Bitcoin’s Last Support Before $100K Breaks as ‘Mag 7’ Skew Flips, Oracle CDS Surges

Bitcoin’s final support before the $100K level gave way during Asian trading, sparking renewed concern over a deeper correction as global risk sentiment weakened. The breach underscores growing caution among traders after weeks of overheated positioning and thin liquidity across crypto markets.

The decline also coincides with broader market stress signals. Options data show an unusual reversal in the “Magnificent 7” tech skew, suggesting investors are hedging against downside in previously resilient AI-linked stocks. Meanwhile, a jump in Oracle’s credit risk points to emerging doubts over the sustainability of AI-driven spending—a theme that had buoyed risk assets through most of the year. Together, these signs highlight fading confidence in both tech and digital assets as macro uncertainty returns.

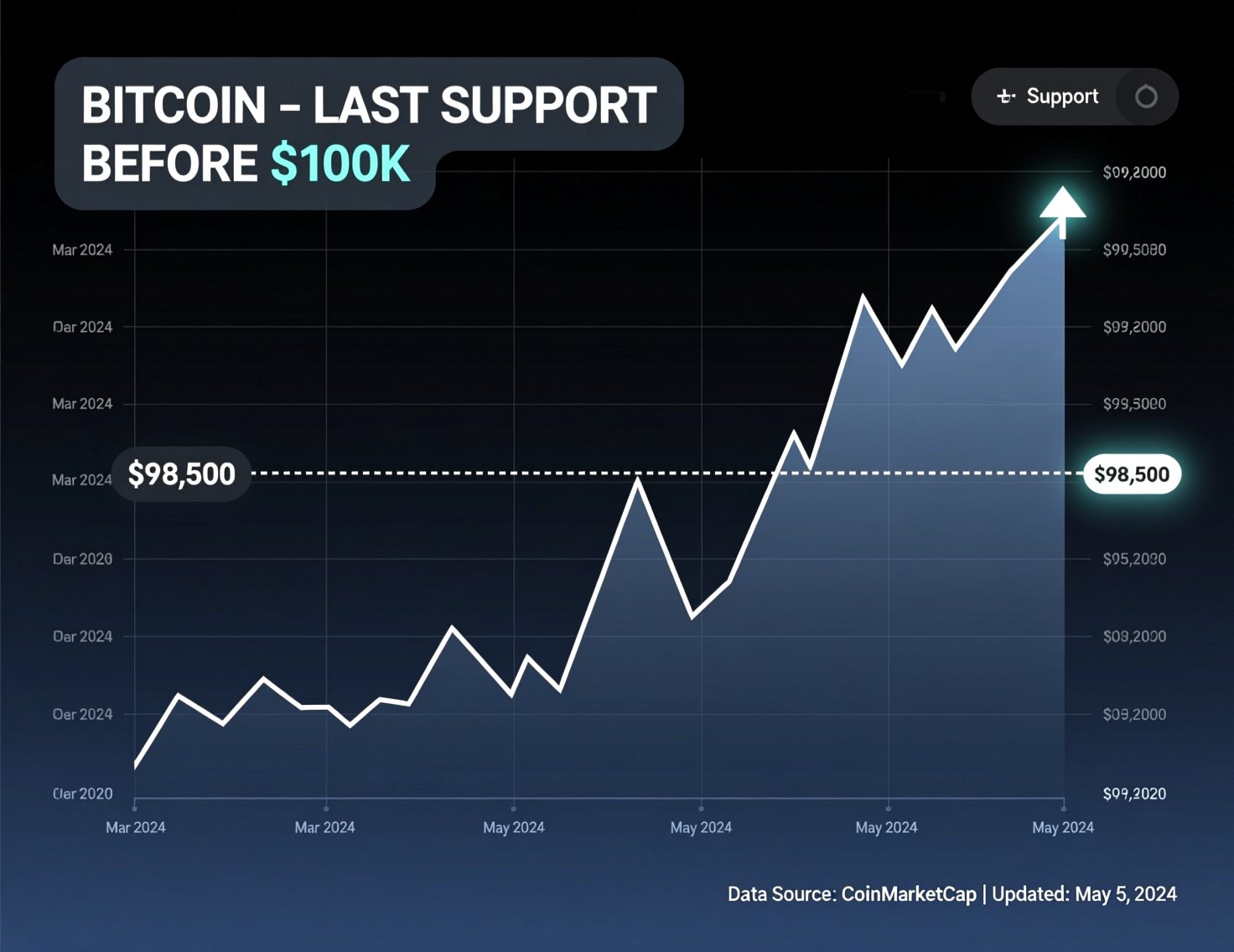

Market move: slide toward the $100K–$101K zone

BTC fell below ~$106K, taking out a shelf that had repeatedly held in recent weeks. 10x Research’s Markus Thielen says the breakdown shifts focus to $100K–$101K; a failure there risks $94K and, in an extreme case, ~$85K where on-chain support clusters. CoinDesk

