The Next Wave of Stablecoins

Stablecoins keep gaining ground as the connective tissue between traditional finance and web3. Over the past year, stablecoins crossed the $250B–$310B range in total market capitalization depending on source and cutoff date, with USDT and USDC together holding the lion’s share. Regulatory clarity is advancing on both sides of the Atlantic: the EU’s MiCA regime entered into force with rules for tokens referencing assets and e-money tokens, while the U.S. moved forward with a federal stablecoin bill (GENIUS Act).

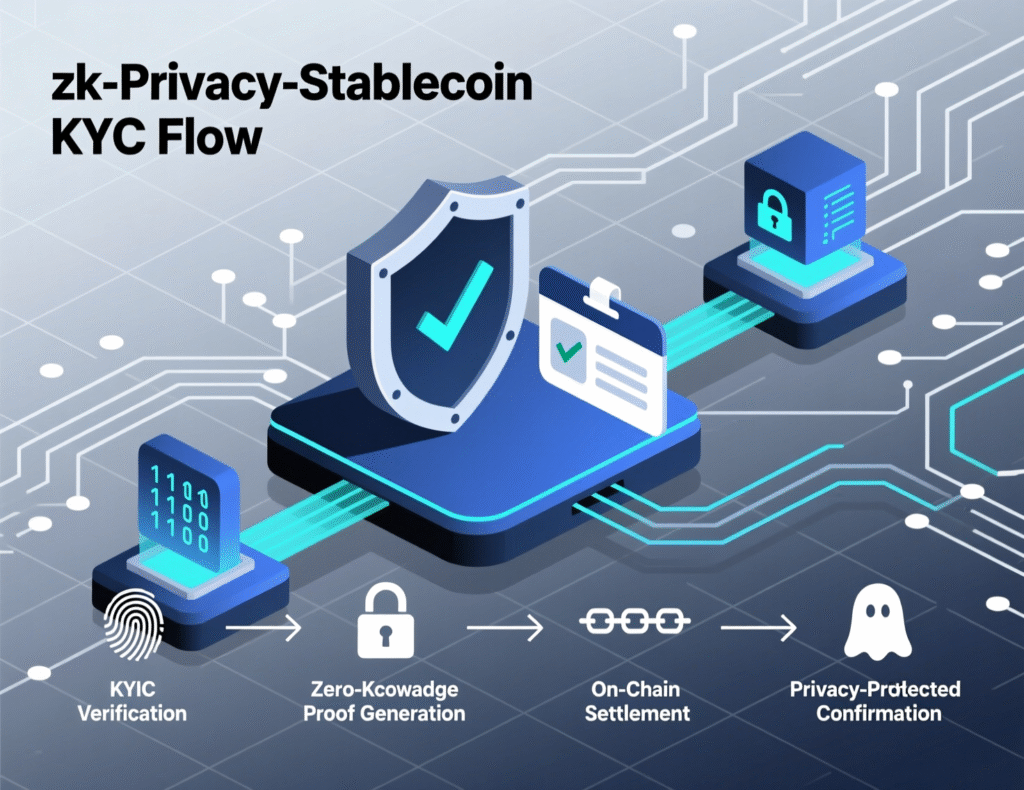

At the same time, the privacy debate matured: rather than “privacy vs. compliance,” teams are shipping zero-knowledge proofs (ZKPs) and “compliance-by-design” architectures that promise lawful, auditable, yet private transactions.

In this guide, we map the next wave of stablecoins across three vectors privacy, regulation, and innovation so builders and buyers can spot real opportunities and avoid compliance dead ends.

Why Stablecoins Still Matter (and Where They’re Going)

Payments & settlement

Exchanges and fintechs continue to expand stablecoin payouts and merchant settlement (e.g., Coinbase PayPal moves around PYUSD), while cross-border payroll and marketplace flows migrate from wires to token rails.

Liquidity & DeFi collateral

USDC’s on-chain volumes and circulation posted record highs into 2025; Aave’s GHO and other programmatic dollars are embedding policy controls at the protocol level. Kaiko Research+2Circle+2

Macro pressure & EM demand

Analysts warn of potential deposit flight from emerging-market banks as dollar stablecoins become an accessible savings hedge; central banks and the BIS are responding with sharper critiques and tokenization roadmaps.

Bottom line

The next phase isn’t just bigger; it’s more regulated, programmable, and privacy-aware.

