Ripple Expands Custody Network to Africa Following RLUSD Rollout

Ripple’s presence in Africa’s digital asset sector advanced on Wednesday as Absa Bank, one of South Africa’s largest financial institutions, adopted Ripple’s institutional custody solution. The partnership will enable Absa to securely store cryptocurrencies and tokenized assets for its clients, marking a key step in integrating blockchain technology into mainstream banking services.

This agreement makes Absa Ripple’s first major custody client on the African continent, highlighting increasing demand for regulated digital asset infrastructure in emerging markets. The move reflects growing confidence among traditional banks in blockchain-based solutions as they seek to offer secure, compliant access to the expanding world of digital assets.

Why Absa’s move matters

Absa’s integration of Ripple’s custody stack positions South Africa among the few African markets with a bank-backed crypto custody offering. The solution aims to deliver secure key management, policy controls and compliance tooling for institutions exploring tokenized assets and blockchain-based payment rails. Ripple’s custody service has gone live this year with clients in Europe, Asia and Latin America and now extends to Africa through Absa.

RLUSD and Africa-focused partnerships

The custody expansion follows Ripple’s push to make its USD-backed stablecoin, RLUSD, available in African markets through partners including Chipper Cash, VALR and Yellow Card an effort designed to connect tokenized value with existing payment infrastructure. Earlier announcements flagged Africa as a priority market for RLUSD-enabled use cases. Mariblock+1

Demand drivers in MEA

Ripple’s research indicates 64% of finance leaders in the Middle East and Africa view faster settlement and lower costs as primary reasons to integrate blockchain-based currencies into payment flows, a backdrop that supports bank-grade custody demand.

