Nearly $6 Billion in Bitcoin and Ethereum Options Expire Ahead of September CPI

KARACHI, October 24, 2025 Nearly $6 billion worth of Bitcoin and Ethereum options are set to expire today at 08:00 UTC on Deribit. This monthly expiry often influences short-term crypto market movements, as traders and market makers adjust their positions to manage risk and capture profits.

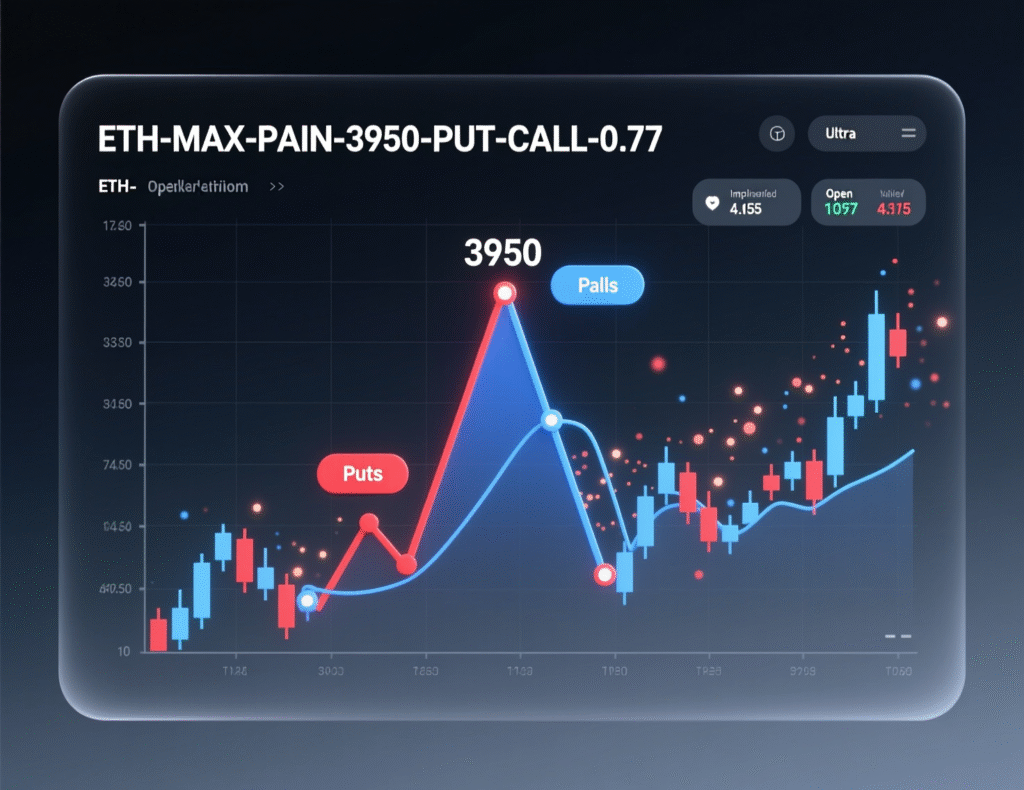

According to Deribit data, around $5.1 billion in Bitcoin options and $754 million in Ethereum options will expire. Market participants are closely monitoring the “max pain” levels — the strike prices where most losses occur for option holders — along with the overall put-to-call ratio. These metrics are expected to guide short-term volatility and may signal how prices could react once the expiry passes.

Scale, timing, and sentiment

At 08:00 UTC, tens of thousands of BTC and ETH option contracts expire, concentrating risk around max pain the level where most options expire worthless—estimated near $113,000 for BTC and $3,950 for ETH. Current put-to-call ratios hover around 0.90 (BTC) and 0.77 (ETH), signaling cautious optimism while leaving room for two-way moves as books are reset. CoinNess+1

