The Rise of Institutional Crypto Products

Institutional adoption has changed crypto’s trajectory. In just a few short cycles, institutional crypto products from spot Bitcoin ETFs to regulated ETNs, qualified custody, and futures/derivatives access have shifted digital assets from niche to mainstream rails. For retail investors, this is not just a headline about Wall Street; it’s a practical change in how you can buy, hold, and risk-manage crypto inside existing brokerage accounts, retirement wrappers, and tax-advantaged plans.

In 2024–2025 the U.S. approved spot Bitcoin ETFs and, later, Ether ETFs, while the UK advanced exchange-traded notes (ETNs) and Europe implemented MiCA, a sweeping framework for crypto markets. These milestones helped translate crypto exposure into familiar wrappers, with audited reserves, standardized disclosures, and professional custody.

The result

institutional crypto products now offer a path to participate without moving funds to unfamiliar exchanges or juggling private keys. This article breaks down what’s inside these products, how they affect costs, liquidity, and taxes, and what institutional crypto products ultimately mean for everyday investors.

Key takeaway

The institutionalization of crypto increases convenience and oversight, but it doesn’t eliminate volatility. Retail investors still need a plan.

Why institutional crypto products took off

The growth spurt wasn’t an accident it followed regulatory clarity, product-market fit, and maturing infrastructure.

Regulatory green lights

The U.S. authorized spot Bitcoin ETFs in early 2024 and spot Ether ETFs thereafter, unlocking massive brokerage-channel demand. In parallel, the UK advanced ETN access on the London Stock Exchange, and the EU’s MiCA began phasing in, enhancing issuer obligations and market conduct. ESMA+4Investopedia+4London Stock Exchange+4

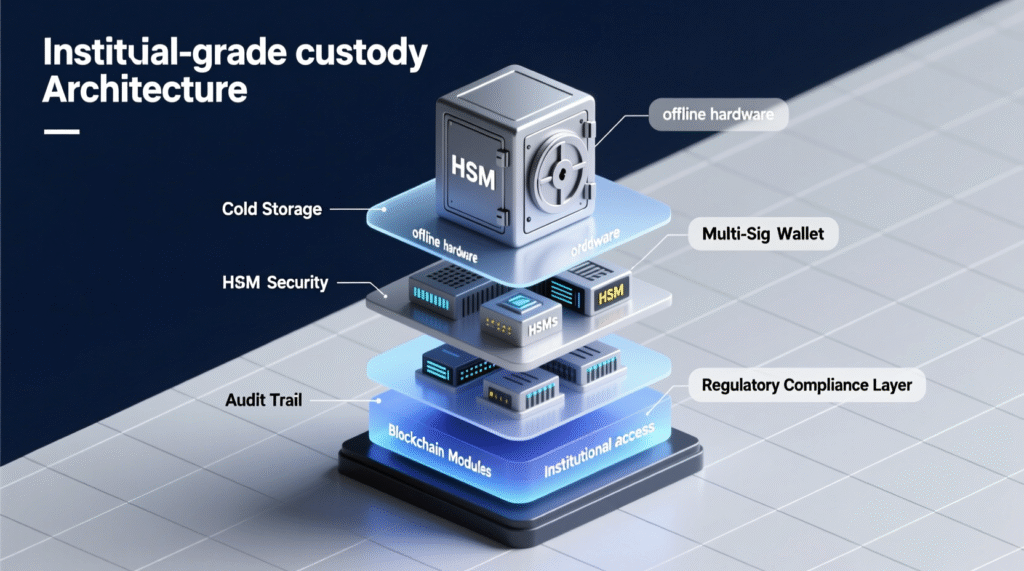

Scalable custody

Institutional custodians now secure large shares of the market’s assets under robust controls and insurance, which reduces operational risk for funds serving both institutions and retail.

Distribution via existing rails

Brokerage, retirement, and wealth platforms can list ETFs/ETNs, making crypto “one click” for mainstream investors. The U.S. has also streamlined listing rules to shorten the path from filing to launch.

