Crypto and the Creator Economy

Advertising has never been a comfortable fit for most creators. Revenue is fickle, platforms change the rules, and a 30% platform tax eats margins. Crypto offers a parallel path: Web3 creator monetisation that lets audiences pay you directly, collect your work on-chain, and participate in your upside. In 2025, the tooling has matured minting protocols (e.g., Zora), publishing (Mirror), social graphs (Lens), and programmable social (Farcaster) are converging into a creator stack where the “follow” is portable and the “buy” is native. Reports show steady growth in on-chain consumer apps and fees across creator-friendly protocols, suggesting real (not just speculative) usage. a16zcrypto.com+1

This guide breaks down Web3 creator monetisation models you can implement now—NFT mints, token-gated subscriptions, on-chain memberships, and micro-patronage via stablecoins plus the compliance pitfalls and analytics you need to track. We’ll compare Web3 earnings dynamics with Web2 stalwarts like Patreon (now past $10B in total payouts) to help you pick the right mix.

Why Web3 Now? (Signals That Matter)

Ownership & portability

In Web2, your paying fans are locked inside platforms; in Web3, audiences live on open graphs (e.g., Lens) and can pay/collect across frontends. Lens “Collect” and Open Actions allow monetisation at the post level.

Programmable distribution

On Farcaster, Frames embed mini-apps inside posts think “mint,” “tip,” or “subscribe” without leaving the feed. Activity has cycled, but Frames established a native transaction surface for creators.

Protocol revenue traction

Zora’s protocol fees and revenue surged across 2024–2025, indicating sustained mint demand by creators and communities.

Macro tailwinds

A16z’s 2024 State of Crypto highlighted rising consumer crypto usage, particularly around stablecoins and creator-facing apps.

Bottom line

the rails for Web3 creator monetisation are no longer experimental they’re viable, modular, and increasingly composable.

Core Models of Web3 Creator Monetisation

NFT Mints (Art, Editions, Drops)

How it works

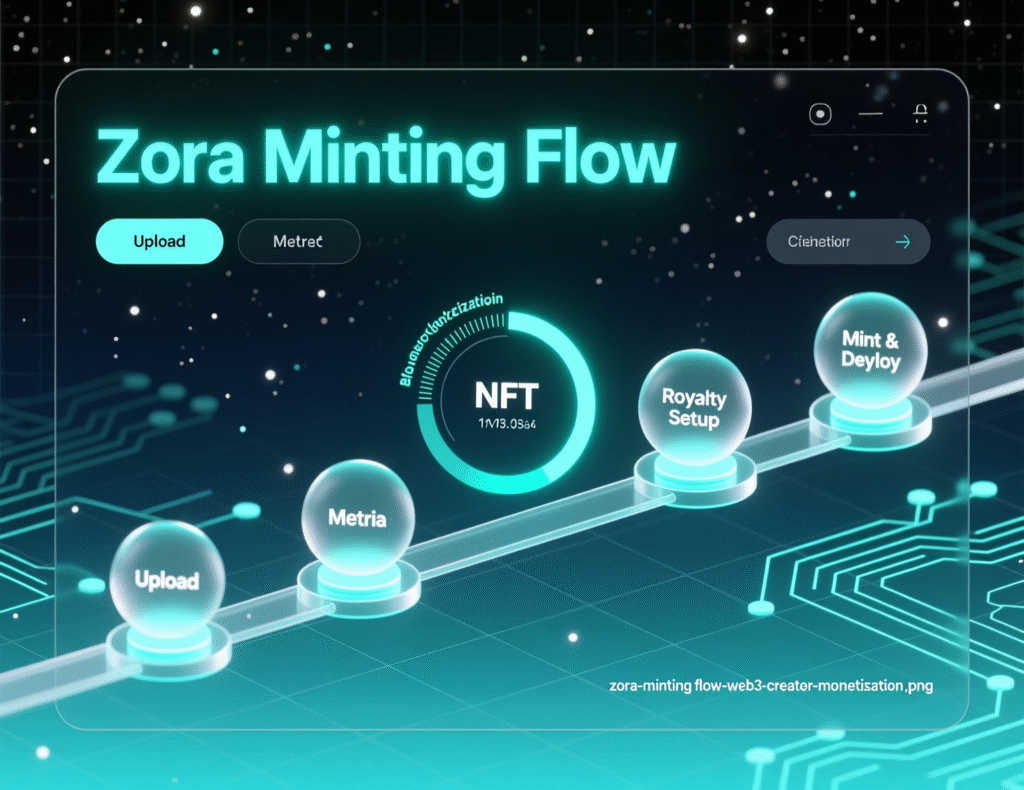

You publish an editioned artwork, music track, long-form essay, or access token as an NFT. Fans collect it as a digital collectible with built-in provenance.

Stack

Zora for minting; primary sales + optional creator splits; royalties (where supported) on secondary markets. Web3 creator monetisation via mints is great for milestone releases or seasonal launches.