Technical levels: Bitcoin last support before $100K and next zones

Traders now watch the $100K–$101K band as first defense. Below it, technicians cite prior congestion near $94K and deeper “max-pain” support in the mid-$80Ks. Thielen adds downside risk stays contained if BTC holds above its prevailing downtrend line.

Cross-asset signals: Mag 7 skew flips

Goldman Sachs, via market commentary shared by analyst Neil Sethi, flagged that the Magnificent 7 complex saw call implied volatility trade over puts an inversion of typical skew seen only a handful of times since late 2024. Such episodes often precede consolidation as optimism peaks.

Credit watch: Oracle CDS surges on AI capex angst

Oracle’s 5-year CDS has climbed to levels not seen since late-2023, following outsized AI-infrastructure commitments and related funding. Bloomberg and other outlets link the wider move to concern over leverage as AI spending ramps.

Altcoin pressure broadens

The selloff extended to majors: ETH and SOL slid to multi-month lows, while XRP approached a bearish “death cross,” underscoring fragile momentum across crypto.

Strategy notes and risk management

Short-term, the path of least resistance depends on the $100K–$101K shelf. Macro headwinds include ebbing expectations for rapid Fed cuts and a firmer U.S. dollar—both historically unfriendly to crypto beta.

Context & Analysis

The rare Mag 7 skew inversion highlights momentum-chasing in mega-cap tech just as credit markets flash caution via Oracle CDS. For crypto, stretched tech sentiment and tighter financial conditions can amplify volatility, making the $100K area pivotal for near-term direction.

Conclusion

If Bitcoin manages to hold the $100K–$101K zone, the market could enter a consolidation phase as traders reassess risk and liquidity conditions. This area now serves as a key short-term battleground between dip buyers and momentum sellers.

However, a clear break below support may open the door to a sharper slide toward $94K, or even the mid-$80K range if sentiment worsens. The backdrop of equity exuberance and growing unease around AI-linked credit risks adds another layer of volatility, making positioning discipline and risk management critical in navigating the next phase of Bitcoin’s price action.

FAQs

Q : What does it mean that the Bitcoin last support before $100K broke?

A : It indicates a multi-week price floor failed, shifting focus to the $100K–$101K support band and lower zones if that fails.

Q : Why did the Mag 7 options skew inversion matter?

A : It signaled heavy demand for calls over puts — a contrarian caution that often precedes consolidation.

Q : Why is Oracle’s CDS in focus?

A : Rising CDS implies higher perceived default risk amid aggressive AI capex and leverage concerns.

Q : Which altcoins moved with BTC?

A : ETH, SOL, and XRP posted multi-month lows; XRP neared a “death cross.”

Q : What levels are traders watching next?

A : The $100K–$101K area first, then around $94K and, in extremes, the mid-$80Ks.

Q : How do rates and the dollar affect BTC?

A : Higher real yields and a stronger USD typically weigh on risk assets, including crypto.

Q : Is this move part of a longer trend?

A : Momentum has softened since recent peaks; confirmation depends on how BTC reacts around $100K.

Facts

Event

Breakdown of key BTC support; focus shifts to $100K–$101K amid cross-asset froth and credit jittersDate/Time

2025-11-04T12:49:00+05:00Entities

Bitcoin (BTC); Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla); Oracle Corp. (ORCL)Figures

BTC <$106K; Oracle 5Y CDS near highest since Oct 2023; downside zones $100K–$101K / $94K / ~$85K (technical). CoinDesk+2Bloomberg+2Quotes

“Put-call skew… inverted for the first time since December of last year… implies investors are overwhelmingly positioned for continued upside.” Neil Sethi, citing Goldman Sachs. X (formerly Twitter)Sources

CoinDesk article; Bloomberg on Oracle CDS (via Investing.com summary)