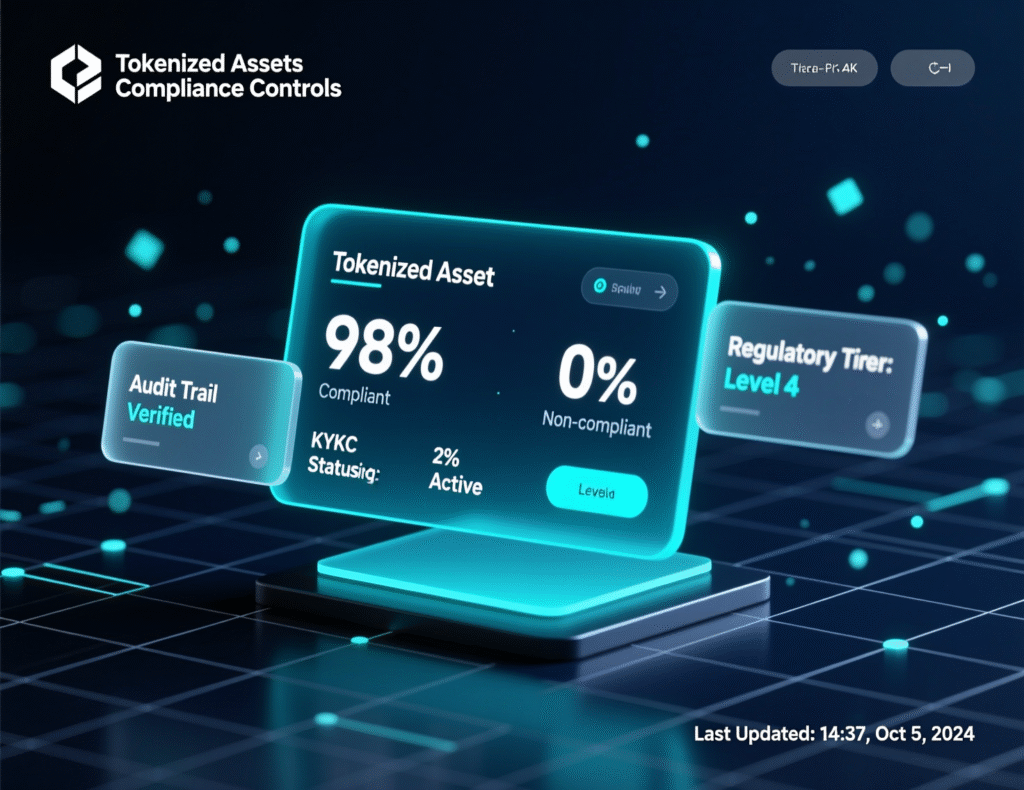

Compliance footing and strategy

Ripple says it now operates with more than 60 regulatory licenses and registrations worldwide—a factor it argues gives banks confidence to pilot tokenization and stablecoin settlement. The company’s recent stablecoin strategy has included the acquisition of Rail, a stablecoin payments platform, to deepen enterprise payment capabilities.

What’s next for Ripple Absa digital asset custody in Africa

Absa’s rollout timeline and product scope were not disclosed. Industry observers will watch for onboarding of corporate treasuries, asset managers and fintechs, plus interoperability with RLUSD for settlement where regulations allow.

Regional outlook for Ripple Absa digital asset custody in Africa

As tokenization pilots accelerate, Africa’s regulated financial institutions are testing custody, stablecoin settlement and cross-border remittances. Success for Absa and Ripple could catalyze similar bank-backed offerings in other markets with clearer rules.

Integration path for Ripple Absa digital asset custody in Africa

Initial focus areas typically include institutional cold/warm storage, governance workflows, whitelisting, and connectivity to payment corridors. Over time, RLUSD-based settlement and tokenized deposits may be added, subject to regulation.

Context & Analysis

The Absa partnership aligns with Ripple’s pivot toward providing back-end infrastructure for regulated institutions rather than consumer-facing trading. Combining custody with a compliant stablecoin (RLUSD) and payments rails positions Ripple to compete in enterprise tokenization provided African regulatory harmonization continues.

Conclusion

Absa’s adoption of Ripple’s institutional custody technology marks a major milestone for digital asset development in Africa. The move strengthens the region’s push toward secure, compliant infrastructure for cryptocurrencies and tokenized assets, setting a new standard for institutional participation.

Next steps for the partnership include rolling out client onboarding, defining supported asset types, and exploring potential integration with Ripple’s RLUSD stablecoin for settlements where regulations allow. This progress underscores the growing alignment between traditional banking and blockchain innovation across African markets.

FAQs

Q : What is the scope of the Ripple–Absa partnership?

A : Absa will use Ripple’s technology to offer institutional digital asset custody in South Africa, with details on assets and rollout to follow.

Q : How does RLUSD fit into the strategy?

A : RLUSD’s African rollout via partners like Chipper Cash supports settlement use cases that may complement bank custody over time, subject to regulation.

Q : Does Ripple have strong regulatory coverage?

A : Ripple reports holding 60+ licenses and registrations globally, strengthening its institutional offerings.

Q : Which clients might use Absa’s custody?

A : Likely corporate treasuries, asset managers, and fintechs exploring tokenized assets and compliant crypto exposure.

Q : When will services go live?

A : A specific go-live date wasn’t disclosed as of Oct. 15, 2025.

Q : Is this the first bank-backed custody play in Africa?

A : It’s among the first by a major African bank using a global crypto infrastructure provider.

Q : Does the partnership affect XRP?

A : The announcement focuses on custody infrastructure; any asset coverage will depend on Absa’s policy and regulation.

Facts

Event

Ripple partners with Absa Bank to launch institutional digital asset custody in AfricaDate/Time

2025-10-15T14:47:00+05:00Entities

Ripple Labs, Inc.; Absa Bank Limited (South Africa); RLUSD (Ripple USD stablecoin); Chipper CashFigures

“60+” regulatory licenses/registrations (Ripple); 64% of MEA finance leaders cite faster settlement & lower costs as key drivers (Ripple survey)Quotes

(No direct quotes provided in the available materials.)Sources

Ripple press release (ripple.com); CoinDesk report (coindesk.com)