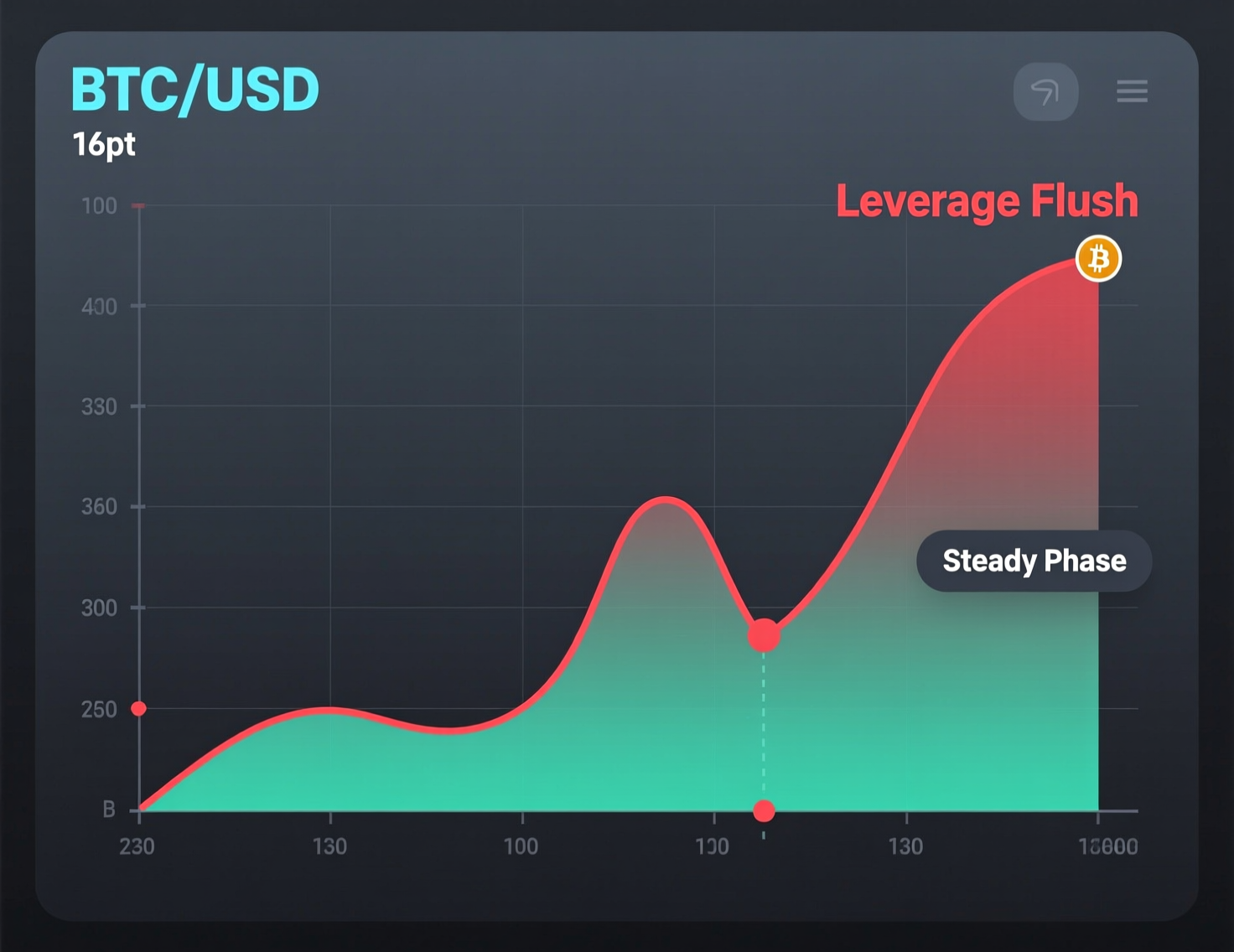

Asia Morning Briefing: Bitcoin Holds Steady as Market Resets After Leverage Flush

Bitcoin is stabilizing as the Asian session begins, following a sharp correction that cleared excessive leverage from the market. After last week’s rapid drawdown, price movements have cooled, signaling a healthier trading environment. Analysts note that the recent flush has reset speculative positioning and reduced market froth.

