Bitcoin’s Plunge Below $105,000 Sends Crypto Market Cap to Lowest Level Since July

Bitcoin slipped below $105,000 on Friday, triggering a broad pullback across the cryptocurrency market. The move reflected renewed investor caution, with total digital asset market capitalization dropping to around $3.64 trillion its lowest point since July 2025. The decline underscored waning risk appetite following weeks of volatility and profit-taking among large-cap tokens.

Selling pressure intensified as weakness from traditional markets spilled into crypto. Fresh disclosures from several U.S. regional banks reignited credit-risk concerns, prompting traders to scale back exposure to speculative assets. Analysts noted that sentiment remains fragile, with investors closely watching for signs of stabilization before re-entering higher-risk positions. The latest downturn highlights how traditional financial stress continues to influence digital asset performance.CoinGecko+1

Banking Stress Triggers “Flight to Safety”

Concerns about loan book issues and alleged borrower fraud at Zions Bancorporation and Western Alliance weighed on bank shares, souring sentiment across risk assets globally. Equity futures and regional bank ETFs fell, with analysts citing a broad de-risking impulse that bled into crypto markets.

Market Snapshot: Bitcoin below $105,000

Bitcoin fell as much as ~5–6% in 24 hours to an intraday low near $104,853 before stabilizing. The drawdown pulled the total crypto market cap to about $3.64 trillion as of Friday morning, marking the weakest level since July.

Altcoins Under Pressure as Bitcoin below $105,000 Weighs

Altcoins, already fragile after last week’s flash crash, saw 4–12% declines. BNB led large caps lower on the day, while Ethereum, XRP, Solana, TRON, Dogecoin, and Cardano also posted losses.

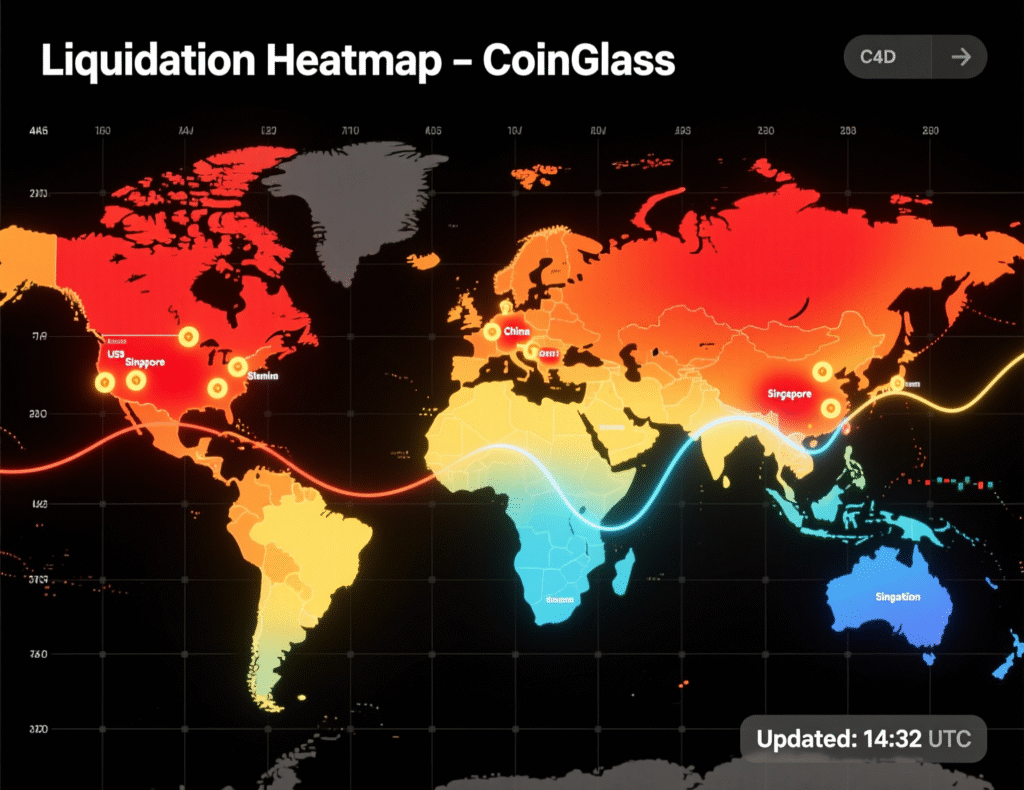

Leverage Unwinds: $1.09B in Liquidations

Roughly $1.09 billion in leveraged positions were wiped out over 24 hours, with Bitcoin and Ethereum accounting for more than half of the total, according to CoinGlass. This follows a record liquidation event last week when nearly $19B was cleared during a sharp, tariff-driven shock.

Context & Analysis

The proximate driver appears to be renewed banking stress, not a crypto-native catalyst. While spot prices broke near-term supports, market structure optimists point to still-elevated BTC dominance and constructive higher-timeframe trends. That said, sustained pressure in regional banks could extend risk aversion and keep crypto choppy.

Conclusion

Macro uncertainty, especially surrounding U.S. regional banks, is driving investors toward safer assets and away from higher-risk markets like crypto. The renewed focus on financial stability has amplified caution, curbing speculative flows that had recently fueled digital asset gains.

Analysts suggest that if banking headlines calm in the coming weeks, crypto markets could regain footing toward the end of the month. However, if credit concerns deepen, volatility may stay elevated and liquidation pressures could intensify. For now, traders remain defensive, waiting for clearer signals from both financial and macroeconomic fronts before re-engaging in risk assets.

FAQs

Q: What pushed crypto lower today?

A: Concerns over U.S. regional banks (including Zions and Western Alliance) drove a wider risk-off move.

Q: Did Bitcoin break key levels?

A: Yes. Bitcoin below $105,000 marked a fresh multi-week low intraday.

Q: How large were liquidations?

A: About $1.09B over 24 hours, led by BTC and ETH.

Q: Which altcoins fell the most?

A: BNB led large-cap losses; ETH, XRP, SOL, TRX, DOGE, and ADA also declined.

Q: Is the bull market over?

A: Not necessarily; some analysts still see a constructive higher-timeframe structure, but near-term volatility remains high.

Q: Why do banks affect crypto?

A: Credit stress can reduce risk appetite broadly, prompting de-leveraging across assets, including crypto.

Q: What should traders watch next?

A: Bank headlines, funding rates/open interest, and BTC dominance for risk clues.

Facts Box

Event

Bitcoin drops below $105,000; total crypto market cap hits ~$3.64TDate/Time

2025-10-17T10:00:00+05:00Entities

Bitcoin (BTC); CoinGecko; CoinGlass; Zions Bancorporation, N.A.; Western Alliance BankFigures

BTC low ~$104,853 (intraday); crypto market cap ~$3.64T; total liquidations ~$1.09B (24h) (USD)Quotes

“As concerns spread through the financial sector, risk appetite weakened pretty severely across all markets.” Derek Lim, Caladan (to Decrypt) DecryptSources

CoinGecko Market Cap Chart (https://www.coingecko.com/en/charts), Reuters Wall St futures tumble (https://www.reuters.com/business/wall-st-futures-tumble-bad-loans-by-regional-banks-make-investors-nervous-2025-10-17/)