BlackRock’s IBIT Bucks the Trend with Continued Inflows Despite Weak Bitcoin Price Action

BlackRock’s IBIT fund continued to attract steady inflows despite recent market turbulence, recording about $134 million over the last two U.S. trading sessions on October 10 and 13. The data highlights consistent investor confidence in the fund even as broader sentiment turned cautious across the crypto market.

The resilience of IBIT stood out on Monday when U.S. spot bitcoin ETFs collectively faced their largest single-day net outflow since September 26. During the same session, bitcoin pulled back sharply from last week’s highs, reflecting a shift toward short-term risk aversion. Yet, the continued inflows into BlackRock’s ETF suggest that institutional participants may still view price weakness as a buying opportunity, reinforcing IBIT’s growing role as a preferred vehicle for long-term bitcoin exposure.

IBIT bucks the ETF trend

Farside Investors’ daily fund table shows IBIT took in $74.2M on Oct. 10 and $60.4M on Oct. 13, extending a 10-day inflow streak. In the same Oct. 13 print, several rival spot bitcoin ETFs saw withdrawals, producing a -$326.4M combined outflow the biggest since Sept. 26.

Price backdrop and flows

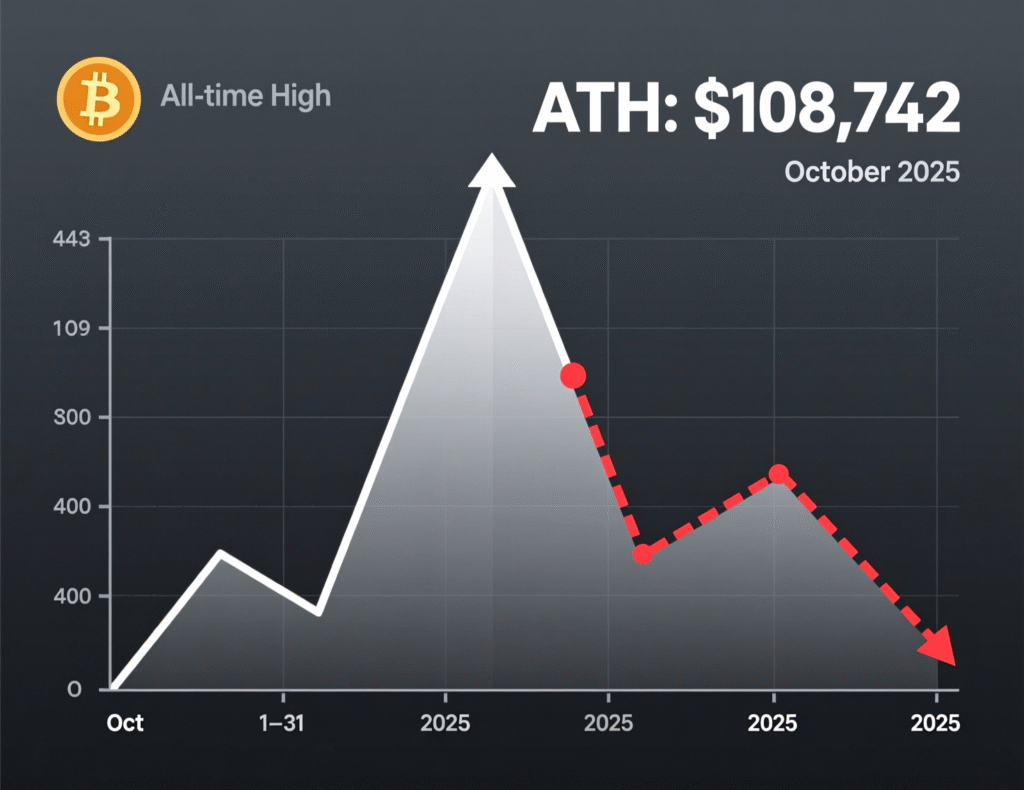

Bitcoin set a new all-time high near $126K on Oct. 6 before a swift deleveraging drove prices as low as the $106–107K area over the weekend; by Monday it had stabilized near $114–116K. Glassnode and market reports linked the ATH to strong ETF demand, while subsequent leverage and risk-off positioning magnified the downdraft.