A quick tour of institutional crypto products

Spot ETFs (e.g., Bitcoin, Ether

Hold the underlying asset in custody.

Trade on stock exchanges, settle like any equity ETF, are eligible for many brokerage and retirement accounts.

Examples include large U.S. spot Bitcoin ETFs (with tens of billions in AUM) and U.S. spot Ether ETFs launched after approvals.

ETNs (Exchange-Traded Notes

Debt securities referencing crypto; common in Europe/UK.

The London Stock Exchange admitted Bitcoin and Ether ETNs in 2024 and the UK has moved toward broader retail access and tax-wrapper eligibility.

Futures & other derivatives (institutional channels

Useful for hedging and basis strategies; often accessed by institutions, but benefits trickle down via improved price discovery and market depth in ETFs.

Qualified custody & prime brokerage

Institutions rely on regulated custodians and prime brokers for secure storage, financing, and liquidity access. Some custodians secure double-digit percentages of total crypto market cap critical plumbing for ETFs/ETNs that retail ultimately buys.

What this means for retail investors

Lower frictions, higher familiarity

Buying an ETF is easier than opening a new crypto exchange account, wiring funds, and managing wallets. That ease tends to increase participation.

Better price discovery and liquidity

Large funds aggregate demand and arbitrage premiums, helping align ETF prices with net asset value and deepening order books.

More traditional-finance protections

Disclosures, audited statements, and regulated custodians reduce some operational risks. (Market risk remains.)

Tax wrapper access

Depending on jurisdiction, you may be able to hold crypto exposure inside ISAs, SIPPs, IRAs or 401(k)-like accounts, improving after-tax returns. UK policy has evolved to allow certain crypto ETNs in tax-advantaged accounts, though platform rollout may lag.

Still volatile

ETFs track a volatile underlying. New access does not tame drawdowns.

Costs & tracking: the fine print

Expense ratios

Compare management fees across Bitcoin/Ether ETFs/ETNs. Lower fees improve long-term tracking.

Spreads & liquidity

Larger products usually enjoy tighter spreads.

Premium/discount dynamics

Efficient creation/redemption keeps ETFs near NAV, but in stress they can deviate.

Custody model

Understand who holds the coins and the control framework.

Taxes

Wrappers differ by country; consult local rules before placing institutional crypto products in tax-advantaged accounts.