Data indicates that institutional investors remain active, continuing to provide steady liquidity and confidence in the market’s long-term outlook. However, retail participation has slowed, reflecting a more cautious tone among smaller traders. With leverage largely normalized, Bitcoin appears better positioned for more sustainable price action in the days ahead.

Market Overview

BTC and ETH: Reset, not rupture

Glassnode’s latest Market Pulse (Week 43) says BTC fell from ~$115K to ~$104K in four days, then bounced toward ~$111K indicative of a decisive “flush” that relieved speculative pressure. As of this morning, BTC trades around the high-$100Ks, with intraday ranges clustering near $108K–$112K. ETH is near the high-$3Ks after a brief pop above $4K. Glassnode Insights

Positioning

Glassnode notes sharply lower futures open interest and funding, neutralized ETF flows, and realized losses without wholesale capitulation consistent with a defensive normalization rather than breakdown.

Institutional signals: SPAC talk and ETH accumulation

CoinDesk reports Blockchain.com has held talks to go public via a SPAC, with Cohen & Company Capital Markets advising framing a tentative re-entry of crypto exchanges into public markets. Separately, The Block reports BitMine added ~203,800 ETH last week, with commentary linking the buys to chairman Thomas (Tom) Lee, reinforcing the view of ongoing institutional layering beneath subdued retail sentiment.

Gold: Record highs, then a breather

Gold spiked to fresh records (intraday >$4,380/oz) before easing as the dollar firmed. The move reflects safe-haven demand, rate-cut expectations, and persistent U.S.–China trade tensions. Prices remain elevated after an exceptional YTD run.

Japan equities: Nikkei extends gains

The Nikkei 225 touched/closed near record territory as investors assess policy signals from newly appointed Prime Minister Sanae Takaichi. The rally has been most pronounced in domestically oriented and consumer names.

Bitcoin holds steady after leverage flush what it means

De-risked derivatives

Compressed funding and trimmed open interest reduce forced-liquidation risk and may improve price discovery.Flows turn selective

Neutral ETF flows and realized losses suggest hedging over capitulation.Under-the-hood bids

SPAC exploration and large ETH treasuries hint at institutional conviction despite choppy spot prices.

ETH checkup

ETH trades near the high-$3Ks. Some desks flag sliding chain fees vs. Solana/BNB, but treasury-scale accumulation by BitMine offsets short-term activity concerns.

Context & Analysis

Historically, swift deleveraging phases that leave spot structure intact often precede range formation and selective trend resumption. Today’s setup lighter leverage, neutral flows, and incremental institutional activity leans toward consolidation with dips met by strategic buyers. External macro (rate-cut path, trade frictions) and cross-asset hedging (gold at records) remain key wildcards.

Conclusion

Asia opens to a quieter crypto market, with Bitcoin steady after last week’s leverage washout and Ethereum finding support from continued treasury accumulation. The cooling momentum reflects a market catching its breath after intense volatility, with traders now reassessing positioning.

Broader risk sentiment remains stable as traditional hedges like gold hold firm, signaling limited contagion across assets. In the near term, analysts are watching leverage ratios and ETF inflows to gauge whether a stronger base is forming or if another bout of volatility could emerge as liquidity shifts through global sessions.

FAQs

Facts

Event

Asia Morning Briefing crypto steadies after deleveraging; gold and Nikkei firmDate/Time

2025-10-21T06:16:00+05:00Entities

Bitcoin (BTC), Ethereum (ETH), Glassnode, Blockchain.com, Cohen & Company Capital Markets, BitMine, Thomas (Tom) Lee, Nikkei 225, Sanae TakaichiFigures

BTC ~$108K–$111K; ETH ~$3.9K; Gold record >$4,380/oz; Nikkei record zone ~49K. Reuters+1Quotes

“A fast and decisive flush that shook out weaker hands… positioning reflects caution.” Glassnode, Week 43 note. Glassnode InsightsSources

Reuters (gold & Nikkei), Glassnode (Week 43), CoinDesk (Blockchain.com SPAC), The Block (BitMine ETH)