‘Ethereum could flip Bitcoin’ like Wall Street flipped gold: Tom Lee

NEW YORK, October 17, 2025 In a recent interview, market strategist Tom Lee suggested that Ethereum could potentially surpass Bitcoin in value by becoming the foundation of tokenized finance. He compared this possible shift to how traditional equities and Wall Street overtook gold as the core of global wealth after the 1971 end of the gold standard. According to Lee, Ethereum’s versatility and growing role in decentralized applications could make it the “infrastructure layer” of the digital economy.

Currently, Bitcoin continues to dominate the crypto market with a valuation of around $2.16 trillion, roughly four to five times larger than Ethereum’s $0.47 trillion. However, Ethereum’s expanding ecosystem in DeFi, NFTs, and tokenized assets positions it as a strong contender for future dominance in blockchain-based finance.

What does “Ethereum could flip Bitcoin” mean?

Lee’s analogy is straightforward: when the U.S. decoupled the dollar from gold in 1971, Wall Street engineered financial products that entrenched dollar dominance and expanded equity markets relative to gold. He contends that tokenization, stablecoins, and on-chain market infrastructure could similarly favor Ethereum—positioning it as the settlement layer for modern finance and potentially lifting ETH’s network value above BTC’s over time. TradingView

Current market snapshot: the gap ETH must close

Bitcoin market cap: ≈$2.16T

Ethereum market cap: ≈$0.47T

Gap: ~4.6x

Real-time market data show ETH would need a multi-trillion-dollar re-rating (or BTC underperformance) for a flippening.

Tom Lee’s role and the ETH-treasury narrative

Lee is chairman of BitMine Immersion Technologies and co-founder of Fundstrat. BitMine has promoted an ETH-treasury strategy and public presentations arguing that tokenized assets and on-chain liquidity could accrue to Ethereum’s base layer.

Flippening advocates vs. skeptics

Bull case

ConsenSys founder Joseph Lubin says Wall Street will stake ETH and adopt decentralized rails, potentially driving a 100x ETH surge and a flip of Bitcoin’s “monetary base.”Skepticism

While sentiment has warmed to ETH’s productive yield and tokenization role, critics note Bitcoin’s monetary premium, supply cap, and dominant brand remain durable headwinds to any near-term flippening. (Context from the broader debate referenced in Lee’s interview.)

Measuring progress toward ‘Ethereum could flip Bitcoin’

Key markers to watch include

On-chain settlement share of stablecoins and tokenized assets on Ethereum vs. competitors.

Institutional participation

ETFs, custody, staking policies, and regulatory clarity.Revenue and burn dynamics

