UK tax authority doubles crypto warning letters in crackdown on unpaid gains

HMRC has sharply increased its crypto warning letters in 2025 as part of a wider push to track undeclared digital asset gains. During the 2024–25 tax year, the UK tax authority sent nearly 65,000 “nudge letters” to investors suspected of non-compliance—more than double the previous year’s figure.

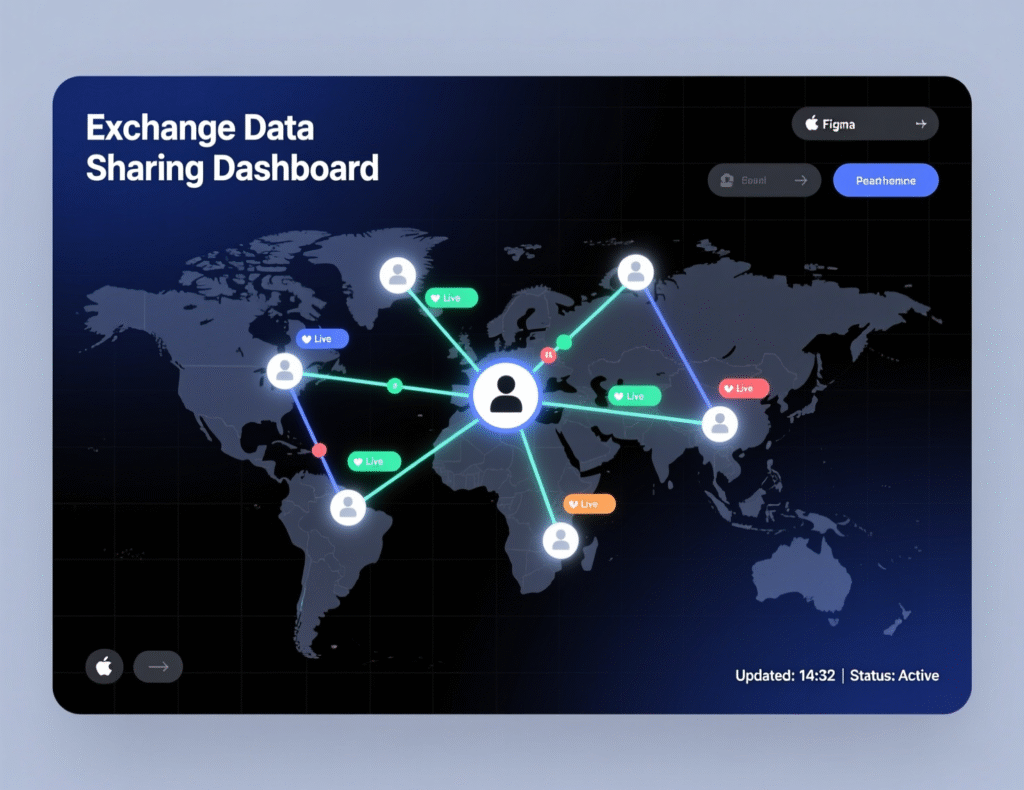

This surge highlights HMRC’s growing focus on crypto taxation, driven by enhanced data sharing with exchanges and new international reporting standards. The letters urge recipients to review past filings and declare any missing income or capital gains before formal investigations begin, signalling a tougher stance on transparency and enforcement in the crypto sector.

HMRC doubles warning letters as crypto ownership grows

HMRC’s letters aimed at prompting voluntary corrections before formal inquiries jumped to nearly 65,000 in 2024–25 from about 27,700 in 2023–24. The rise aligns with expanding UK crypto participation: the Financial Conduct Authority estimates 12% of adults (≈7 million) held crypto in 2024. advisers note many investors overlook that swapping one coin for another can crystallize a capital gain.

What’s changing from 2026: OECD CARF data sharing

From 1 January 2026, the UK will implement the OECD’s Crypto-Asset Reporting Framework (CARF), requiring UK reporting crypto-asset service providers to collect standardized user and transaction data and share it with HMRC, enhancing visibility into offshore and domestic activity. Guidance confirms data collection must begin for transactions from that date.

