to align virtual-asset service providers with existing financial oversight standards.

Companies dealing with stablecoin payments or wallet-to-exchange transfers must begin adapting now. They’ll need to ensure compliance with foreign exchange (FX) classifications, secure appropriate licenses, and strengthen reporting processes. Early preparation will be essential for firms seeking to operate smoothly under Brazil’s new regulatory structure and to maintain credibility in an increasingly scrutinized crypto environment.

FAQs

Q : What changed under Brazil’s new crypto rules?

A : The BCB created the SPSAV category, extended banking-style AML and consumer-protection rules to crypto firms, and classified many stablecoin transactions as foreign exchange (FX) operations.

Q : When do the rules apply?

A : Most provisions take effect on February 2, 2026, while FX and capital-accounts reporting requirements begin on May 4, 2026.

Q : Do the Brazil stablecoin foreign exchange rules ban self-custody?

A : No. However, when a provider intermediates transfers to or from self-custody, it must identify the wallet owner and record the asset’s origin and destination.

Q : Who can perform FX-classified stablecoin operations?

A : Only FX-licensed institutions and SPSAVs can do so, subject to documentation and transaction value limits.

Q : Are there value caps?

A : Yes. For instance, operations with unlicensed foreign counterparties are capped at US$100,000 per transfer, and other ceilings apply to FX-authorized firms.

Q : Why is Brazil doing this now?

A : The BCB cites goals such as improving efficiency, ensuring legal certainty, addressing AML risks, and regulating the stablecoin market, which accounts for roughly 90% of Brazil’s crypto use.

Q : What should smaller exchanges do?

A : They should explore licensing options (SPSAV or partnerships), implement wallet-identification systems, and prepare reporting infrastructure well before 2026.

Facts

Event

BCB finalizes SPSAV framework; classifies stablecoin transactions as FXDate/Time

2025-11-11T12:00:00+05:00Entities

Banco Central do Brasil (BCB); SPSAVs; FX-authorized institutions; Gabriel Galípolo (BCB president)Figures

In-force date 2026-02-02; reporting from 2026-05-04; cap US$100,000 with unlicensed foreign counterparties; stablecoins ≈ 90% of Brazil’s crypto usageQuotes

“New rules will reduce the scope for scams, fraud, and the use of virtual asset markets for money laundering.” BCB regulation director (per press briefing). ReutersSources

BCB explainer (PDF) https://bcb.gov.br (mirror), Resolution 521 (PDF)