Proof of traction:

Protocol revenue/fees on Zora have grown meaningfully, reflecting creator demand for mints across art and culture. Music platforms like Sound have reported multi-million-dollar creator revenue since launch phases.

Best for

Visual artists, musicians, writers who ship in “drops.”

Pricing tips

Start with low-cost open editions to widen collector base; later, introduce scarce, higher-priced works.

On-Chain Subscriptions & Token-Gated Content

How it works

Offer a monthly membership represented by an NFT or subscription token that unlocks posts, community calls, early listening parties, or behind-the-scenes. Mirror supports subscriptions and token-gated content; Lens “Collects” can function like paid posts.

Compare Web2

Patreon’s monthly creator earnings hover in the mid-$20M range and the company passed $10B all-time payouts evidence that direct fan funding works at scale. Web3 versions mimic this but with portable identity and programmable perks.

Best for

Writers, podcasters, educators with recurring value.

Pricing tips

Use stablecoin tiers (e.g., $5, $15) to reduce crypto volatility for fans.

Social Tokens & Access Passes

How it works

Issue a fixed supply community token or sell access passes that grant entry to a Discord, private channel, or quarterly workshop. Tie utility to real benefits (AMAs, collab slots) to avoid pure speculation.

Risk

Treat tokens as access/loyalty instruments not investment contracts. (Get legal advice in your jurisdiction.)

Micro-Patronage & Tipping with Stablecoins

How it works: Fans tip $1–$5 stablecoins per post/live stream. No 30% cut; programmable revenue splits to contributors.

Why it resonates: Stablecoins are a “killer app” for payments; they’re the simplest entry to Web3 creator monetisation for mainstream audiences.

Embedded Commerce via Frames/Open Actions

How it works: Add a “Mint,” “Collect,” or “Buy” button directly inside posts through Farcaster Frames or Lens Open Actions. This compresses the funnel and increases conversion. Web3 creator monetisation thrives when friction is low.

Choosing Your Stack (Three Blueprints)

The Writer’s Stack (Newsletters & Long-Form)

Publish

Mirror for essays and token-gated archives.

Monetise

NFT collects for premium posts; monthly on-chain subscriptions; stablecoin tips.

Distribute

Cross-post links to Farcaster/Lens with embedded collect.

Why it works

You own the graph and the paywall.

The Musician’s Stack (Singles & Early Access)

Publish

Sound for track drops; Zora for visual editions or tour posters as collectibles.

Monetise

Limited editions; fan splits for remix contests; token-gated listening parties.

Evidence

Sound reported $5.5M to artists in an early phase proof fans pay for on-chain music experiences.

The Community Builder’s Stack (Clubs & Courses)

Publish

Lens posts with paid Collects; Discord gated by NFT roles.

Monetise

Quarterly “access pass” NFTs; stablecoin memberships.

Automate

Revenue splits to moderators and collaborators via contracts.

Pricing, Fees, and Take-Rates

Web2 Benchmarks

YouTube memberships: typical 30% platform cut; membership conversion often ~1–2% of subscribers.

Patreon: moving to a 10% standard take-rate for new creators in 2025 (grandfathered tiers vary). Monthly payouts ≈ mid-$20M.

Web3 Economics

Minting fees

Protocol fees + gas; many chains keep costs near cents. Zora protocol fees/revenue show traction; creators can set their own primary sale price and splits.Royalties

Not guaranteed across all secondary marketplaces; assume primary sales are the core.Stablecoin tips

Near-zero take-rates if peer-to-peer; frontends may add a small fee.

Takeaway

Web3 creator monetisation can reduce platform tax but introduces gas and variability. Price for value, not for hype.

Compliance, Taxes, and Risk (Read This)

Tax reporting (U.S. example)

New crypto broker reporting rules (Form 1099-DA) begin phasing in for the 2026 tax season, with stablecoin thresholds noted. Track cost basis and proceeds for sales. Consult a qualified tax professional in your country.

Securities risk

Avoid selling tokens with profit expectations; anchor benefits in access/utility.

IP & licensing

Attach explicit licenses (e.g., CC0, personal use) to mints to prevent ambiguity.

Custody & safety

Use hardware wallets and multisig for treasury and community funds.