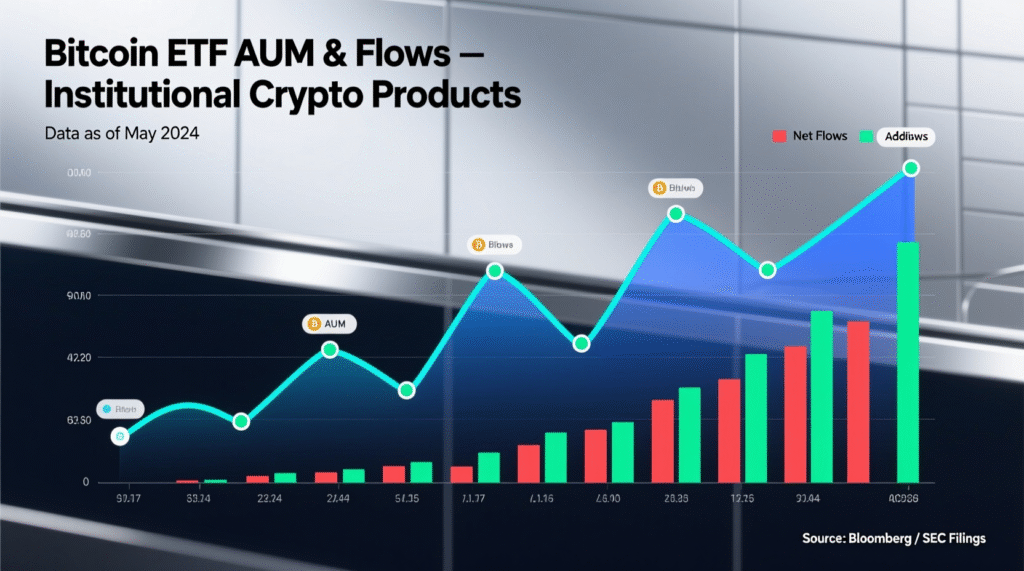

Case study 1: U.S. retail adoption through spot Bitcoin ETFs

Spot Bitcoin ETFs rapidly amassed assets via brokerage channels. At various points in 2024–2025, single issuers such as BlackRock’s IBIT reached tens of billions in AUM, with daily flows becoming a market driver; industry dashboards track cumulative net inflows for U.S. spot Bitcoin ETFs. The upshot for retail: easier entry, institutional-grade custody, and better liquidity through a familiar product.

Case study 2: UK/Europe ETNs, MiCA, and the path to retail

London listed Bitcoin/Ether ETNs in 2024 and has moved to open retail access subject to safeguards, including eligibility inside certain ISAs/SIPPs. Meanwhile, the EU’s MiCA has phased in stablecoin and broader crypto-asset requirements, setting a rulebook for issuance and market conduct. For retail, this means expanding choice on mainstream exchanges within clearer rule frameworks.

How institutional crypto products change portfolio construction

Access without operational burden

ETFs/ETNs let you add 1–5% allocations to a diversified portfolio without wallets or on-chain ops.

Rebalancing discipline

Brokerage tools can auto-rebalance positions monthly/quarterly—ideal for volatile assets.

Use cases expand

In some markets, institutional crypto products can sit in retirement accounts, enabling long-horizon, tax-aware compounding.

Risk layering

Market risk is still primary; wrapper risk (expense, tracking) is secondary.

Risks retail shouldn’t ignore

Volatility & correlation spikes

Crypto can fall 50–80% in bear phases.

Regulatory change

Access can widen or narrow based on policy. The SEC recently streamlined parts of the listing process for spot crypto ETFs, but rule changes cut both ways.

Single-asset concentration

Many products track one coin; diversify thoughtfully.

Fee drag in sideways markets

In low-return periods, expense ratios matter more.

Behavioral risk

Easy access can tempt over-trading. Use IPS (Investment Policy Statements) to curb impulses.

Practical playbook for retail investors

Define your why

Inflation hedge? Long-term thesis? Tech adoption? Write it down.

Pick the wrapper

ETF or ETN? Consider fees, liquidity, and tax treatment.

Size the allocation

Many investors cap crypto at 1–5% of total liquid assets to manage drawdowns.

Decide on funding & timing

Lump sum vs. DCA.

Rebalance rules

Pre-commit to trimming after rallies and adding after declines.

Track the plumbing

For institutional crypto products, monitor custodian disclosures, AUM, flows, and spreads.

Educate continuously

Follow regulator updates (SEC, FCA, ESMA) and issuer reports.

Where we are now and what’s next

Breadth beyond BTC/ETH

New products (e.g., Solana) have begun launching in some markets, indicating a widening investable universe.

Faster product cycles

U.S. listing procedures have been streamlined, potentially compressing time-to-market for future crypto ETFs when rules permit.

Mature infrastructure

Large custodians/prime brokers now underpin flows for both institutions and retail channels.

Outlook

The institutional era has made crypto simpler to access, cheaper to hold, and easier to fit inside a disciplined portfolio. Institutional crypto products wrap volatile assets in familiar, regulated formats with professional custody and improved oversight. That combination lowers operational risk and broadens distribution but it does not change the underlying price swings. For retail investors, the mandate is clear: use the convenience to implement a plan, not to chase headlines.

Allocate deliberately, respect position sizing, and rebalance on a schedule. Compare fees, watch tracking, and understand your tax context. As ETFs/ETNs expand beyond Bitcoin and Ether and global frameworks like MiCA mature, retail investors will see even more options—each with its own trade-offs. Treat institutional crypto products as tools: powerful when used with discipline, hazardous when used without one. Build your rules now, before the next wave of volatility arrives.

CTA

Want a one-page checklist for adding institutional crypto products to your portfolio? Download our free allocation worksheet and rebalancing template.

