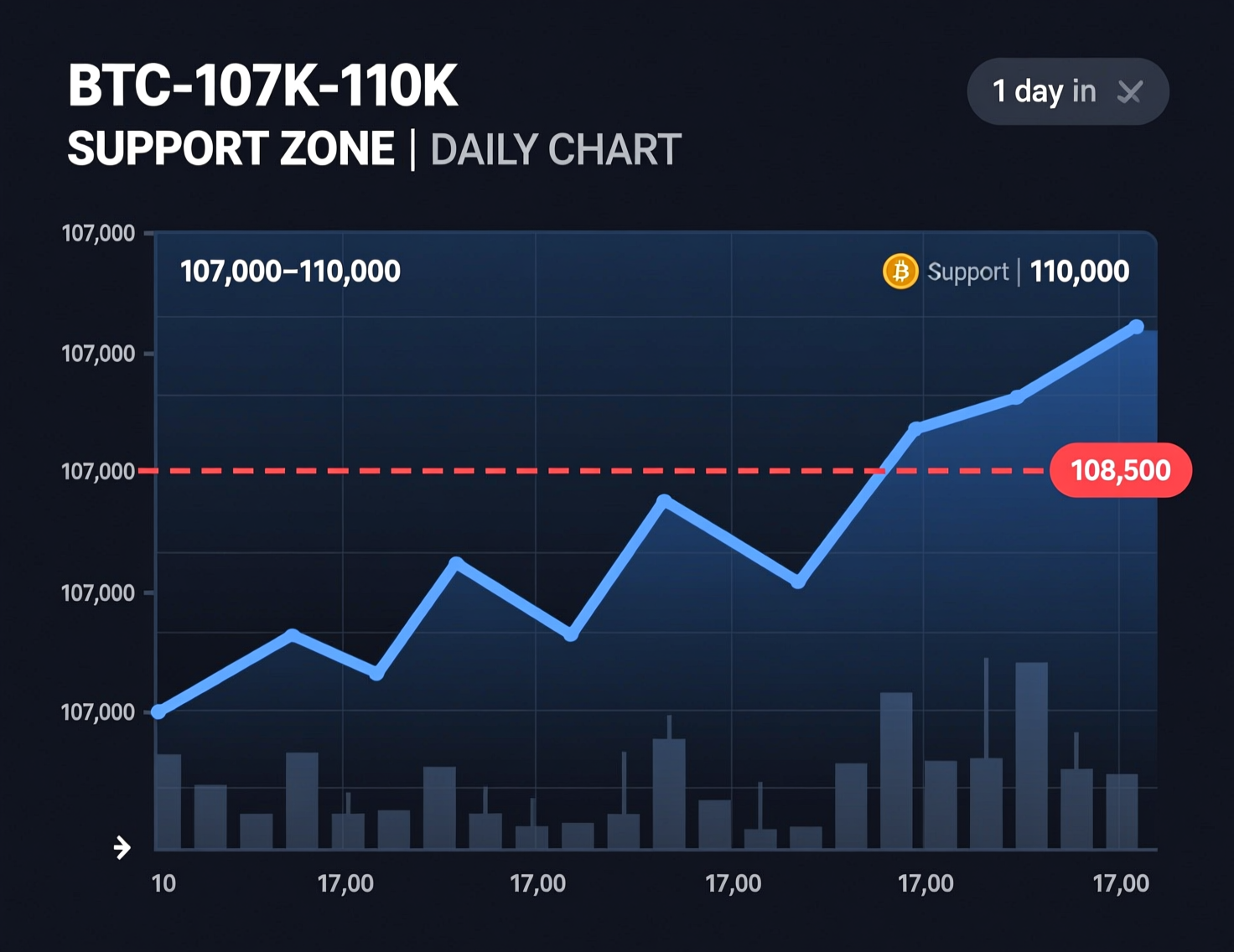

How Deep Could BTC Crash If Bulls Fail to Defend $107K–$110K Support Zone?

Bitcoin is holding just above a key inflection zone, with traders closely monitoring the $107K–$110K support range for the next directional move. This area has acted as a crucial floor in recent sessions, aligning with important technical levels and sentiment indicators.

A clear break below this shelf reinforced by multiple recent swing lows and the 200-day simple moving average around $107.5K could trigger stronger selling pressure. Such a move would likely open the path toward earlier downside targets identified by market technicians, signaling a potential shift in trend momentum if buyers fail to defend current levels.

Why the BTC 107K-110K support zone matters

Intraday highs from December–January and lows from September cluster in this band, marking a tug-of-war area where neither bulls nor bears dominated for long. The 200-day SMA now sits around $107.5K, further concentrating technical significance. A breakdown would signal fading dip-buying strength and stronger control by sellers. CoinDesk

Scenarios below the BTC 107K-110K support zone

Technicians highlight $98,330 the June 22 swing low as the first logical checkpoint if $107K–$110K fails. A deeper drawdown could expose the lower rail of the multi-month ascending channel, assessed near ~$82K, replicating the dynamic seen during the March April slide when upside break attempts quickly faded.

What the tape says right now

Prices are consolidating near ~$111K after last week’s sharp flush, keeping intraday mood cautious. While rebounds have appeared, momentum remains tentative amid a recent deleveraging event that saw BTC drop from ~$122K to ~$107K.

Liquidity backdrop and why it matters

September’s combined spot and derivatives volumes fell 17.5% to $8.12T, the first pullback after three months of growth. Thin liquidity can amplify moves when key levels break, increasing the risk of overshoots below support before any stabilization attempt.

Context & Analysis

Analysis: BTC’s trend since late-2023 has respected a rising parallel channel. Repeated failures near the upper band often precede mean-reversions toward the midline or lower rail. With macro catalysts (rates, policy headlines) injecting volatility, a loss of the $107K–$110K zone could accelerate a move toward $98K, with overshoot risk into the low-$80Ks if liquidity is thin and forced selling resumes. Conversely, a forceful bounce that clears ~$116K would reduce immediate downside odds and refocus traders on prior highs.

Concluding Remarks

As the weekend approaches, traders are watching how Bitcoin closes relative to the $110K and $107K levels, along with its ability to reclaim the ~$116K area on rebounds. These zones will likely determine whether the market can stabilize or extend its decline.

Holding above the $107K–$110K band could allow Bitcoin to rebuild short-term strength and attract renewed buying interest. However, if price slips decisively below this range, it may open the door for a retest of around $98.3K and if downside momentum increases, even expose levels near the channel’s lower boundary around $82K.