XDC Network Acquires Contour to Expand Stablecoins and Tokenization in Trade Finance

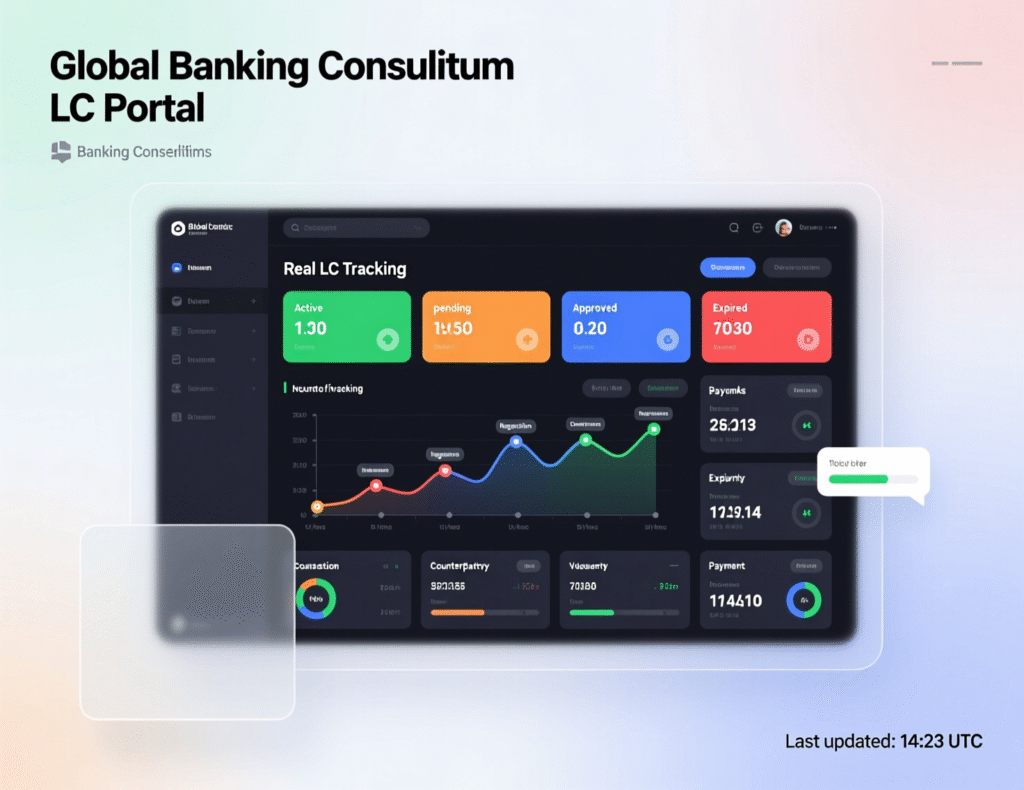

XDC Network has acquired Contour to relaunch a next-generation trade finance platform powered by blockchain, tokenization, and stablecoin-based settlement. The integration aims to bring institutional-grade efficiency to global trade by digitizing documentation, automating workflows, and linking every transaction to verifiable on-chain events.

Through this move, XDC seeks to reduce the traditional letter-of-credit (LC) processing time from several days to just a few hours. The platform will also enable compliant, programmable payments across borders, improving transparency and liquidity for banks, exporters, and importers. By combining Contour’s banking network with XDC’s blockchain infrastructure, the initiative positions itself as a catalyst for faster, more secure, and cost-effective trade settlement in the global financial ecosystem.

Why XDC bought Contour

Contour built a network for digitizing Letters of Credit with backing from HSBC, Citi, and Standard Chartered but shut down in late 2023 after funding shortfalls. XDC Ventures says it will inject capital, overhaul the go-to-market plan, and integrate stablecoin rails to enable real-time settlement alongside document digitization. Global Trade Review (GTR)+2Ledger Insights+2

What the relaunch targets

Under XDC ownership, the restructured platform will couple LC workflows (application, presentation, discrepancy handling) with on-chain tokens and bank-friendly controls. XDC also unveiled a Stablecoin Lab to pilot regulated stablecoins (e.g., USDC) for treasury and settlement use cases with banks and corporates in multiple regions. Early regulator-supervised testing is planned in the U.S., EU, and Asia.