Regulation: From Ambiguity to Rulebooks

MiCA in the EU: What’s Live

The Markets in Crypto-Assets (MiCA) framework entered into force with a staged implementation, defining e-money tokens (EMTs) and asset-referenced tokens (ARTs), disclosure, reserve, and governance rules including caps for non-euro EMTs used as means of exchange inside the EU. Issuers face authorization, whitepaper, and reserve-asset standards, with ESMA and EBA technical standards rolling out. For product and compliance teams, MiCA creates a predictable path to EU distribution.

The U.S.: Federal Guardrails Arrive

In 2025, the U.S. Senate passed and later the White House announced signing—the GENIUS Act, a federal regime addressing reserve quality, issuer licensing, redemption rights, and restrictions around yield. While final rulemaking will shape details, the direction is clear: bank-grade reserves, redeemability at par, disclosures, and a ban or tight limits on paying “interest-like” returns from issuers. Expect state regimes to harmonize with the federal baseline.

Global AML: The Travel Rule Gets Teeth

FATF’s targeted updates urge jurisdictions to operationalize the Travel Rule sender/receiver information for qualifying transfers and to supervise compliance effectively. For stablecoins, that means exchanges, custodians, and payment processors must integrate Travel Rule messaging and counterparty due diligence workflows, including for self-hosted-wallet interactions.

What this means for teams

Build for proofs and logs

Regulators will expect demonstrable controls, not promises.

Design redemption UX that survives audits (T+0 where possible).

Model EU usage caps and issuance limits if you target eurozone commerce.

Privacy: From Binary to “Compliance-by-Design”

The false binary “total surveillance vs. total anonymity”—is giving way to privacy-preserving compliance. With ZKPs, issuers or VASPs can attest “KYC completed” or “not on sanctions lists” without exposing raw PII on-chain. Designs include:

Selective disclosure

Using zk-credentials: Users prove age/jurisdiction/AML screening while revealing nothing else.

View keys / audit keys

For regulated access under due process.

On-chain policies

Deny-lists/allow-lists enforced by smart contracts, with proofs attached to transfers.

Academia and industry reports in 2025 outline cryptographic frameworks to verify AML/KYC while preserving privacy; central-bank and BIS commentaries, however, continue to question peg robustness and systemic risk. The pragmatic approach: encode controls into tokens, prove compliance via ZK, and reserve off-chain PII to trusted enclaves.

Example 1 Marketplace payouts

A freelance platform routes EUR and USD stablecoins to creators globally. The payout flow attaches a Travel-Rule message and a ZK proof that the receiver passed KYC with a recognized provider; auditors can open the proof trail without accessing raw documents. (Architecture inspired by FATF guidance and ZK compliance papers

Example 2 Institutional DeFi

A fund provides liquidity on a permissioned pool that accepts only addresses with compliant credentials (revocable if sanctions change). Transfers embed policy checks, and the fund holds an audit key to satisfy regulator inquiries no public PII leakage.