Transaction fees, MEV, and net issuance.Developer and enterprise traction

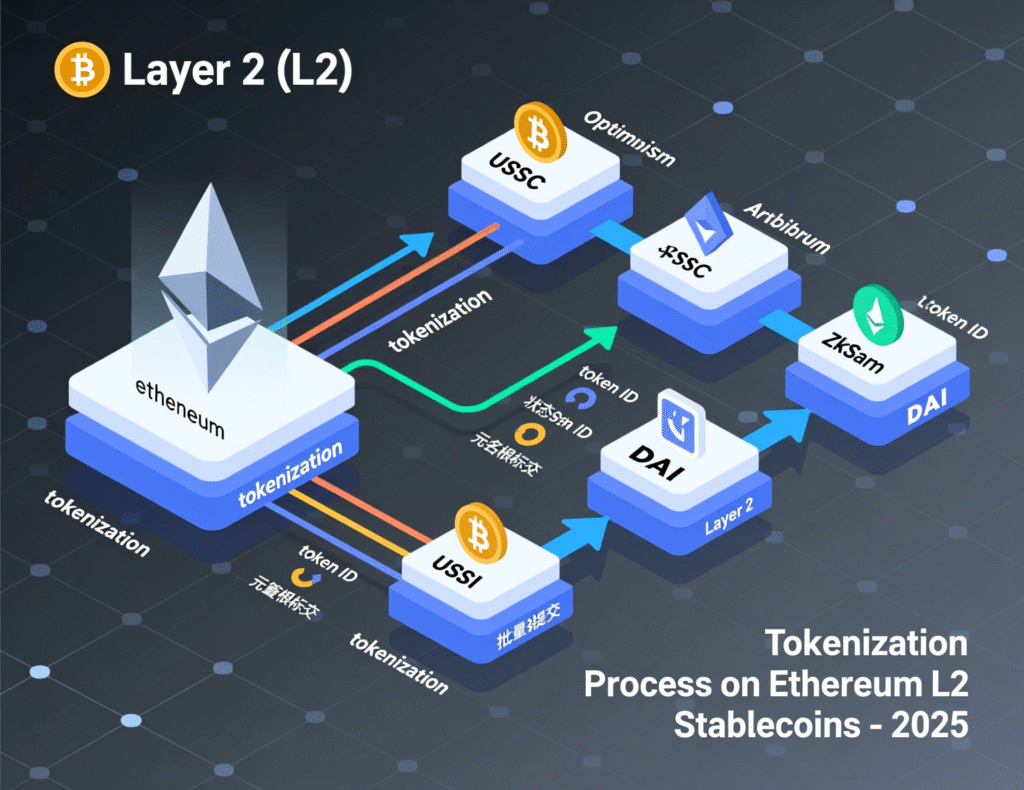

L2 adoption, corporate tokenization pilots, and real-world asset volume.

Scenarios where ‘Ethereum could flip Bitcoin’ becomes plausible

Tokenization boom: Major equities, treasuries, and real-estate issuance migrate to EVM chains; ETH demand rises as collateral/settlement asset.

Stablecoin dominance

USD stablecoins on Ethereum (and L2s) become the default global payment rail.

Policy tailwinds

Clear staking and accounting rules unlock corporate ETH treasuries and yield strategies.

Relative underperformance of BTC

If BTC plateaus after ETF adoption while ETH fundamentals compound, the cap gap could tighten.

Context & Analysis

Lee’s analogy is provocative, not predictive. Post-1971 financialization had legal, monetary, and geopolitical pillars that crypto lacks today. Still, the infrastructure argument that utility-rich rails attract capital aligns with Ethereum’s design (smart contracts, programmability, L2 ecosystems). Whether that utility can overcome Bitcoin’s pristine monetary narrative and first-mover dominance remains the crux of the flippening debate.

Conclusion

Tom Lee believes that Ethereum could eventually surpass Bitcoin by becoming the main platform for tokenized assets and stablecoin transactions. He compares Ethereum’s potential role in digital finance to how traditional markets replaced gold as the foundation of value after 1971.

However, this remains more of a theory than a reality. Despite Ethereum’s rapid growth and expanding use in decentralized finance, the data show a significant gap. Bitcoin’s market value is still about 4.6 times larger, meaning Ethereum has a long way to go before it can challenge Bitcoin’s dominance in the crypto market.

FAQs

Q : What does Tom Lee mean by “Ethereum could flip Bitcoin”?

A : He’s comparing a potential ETH rise to how Wall Street products helped equities and the dollar outpace gold after 1971.

Q : How big is the market-cap gap today?

A : About $2.16T (BTC) vs. $0.47T (ETH)—roughly 4.6x.

Q : Who is Tom Lee in this context?

A : Tom Lee is a well-known market strategist and co-founder of Fundstrat Global Advisors, known for his crypto market insights.

Q : What evidence supports the bull case for ETH?

A : Joseph Lubin says Wall Street will adopt ETH rails and staking, potentially driving a 100x surge and a flip of Bitcoin’s monetary base.

Q : Is “Ethereum could flip Bitcoin” likely soon?

A : It’s a working theory; ETH would need sustained adoption and capital flows to close a multi-trillion-dollar gap.

Q : How can I track progress toward a flippening?

A : Watch the ETH/BTC market-cap ratio, on-chain activity, staking metrics, and institutional product launches (see How To).

Q : Does Lee still like Bitcoin?

A : Yes he remains a Bitcoin bull; he simply thinks tokenized finance could favor ETH’s long-run network value.

Facts

Event

Tom Lee says “Ethereum could flip Bitcoin” as tokenization expands on Ethereum.Date/Time

2025-10-17T12:00:00+05:00Entities

Thomas “Tom” Lee (BitMine Immersion Technologies; Fundstrat); Ethereum (ETH); Bitcoin (BTC); ARK Invest/Cathie Wood (interviewer)Figures

BTC mkt cap ≈ $2.16T; ETH mkt cap ≈ $0.47T (≈4.6x gap) (USD)Quotes

“Ethereum could flip Bitcoin similar to how Wall Street and equities flipped gold post ’71.” Tom LeeSources

Cointelegraph interview summary via TradingView (Lee quote) + URL; CoinMarketCap BTC + ETH pages (market caps)