Market Maker Flowdesk Says Crypto Credit Is Finding a Fragile Balance

Digital-asset credit markets are tightening after recent volatility but remain active. According to Flowdesk, a wave of deleveraging is underway as trading firms and lenders reassess counterparty risk in the wake of Stream Finance’s $93 million loss. The event has prompted stricter collateral management and reduced leverage across key venues.

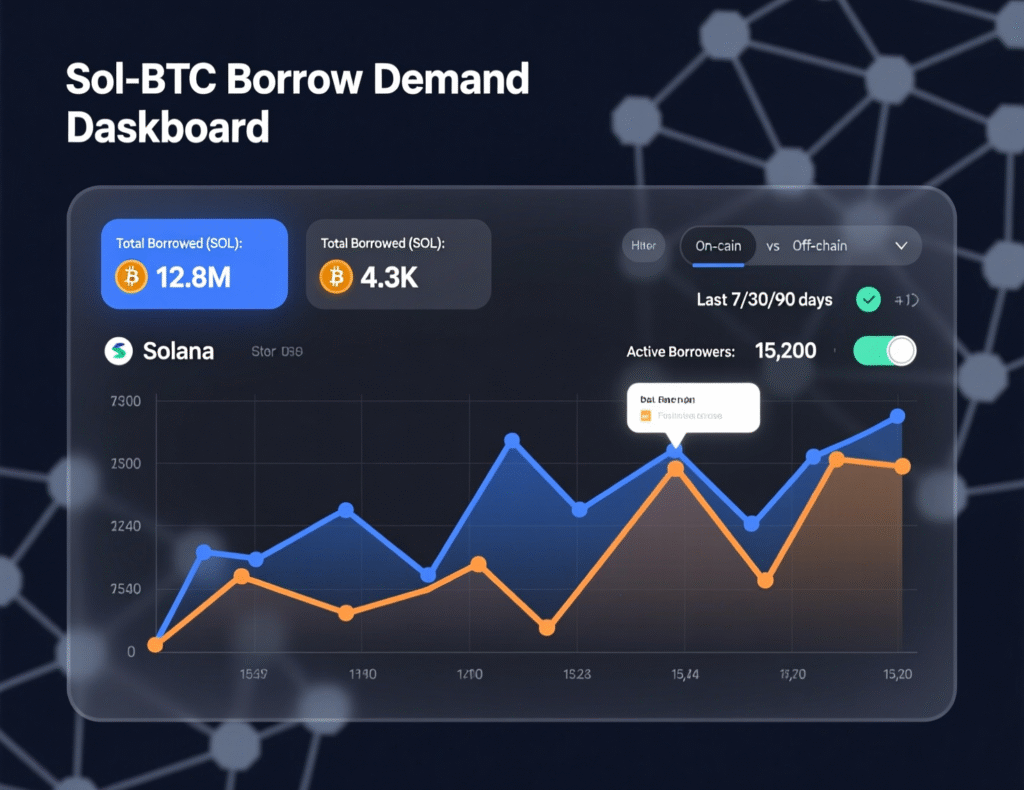

Despite the caution, borrowing demand for leading tokens such as Bitcoin and Solana has stayed firm, driven by ongoing hedging and basis-trade activity. Flowdesk notes that while lending yields have compressed from recent highs, many pools still offer returns above typical DeFi benchmarks. The market appears to be recalibrating rather than retreating, signaling a more measured approach to crypto credit exposure going forward.

Flowdesk’s read: deleverage, don’t disengage

Flowdesk’s credit desk observed “deleveraging flows as counterparties reposition,” while some participants added leverage at current levels, focusing on majors. The firm describes defensive positioning and sidelined capital awaiting clearer direction—but no freeze in credit. CoinDesk

Where borrowing holds up

Borrow demand for SOL, XLM, ENA, APT and BTC remains “robust,” largely tied to hedging/funding strategies rather than directional longs, according to Flowdesk. That pattern helps keep basis and market-making strategies functioning despite lower overall risk appetite.