FAQs

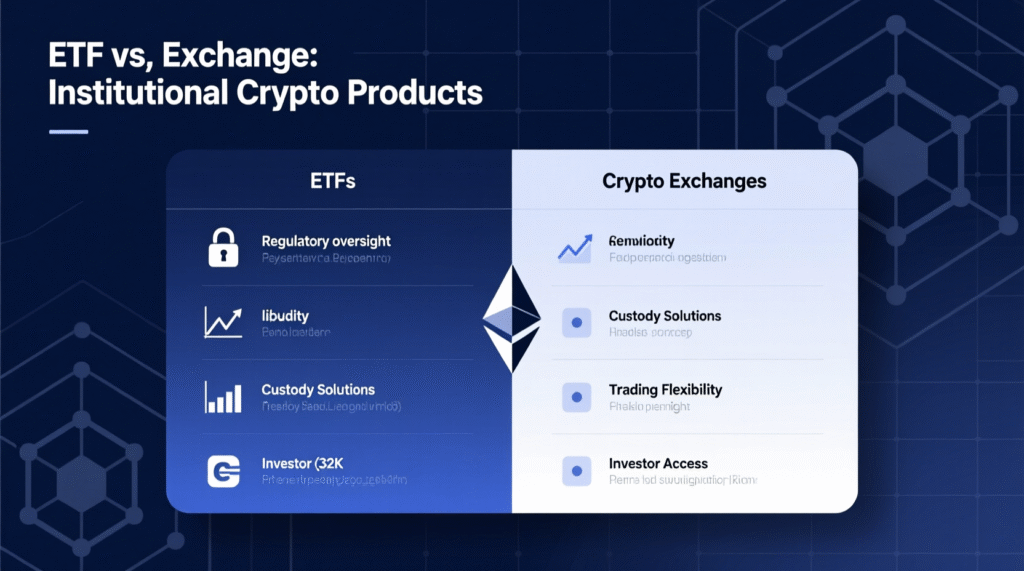

Q1 : How do institutional crypto products differ from buying coins on an exchange?

A : Institutional products (ETFs/ETNs) trade on stock exchanges, use regulated custodians, and provide audited disclosures, making them easier to add to brokerage or retirement accounts. Direct exchange purchases may offer broader asset choice and on-chain utility but require wallet management and carry exchange operational risk.

Q2 : How can retail investors compare spot Bitcoin/Ether ETFs?

A : Check expense ratios, spreads, AUM/liquidity, tracking error vs. NAV, and custodial arrangements. Larger funds often have tighter spreads and deeper markets, which can reduce total cost of ownership.

Q3 : How much of a portfolio should be in institutional crypto products?

A : Many planners keep crypto to 1–5% depending on risk tolerance and time horizon. Start at the low end, then rebalance. A written policy can prevent emotional decisions during volatility.

Q4 : How do taxes work for ETFs vs. coins?

A : Tax treatment varies by jurisdiction. Some wrappers allow holdings in tax-advantaged accounts (e.g., ISAs/SIPPs in the UK as rules evolve). Always confirm local rules before allocating.

Q5 : How do ETFs get their coins and keep prices aligned?

A : Authorized participants create or redeem shares by delivering or receiving the underlying assets. This arbitrage generally keeps ETF prices near NAV, though dislocations can occur in stressed markets.

Q6 : How risky are institutional crypto products?

A : They reduce operational risk (custody, disclosures) but not market risk. Expect sharp drawdowns and manage position sizes accordingly.

Q7 : How do flows into ETFs affect crypto prices?

A : Large, steady inflows can tighten spreads and improve liquidity; in certain regimes, they may contribute to upward price pressure. Outflows can do the opposite. Flow impact varies with market depth and sentiment.

Q8 : How can retail monitor product health?

A : Track AUM, net flows, spreads, and premium/discount to NAV. Issuer websites and independent dashboards publish frequent updates.

Q9 : What new institutional crypto products are on the horizon?

A : Markets have begun listing products beyond BTC and ETH (e.g., Solana). Future launches depend on regulatory approvals and market demand.