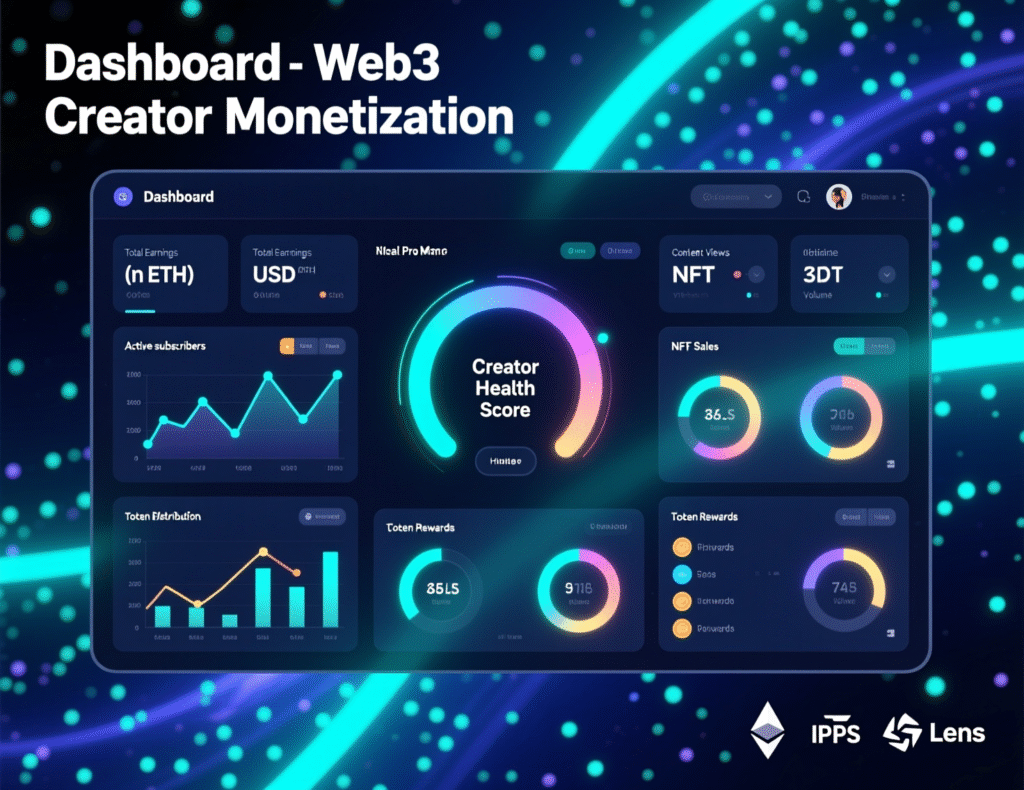

Analytics That Matter (Measure the Right Things)

Collector conversion rate

Collects / Post views

Average revenue per collector (ARPC)

Total mint revenue / Unique collectors

Retention

% of members renewing token-gated subscriptions monthly

Funnel compression

Click-to-collect rate on Frames/Open Actions

Cohorts

First-time vs repeat collectors; whales vs long-tail

Add these KPIs to a dashboard (Dune dashboards exist for Lens/Farcaster/Zora) to assess Web3 creator monetisation health.

Two Mini Case Studies

Case A Indie Illustrator “Aya” (editions + tips)

Aya mints weekly sketch editions at $5 on Zora, capped at 500. Average sell-through 60% = $1,500/week gross, minus ~5–8% combined protocol/tx. She embeds Frame-based “Mint” in Farcaster to reduce friction and adds a stablecoin tip jar for WIPs. After 12 weeks, Aya has 1,800 unique collectors and a consistent $5–6k/month her first sustainable Web3 creator monetisation loop.

Case B Producer Duo “Northwave” (music drops + access pass)

They release monthly micro-editions (100–250) on Sound and Zora, then a quarterly “Backstage Pass” NFT that unlocks stems and a feedback session. Primary sales now dominate revenue; secondary royalties are a nice bonus when remixes trend. Their Discord is token-gated to curb spam and deliver value.

Step-by-Step: Your First Web3 Creator Monetisation Workflow

Define your offer

What will fans get this month (edition, lesson, AMA, early access)?

Pick network & minting tool

Start where your audience is Zora (editions), Sound (music), Mirror (writing).

Price & supply

Use lower-priced open editions to seed collectors; layer scarce items later.

Set perks/licensing

Spell out rights and benefits on the mint page.

Distribute

Post on Lens/Farcaster with a one-tap Collect/Frame.

Automate splits

Route a % to collaborators/moderators.

Track KPIs

Use Dune or built-in analytics; iterate monthly.

Common Mistakes to Avoid

Treating tokens as investments instead of access/utility.

Over-reliance on royalties; plan for primary sales.

Ignoring tax/record-keeping especially across chains.

Launching without a clear content cadence.

Wrap It Up

Creators finally have a credible alternative to ad-driven income.

Web3 creator monetisation that runs on open rails, portable audiences, and programmable payments. Whether you mint editions, offer token-gated memberships, or embed instant “collects” in social feeds, the path to sustainable revenue is to ship consistently, price fairly, and reward true fans. Use protocol-native tools where they shine (Zora/Sound for drops, Mirror for writing, Lens/Farcaster for distribution) and bring stablecoins into your pricing to reduce volatility.

Keep careful records, respect local regulations, and measure collector retention over vanity metrics. With the right stack and rhythm, Web3 creator monetisation can become your default business model not just an experiment.

CTA

Want a custom on-chain monetisation rollout for your niche? Get a free 30-minute assessment and a 90-day roadmap book a call.