Bitcoin Slips Under $112K, ETH, DOGE Drop 6% as China Hits Back on U.S. Tariffs

Bitcoin fell below $112,000 as renewed tensions between China and the U.S. sparked uncertainty in global markets. Beijing imposed sanctions on U.S.-linked subsidiaries of Hanwha Ocean and indicated that further measures targeting shipping could follow. The move raised concerns among investors, prompting a cautious approach across multiple asset classes. Market participants reacted quickly, with risk-off sentiment spreading across trading floors.

The broader impact was visible as cryptocurrencies declined alongside U.S. and European equity futures, reflecting heightened market nervousness. Analysts noted that such geopolitical developments tend to pressure volatile assets like Bitcoin, while safe-haven strategies gain traction. Traders are now closely monitoring the situation for potential escalation, as the market remains sensitive to policy announcements and international trade conflicts.

Why markets moved

China’s Commerce Ministry sanctioned five U.S.-linked Hanwha Ocean units, a response tied to a U.S. probe into Chinese shipbuilding dominance and recent port-fee tit-for-tat. The escalation followed a 100% tariff threat from President Donald Trump last week, keeping traders on edge ahead of potential talks. AP News+2Bloomberg+2

Crypto market snapshot: Bitcoin slips under $112K

Bitcoin (BTC)

down ~3% to ~$111,869 during Tuesday afternoon Hong Kong trading.Ethereum (ETH)

~4% lower near $4,000.BNB

>10% lower after prior outperformance.XRP, SOL, DOGE

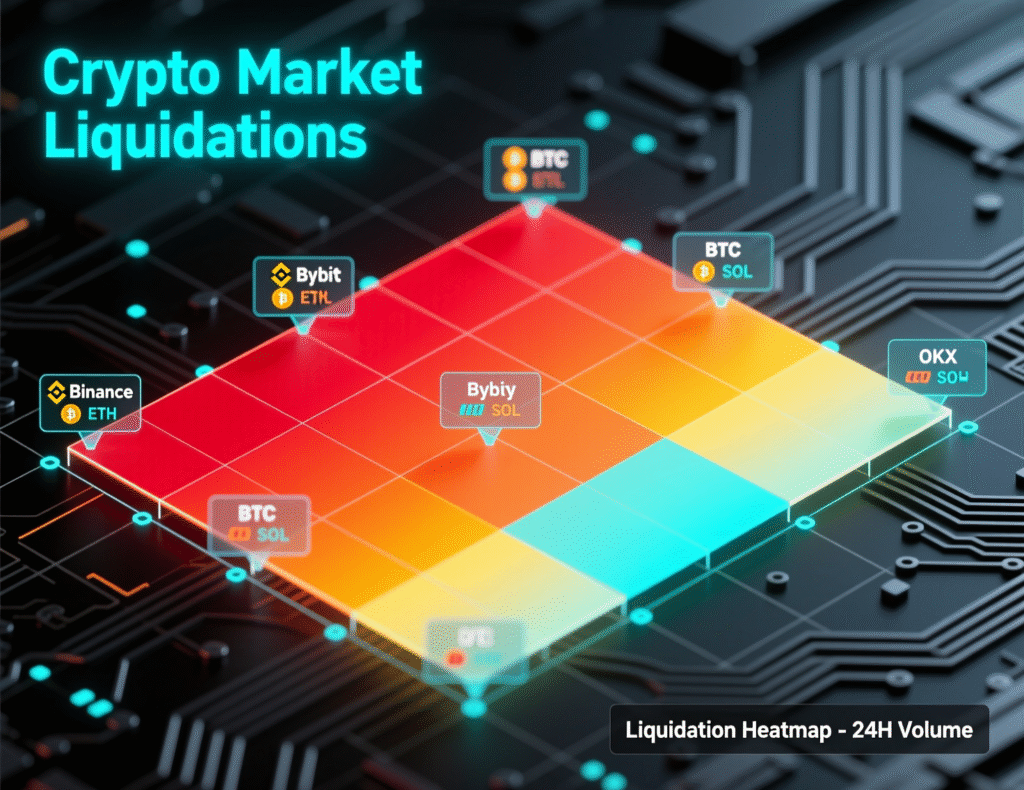

Down ~5–6% over 24h.Liquidations

≈$630M in 24h; longs ≈ two-thirds.

These moves underline crypto’s continued sensitivity to macro headlines.

Market reaction: Bitcoin slips under $112K and altcoins follow

Risk assets faded: S&P 500 and Nasdaq 100 futures fell ~0.7% and ~1.0%, respectively, while Asia shares were mixed and sentiment remained fragile. Haven flows pushed U.S. 10-year yields slightly lower in early trade, and the yen firmed versus the dollar.

Context & Analysis

The sanctioning of Hanwha Ocean’s U.S. units reinforces that shipping and maritime infrastructure are now front-line instruments in the trade dispute. Crypto remains tightly coupled to this macro pulse: when port fees, sanctions, or tariff rhetoric intensify, liquidity thins and leverage unwinds amplifying drawdowns, as reflected in today’s $630M washout. Watch for any moderation in tariff language or concrete steps toward talks; either could stabilize risk appetite.

Conclusion

Without signs of de-escalation, ongoing headline risk from China–U.S. trade tensions is expected to keep cryptocurrency volatility high. Market participants remain cautious, as geopolitical developments continue to influence risk sentiment across asset classes.

In the near term, attention is on whether Beijing implements additional shipping measures and if Washington eases its tariff threats. These actions could serve as major catalysts for risk assets, including crypto. Traders are closely monitoring developments, as any escalation or easing in trade policies is likely to drive sharp moves in both equities and digital currencies.

FAQs

Q : What triggered today’s crypto sell-off?

A : China sanctioned U.S.-linked Hanwha Ocean units and signaled further measures, reviving trade-war fears.

Q : How far did Bitcoin fall?

A : Bitcoin slipped under $112K, trading near $111,869 intraday.

Q : How much was liquidated?

A : About $630M in 24 hours, with roughly two-thirds from long positions (CoinGlass, via CoinDesk).

Q : Did equities also decline?

A: Yes. U.S. futures fell (S&P −0.7%, Nasdaq 100 −1.0%) as risk sentiment weakened.

Q : Is this tied to the 100% tariff threat?

A : Yes, recent rhetoric added to uncertainty, keeping markets sensitive to headlines.

Q : What else should traders watch?

A : Any new shipping curbs or tariff updates and shifts in funding rates/liquidation clusters.

Q : Will Bitcoin recover quickly?

A : Recovery depends on macro de-escalation and leverage reset depth; there’s no guarantee.

Facts

Event:

Crypto declines as China sanctions U.S.-linked Hanwha Ocean units; Bitcoin under $112K; ~$630M liquidationsDate/Time:

2025-10-14T15:00:00+05:00Entities:

Bitcoin (BTC); Ethereum (ETH); Dogecoin (DOGE); Hanwha Ocean (South Korea); U.S. Gov’t; China’s Ministry of CommerceFigures:

BTC ~$111,869 (−~3%); ETH ~ $4,000 (−~4%); Liquidations ≈ $630M (≈⅔ longs)Quotes:

“Total liquidations hit $630 million, with long positions making up two-thirds of the wipeout, according to CoinGlass.” CoinDesk report CoinDeskSources:

Reuters (China takes steps against US-linked units of Hanwha); AP (China sanctions 5 U.S. units of Hanwha Ocean)