Balancer Hit by Apparent Exploit as $110M in Crypto Moves to New Wallets

Balancer, a decentralized finance (DeFi) protocol, was hit by what appears to be its largest security incident to date, with around US$110 million in crypto drained to new wallets. Early analyses attribute the breach to an access-control flaw in Balancer V2’s user-balance logic that allowed unauthorized internal balance withdrawals.

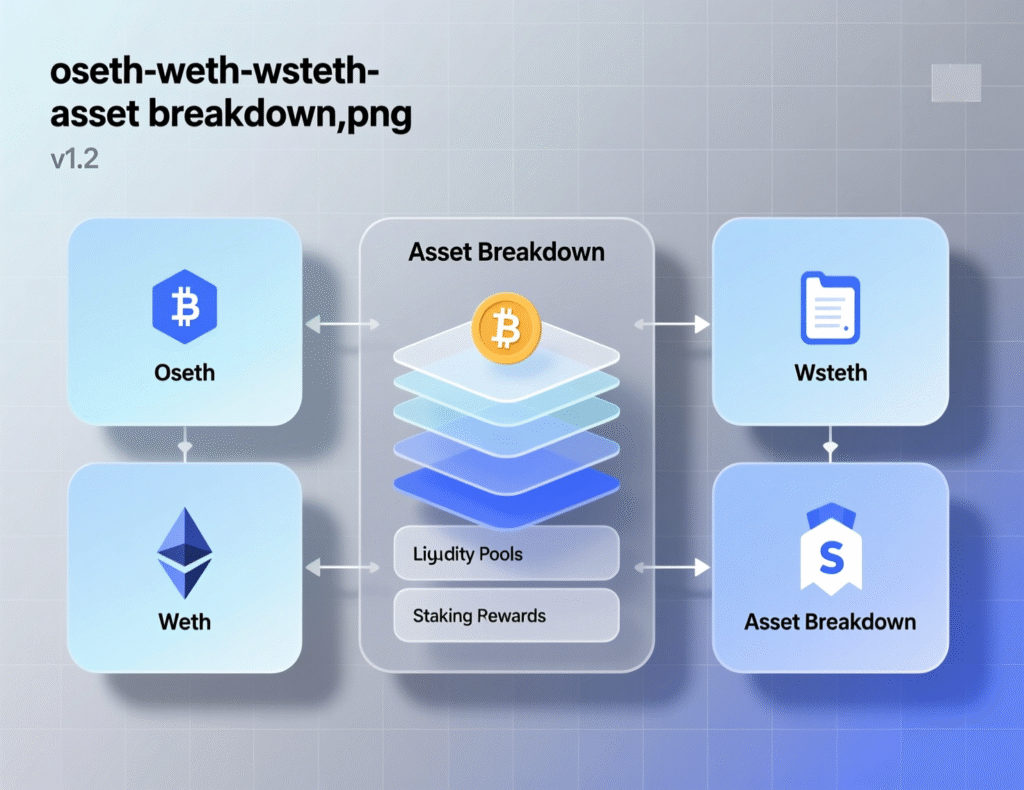

The attacker has begun consolidating osETH, WETH, and wstETH positions, heightening laundering concerns through bridges or mixers. This Balancer exploit $110 million has also coincided with a drop in the BAL token price. Phemex+2CoinCentral+2

What happened and why it matters

Preliminary security write-ups and alerts suggest the root cause sits in a manageUserBalance pathway, where a check comparing msg.sender to a user-supplied sender field may be bypassed for the WITHDRAW_INTERNAL operation permitting unauthorized internal withdrawals from the Vault. While Balancer has previously emphasized risks inherent to smart-contract systems, this incident underlines the systemic impact a Vault-centric design can have across integrated services and forks.

Timeline and flows in the Balancer exploit $110 million

Nov. 3, 2025 (UTC morning/afternoon):

Exploit activity flagged; theft tallies climb from tens of millions toward ~US$110M as multiple assets are moved.

Post-theft

Stolen assets ~6,851 osETH, ~6,587 WETH, and 4,260 wstETH are consolidated across a small set of addresses. (Counts may update as attribution improves.)

Market reaction

BAL trades lower (~5% down over 24h).

Assets involved in the Balancer exploit $110 million

Initial tallies highlight osETH, WETH, and wstETH among the largest line items siphoned into attacker wallets, with additional long-tail transfers continuing as addresses consolidate and route funds.

Impact on forks and integrated services

Forks and integrations that inherit Balancer V2 Vault assumptions reported exposure. Beets/Beethoven X publicly acknowledged impact totaling ~US$3M+, illustrating how shared architectural patterns can propagate risk beyond a single deployment.

Current TVL and risk posture

As of today, DefiLlama shows ~US$479M TVL on Balancer across chains (Ethereum, Gnosis, Arbitrum, Base, Polygon, and others). Users should treat any Vault-dependent integrations with caution until official patches or mitigations are communicated by maintainers.

Context & Analysis

Balancer’s single-Vault design streamlines liquidity and simplifies pool contracts, but it centralizes certain trust and failure domains. When a Vault-level path is exploitable—especially around user balance accounting the blast radius can extend to many pools and to forks that mirror the pattern. This event echoes prior (smaller) 2023 incidents but at greater scale, and it may spur Vault-level hardening, broader audits, and emergency circuit-breaker designs across the ecosystem.

Conclusion

Balancer is expected to release formal post-mortems alongside independently audited remediations addressing the recent incident. In the meantime, users and integrated protocols are advised to take precautionary actions revoking token allowances, withdrawing funds from flagged pools, and monitoring official channels for bounty or negotiation updates.

The event could influence broader DeFi security standards, prompting developers to better isolate internal balance mechanisms and strengthen cross-protocol incident response. This focus on compartmentalization and coordinated transparency aims to reduce the systemic impact of similar vulnerabilities in the future.

FAQs

Q1. What is known about the root cause?

A : An access-control issue in a user-balance withdrawal path appears responsible, enabling unauthorized “internal balance” withdrawals from the Vault. (Awaiting official post-mortem.)

Q2. Which assets were taken?

A : Early tallies include osETH, WETH, and wstETH with a combined value in the tens of millions of dollars.

Q3. How much was stolen in total?

A : Estimates range around US$70–110M as addresses consolidate; figures may update with further attribution.

Q4. Did forks get impacted?

A: Yes Beets/Beethoven X indicated losses in the low-million-dollar range due to shared architecture.

Q5. What should liquidity providers do now?

A : Check pool status, withdraw from flagged pools, and revoke approvals to affected contracts until maintainers confirm safety.

Q6. Did BAL price react?

A : Trackers show a ~5% decline intraday around the incident window.

Q7. Does this change Balancer’s TVL risk?

A : DefiLlama lists ~US$479M TVL today; users should monitor TVL shifts and official advisories.

Facts

Event

Apparent exploit against Balancer V2 enabling unauthorized internal balance withdrawalsDate/Time

2025-11-03T14:17:00+05:00 (updated activity observed throughout the day)Entities

Balancer (protocol); attacker wallets; Beets/Beethoven X (fork)Figures

~6,851 osETH; ~6,587 WETH; 4,260 wstETH; total ~US$70–110M (est.)Quotes

“If there is a flaw in the smart contract code, it can be exploited by attackers to steal funds from the protocol.” Balancer docs (Risks) BalancerSources

Phemex News (real-time bulletin), Coinfomania quick report, DefiLlama protocol page, Balancer Risks page. Balancer+3Phemex+3Coinfomania+3