Why stablecoins and tokenization matter

Tokenized assets and programmable payments can automate conditional releases (e.g., documents-against-payment) and reconcile data across banks and corporates. Ripple and BCG project a multi-trillion-dollar tokenization market this decade, with operational savings from smart-contract workflows in areas like trade finance.

XDC’s positioning in real-world finance

XDC is an EVM-compatible layer-1 emphasizing trade finance: two-second settlement targets, ISO 20022 messaging support, and integrations aligned to cross-border finance such as MLETR frameworks and R3 Corda connectivity. Recent partnerships include Circle, Deutsche Telekom MMS and Securitize for RWA programs.

Roadblocks and what to watch

Scaling bank consortia remains hard: Contour’s 2023 closure underscored funding and adoption hurdles despite blue-chip backing. The relaunch’s success will hinge on regulatory clarity for stablecoin settlement, standardized digital trade documents, and convincing banks to commit transaction volume.

Context & Analysis

The acquisition gives XDC an established (though dormant) bank network and LC workflow IP, potentially shortening sales cycles versus building from scratch. If regulated stablecoin rails pass internal bank risk tests and if MLETR-style e-documents gain broader legal recognition end-to-end digital trade (data + settlement) could finally move beyond pilots. Still, onboarding multiple global banks to common standards, especially for treasury and liquidity ops, is non-trivial.

Outlook

If XDC successfully integrates Contour’s letter-of-credit expertise with compliant stablecoin settlement and gains regulator support, it could significantly streamline trade finance operations. The collaboration aims to cut processing times, lower transaction costs, and enhance transparency across global trade networks.

Industry observers are watching for key developments such as pilot programs with major banks, the first live LCs settled via stablecoins, and updates on regulatory approvals for cross-border use. These milestones will determine how effectively the revamped platform can modernize traditional trade finance and position XDC as a leading player in blockchain-based financial infrastructure.

FAQs

Q : What is Contour and why did it close?

A : Contour digitized Letters of Credit with backing from major banks but shut down in late 2023 due to funding shortfalls.

Q : How does this deal change trade finance?

A : XDC plans end-to-end digitization, linking LC documentation to on-chain settlement using regulated stablecoins.

Q : Will banks use USDC or other stablecoins?

A : XDC’s Stablecoin Lab will pilot regulated stablecoins such as USDC for settlement; specific banks and coins will depend on pilot programs.

Q : Does the platform integrate with existing finance standards?

A : Yes. XDC cites ISO 20022 messaging support and integrations like MLETR and R3 Corda to align with existing bank systems.

Q : What savings could tokenization unlock?

A : Ripple and BCG estimate significant efficiency gains and a multi-trillion-dollar opportunity in tokenized assets, including trade finance.

Q : When will live transactions start?

A : Testing with regulators in the U.S., EU, and Asia is planned before a broader rollout; timing depends on pilot results and regulatory approvals.

Q : Does this mean Contour’s original bank backers are returning?

A : Not yet disclosed. The relaunch strategy and participant list will be revealed alongside upcoming pilot announcements.

Facts

Event

XDC Ventures acquires Contour to relaunch a blockchain-based trade finance platform with stablecoin settlementDate/Time

2025-10-22T14:00:00+05:00Entities

XDC Network (XDC), XDC Ventures, Contour Network Pte. Ltd., HSBC, Citi, Standard Chartered, Circle (USDC)Figures

Targeted cycle-time reduction from days to hours in prior Contour live trades; market projection: tokenized assets to ~$18.9T by 2033 (Ripple/BCG) (USD). CoinDesk+1Quotes

“Banks need settlement rails, treasury optimization and compliance frameworks.” Ritesh Kakkad, XDC co-founder (to CoinDesk). CoinDeskSources

CoinDesk piece + URL; GTR article on Contour shutdown + URL.