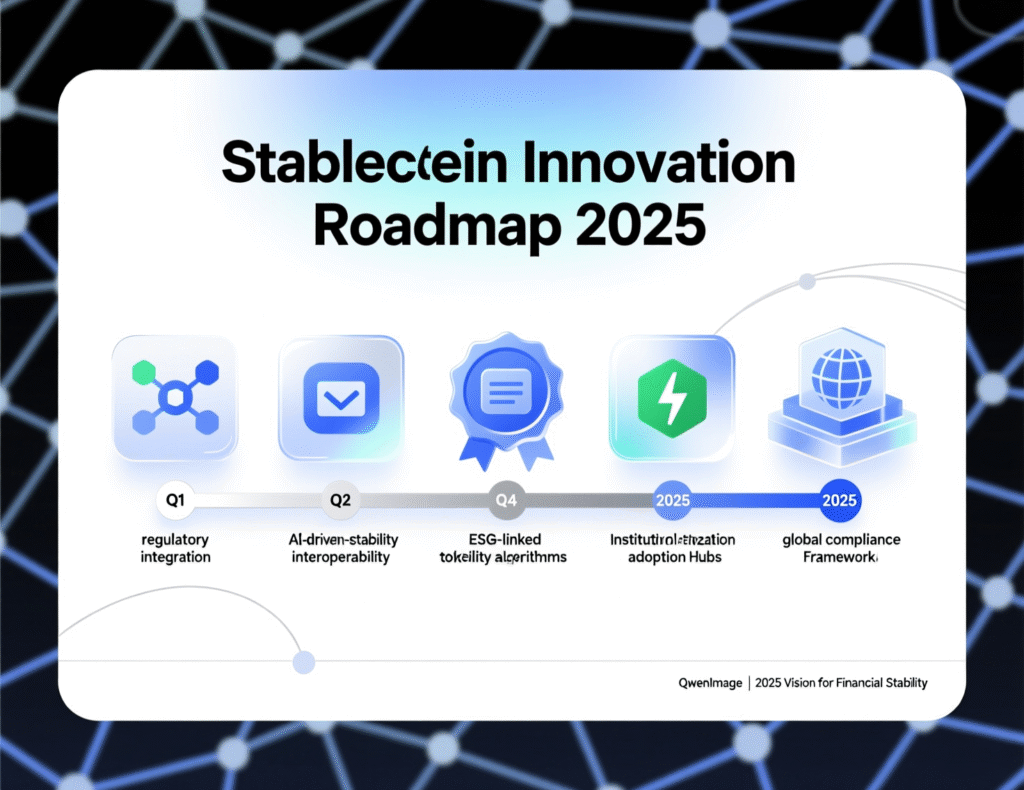

Innovation: What “Stablecoins 2.0” Look Like

Programmable Policy Controls

New tokens embed circuit breakers, velocity caps, and issuer-controlled hooks to enforce blacklists and freeze/unfreeze under court orders. Governance defines when and how those controls may be used (with on-chain transparency).

Omnichain & Interop

Bridged and native deployments increasingly use canonical routers or chain-agnostic mints to reduce fragmentation and bridge risk. Expect broader acceptance in L2s and appchains.

Payments Rails Integration

Partnerships like Coinbase-PayPal around PYUSD show how stablecoins reach mainstream rails payout APIs, treasury dashboards, and merchant settlement alongside fiat.

Transparency & Attestations

Daily reserve attestation and short-dated T-bill portfolios are table stakes. Market leaders publish independent attestations, breakdowns, and intramonth snapshots; scrutiny of asset quality (and concentration risk) remains intense per BIS and media coverage.

Protocol-Native Dollars

DAO-issued stablecoins like Aave’s GHO continue to evolve with staking, over-collateralization, and redemption mechanics that balance peg stability with capital efficiency.

Market Landscape 2025: Signals to Watch

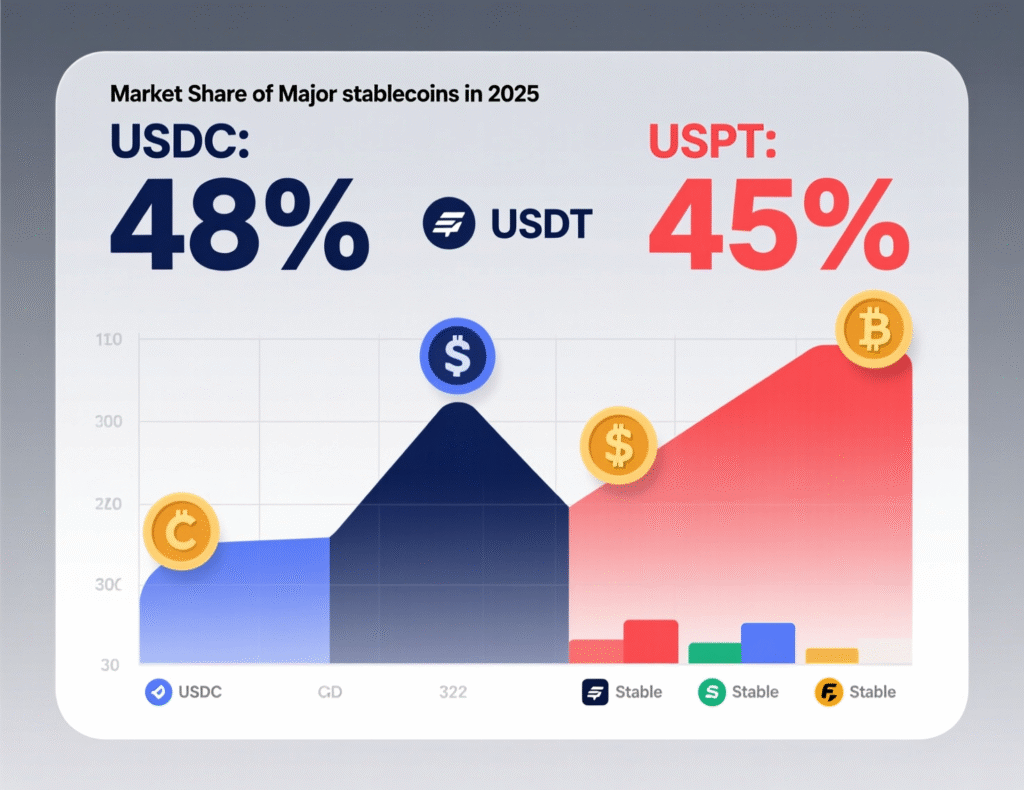

Market concentration

USDT and USDC still dominate the stablecoins category; industry dashboards put the combined share near ~90%.