How this affects UK taxpayers

Record-keeping

Maintain dates, amounts, and valuations (in GBP) for each disposal or exchange.

CGT triggers

Disposals include selling for fiat, swapping tokens, or spending crypto on goods/services.

Income elements

Some activities (e.g., certain staking, mining, or airdrops) may be taxed as income before any later CGT on disposal.

Voluntary disclosure

Responding early to an HMRC nudge letter can reduce penalties compared to enforcement. (General principles reflected in FT reporting and HMRC practice.)

International context: policy moves in the U.S.

In parallel, U.S. lawmakers are weighing a de minimis exemption for small crypto payments (e.g., under $300) and clarifying the taxation of staking rewards. Industry witnesses, including Coinbase’s VP of Tax Lawrence Zlatkin, urged Congress to simplify reporting to avoid billions of trivial transactions clogging compliance. Senate Finance Committee+2Senate Finance Committee+2

With exact keyword: What the surge in HMRC crypto warning letters 2025 signals

The volume and pace of letters suggest HMRC is leveraging broader data feeds ahead of CARF, focusing on voluntary compliance first. With more UK adults holding crypto, investors who ignored prior guidance are more likely to receive prompts or face inquiries if discrepancies persist.

With exact keyword: Who is most likely to get HMRC crypto warning letters 2025

Patterns that can draw attention include high-volume trading, large unreported disposals, or mismatches between reported income/gains and data obtained from exchanges. Upcoming CARF data will make cross-border wallets more transparent to HMRC.

Context & Analysis

The combination of domestic letters and upcoming international data exchange points to a “compliance-first” model: prompt self-correction via nudges, then escalate where gaps remain. In the U.S., movement toward a limited de minimis rule could reduce friction for everyday payments an approach UK policymakers may monitor as they calibrate their own regime.

Conclusion

With the CARF (Crypto-Asset Reporting Framework) set to launch in 2026, HMRC is expected to expand its outreach to crypto investors. The new framework will enhance global data sharing, giving tax authorities clearer visibility into cross-border crypto holdings and transactions.

UK investors are advised to review their past records, correct any filing gaps, and ensure full compliance before the new rules take effect. Strengthened data matching between exchanges and HMRC means undeclared gains will become easier to detect, making early action the smartest way to avoid penalties and protect financial credibility.

FAQs

Q : What are HMRC’s crypto ‘nudge letters’?

A : Notices encouraging taxpayers to correct filings related to crypto gains before formal investigation.

Q : How many were sent in 2024–25?

A : Nearly 65,000 more than double the previous year’s ~27,700.

Q : Why the increase?

A : Rising ownership (≈12% of UK adults) and expanded data access from exchanges ahead of CARF.

Q : Does swapping crypto for crypto trigger UK CGT?

A : Yes, exchanging one token for another can be a disposal for CGT purposes. (General UK tax principle referenced in reporting.)

Q : What changes in 2026 under CARF?

A : UK providers must collect and report standardized user and transaction data from 1 Jan 2026.

Q : Are other countries tightening crypto tax rules?

A : In the U.S., senators are weighing a de minimis exemption and staking clarity.

Q : What should I do if I receive HMRC crypto warning letters 2025?

A : Reconcile records, amend returns, and respond by the deadline (see How To). (Best practice summary.)

Facts

Event

HMRC doubled crypto “nudge letters” to address unpaid gainsDate/Time

2025-10-18T12:00:00+05:00Entities

HM Revenue & Customs (HMRC); Financial Conduct Authority (FCA); OECD (CARF)Figures

~65,000 letters (2024–25); ~27,700 (2023–24); ~12% UK adults (≈7m) own cryptoQuotes

“Exchanging one cryptocurrency for another can trigger capital gains tax.” Reported by FT via tax advisers (context) Financial TimesSources

FT report (HMRC letters) Financial Times; FCA research note (ownership) FCA