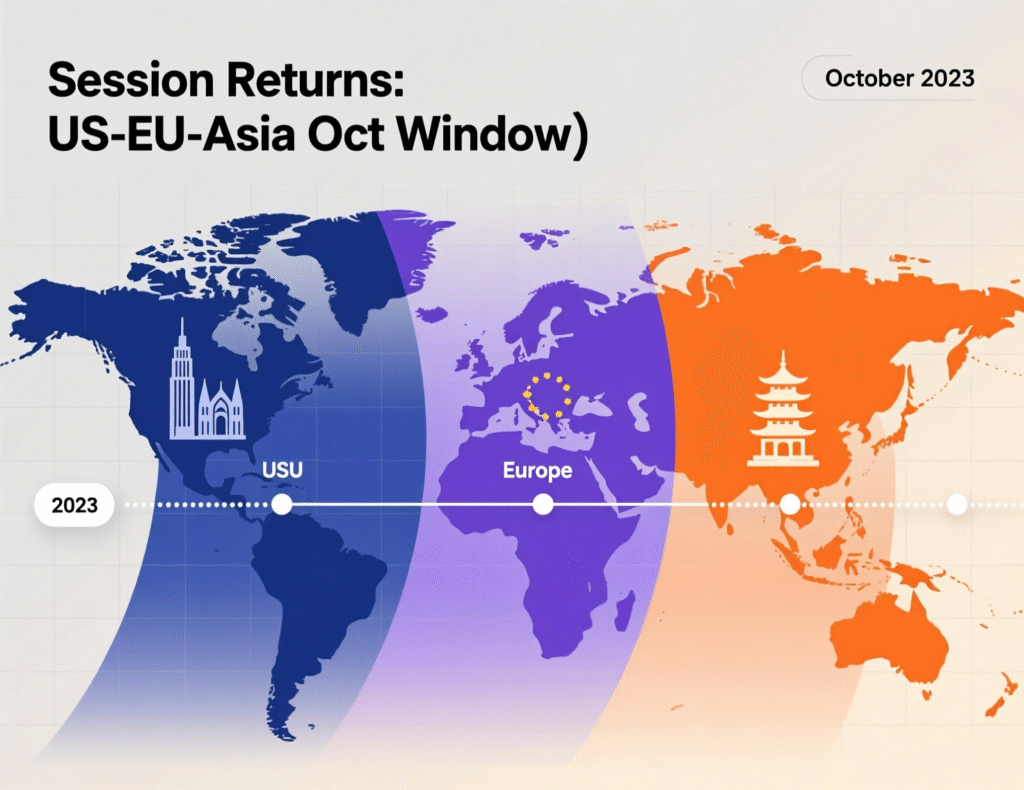

Session performance: U.S. hours cool, still lead

CoinDesk, citing Velo data, notes bitcoin’s rolling one-month performance during U.S. trading hours has faded from >10% in early October to ~1.7%, yet it still outpaces European and Asian sessions, which turned negative over the same lookback.

Historical pattern: Flows vs. price

Glassnode’s recent on-chain updates highlight how ETF flows have tended to strengthen during rallies and ease during pullbacks behavior consistent with momentum-sensitive allocators. IBIT’s continued bids through the latest drawdown underscore its relative dominance among spot bitcoin ETFs. Glassnode Insights

BlackRock IBIT inflows vs. peers (latest prints)

IBIT: +$60.4M (Oct. 13)

U.S. spot bitcoin ETFs (aggregate): -$326.4M (Oct. 13)

IBIT: +$74.2M (Oct. 10)

Context: This follows outsized IBIT inflows during the Oct. 6–9 rally window.

Context & Analysis

IBIT’s ability to keep attracting cash while broader U.S. spot bitcoin ETFs see outflows suggests stickier institutional mandates and/or model-driven DCA behavior. The streak also reflects IBIT’s liquidity and brand moat built earlier in the cycle. However, flow momentum has slowed from the Oct. 6–9 surge consistent with a market digesting leverage washouts. Sustained risk appetite likely hinges on volatility normalization and whether bitcoin reclaims the $120K–$123K range that capped rebounds on Monday.

Conclusion

IBIT’s 10-day inflow streak during bitcoin’s recent pullback highlights steady investor demand, suggesting confidence in the ETF even as prices softened. This resilience underscores continued institutional interest despite broader market caution and shifting sentiment.

However, the slowdown in daily inflows and simultaneous outflows across other spot ETFs point to a more selective risk appetite. Investors now appear focused on key technical levels for direction. Bitcoin’s ability to hold above the $107K support zone or reclaim resistance near $123K will likely determine whether the market stabilizes for a rebound or extends its corrective phase in the sessions ahead.

FAQs

Q : Why did IBIT see inflows while other ETFs had outflows?

A : Large, brand-aware mandates and better secondary-market liquidity can keep IBIT bid even during risk-off sessions, according to recent flow patterns.

Q : Did bitcoin really hit a new ATH this month?

A: Yes. Multiple analyses mark a fresh ATH near $126K on Oct. 6 before a sharp deleveraging move.

Q : Are U.S. trading hours still leading bitcoin returns?

A : Yes, but leadership has cooled: the one-month U.S. session edge has narrowed to ~1.7%, still ahead of Europe and Asia, per reporting.

Q: How do I check daily BlackRock IBIT inflows?

A : Consult Farside’s ETF flow page and issuer updates; both are widely referenced by analysts.

Q : What levels matter now for BTC?

A : Technical commentary flags ~$107K support and ~$123K resistance as reference points after the pullback.

Q : Do ETF flows drive price or follow it?

A : Both dynamics appear at times; Glassnode notes flows often strengthen into rallies and soften on pullbacks.

Q : Was Oct. 13 the biggest outflow day recently?

A : Yes, the largest daily outflow since Sept. 26 across U.S. spot bitcoin ETFs.

Facts

Event

IBIT continues to draw inflows while broader U.S. spot bitcoin ETFs see net outflowsDate/Time

2025-10-14T14:02:00+05:00Entities

BlackRock iShares Bitcoin Trust (IBIT); U.S. spot bitcoin ETFs (aggregate)Figures

IBIT +$74.2M (Oct. 10), +$60.4M (Oct. 13); U.S. ETFs aggregate -$326.4M (Oct. 13); BTC ATH ~$126K (Oct. 6); BTC low ~$106–107K (Oct. 11–13)Quotes

Sources

Farside Investors – Bitcoin ETF Flow (All Data) farside.co.uk; CoinDesk – Daybook/Flows report CoinDesk