USDC momentum

Circle’s reports and independent research highlight YoY growth in USDC circulation and volumes, with new banking ambitions and public-market milestones.

PYUSD push

Exchanges and payment platforms lower frictions to push merchant use cases.

Skepticism from central banks

BIS and ECB authors warn on peg fragility and financial-stability risk, nudging policy toward tokenized bank money and unified ledgers.

Building a Privacy-Preserving, Compliant Stablecoin: A Mini How-To

Define your perimeter

EMT vs. ART vs. programmatic design; target regions and use cases (payments, DeFi, B2B).

Licensing & governance

Choose issuer entity, board, and control framework aligned with MiCA/EU or U.S. GENIUS requirements.

Reserve architecture

Segregated accounts, short-duration sovereigns, independent attestation schedule.

Compliance fabric

Integrate Travel Rule providers; add ZK proof rails for KYC/AML attestations.

Policy-aware contracts

Freeze/unfreeze mechanics, deny-lists, and emergency pause—codified with transparent governance.

Observability

Real-time supply dashboards, proof-of-reserves, and redemption SLAs.

Rollout

Start with controlled pilots (B2B payouts, remittances) before opening retail flows; map UX for edge cases (mismatched jurisdiction, failed proofs).

Risks & Mitigations

Run/peg risk

Maintain conservative, highly liquid reserves; publish daily and intraday snapshots. BIS continues to flag peg stability and transparency risks.

Regulatory drift

Track ESMA/EBA standards and U.S. rulemaking updates; design for feature flags you can toggle as rules finalize.

Privacy misuse concerns

ZK does not mean “invisible.” Enable audit keys, revocation policies, and escalation paths that meet legal thresholds.

Wrapping It Up

The next wave of stablecoins is defined by trust, programmability, and privacy that satisfies real regulators not just rhetoric. With MiCA live in Europe and U.S. federal legislation pointing toward bank-grade reserves and redemption rights, the table is set. Add ZK attestation layers, Travel-Rule-ready messaging, and transparent reserves, and stablecoins can power cross-border commerce without exposing user data.

Call to action

If you’re shipping payments, marketplaces, or DeFi, start a 90-day pilot: instrument policy-aware contracts, wire up a Travel Rule provider, and test ZK attestations for KYC—then measure cost, speed, and compliance outcomes.

FAQs

Q : How do stablecoins stay at $1?

A : They hold liquid reserves (e.g., cash/T-bills) or over-collateralized crypto and offer redemption at par. Attestations and redemption SLAs are key to maintaining confidence. (VERIFY LIVE with issuer disclosures.

Q : How does MiCA affect stablecoin issuers?

A : MiCA introduces licensing, reserve, disclosure, and usage-cap rules for EMTs/ARTs in the EU, plus ongoing supervision via ESMA/EBA technical standards.

Q : How can stablecoins preserve privacy and still meet AML rules?

A : By using ZK proofs for KYC/AML assertions and operationalizing the FATF Travel Rule through VASP integrations off-chain PII, on-chain proofs.

Q : How do U.S. rules change stablecoin design?

A : The GENIUS Act framework emphasizes high-quality reserves, issuer authorization, and restrictions on yield. Expect tighter disclosure and consumer-protection standards.

Q : What are BIS/central-bank concerns?

A : They cite peg fragility, transparency gaps, potential runs, and monetary-sovereignty risk pushing policy toward tokenized bank money.

Q : How can businesses start accepting stablecoin payments?

A : Use payment processors/exchanges with zero-fee or low-fee stablecoins, implement Travel Rule checks, and reconcile redemptions to bank accounts.

Q : Do privacy features make audits harder?

A : Not if designed correctly. Use audit/view keys and keep verifiable logs of ZK attestations for regulated disclosure without public PII.

Q : Which stablecoins are most transparent?

A : Look for daily attestations, short-duration reserves, auditor reports, and explicit redemption SLAs. (Cross-check issuer sites and independent research.

Q : How can DeFi protocols remain compliant with stablecoin flows?

A : Whitelist credentialed addresses, embed deny-lists, and integrate Travel-Rule-capable gateways while preserving UX with ZK credentials.