Volatility, positioning, and macro triggers

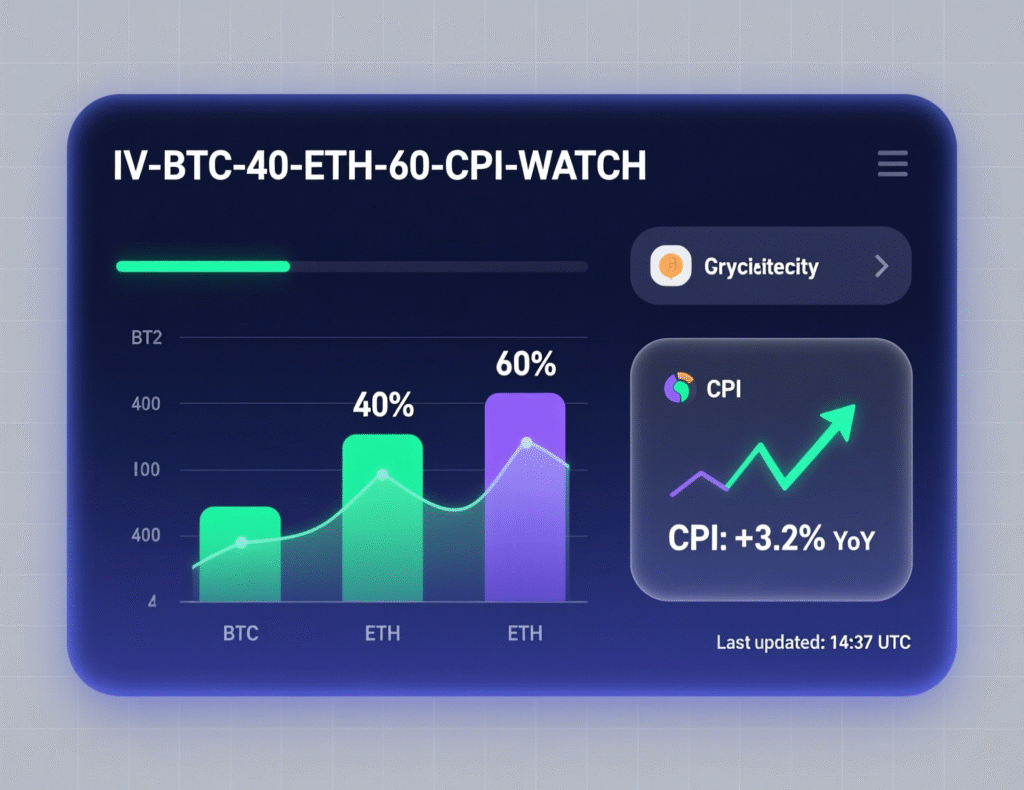

After sharp swings earlier this month, implied volatility has eased, with BTC IV ~40 and ETH IV ~60, according to market commentary collated today. Analysts also flag open interest in calls above $120,000 (BTC) and interest in $100,000 puts, reflecting guarded positioning into the event. The expiry lands as traders monitor U.S. CPI and the FOMC potential catalysts for a renewed volatility burst.

“Volatility is cooling off… but calm doesn’t last forever… BTC vol is ~40 and ETH ~60,” Amberdata analysts noted, highlighting how a single headline could flip market dynamics.

What to expect after the print

Historically, monthly expiries can pin spot prices near max-pain levels in the hours leading up to settlement, followed by post-08:00 UTC adjustments as hedges roll off and dealers rebalance. With liquidity still recovering after recent market turbulence, traders are watching for squeezes if spot strays too far from key strikes.

Deeper context (Analysis)

Options market dynamics today follow a week where crypto realized volatility spiked and then faded. With macro uncertainty elevated, the term structure and dealer positioning may matter as much as outright direction; a clean expiry that keeps spot near max-pain could mute moves, while a break from those levels especially alongside CPI surprises could reignite vol.

Conclusion

Today’s Bitcoin and Ethereum options expiry is drawing heavy attention, with risk concentrated at well-known strike levels. As the contracts settle, traders can expect heightened activity and liquidity pockets forming around key price zones, potentially leading to short bursts of volatility.

Market participants are advised to stay cautious and monitor broader macroeconomic developments. Any major headlines or data releases could quickly shift sentiment and trigger new volatility trends once the expiry clears. The post-roll period may reveal fresh directional momentum as traders reposition for the weeks ahead.

FAQs

Q : What time do today’s BTC and ETH options expire on Deribit?

A : 08:00 UTC (13:00 Pakistan Standard Time).

Q : What are the max-pain levels for BTC and ETH?

A : BTC ~$113,000; ETH ~$3,950, per exchange-reported metrics.

Q : How big is today’s notional expiry?

A : About $5.86B combined (~$5.1B BTC; ~$0.75B ETH).

Q : What do current put/call ratios imply?

A : ~0.90 (BTC) and ~0.77 (ETH), suggesting cautious upside bias but two-way risk.

Q : Could volatility increase after the Bitcoin and Ethereum options expiry?

A : Yes, settlement often reshuffles hedges; CPI/FOMC headlines could amplify moves.

Q : Why does ‘max pain’ matter?

A : It’s where most options expire worthless; prices can gravitate toward it into expiry, though not always.

Q : Where can I track live options metrics?

A : Deribit statistics and third-party dashboards provide OI, IV, and max-pain data.

Facts

Event

Monthly BTC/ETH options expiry on DeribitDate/Time

2025-10-24T13:00:00+05:00 (08:00 UTC)Entities

Bitcoin (BTC), Ethereum (ETH), Deribit (exchange), Amberdata (analytics)Figures

~$5.1B BTC; ~$754M ETH; max-pain BTC ~$113,000; ETH ~$3,950; PCR BTC ~0.90; ETH ~0.77; IV BTC ~40; IV ETH ~60 (units: USD, ratios, IV points). CoinNess+1Quotes

“Volatility is cooling off… BTC vol ~40 and ETH ~60… calm doesn’t last forever.” Amberdata analysts. BeInCryptoSources

BeInCrypto report + Deribit data.