Yields: compression across Maple and JitoSOL venues

Risk-off behavior is pressuring yields lower in blue-chip lending pools. Even so, broad DeFi lending returns captured by Chainlink’s DeFi Yield Index are in the ~4–5% range, while the U.S. 10-year Treasury sits near ~4.1%, narrowing the pickup. Flowdesk notes rates have compressed “across the board.

Crypto credit market deleveraging and treasuries

As spreads over Treasuries tighten, lenders continue rotating out of riskier pools toward higher-quality collateral and venues with stricter underwriting, keeping utilization healthy in majors while secondary assets see softer demand.

Stress catalyst: Stream Finance’s $93M loss

Stream Finance halted deposits/withdrawals and initiated a legal probe after an external fund manager disclosed $93M in losses. The episode accelerated risk reviews among lenders and market makers, adding to October’s drawdown shock.

Outlook: 2022 vibes?

CryptoQuant warns of bearish parallels to 2022 including funding-price divergences—raising the risk of further yield compression and softer funding. If weakness persists, DeFi yields may drift closer to Treasury returns.

Signals inside crypto credit market deleveraging

Key “tells” include declining borrow caps on long-tail assets, rate step-downs in priority pools, and stickier demand for majors that support delta-neutral or basis trades even as overall leverage falls.

Context & Analysis

While deleveraging reduces tail risk, it can also limit liquidity for smaller tokens, reinforcing a barbell market where majors retain credit while alt-assets face tighter terms. If macro risk eases and spot stabilizes, compressed yields could re-expand, particularly where utilization remains high and defaults are limited.

Conclusion

Crypto credit markets remain fragile yet operational, with leverage reduced and key assets like Bitcoin and Solana still attracting funding. Borrowing conditions have tightened, and yields have narrowed compared to broader benchmarks, reflecting a cautious tone among lenders and traders after recent market turbulence.

The next phase will depend on how funding dynamics evolve. A sustained recovery could restore confidence and liquidity, while renewed risk aversion may trigger further deleveraging. Much will hinge on whether current bearish sentiment fades or deepens, setting the direction for credit conditions across both centralized and decentralized lending platforms.

FAQs

Q : What does Flowdesk say about current crypto credit conditions?

A : Flowdesk reports deleveraging but ongoing credit activity, with strong borrow demand for majors.

Q : Did Stream Finance trigger this risk reset?

A : Stream Finance’s disclosure of a $93M loss and withdrawal freeze heightened risk reassessments across lenders.

Q : Are DeFi yields still attractive versus bonds?

A : Broad DeFi yields (per Chainlink’s index) hover around 4–5%, near the U.S. 10-year’s ~4.1%, reducing the pickup.

Q : How could bearish market signals affect lending?

A : If CryptoQuant’s bearish read holds, funding could soften and yields compress further.

Q : Where is borrowing strongest?

A : In majors such as SOL and BTC, mainly for hedging/funding strategies rather than directional longs.

Q : Is there a risk of credit freezing?

A : Flowdesk indicates no freeze, just lower leverage and defensive positioning.

Q : Does this article cover “crypto credit market deleveraging” steps I can follow?

A : Yes, see the How To section for a quick monitoring framework.

Facts

Event

Flowdesk notes deleveraging and yield compression; Stream Finance reveals $93M loss; market shows bearish signals.Date/Time

2025-11-07T13:15:00+05:00Entities

Flowdesk; Stream Finance; Maple Finance; Jito (JitoSOL); Chainlink; CryptoQuant; Bitcoin (BTC); Solana (SOL).Figures

Stream Finance loss: USD 93m; Chainlink DeFi Yield Index ~4–5%; U.S. 10-year Treasury ~4.1%. CoinDesk+2Chainlink+2Quotes

“Deleveraging flows as counterparties reposition…”; “Rates and yields have compressed across the board…” Flowdesk credit desk. CoinDeskSources

CoinDesk Flowdesk note; CryptoBriefing on Stream Finance.